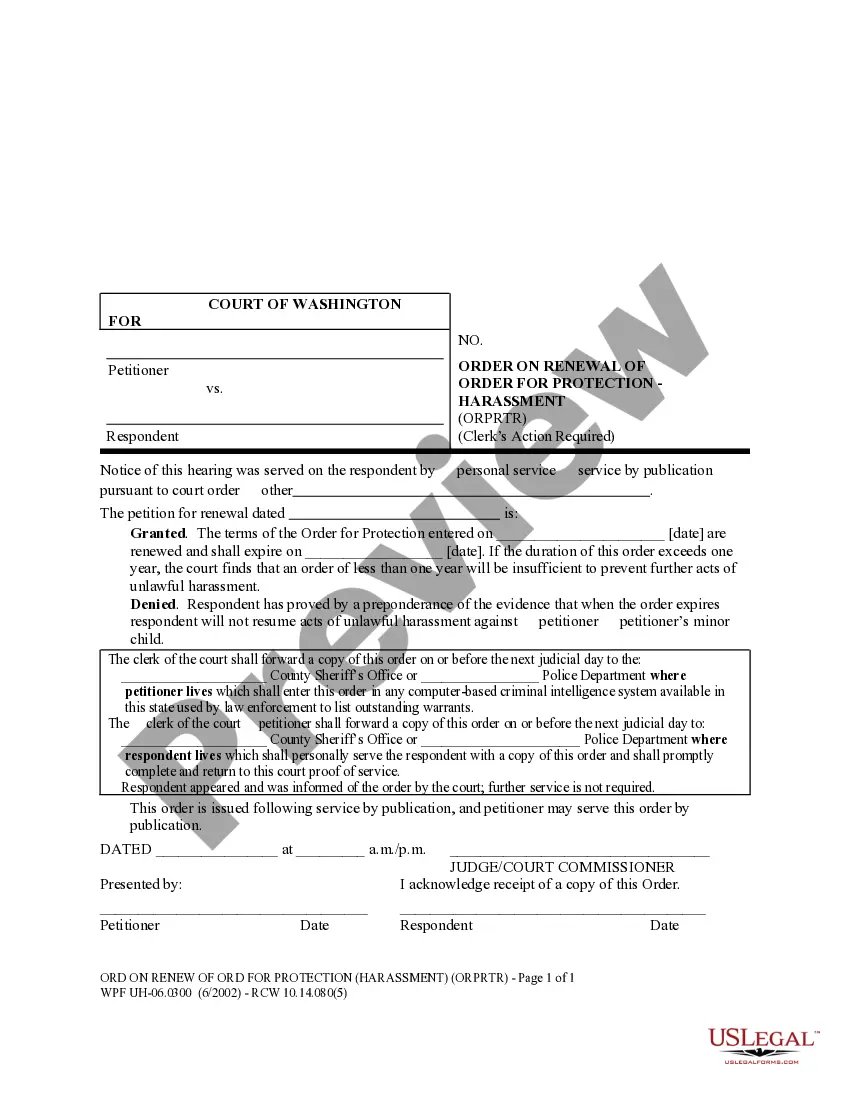

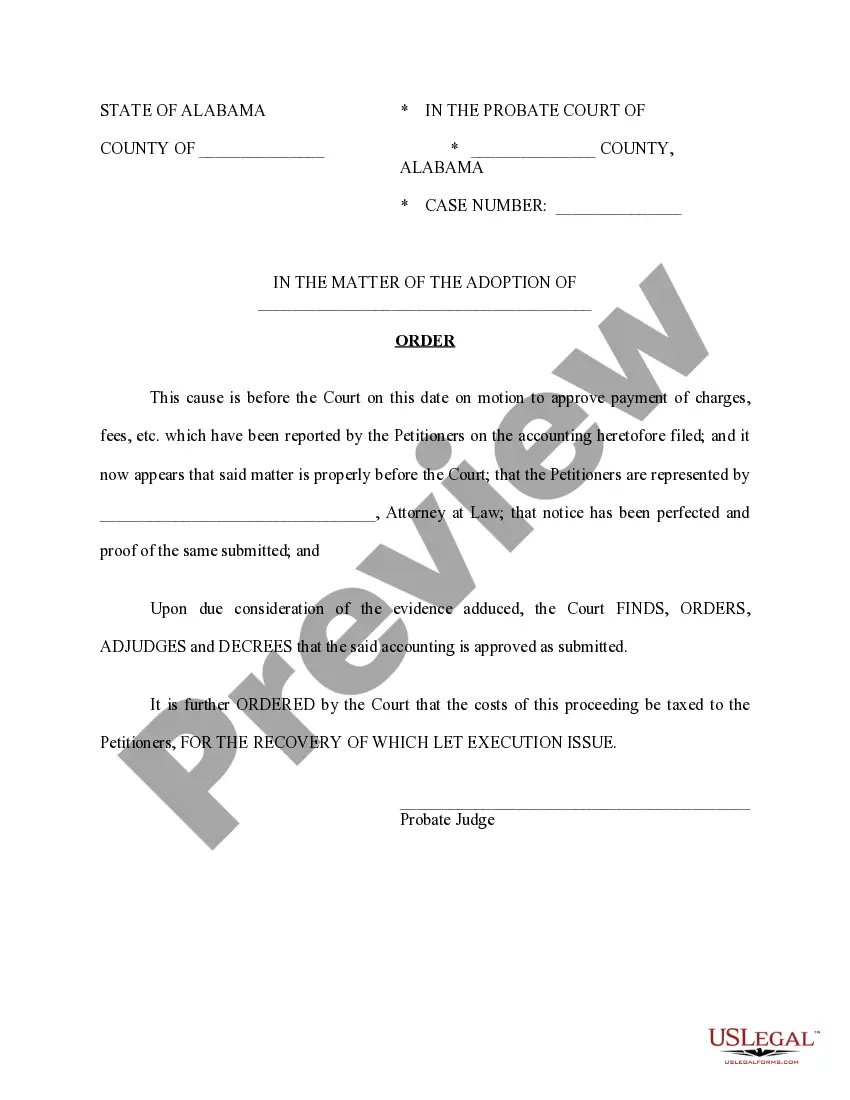

This form is an order of the Court that the said accounting submitted by the petitioners is approved as submitted. The form is available in both word and word perfect formats.

Alabama Order Approving Disbursements

Description

How to fill out Alabama Order Approving Disbursements?

Utilizing Alabama Order Approving Disbursements samples crafted by experienced attorneys helps you prevent complications when filing paperwork.

Simply download the template from our site, complete it, and request legal guidance to verify it.

This approach will save you significantly more time and effort compared to searching for a legal expert to draft a document for you.

Utilize the Preview feature and review the description (if available) to determine if you need this particular sample and if you do, click Buy Now. Locate an additional file using the Search field if necessary. Select a subscription that aligns with your needs. Initiate with your credit card or PayPal. Choose a file format and download your document. Soon after completing all the above steps, you will be able to fill out, print, and sign the Alabama Order Approving Disbursements template. Remember to double-check all entered information for accuracy before submission or mailing. Minimize the time spent on document creation with US Legal Forms!

- If you already possess a US Legal Forms subscription, simply Log In/">Log In to your account and navigate back to the sample page.

- Locate the Download button adjacent to the template you are reviewing.

- After obtaining a file, you can find all your saved samples in the My documents section.

- If you don’t have a subscription, it’s not a significant issue.

- Just follow the instructions below to register for an account online, procure, and fill out your Alabama Order Approving Disbursements template.

- Check and ensure that you are downloading the correct state-specific form.

Form popularity

FAQ

Disbursement means paying out money. The term disbursement may be used to describe money paid into a business' operating budget, the delivery of a loan amount to a borrower, or the payment of a dividend to shareholders.A disbursement is the actual delivery of funds from a bank account.

A payment made to suppliers on behalf of your customers is called a 'disbursement' if you pass the cost on to your customers when you invoice them.you pass on the exact amount of each cost to your customer when you invoice them. the goods and services you paid for are in addition to the cost of your own services.

Disbursement means paying out money. The term disbursement may be used to describe money paid into a business' operating budget, the delivery of a loan amount to a borrower, or the payment of a dividend to shareholders.A disbursement is the actual delivery of funds from a bank account.

Depending on the circumstances of the matter, disbursements may include expenses such as witness fees, court filing and hearing fees, interpreter's fees and fees for the service of court documents such as subpoenas. A legal aid grant may cover these fees.

Some examples of disbursements are payroll expenses, rent, taxes or insurance premiums. In organizational structures, the Finance Department is often the one that handles the disbursement program where all the company's financial commitments are scheduled to be paid at certain moment.

There is no absolute definition of disbursements, but are generally expenses a solicitor has to pay out on behalf of a client, for goods or services provided to the client, or on the client's behalf.The starting point for recoverability of any disbursement is whether it is covered in the contract.

When a business sends a disbursement on behalf of a client, the reimbursement is what the client pays to the company as a refund for the original payment.In general, the difference between a payment and disbursement is that one is the instance or process of disbursing while the other is the act of paying.

HMRC defines 'disbursements' as 'a payment made to suppliers on behalf of your customers'.you paid the supplier on your client's behalf and acted as the agent of your client. your client received, used or had the benefit of the goods or services you paid for on their behalf.

Disbursements, are out of pocket expenses which we incur on your behalf to a third party, whilst conducting your sale or purchase. Examples of disbursements are your search fees, your land registry fees and your CHAPS payment fees (same day electronic transfer of funds fees).