Alaska Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer

Description

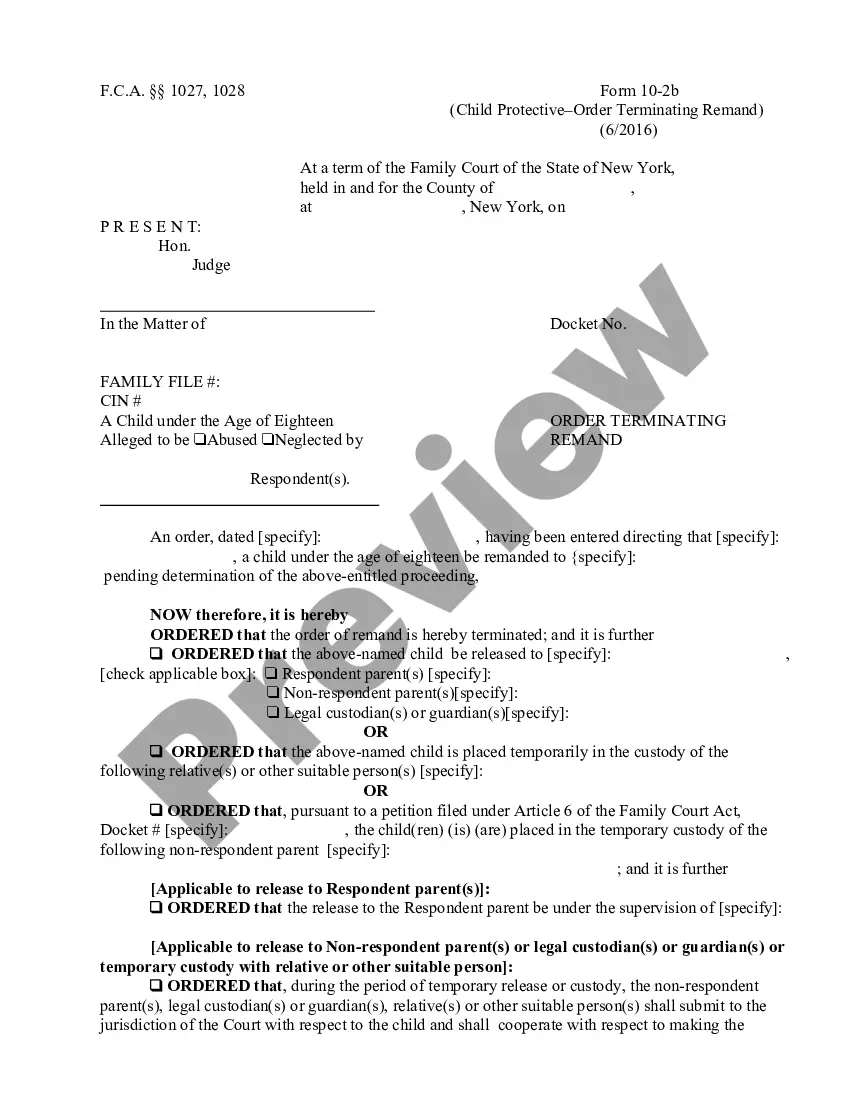

How to fill out Subordination By Mineral Owners Of Rights To Make Use Of The Surface Estate - Transfer?

If you have to total, acquire, or printing lawful record themes, use US Legal Forms, the most important variety of lawful varieties, that can be found on the web. Take advantage of the site`s simple and easy hassle-free research to get the documents you require. Various themes for enterprise and person uses are sorted by categories and suggests, or key phrases. Use US Legal Forms to get the Alaska Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer with a couple of mouse clicks.

Should you be presently a US Legal Forms consumer, log in to your account and click on the Download option to have the Alaska Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer. You may also entry varieties you earlier acquired within the My Forms tab of your account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for the proper city/nation.

- Step 2. Utilize the Preview solution to check out the form`s content material. Never overlook to see the information.

- Step 3. Should you be not satisfied with all the develop, use the Lookup field near the top of the display screen to find other models from the lawful develop design.

- Step 4. When you have found the shape you require, click the Get now option. Select the rates strategy you favor and put your accreditations to register to have an account.

- Step 5. Method the deal. You should use your charge card or PayPal account to accomplish the deal.

- Step 6. Pick the formatting from the lawful develop and acquire it on your gadget.

- Step 7. Comprehensive, change and printing or indication the Alaska Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer.

Each and every lawful record design you purchase is yours for a long time. You might have acces to each and every develop you acquired in your acccount. Select the My Forms section and pick a develop to printing or acquire once more.

Compete and acquire, and printing the Alaska Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer with US Legal Forms. There are many expert and express-distinct varieties you can use to your enterprise or person requires.

Form popularity

FAQ

As for receiving an oil and gas royalty payment, you will receive it ONLY IF the oil company drills a well and ONLY IF the well is a successful producer. Most wells drilled in a new area have only a 20% probability of being successful. There is a lot of money to be made in receiving monthly royalty checks.

The Alaska Constitution is clear: Natural resources belong to the state. The Alaska Statehood Act, the law of the U.S. government, is clear: natural resources belong to Alaska.

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.

Licensing royalties, like any other asset, can be transferred into a trust. This is a common practice among individuals with intellectual property rights who earn substantial income from licensing royalties. This blog post will guide you through the process of transferring licensing royalties into a trust.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Since mineral rights can be sold separately from the land itself, even if you own the land, someone else may hold ownership of what's below it. And because of the intrinsic value of what's below the surface, the land itself may come with a price tag much higher than otherwise seen in the area.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.