This type of deed is used to transfer property when the grantor is acting in his official capacity as an executor of an estate. The form is available in both word and word perfect formats.

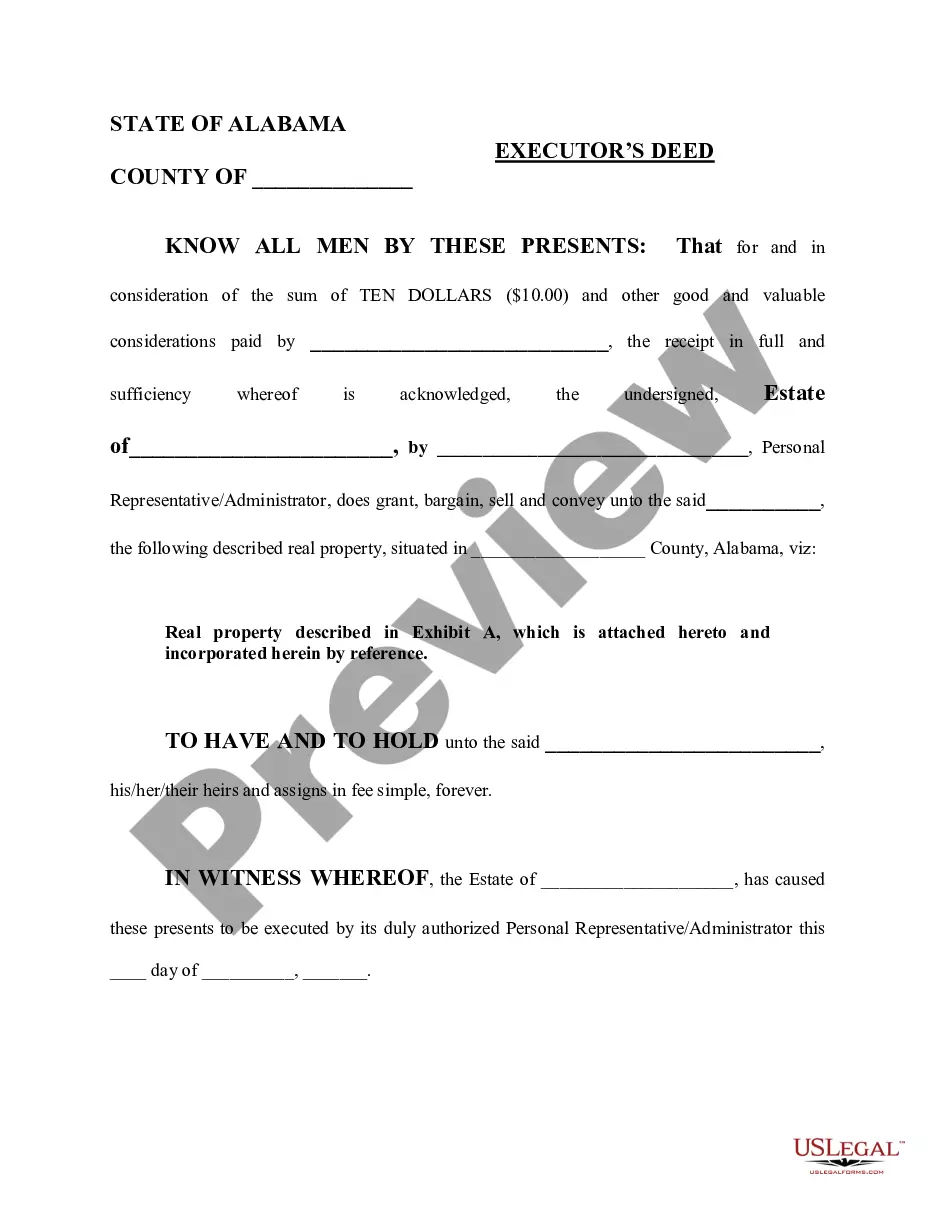

Alabama Executor's Deed

Description Executor Deed

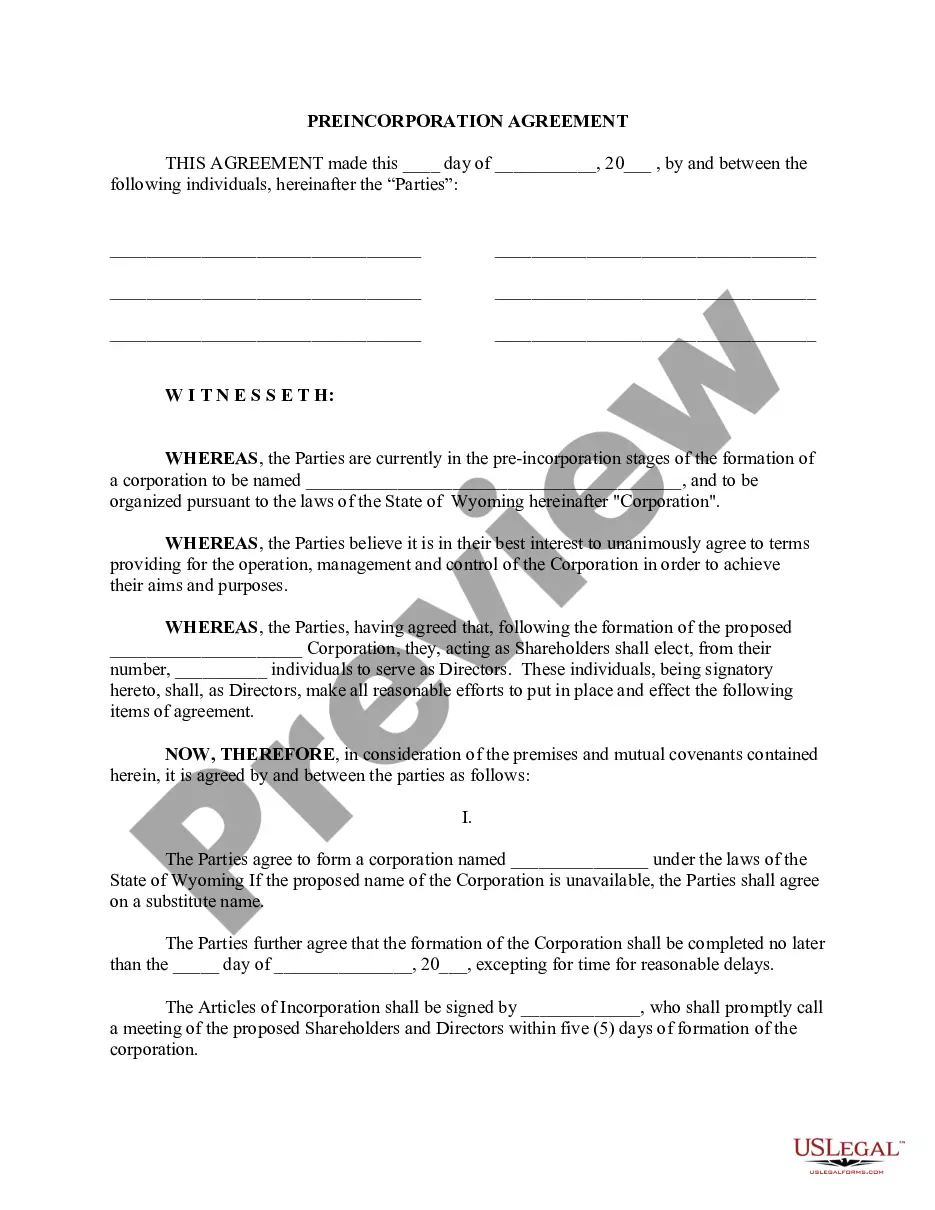

How to fill out What Is An Executor Deed?

Employing Alabama Executor's Deed examples crafted by experienced lawyers allows you to steer clear of troubles when preparing documents.

Simply download the template from our site, complete it, and ask a lawyer to review it.

This approach can save you significantly more time and energy than searching for legal assistance to create a document by yourself.

Once you have completed all the above steps, you will be able to fill out, print, and sign the Alabama Executor's Deed template. Be sure to double-check all entered information for accuracy before submitting or mailing it. Minimize the time spent on document preparation with US Legal Forms!

- Verify that you’re downloading the correct state-specific form.

- Use the Preview feature and review the description (if available) to determine if this specific template is needed and if so, click Buy Now.

- If necessary, search for another file using the Search field.

- Choose a subscription that suits your needs.

- Begin the process using your credit card or PayPal.

- Select a file format and download your document.

Executive Deed Form popularity

Deed Other Form Names

What Is An Administrator's Deed FAQ

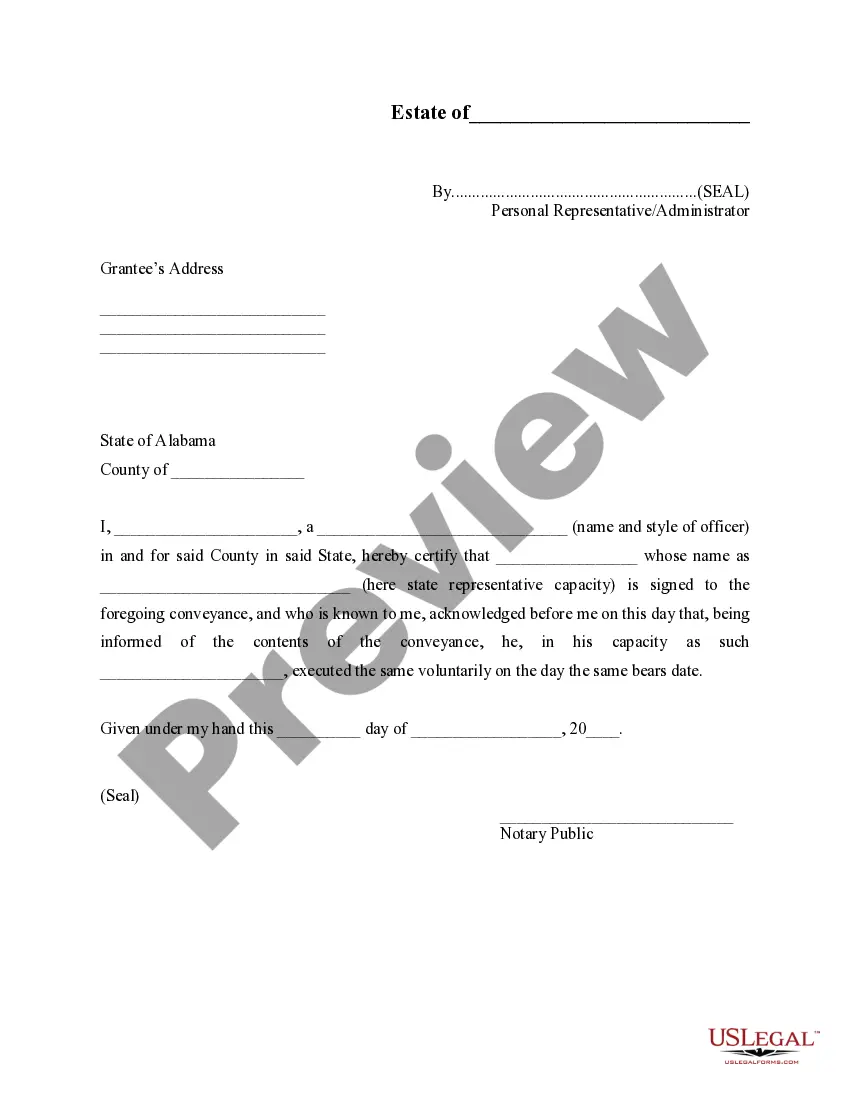

In Alabama, the estate executor is known as a "personal representative". Executors for Alabama estates are entitled to reasonable compensation of up to 2.5% of assets received, and 2.5% of disbursements.

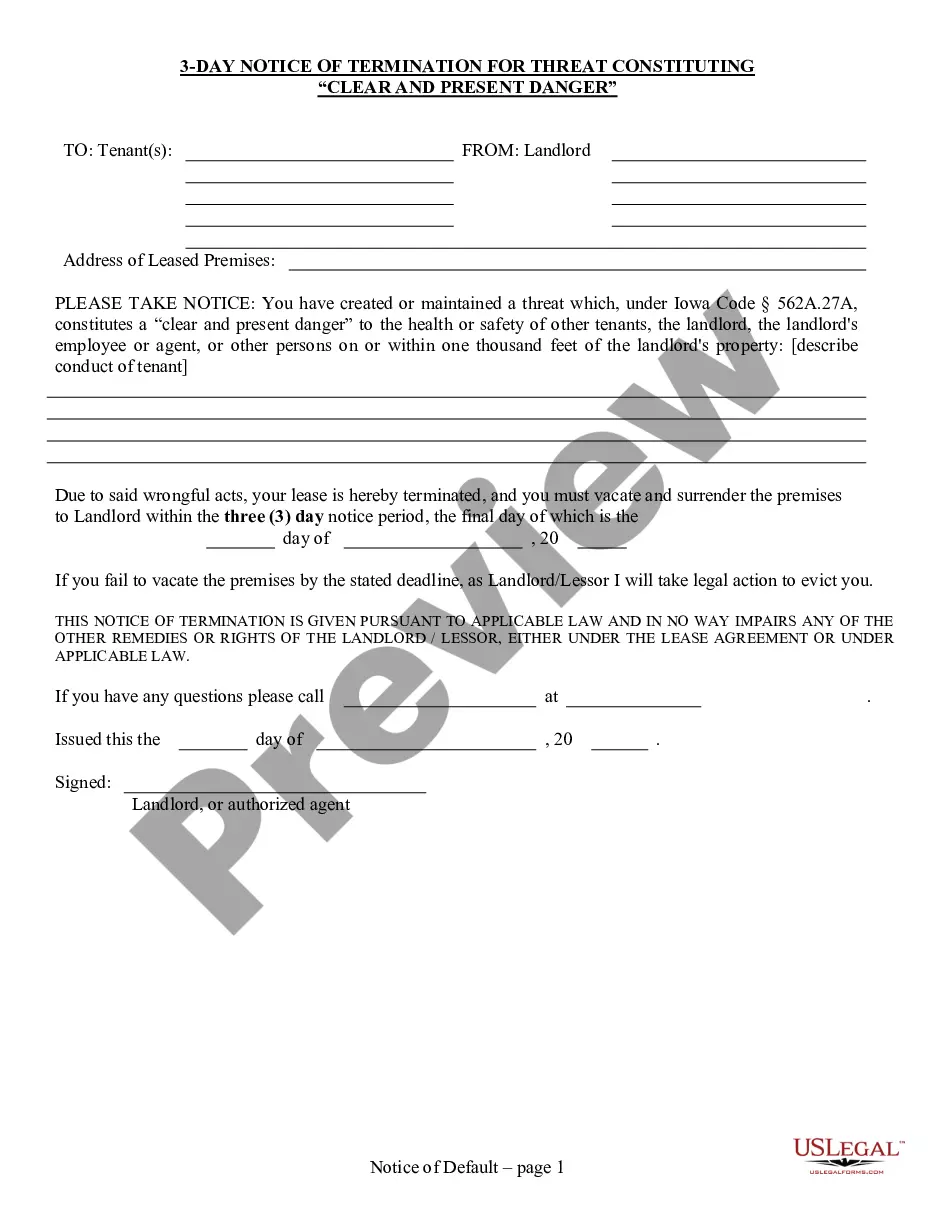

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

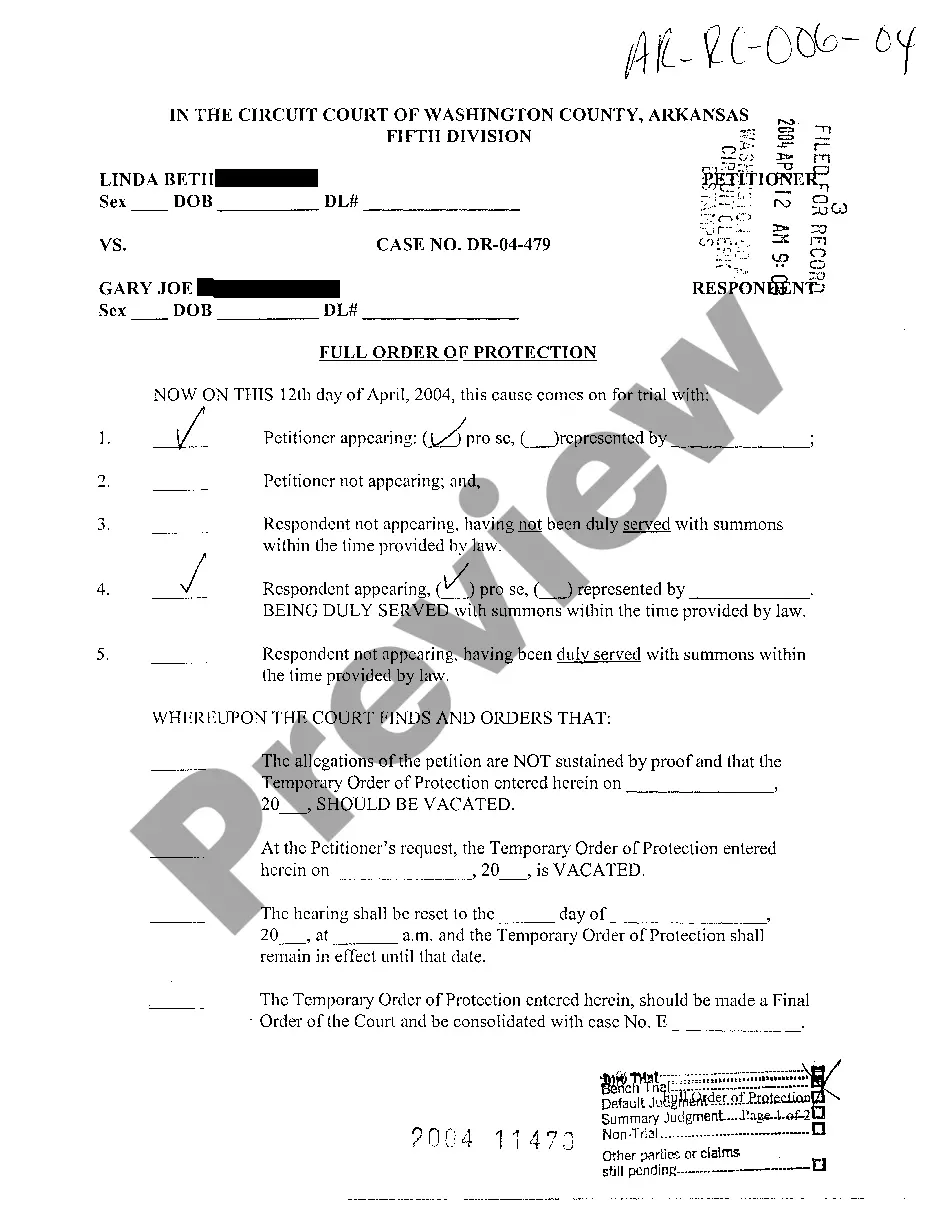

During the administration of the estate those Executors who have obtained a Grant of Probate (more of which later) must act jointly. That is to say that they must all agree on a course of action and each sign any documents, etc. Clearly there may be problems if those appointed do not get on.

By law, the probate of an estate in Alabama will take at least six months. This period gives creditors and others with a claim on the estate time to receive notice that the estate is being probated and to submit a claim.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.