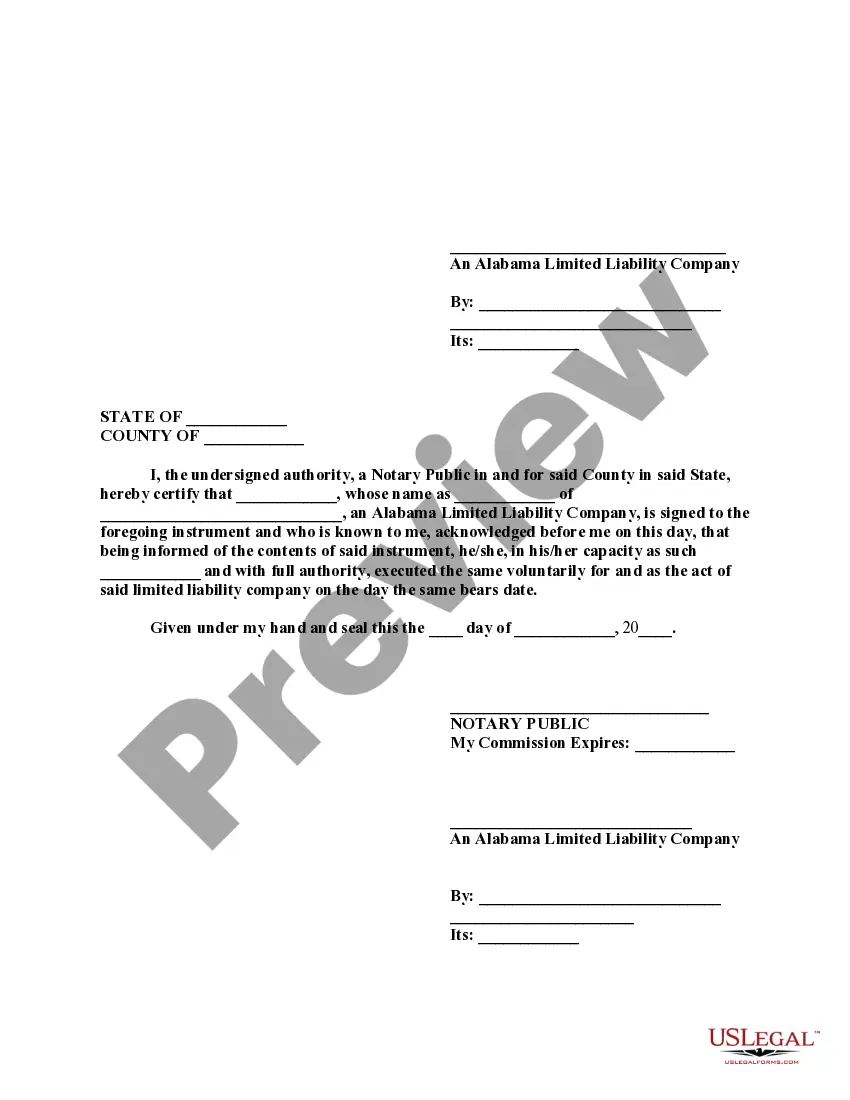

Alabama Additional Collateral and Accommodation Mortgage

Description Accomodation Mortgage

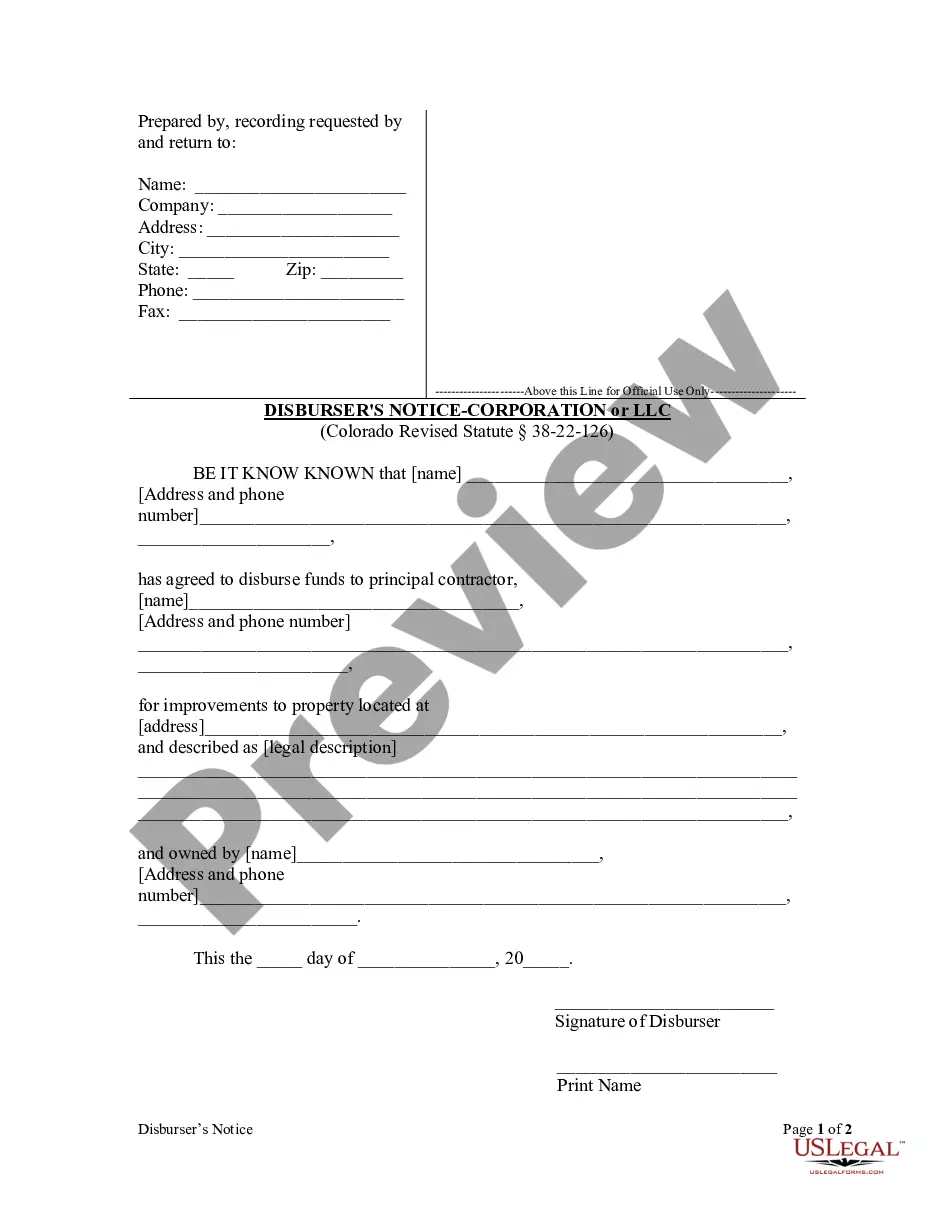

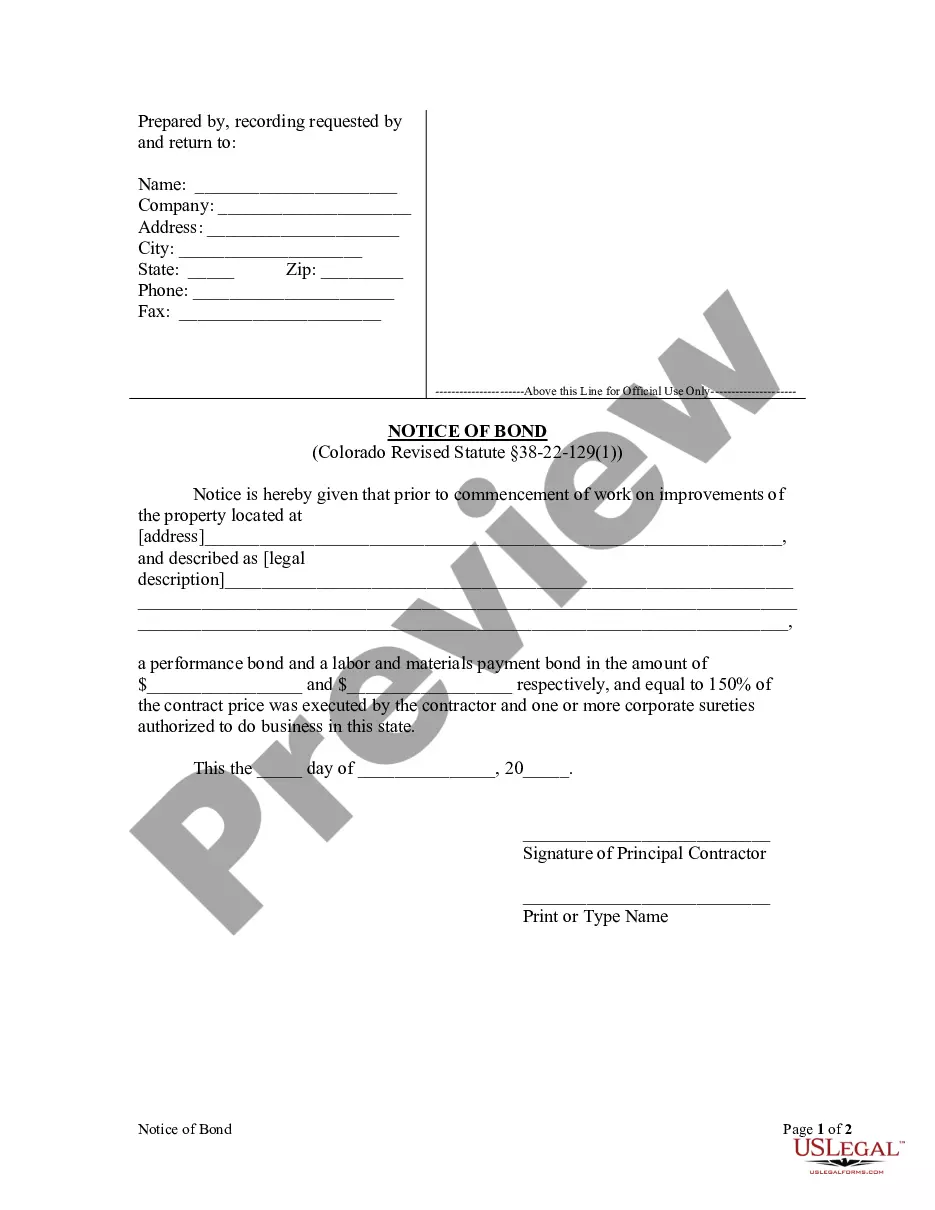

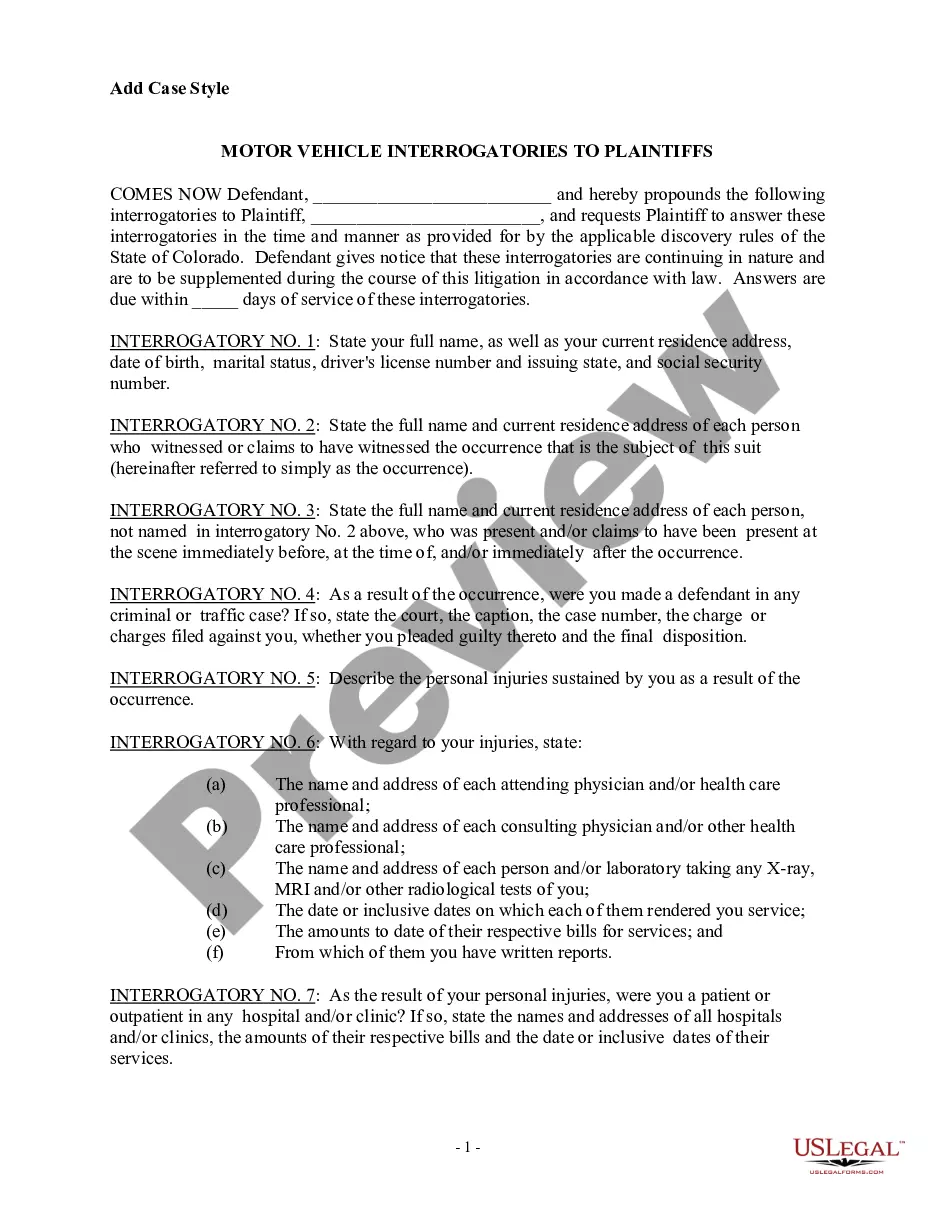

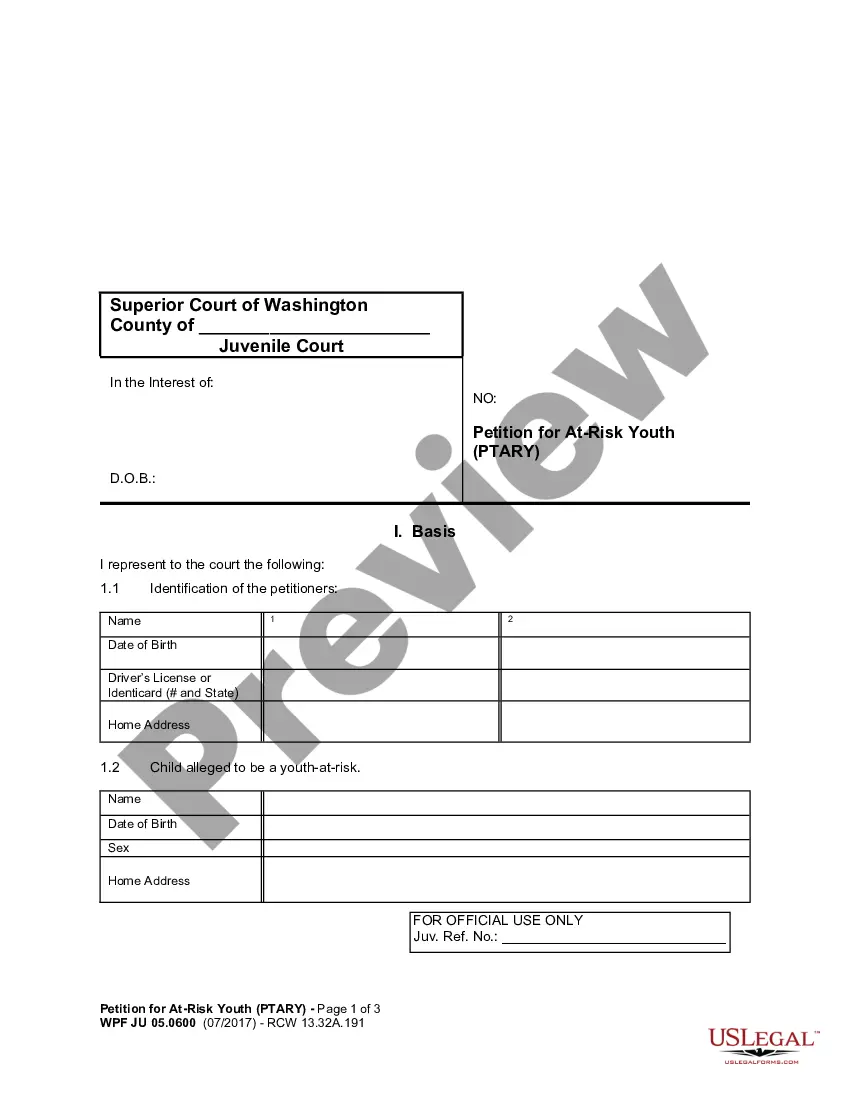

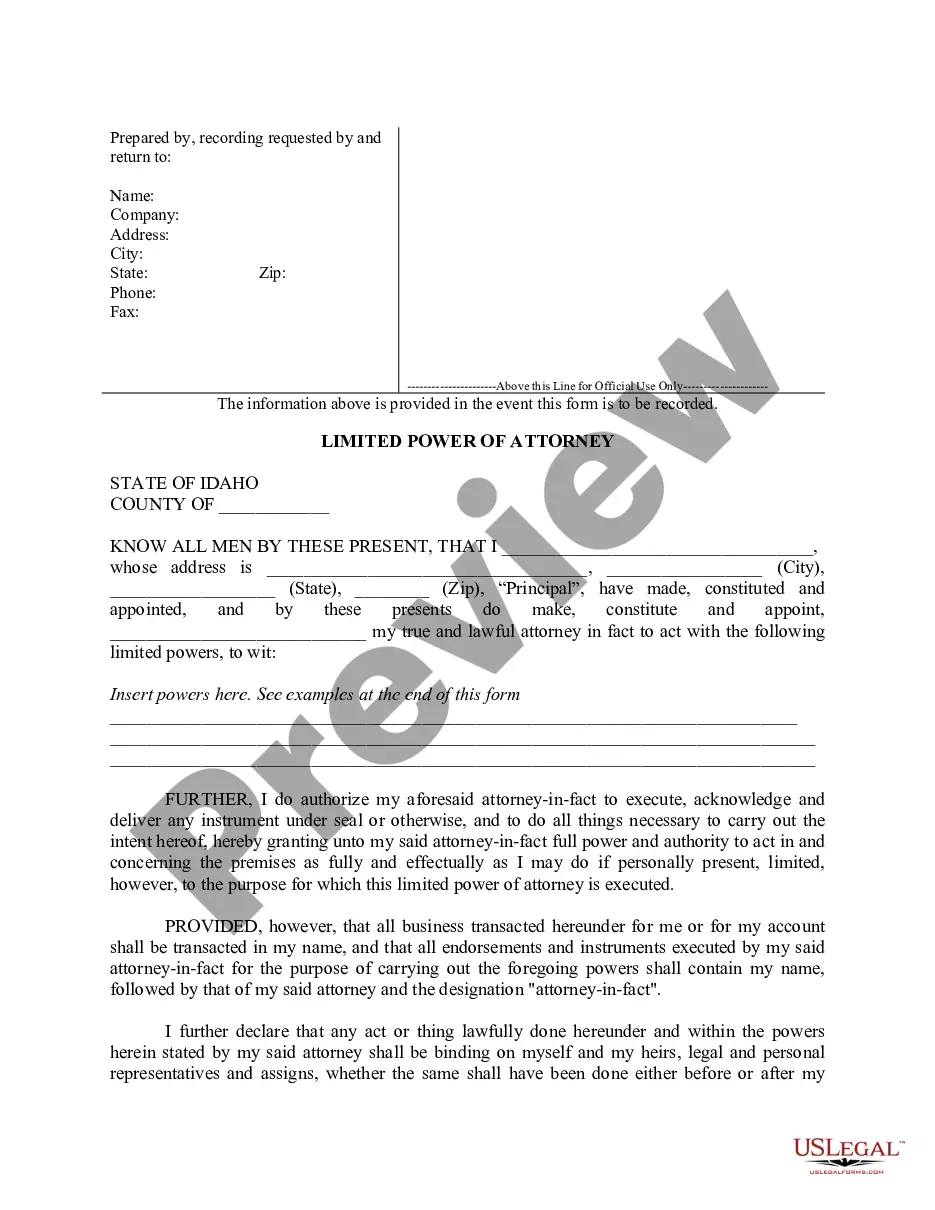

How to fill out Alabama Additional Collateral And Accommodation Mortgage?

Utilizing Alabama Additional Collateral and Accommodation Mortgage templates crafted by expert attorneys enables you to avert complications when submitting paperwork.

Simply download the sample from our site, complete it, and request an attorney to verify it.

This approach will save you considerably more time and expenses than seeking an attorney to draft a document from scratch according to your requirements would.

Once you’ve completed all the above steps, you will be able to fill out, print, and sign the Alabama Additional Collateral and Accommodation Mortgage template. Remember to verify all entered details for accuracy before submitting or sending it. Save time in document creation with US Legal Forms!

- If you hold a US Legal Forms subscription, just Log In to your account and return to the template page.

- Locate the Download button adjacent to the templates you’re reviewing.

- After downloading a file, all your saved forms will be found in the My documents section.

- If you aren’t subscribed, no worries. Just follow the step-by-step instructions below to sign up for an account online, acquire, and complete your Alabama Additional Collateral and Accommodation Mortgage template.

- Double-check to ensure you’re obtaining the correct state-specific document.

- Utilize the Preview feature and read the description (if available) to determine if you need this specific sample, and if so, click Buy Now.

Form popularity

FAQ

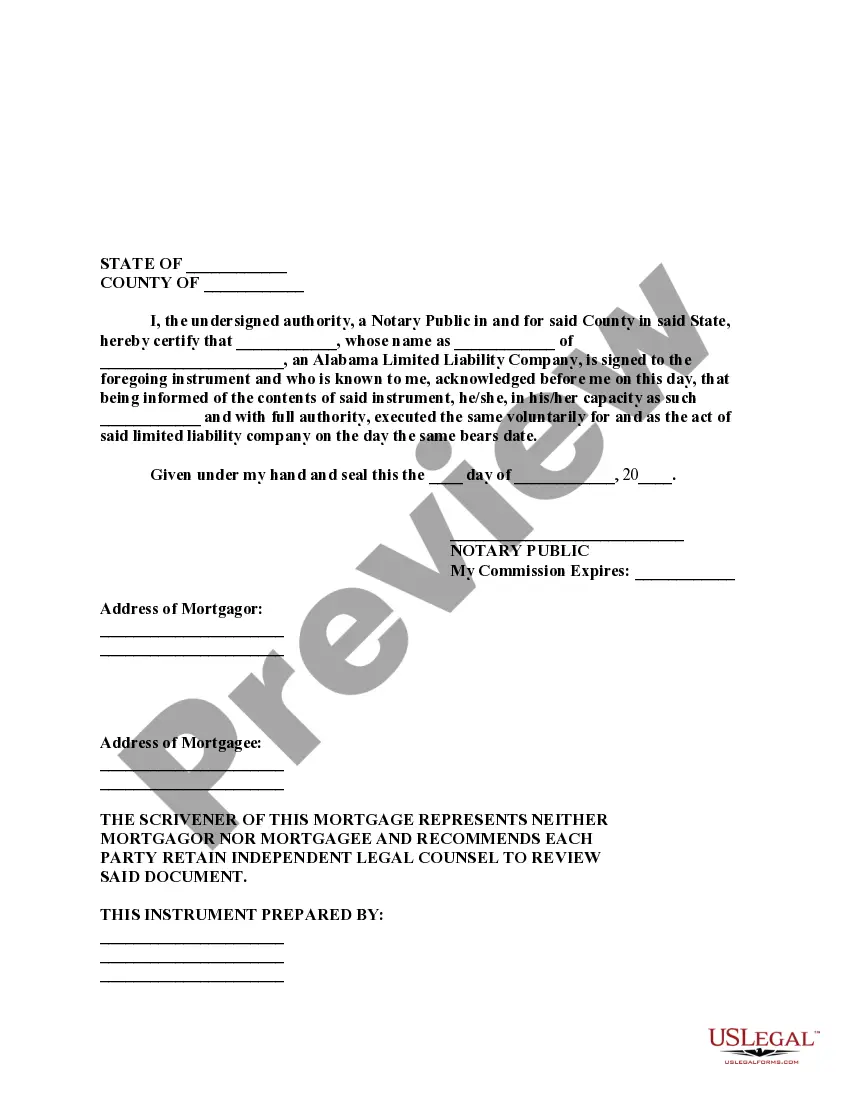

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

Personal loans are typically unsecured, meaning they don't require collateral, but lenders require some personal loans to be backed by something that holds monetary value. Collateral on a secured personal loan can include things like cash in a savings account, a car or even a home.

Secondary Collateral: Any other assets of Borrower in which Lender is receiving a Lien to secure any other financial accommodations provided by Lender to such Borrower.

A collateral mortgage is a readvanceable mortgage product, meaning that your lender can lend you more money as your property value increases without having to refinance your mortgage.

The biggest risk of a collateral loan is you could lose the asset if you fail to repay the loan. It's especially risky if you secure the loan with a highly valuable asset, such as your home. It requires you to have a valuable asset.

Additional collateral is used to lessen the risk the lender takes on when issuing a loan.Additional collateral can include cash, certificates of deposit, equipment, stock, or letters of credit. Collateral itself is property or another asset that a borrower offers as a way for a lender to secure the loan.

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two parties' agreement.

When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

Collateral Personal loans are unsecured and collateral-free. Mortgage loans are secured and require the borrower to mortgage a property as collateral.