This office lease clause is a more detailed form giving the tenant additional rights and the landlord further obligations as it relates to tax increases.

Alaska Detailed Tax Increase Clause

Description

How to fill out Detailed Tax Increase Clause?

If you wish to comprehensive, acquire, or produce lawful document templates, use US Legal Forms, the greatest assortment of lawful varieties, that can be found on the web. Use the site`s simple and easy handy research to obtain the documents you will need. Different templates for business and specific uses are sorted by groups and claims, or search phrases. Use US Legal Forms to obtain the Alaska Detailed Tax Increase Clause within a couple of clicks.

Should you be currently a US Legal Forms client, log in to your accounts and click the Obtain option to find the Alaska Detailed Tax Increase Clause. You can also access varieties you previously saved from the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for that right city/nation.

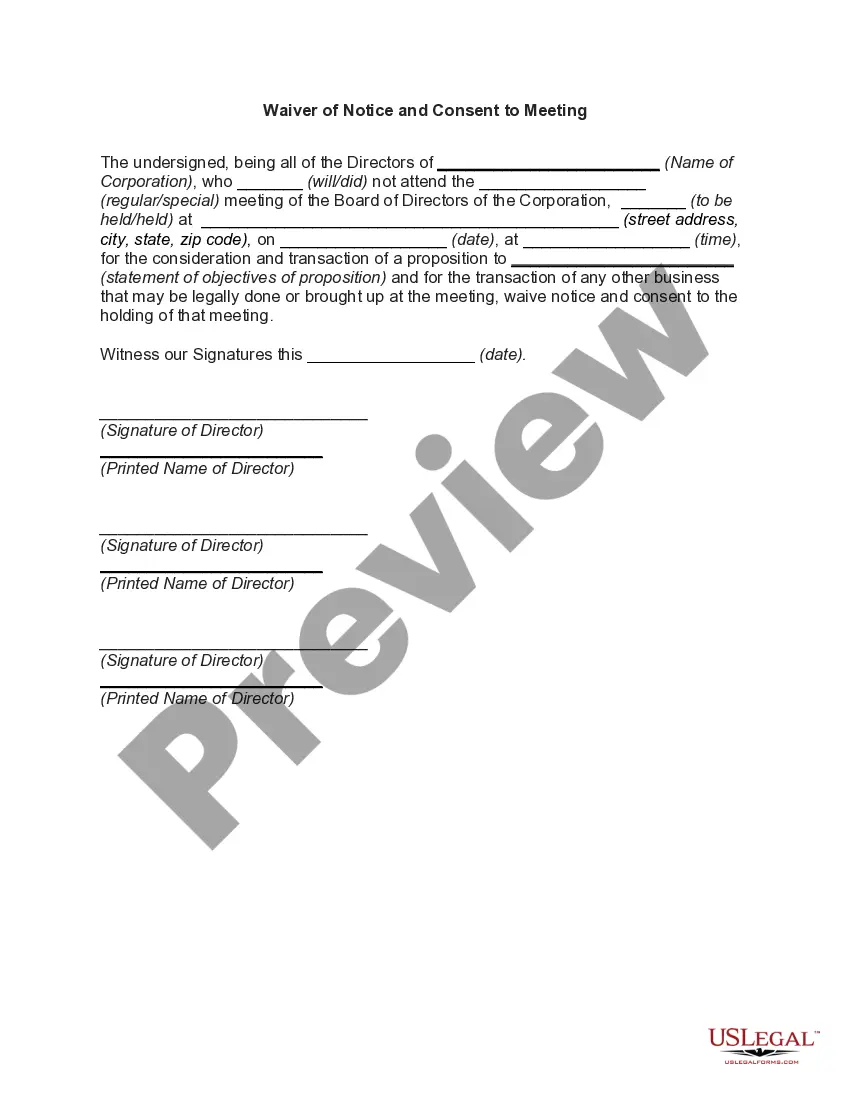

- Step 2. Take advantage of the Review method to examine the form`s articles. Do not forget about to read the description.

- Step 3. Should you be not satisfied using the develop, utilize the Look for discipline towards the top of the screen to discover other versions of your lawful develop web template.

- Step 4. After you have located the shape you will need, click the Purchase now option. Select the pricing plan you favor and add your references to sign up for an accounts.

- Step 5. Method the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Select the file format of your lawful develop and acquire it on the device.

- Step 7. Comprehensive, edit and produce or indicator the Alaska Detailed Tax Increase Clause.

Each and every lawful document web template you buy is yours forever. You possess acces to every single develop you saved with your acccount. Click the My Forms area and pick a develop to produce or acquire again.

Compete and acquire, and produce the Alaska Detailed Tax Increase Clause with US Legal Forms. There are many professional and express-specific varieties you may use to your business or specific demands.

Form popularity

FAQ

Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in Alaska is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.

Alaska has had an income tax before. In fact, to date it is the only state to have repealed an individual income tax, doing so when the state's oil fields started generating enough tax revenue to obviate the need for one.

In Alaska, the average effective property tax rate is 1.22%, which is slightly high but still lower than in many other states.

Port Alexander: The Town In Alaska Without Property Taxes.

Under AS 29.45. 030(e), there is a mandatory exemption up to the first $150,000 of assessed value for the primary residence of a senior citizen, age 65 years and older, or a disabled veteran with a service connected disability of 50% or more.

Alaska does not have a state sales tax, but has a max local sales tax rate of 7.50 percent and an average combined state and local sales tax rate of 1.76 percent. Alaska's tax system ranks 3rd overall on our 2024 State Business Tax Climate Index.

Alaska Property Tax Rates These rates are calculated as ?mills.? A mill is equal to $1 of tax for every $1,000 in assessed value. So, for example, if your home is worth $100,000 and your total mill rate is 30, your tax will be $3,000.