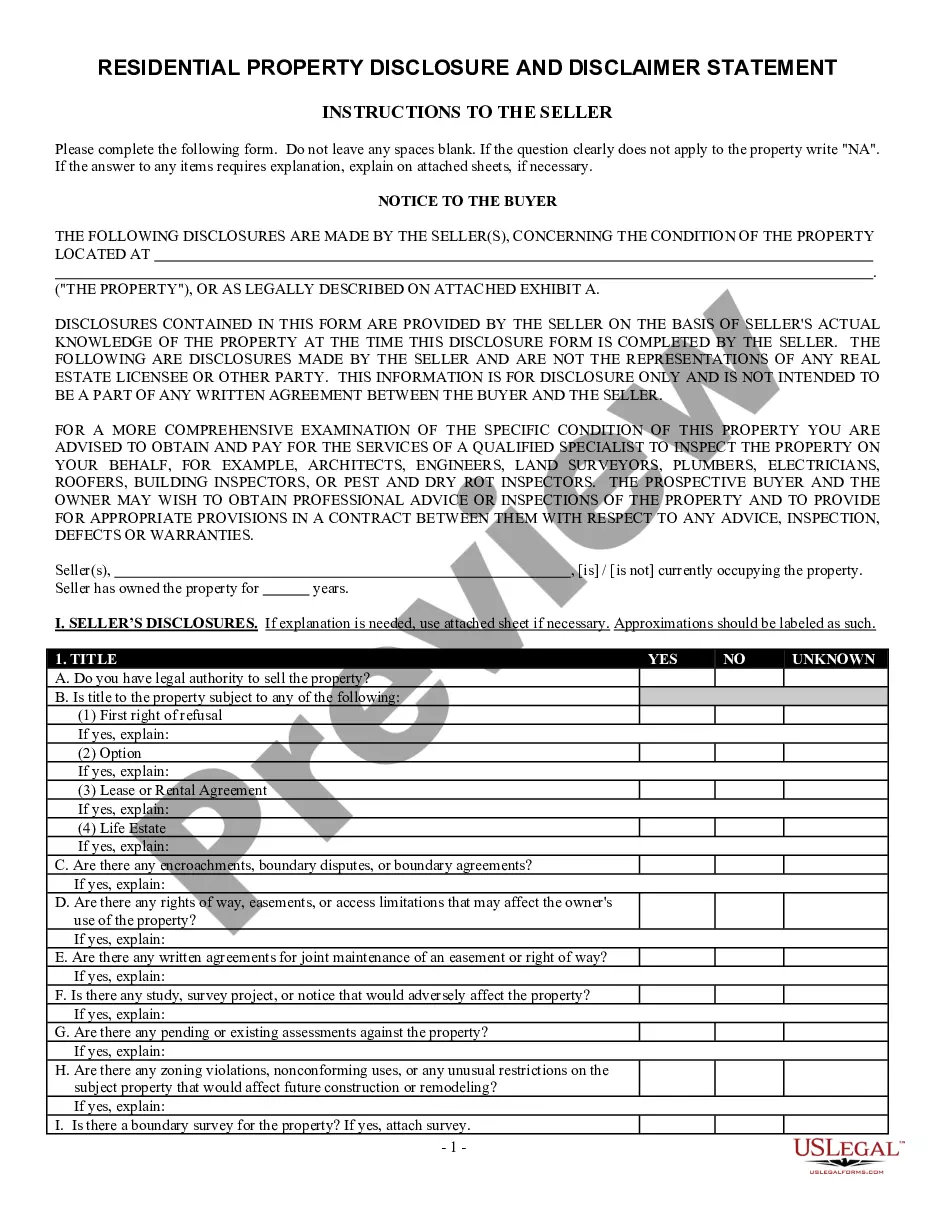

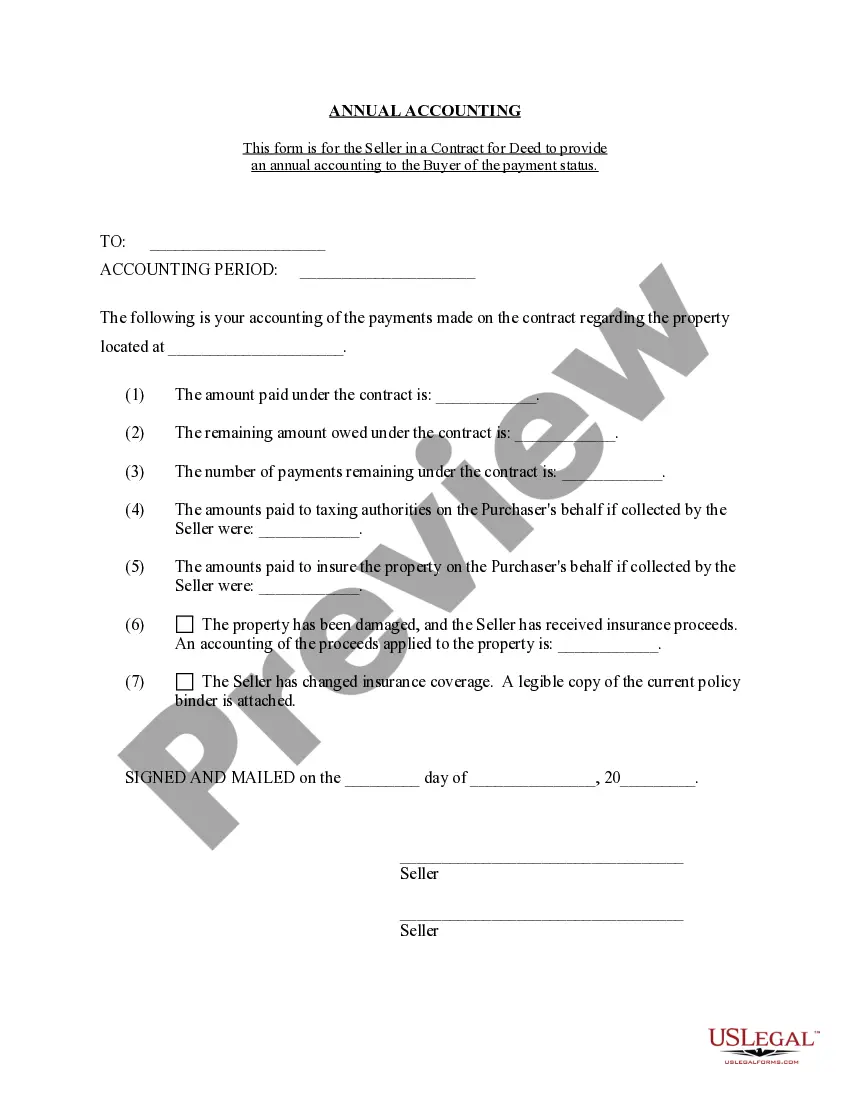

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Alabama Contract for Deed Seller's Annual Accounting Statement

Description Al Seller Printable

How to fill out Alabama Contract Deed Agreement?

Utilize US Legal Forms to obtain a printable Alabama Contract for Deed Seller's Annual Accounting Statement. Our legally admissible forms are crafted and frequently updated by proficient attorneys.

Ours is the most comprehensive Forms library available online and provides economical and precise examples for clients, lawyers, and small to mid-sized businesses.

The templates are organized into state-specific categories, and several can be previewed prior to downloading.

US Legal Forms provides a vast array of legal and tax templates and packages tailored to both business and personal requirements, including the Alabama Contract for Deed Seller's Annual Accounting Statement. Over three million users have effectively utilized our platform. Select your subscription plan and access high-quality forms with just a few clicks.

- To obtain templates, users must maintain a subscription and Log In to their account.

- Select Download beside any template of interest and locate it in My documents.

- For those without a subscription, follow these steps to quickly find and download the Alabama Contract for Deed Seller's Annual Accounting Statement.

- Ensure you verify that you are selecting the correct template corresponding to the necessary state.

- Examine the document by reviewing its description and utilizing the Preview option.

- Click Buy Now if you have chosen the desired template.

- Establish your account and complete payment through PayPal or by card|credit card.

- Download the form to your device and you are free to reuse it as many times as needed.

- Use the Search function if you wish to find another document template.

Alabama Seller Buy Form popularity

Alabama Seller Complete Other Form Names

Alabama Seller Pdf FAQ

The Alabama (AL) state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as 11%.

Legislative Act 2015-448, entitled the Simplified Seller Use Tax Remittance Act, allows eligible sellers to participate in a program to collect, report and remit a flat eight percent (8%) sellers use tax on all sales made into Alabama.

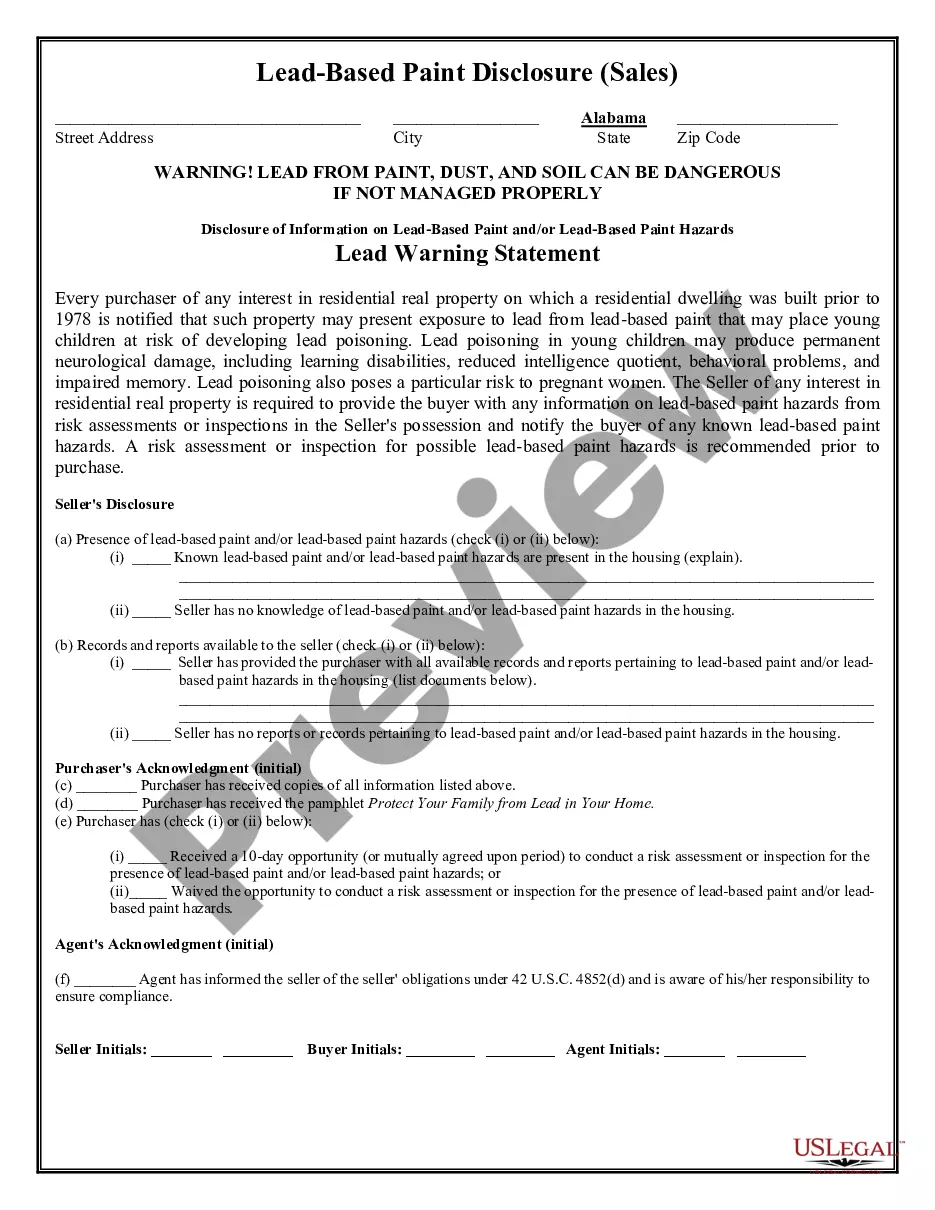

Unlike in many other U.S. states, Alabama law employs a rule known as caveat emptor for the sale of used residential property. Caveat emptor is Latin for let the buyer beware, which means that the seller has no actual duty to advise the buyer of issues with the property's physical condition during the sale.

Alabama law provides that a seller or seller's agent has a duty to disclose information about used real estate in three scenarios 1) Defects affecting health and safety, 2) where a fiduciary relationship exists, and 3) upon specific inquiry by the buyer.

Buyer beware, also known as the doctrine of caveat emptor, is an age-old doctrine. It means that, if you intend to buy property, you generally bear the responsibility for finding out about the property's condition before purchasing it.

While there's no hard-and-fast list of which states follow caveat emptor and which don't, Alabama, Arkansas, Georgia, North Dakota, Virginia, and Wyoming are largely known as caveat emptor states. In others, courts have upheld the principle only some of the time.

In most cases, prepared food to be consumed on or off the premises is fully taxable in Alabama at 4%. However, counties and jurisdictions may charge an additional local sales tax of up to 7%, for a maximum possible combined sales tax of 11%.

4. How much does it cost to apply for a sales tax permit in Alabama? It's free to apply for a sales tax permit, but other business registration fees may apply.

The Alabama Supreme Court has held caveat emptor (buyer beware) to be the law in Alabama when selling existing homes. Everyone should be on notice that there is no warranty which comes with the sale of a used home. Buyers have a chance to inspect the property and should assume the responsibility of a purchase.