Alaska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

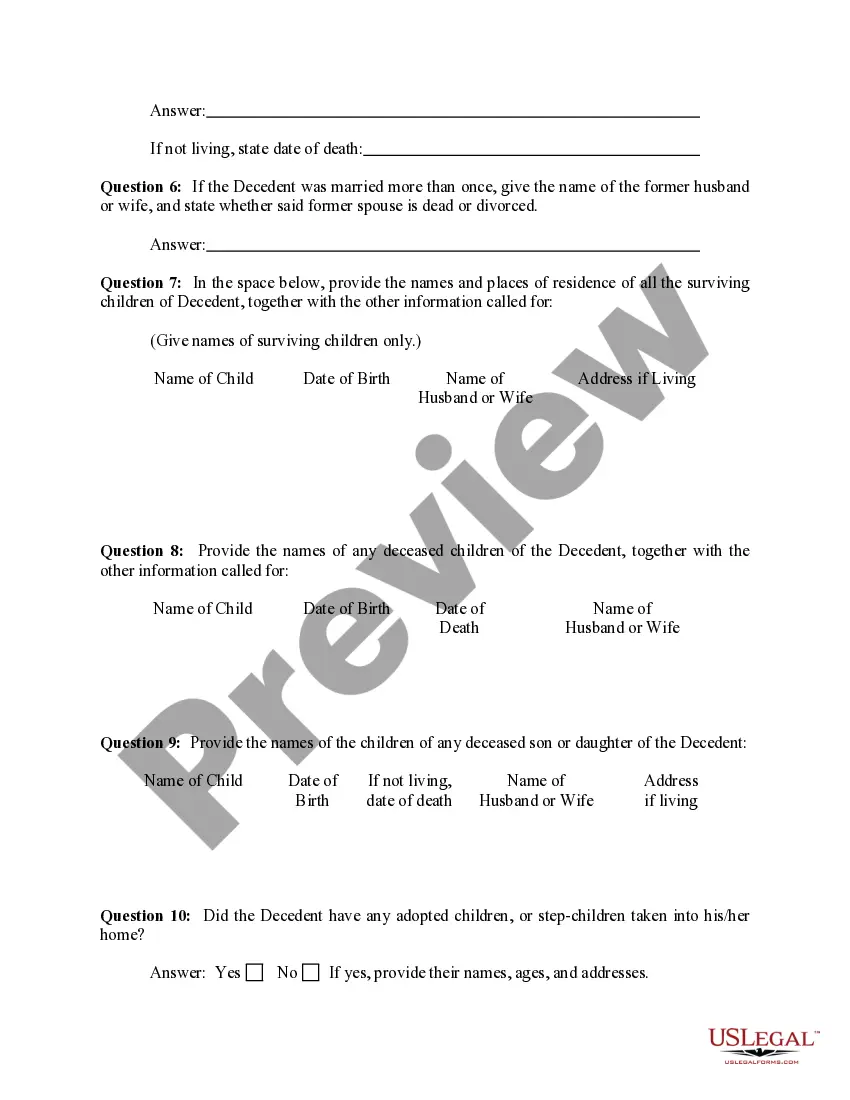

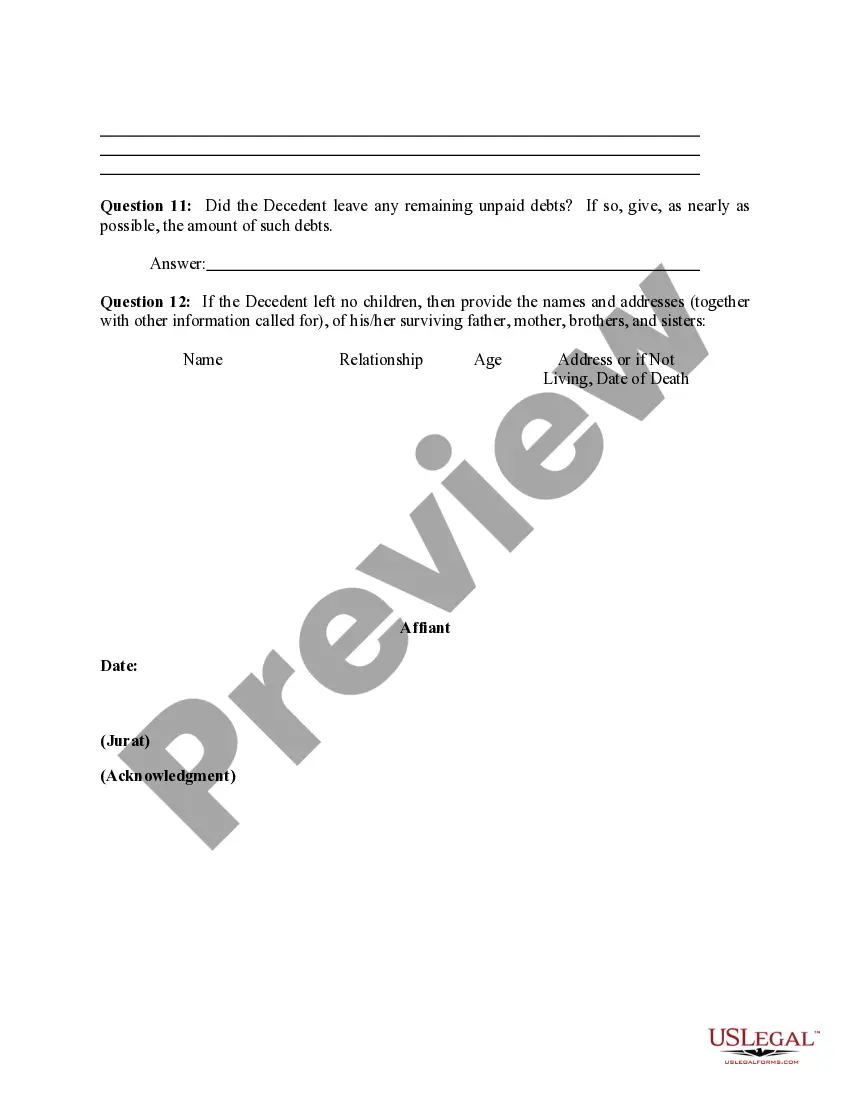

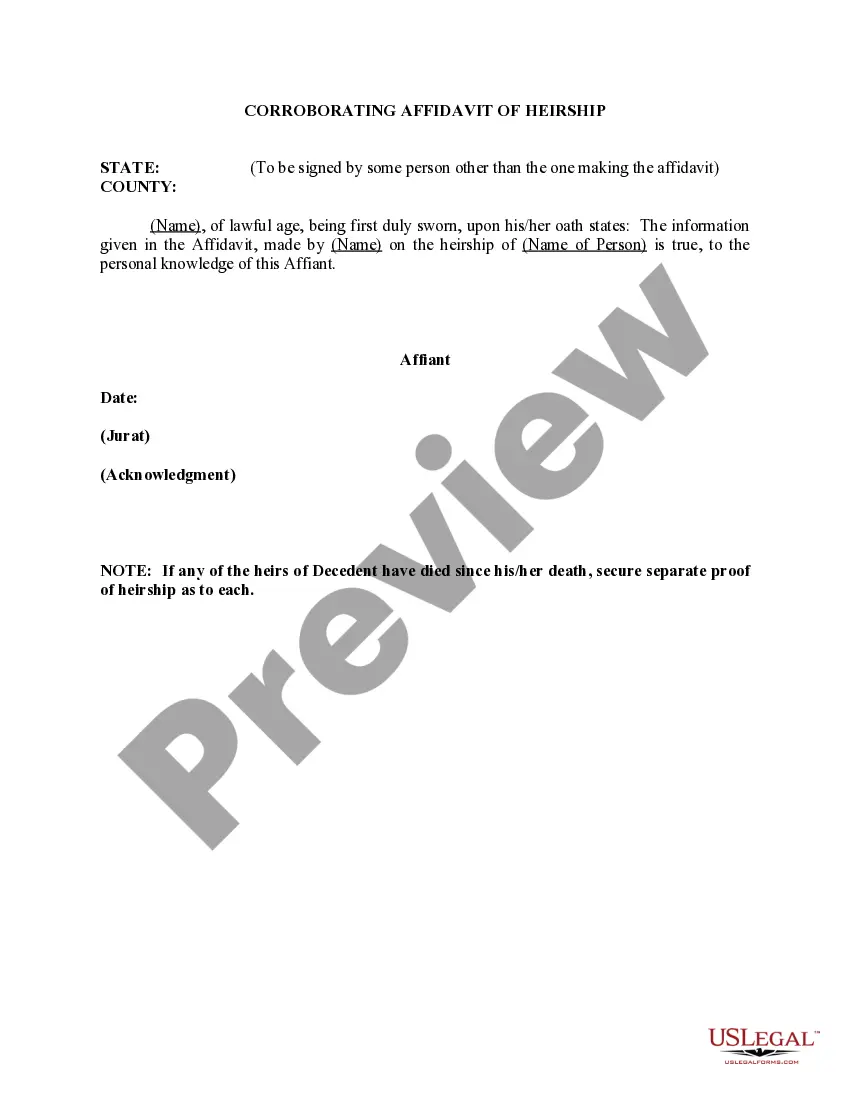

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

Are you presently in the placement the place you need files for sometimes enterprise or person purposes almost every working day? There are plenty of legitimate record web templates accessible on the Internet, but locating versions you can trust isn`t effortless. US Legal Forms provides 1000s of form web templates, like the Alaska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit), which can be composed to satisfy state and federal specifications.

In case you are previously acquainted with US Legal Forms site and possess a free account, simply log in. Afterward, you can acquire the Alaska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) web template.

Unless you provide an bank account and need to begin to use US Legal Forms, adopt these measures:

- Get the form you want and ensure it is to the right area/state.

- Take advantage of the Preview switch to review the shape.

- See the information to actually have chosen the proper form.

- If the form isn`t what you are looking for, make use of the Look for discipline to discover the form that meets your requirements and specifications.

- When you get the right form, click Purchase now.

- Pick the prices prepare you want, complete the desired information to produce your account, and purchase the order with your PayPal or charge card.

- Choose a hassle-free document structure and acquire your backup.

Find each of the record web templates you have bought in the My Forms menus. You can aquire a more backup of Alaska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) whenever, if required. Just go through the needed form to acquire or printing the record web template.

Use US Legal Forms, probably the most considerable assortment of legitimate kinds, to save lots of time and steer clear of faults. The service provides skillfully produced legitimate record web templates which you can use for a selection of purposes. Make a free account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Assets Subject to the California Probate Court Probate assets include any personal property or real estate that the decedent owned in their name before passing. Nearly any type of asset can be a probate asset, including a home, car, vacation residence, boat, art, furniture, or household goods.

Alaska has two ways of avoiding probate. One is an affidavit procedure that allows heirs to completely skip probate when the value of the estate is $50,000 or less after liens, encumbrances, and the value of vehicles that are $100,000 or less have been subtracted.

In addition to the homestead allowance, the decedent's surviving spouse is entitled from the estate to a value, not exceeding $10,000 in excess of security interests in the items, in household furniture, automobiles, furnishings, appliances, and personal effects.

If you create a revocable trust, you will need to choose a Trustee and decide how the property will be managed after you die. If you want to avoid probate, you will also need to transfer ownership of all of your property to the revocable trust or name the revocable trust as a beneficiary of your property.

After Filing the Petition If you are appointed the Personal Representative, the court will send you the Letters Testamentary (or Letters of Administration) once it is signed by the clerk or magistrate. This is the document that you will use to prove that you are authorized to act on behalf of the estate.

How Long Do You Have to File Probate After Death in Alaska? There is no limit to when you can file a will with probate court after the deceased passes in Alaska.

The spouses can agree that when one spouse dies, title to the other half of the property passes automatically to the surviving spouse or passes through probate to the beneficiaries or heirs of the spouse who died.

In fact, many estates can be settled without any court involvement at all. Estates valued at less than $50,000, plus $100,000 worth of motor vehicles, can often avoid the probate process in court, provided the estate contains no real property (land or a home).