Alaska Compliance With Laws

Description

How to fill out Compliance With Laws?

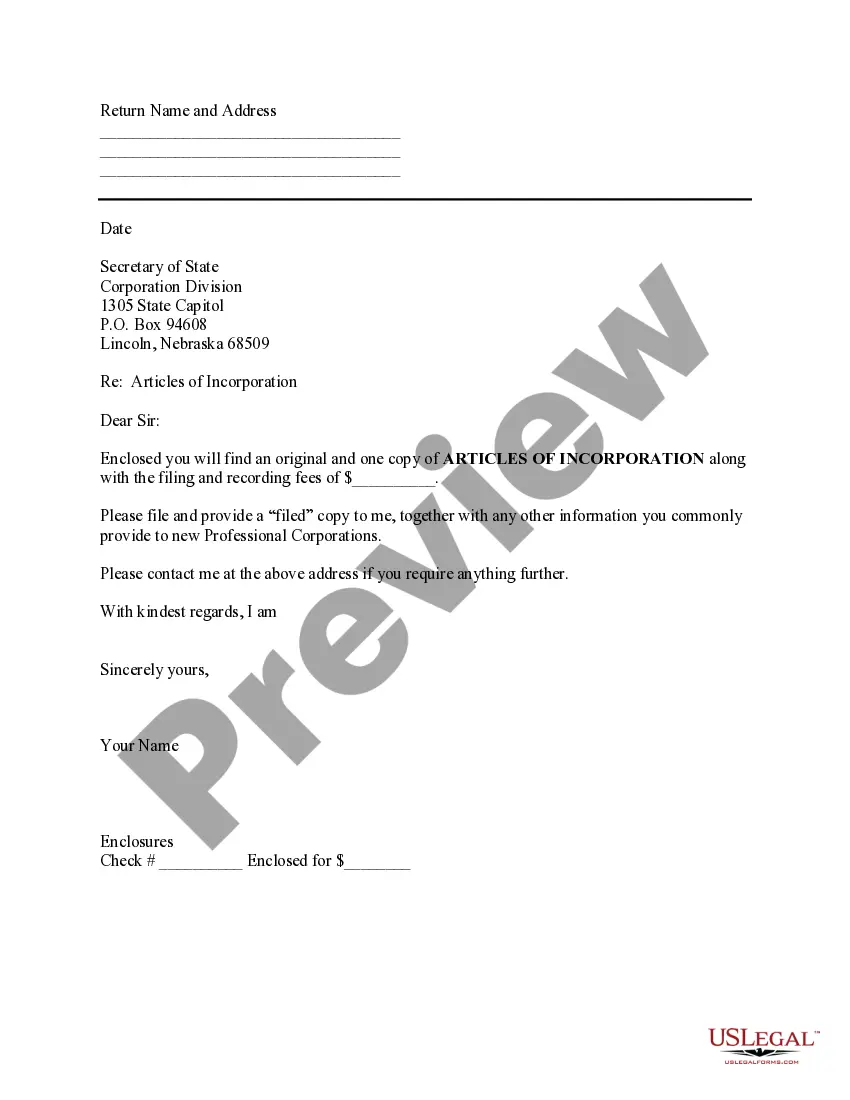

You can invest several hours on the web looking for the legal document web template that suits the federal and state requirements you will need. US Legal Forms gives a large number of legal forms which are analyzed by specialists. You can easily acquire or print the Alaska Compliance With Laws from our services.

If you already have a US Legal Forms bank account, you can log in and click on the Acquire button. After that, you can comprehensive, revise, print, or signal the Alaska Compliance With Laws. Every legal document web template you buy is your own property eternally. To acquire one more version for any bought kind, go to the My Forms tab and click on the related button.

Should you use the US Legal Forms website initially, keep to the straightforward directions below:

- Initially, make sure that you have selected the correct document web template to the area/town that you pick. Browse the kind information to ensure you have picked the correct kind. If offered, utilize the Review button to look from the document web template too.

- If you want to discover one more model of your kind, utilize the Lookup field to obtain the web template that suits you and requirements.

- Once you have discovered the web template you want, click on Acquire now to move forward.

- Find the rates program you want, type your references, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You may use your charge card or PayPal bank account to purchase the legal kind.

- Find the formatting of your document and acquire it to the gadget.

- Make modifications to the document if required. You can comprehensive, revise and signal and print Alaska Compliance With Laws.

Acquire and print a large number of document templates utilizing the US Legal Forms web site, which provides the most important assortment of legal forms. Use skilled and status-certain templates to deal with your company or person needs.

Form popularity

FAQ

Corporation & PC: The state filing fee to file this report is $100. (With foreign Corporation or PC, the state fee is $200). Due date for this filing is January 2nd. If your company was formed or registered in an even-numbered year, you file your biennial report every even-numbered year.

Etsy's seller policies do not require you to have a business license to sell on their platform. However, the inquiry doesn't end there. A seller of goods on Etsy may need a license or permit from municipal, county, state, or federal agencies regulating businesses. Your Etsy shop is either a business or a hobby.

Businesses in the state of Alaska must pay $50 when first filing to receive a business license with the state government.

If any portion of a business activity occurs within the State of Alaska then the expectation, per Alaska Statutes (law), is the business will have an Alaska Business License. Per AS 43.70. 020(a) a business license is required for the privilege of engaging in a business in the State of Alaska.

Alaska Statute AS 43.70. 020 requires you to obtain an Alaska Business License before you engage in business activity. For more information please go to the Business Licensing Section.

Alaska LLCs must file a Biennial Report Every LLC in Alaska is required to file a Biennial Report every 2 years. The purpose of the Biennial Report is to keep your LLC's contact information up to date with the state.

A Certificate of Compliance, Certificate of Good Standing, Certificate and Good Standing are names of certificates that have the same meaning. They show that, at a specific point in time, the entity is in good standing or is in compliance with the State of Alaska Corporations Section.

If any portion of a business activity occurs within the State of Alaska then the expectation, per Alaska Statutes (law), is the business will have an Alaska Business License. Per AS 43.70. 020(a) a business license is required for the privilege of engaging in a business in the State of Alaska.