Alaska Letter regarding Wage Statement

Description

How to fill out Letter Regarding Wage Statement?

Are you currently in a position in which you need files for possibly company or person reasons nearly every day time? There are a variety of authorized file layouts accessible on the Internet, but locating types you can trust is not simple. US Legal Forms gives thousands of develop layouts, just like the Alaska Letter regarding Wage Statement, which can be created to fulfill federal and state requirements.

When you are presently knowledgeable about US Legal Forms web site and get your account, simply log in. After that, you can obtain the Alaska Letter regarding Wage Statement web template.

Should you not provide an accounts and would like to start using US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is for your proper metropolis/county.

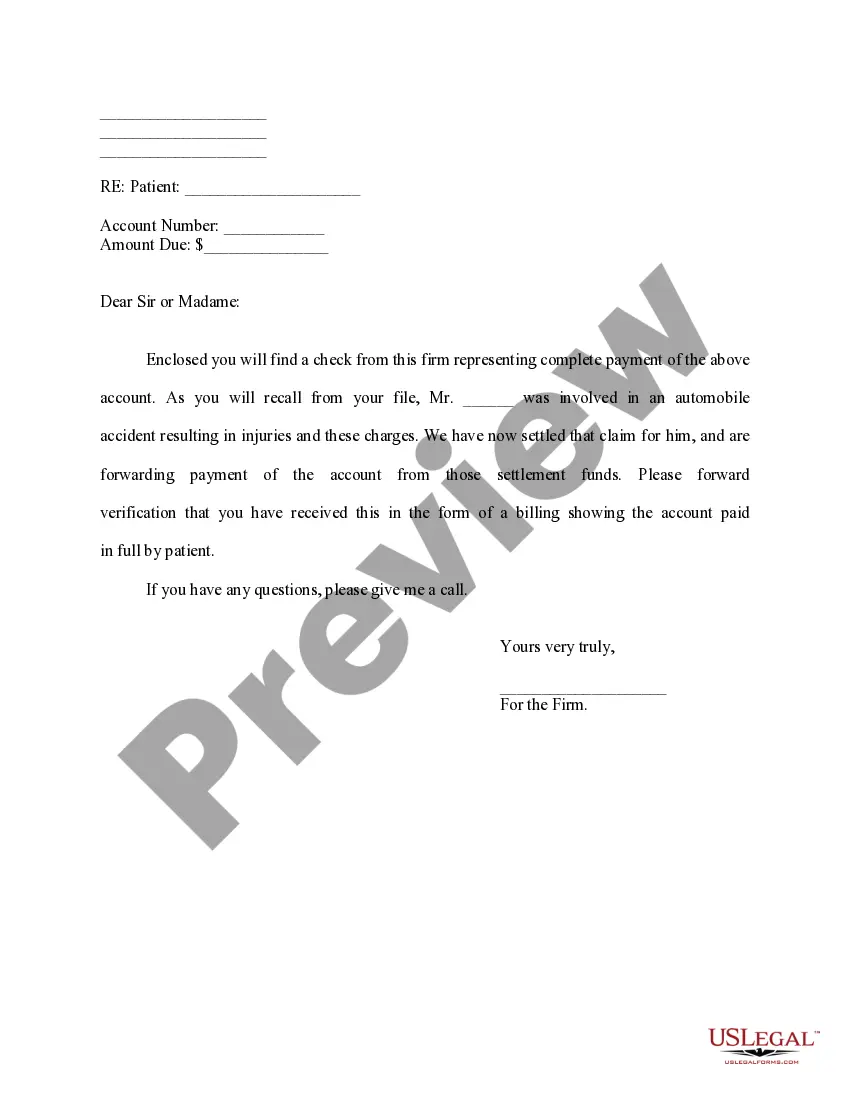

- Make use of the Preview button to check the form.

- Read the description to ensure that you have chosen the appropriate develop.

- If the develop is not what you`re searching for, make use of the Search area to get the develop that meets your needs and requirements.

- If you discover the proper develop, click Purchase now.

- Opt for the pricing plan you need, submit the desired information and facts to create your bank account, and pay for the transaction utilizing your PayPal or credit card.

- Pick a practical paper formatting and obtain your backup.

Locate each of the file layouts you may have bought in the My Forms menu. You can aquire a more backup of Alaska Letter regarding Wage Statement whenever, if required. Just select the needed develop to obtain or printing the file web template.

Use US Legal Forms, the most comprehensive variety of authorized varieties, to conserve some time and avoid errors. The service gives expertly produced authorized file layouts which you can use for a range of reasons. Create your account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

If you are terminated by your employer, your employer must pay you all monies owed within three working days after the day of termination (not counting weekends and holidays). If you quit, you must be paid by the next regular payday that is at least three working days after your last day worked.

In order for the agency to act on your behalf for violations of overtime and minimum wage laws, you must file with the DLWD within two years from the date that the work was actually performed. Claims for straight-time wages or other promised benefits are subject to a three-year deadline.

Wages and breaks The minimum salary threshold for exempt employees is $868 per week (which equals $45,136 per year).

The Alaska Wage and Hour Act requires employers to pay nonexempt employees overtime for all hours worked in excess of 40 hours in a workweek and in excess of eight hours in a workday. However, an employer is not required to pay both daily overtime and weekly overtime for the same hours worked.

Final paychecks in Alaska Employees who are fired or laid off must be paid all due wages within 3 working days. Employees who quit, resign due to a labor dispute, or are suspended must be paid by the next regular payday.

(a) An employer shall permit an employee or former employee to inspect and make copies of the employee's personnel file and other personnel information maintained by the employer concerning the employee under reasonable rules during regular business hours.

1) What is the minimum wage in Alaska? Effective Jan. 1, 2023, Alaska's minimum wage is $10.85 per hour. This is calculated by multiplying all hours worked in the pay period by $10.85.

Alaska Minimum Wage Exemptions Exemptions to the Alaska Wage and Hour Act include individuals employed: in agriculture. in the taking of aquatic life or in the hand-picking of shrimp. in domestic service (including babysitting) in or about a private home.