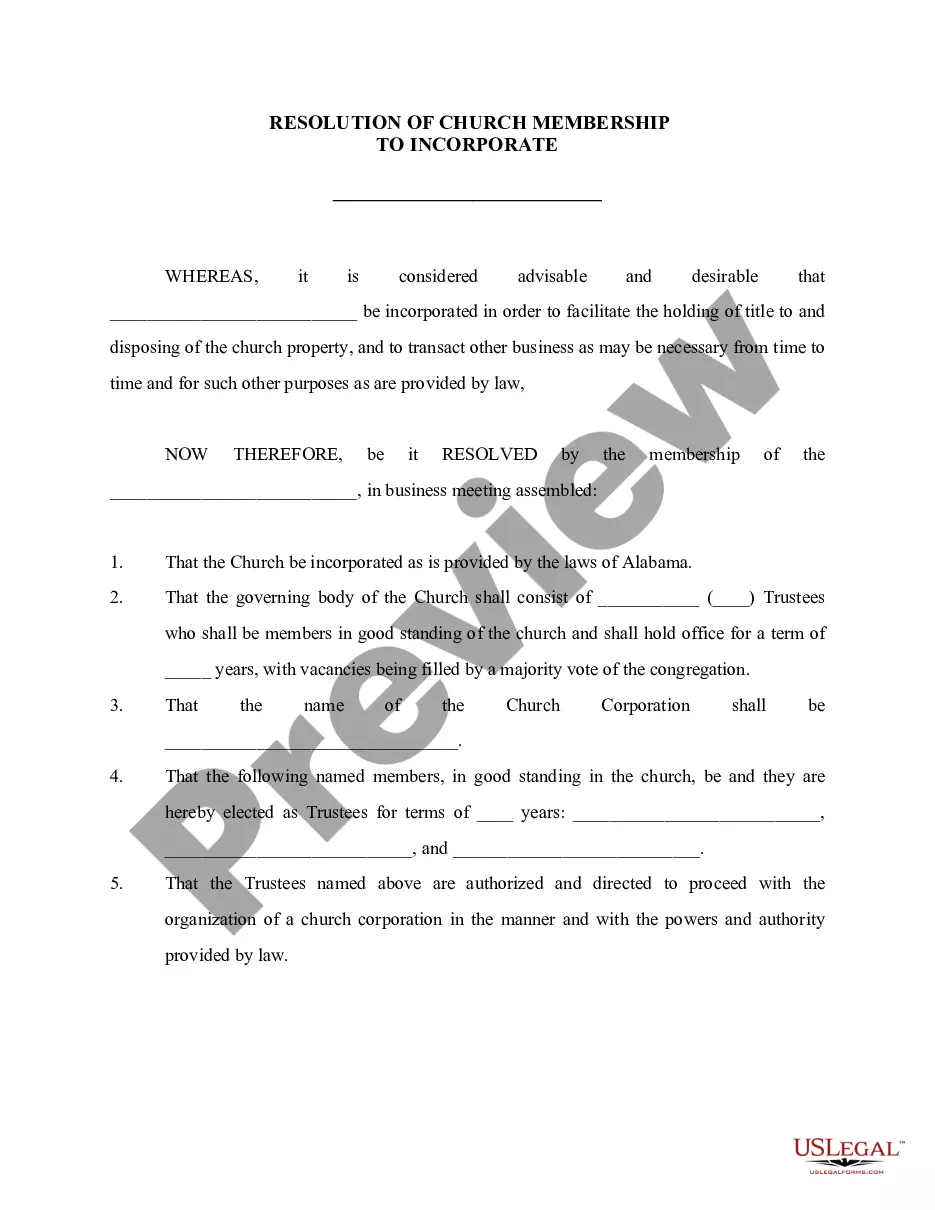

This form is a resolution by the membership of a church authorizing the church to incorporate under the laws of the state of Alabama. The form is available in both word and word perfect formats.

Alabama Resolution of Church Membership For Incorporation

Description

How to fill out Alabama Resolution Of Church Membership For Incorporation?

Employing Alabama Resolution of Church Membership For Incorporation templates crafted by experienced lawyers allows you to evade complications while finalizing paperwork.

Simply download the sample from our site, complete it, and have a legal expert review it.

This approach will save you considerably more time and effort than seeking out a legal professional to create a document for you.

Utilize the Preview feature to review the description (if available) to determine if you require this particular template, and if so, click Buy Now. Explore additional samples using the Search field if necessary. Choose a subscription that meets your requirements. Initiate using your credit card or PayPal. Select a file format and download your document. Once you have completed all the above steps, you'll be able to fill out, print, and sign the Alabama Resolution of Church Membership For Incorporation template. Remember to thoroughly check all entered information for accuracy before submitting or sending it out. Minimize the time spent on document completion with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log In to your account and return to the form section.

- Locate the Download button adjacent to the template you are examining.

- After acquiring a template, all your saved documents can be found in the My documents tab.

- If you do not have a subscription, that’s not an issue.

- Just adhere to the instructions below to register for your account online, obtain, and complete your Alabama Resolution of Church Membership For Incorporation template.

- Verify and ensure that you are downloading the accurate state-specific form.

Form popularity

FAQ

Any time a group gathers for a lawful purpose the law treats it as an unincorporated association, a kind of legal entity. As a nonprofit association, a church can be sued as an organization even if no other formal steps have been taken to organize it.

Churches and ministries should be formed as nonprofit C Corporations. Corporations intended for business activities should generally form as for-profit C corporations. Subchapter S corporations have little application in the world of religious organizations and should usually not be used.

Initially, Alabama requires all entities to file the one-time filing of an Initial Business Privilege Tax Return (Form BPT-IN) with the Department of Revenue within two and one-half months of incorporation.

However, according to the IRS Tax Guide for Churches and Religious Organizations (available for download at the IRS website), churches are not required to incorporate and are automatically tax-exempt, provided that they meet the requirements and the general criteria set forth by the IRS for the definition of a "church.

Submit your articles of incorporation to the Office of the Judge of Probate in the county where the corporation's initial registered office is located. You must submit a packet containing the original articles of incorporation (also called Certificate of Formation), two copies, and the Certificate of Name Reservation.

A corporation organized to operate a church or to be otherwise structured for primarily or exclusively religious purposes is a nonprofit Religious corporation. To form a Nonprofit Religious Corporation in California, you must file Articles of Incorporation with the California Secretary of State.

Incorporate with the Alabama Corporation Commission. Complete initial organization documents as required by the Secretary of State. Apply for a Federal Employer Identification Number (EIN) using IRS Form SS-4. Establish incorporator(s) and Board of Directors.

Although there are various means by which to determine if your church is a corporation, the best option is to check with your state's division of corporations. While churches may be organized as various types of business entities, filing as a non-profit is the most common and advantageous.

Obtain the consent of church members to incorporate. Typically, this involves calling a meeting of the church hierarchy to bring the suggestion to a vote. In some churches, once the church hierarchy votes to incorporate, the issue is brought to the church members for ratification through a general vote.