Title: Alaska Assignment of Overriding Royalty Interests in Multiple Leases: A Comprehensive Overview Introduction: Alaska Assignment of Overriding Royalty Interests allows for the transfer of royalty rights from one party to another on multiple oil and gas leases. This legal arrangement provides an opportunity for investors and landowners to monetize their interests, diversify portfolios, and maximize their revenue potential. Multiple types of Alaska Assignment of Overriding Royalty Interests are available, each with their own unique purpose and scope. 1. Understanding Overriding Royalty Interests: Overriding Royalty Interests (ORI's) provide a portion of the revenue generated from oil and gas leases to a third party, other than the leaseholder. These interests are typically carved out of the lessee's working interest and do not bear the costs of exploration, production, and maintenance. Instead, ORI holders receive a predetermined percentage of the revenue generated, known as the overriding royalty. 2. Alaska's Oil and Gas Industry: Alaska is home to vast oil and gas reserves, making it a hotspot for exploration and production activities. The state offers various leasing opportunities, including offshore and onshore leases, with potential for significant royalties. To leverage these opportunities and capitalize on potential revenue streams, landowners and investors may consider assigning ORI's across multiple leases. 3. Types of Alaska Assignment of Overriding Royalty Interests in Multiple Leases: a) Horizontal Assignment: This type of assignment involves the transfer of ORI's across multiple leases held by the same operator or lessee. It allows for a streamlined approach as the overriding royalty rights remain consolidated under one operator. b) Vertical Assignment: In contrast to horizontal assignment, vertical assignment involves the transfer of ORI's across multiple leases held by different operators or lessees. This type of assignment allows for diversification across various projects, minimizing risk exposure. c) Statewide Assignment: This type of assignment involves the transfer of ORI's across multiple leases situated throughout the entire state of Alaska. It enables investors to benefit from a broader range of opportunities and potentially higher returns. 4. Key Considerations: a) Royalty Percentage: The assigned overriding royalty percentage should be carefully negotiated to ensure a fair and equitable distribution of revenue. b) Lease Evaluation: Thorough due diligence is essential to evaluate the potential of each lease, analyzing factors such as production history, operator credibility, and geological potential. c) Assignment Agreement: A comprehensive assignment agreement should be established, clearly defining the rights and obligations of all parties involved to avoid misunderstandings or disputes. d) Regulatory Compliance: Adherence to federal and state regulations governing oil and gas leases in Alaska is crucial. Hiring experienced legal counsel ensures compliance and minimizes legal risks. Conclusion: The Alaska Assignment of Overriding Royalty Interests in Multiple Leases provides an effective mechanism for investors and landowners to capitalize on the resource-rich landscape of the state. By strategically assigning ORI's, stakeholders can diversify their portfolios, maximize revenue potential, and participate in Alaska's thriving oil and gas industry. Proper evaluation, negotiation, and regulatory compliance are vital to ensure a successful assignment agreement.

Alaska Assignment of Overriding Royalty Interests for Multiple Leases

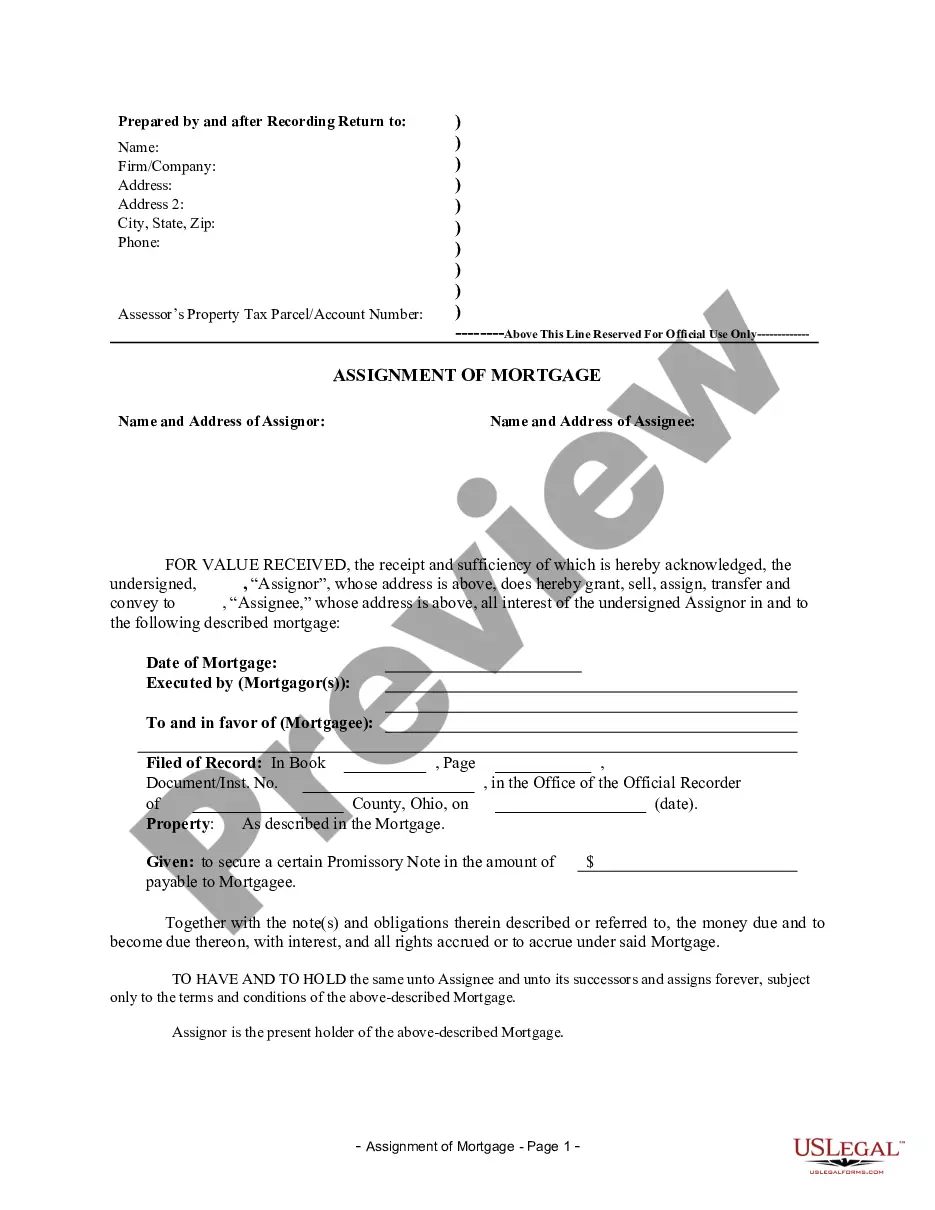

Description

How to fill out Alaska Assignment Of Overriding Royalty Interests For Multiple Leases?

You may invest hours on the web trying to find the legitimate papers design which fits the federal and state requirements you will need. US Legal Forms supplies thousands of legitimate types that happen to be analyzed by experts. It is possible to down load or printing the Alaska Assignment of Overriding Royalty Interests for Multiple Leases from the support.

If you have a US Legal Forms account, you are able to log in and click the Obtain option. Next, you are able to full, edit, printing, or indicator the Alaska Assignment of Overriding Royalty Interests for Multiple Leases. Each legitimate papers design you get is your own property forever. To have an additional backup of the obtained kind, proceed to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms website for the first time, stick to the easy recommendations below:

- Initially, be sure that you have selected the right papers design to the area/metropolis that you pick. Read the kind outline to ensure you have selected the correct kind. If accessible, use the Review option to search throughout the papers design also.

- If you want to discover an additional variation in the kind, use the Search area to discover the design that suits you and requirements.

- Upon having identified the design you need, click Buy now to continue.

- Pick the rates plan you need, enter your accreditations, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to cover the legitimate kind.

- Pick the format in the papers and down load it to your device.

- Make changes to your papers if necessary. You may full, edit and indicator and printing Alaska Assignment of Overriding Royalty Interests for Multiple Leases.

Obtain and printing thousands of papers templates making use of the US Legal Forms site, which provides the largest variety of legitimate types. Use professional and condition-certain templates to deal with your small business or specific requirements.