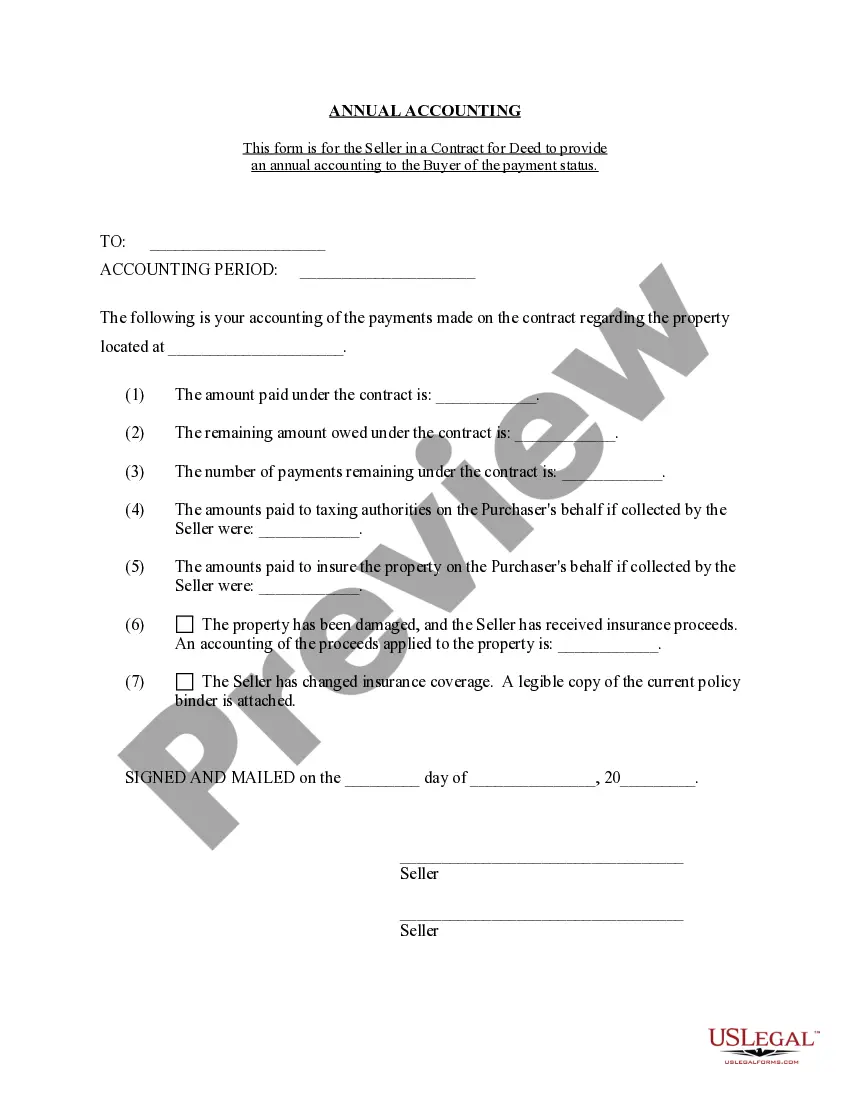

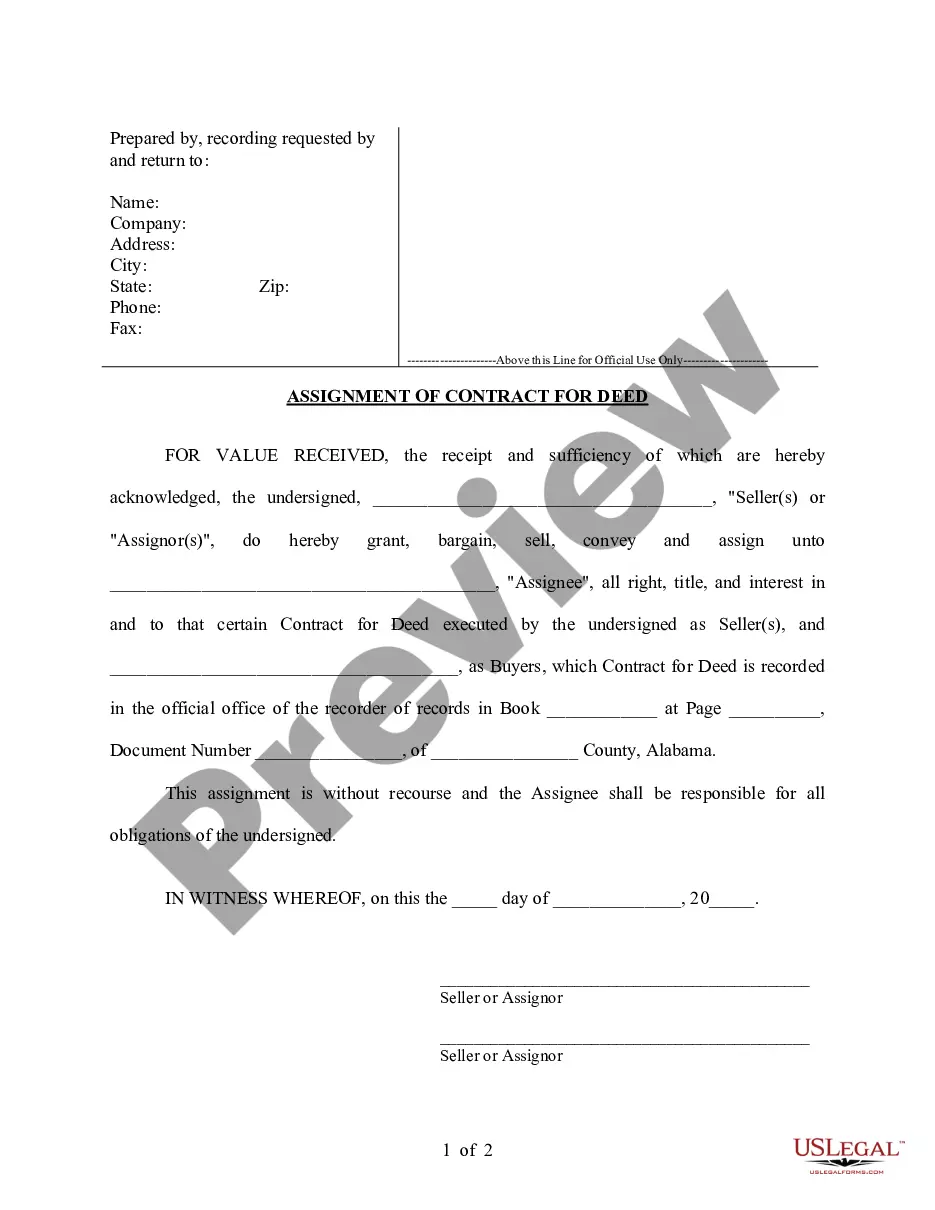

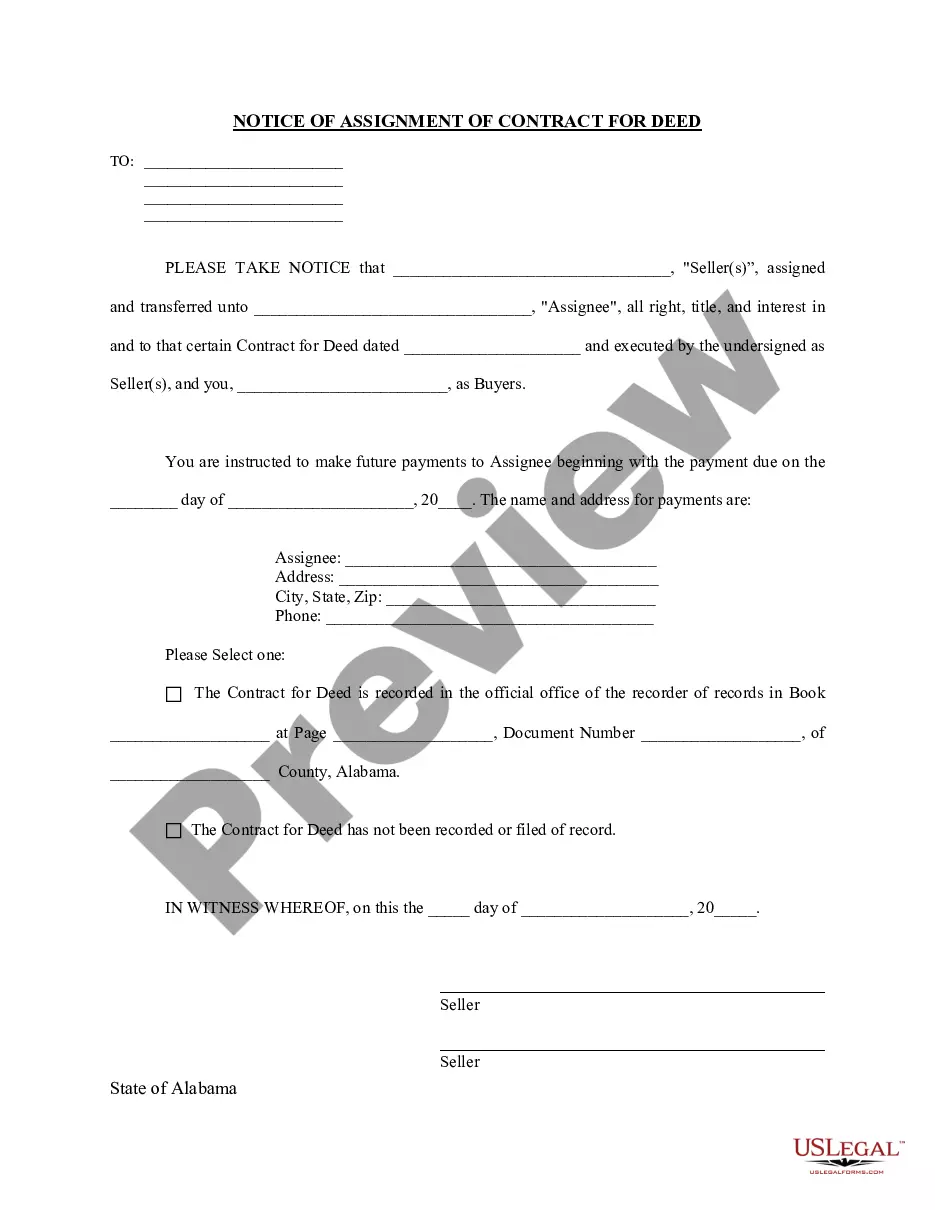

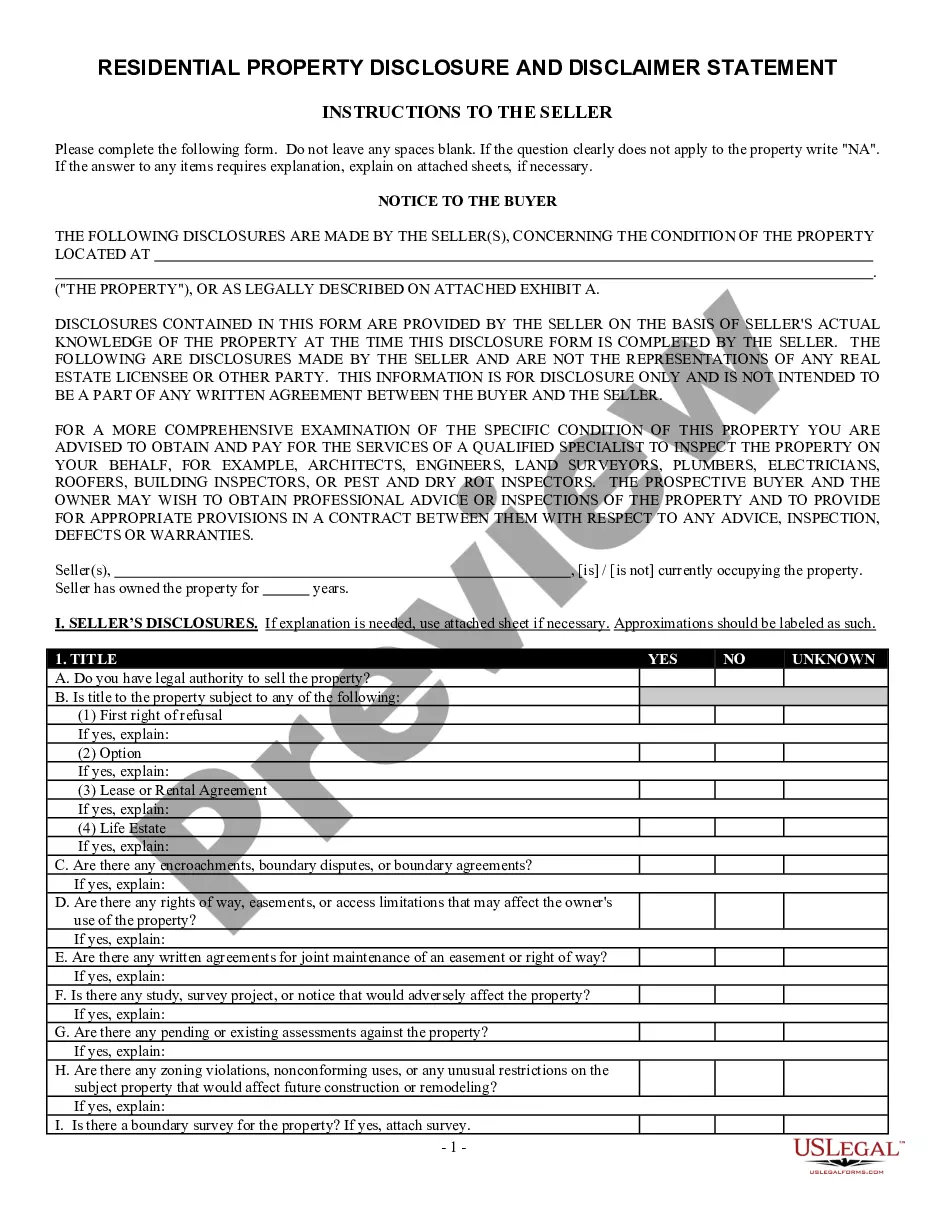

A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

Real Land Executory

Description Sale Aka Executory Application

How to fill out Deed Aka Land?

Making use of Alabama Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract templates created by expert attorneys gives you the opportunity to stay away from headaches when filling out documents. Simply download the template from our website, fill it out, and request legal counsel to verify it. It, can help you save much more time and effort than requesting a lawyer to prepare a file completely from scratch to suit your needs would.

If you’ve already bought a US Legal Forms subscription, just log in to your account and go back to the sample web page. Find the Download button near the templates you’re looking over. After downloading a file, you will find all your saved examples in the My Forms tab.

If you have no subscription, that's not a problem. Just follow the steps below to sign up for an account online, get, and fill out your Alabama Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract template:

- Double-check and make certain that you are downloading the proper state-specific form.

- Utilize the Preview feature and read the description (if available) to know if you need this particular template and if you do, click Buy Now.

- Find another sample utilizing the Search field if necessary.

- Pick a subscription that meets your requirements.

- Get started with your credit card or PayPal.

- Select a file format and download your document.

Right after you’ve performed all the steps above, you'll be able to complete, print, and sign the Alabama Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract template. Don't forget to recheck all inserted details for correctness before submitting it or sending it out. Minimize the time spent on creating documents with US Legal Forms!