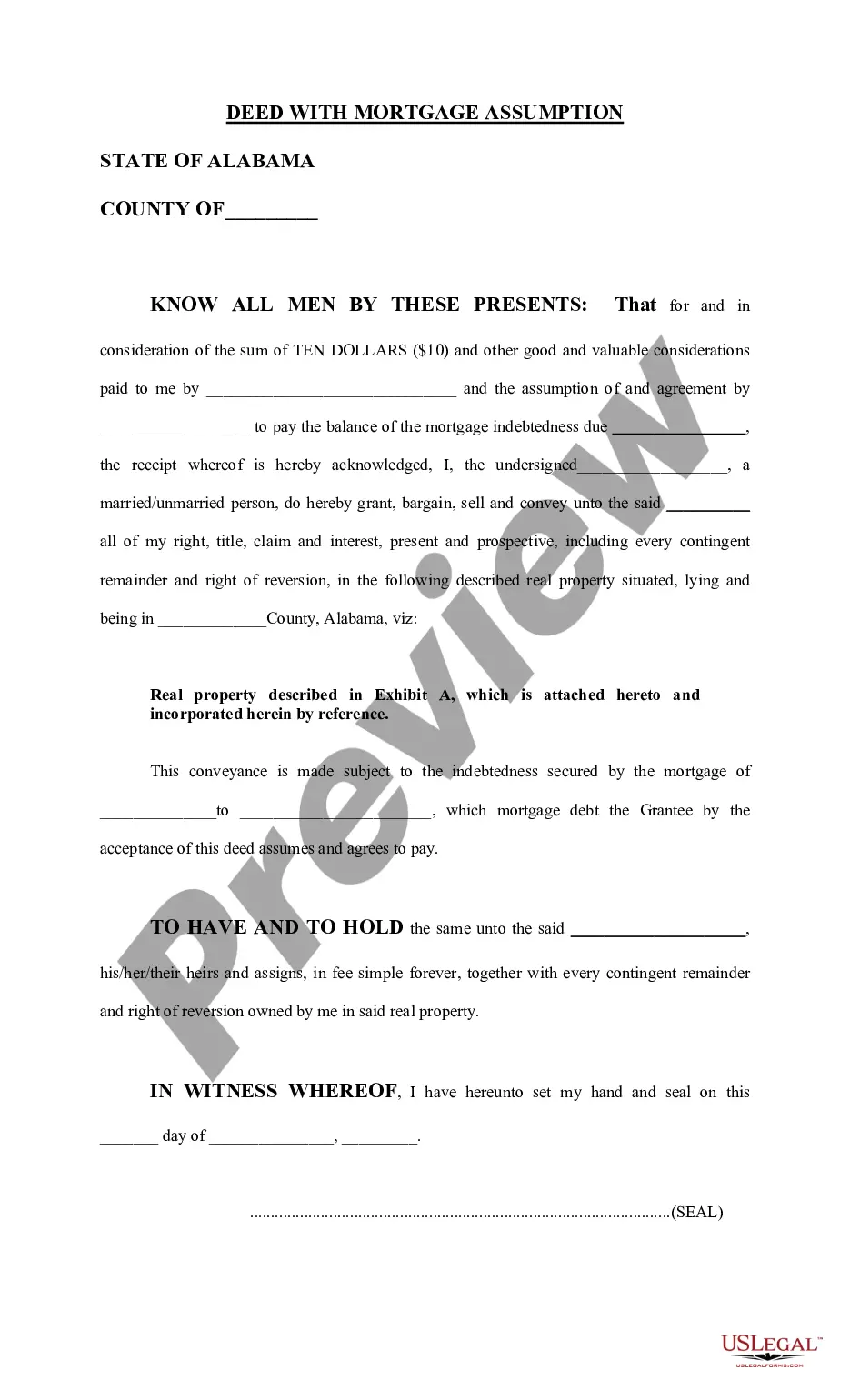

This deed conveys property to the grantee and the grantee agrees to pay the balance of the mortgage indebtedness due. The form is available in both word and word perfect formats.

Alabama Deed with Mortgage Assumption

Description Deed Of Assumption Template

How to fill out Alabama Deed With Mortgage Assumption?

Leveraging Alabama Deed with Mortgage Assumption samples crafted by proficient lawyers offers you the chance to sidestep complications when filing paperwork.

Simply download the sample from our site, complete it, and request an attorney to validate it.

By doing so, you may conserve significantly more time and expenses than searching for a legal expert to draft a document from the ground up to meet your specifications.

Employ the Preview function and read the outline (if available) to ascertain if this specific template is necessary; if it is, simply click Buy Now.

- If you already possess a US Legal Forms subscription, just Log In to your account and return to the form page.

- Locate the Download button adjacent to the templates you are reviewing.

- Once you have downloaded a document, you will find your stored samples in the My documents section.

- If you do not have a subscription, there's no issue.

- Just adhere to the steps below to register for your online account, obtain, and complete your Alabama Deed with Mortgage Assumption template.

- Verify and make certain that you are downloading the appropriate state-specific form.

Form popularity

FAQ

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

No law forbids adding someone to your mortgaged home's deed or in signing your home over to others through one. Mortgage lenders understand deeds, though, and use loan due-on-sale clauses to prevent unauthorized property sales or transfers.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

It is important to note that a quitclaim deed has no effect on a mortgage. A quitclaim transfers a property's title but any mortgage the grantor has will not transfer.

To give the house but keep the mortgage, the parents need permission from the mortgage lender. (And, in the previous example, the value of the gift is $1 million if the mortgage stays with the parents.)

Contact the current lender to request assumption information. Calculate how much you must pay upfront. Qualify with the lender. Pay the down payment, closing fees and mortgage buyout costs. Attend the closing.

The law doesn't forbid adding people to a deed on a home with an outstanding mortgage. Mortgage lenders are familiar and frequently work with deed changes and transfers.When you "deed" your home to someone, you've effectively transferred part ownership, which could activate the "due-on-sale" clause.