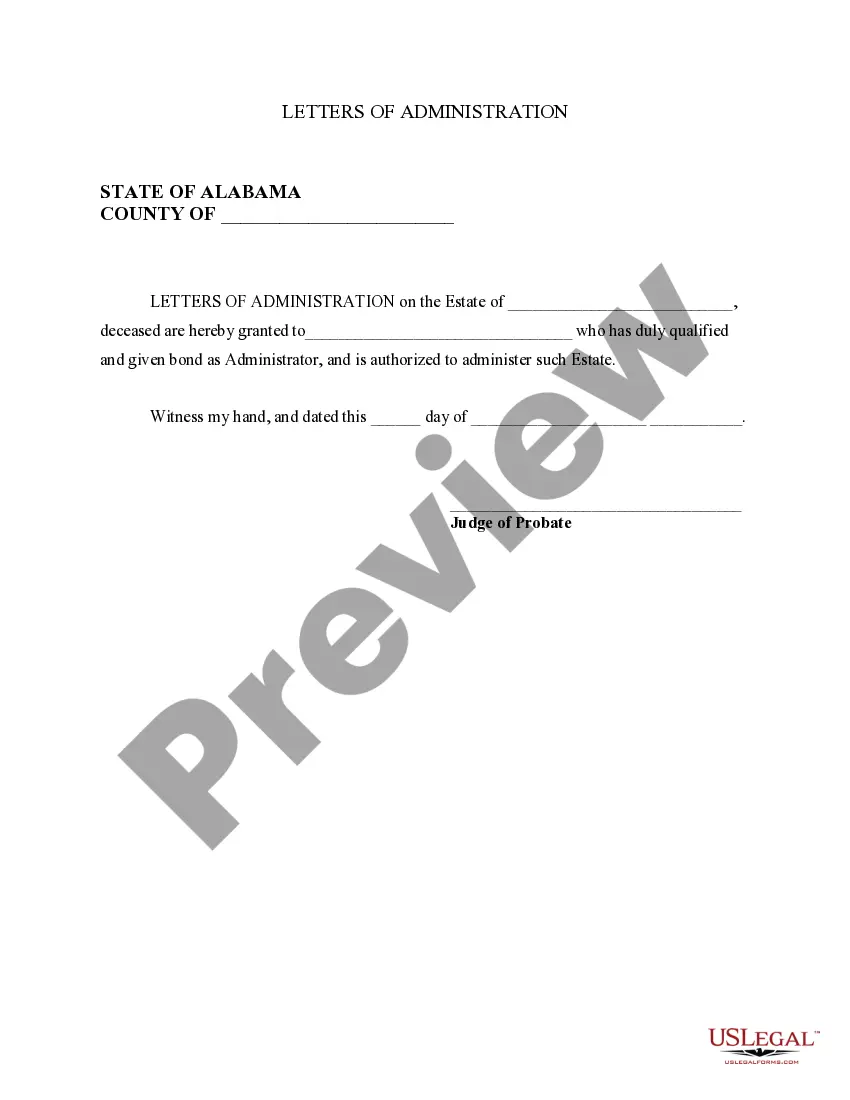

Letters of Administration appoint the individual who is authorized as the Administrator of an Estate. The form is available in both word and word perfect formats.

Alabama Letters of Administration

Description

How to fill out Alabama Letters Of Administration?

Employing Alabama Letters of Administration templates developed by skilled attorneys allows you to avert complications when filing documents.

Simply obtain the template from our site, complete it, and ask a lawyer to review it.

This approach can help you conserve significantly more time and effort than asking legal assistance to create a document from scratch tailored to your requirements would.

Use the Preview feature and examine the description (if available) to determine if you require this particular sample, and if you do, simply click Buy Now. Seek another sample using the Search field if necessary. Select a subscription that suits your needs. Get started with your credit card or PayPal. Choose a file format and download your document. After completing all the steps above, you'll be able to fill out, print, and sign the Alabama Letters of Administration sample. Remember to verify all entered information for accuracy before submitting it or sending it out. Reduce the time spent on document creation with US Legal Forms!

- If you’ve already obtained a US Legal Forms subscription, just Log In to your account and revisit the sample page.

- Locate the Download button adjacent to the templates you are reviewing.

- After downloading a document, all your saved samples will be available in the My documents tab.

- If you don't have a subscription, that's not a significant issue.

- Just adhere to the instructions below to register for your account online, acquire, and complete your Alabama Letters of Administration template.

- Ensure that you’re downloading the correct state-specific form.

Form popularity

FAQ

Before applying for a grant you must publish an online notice of your intention to apply for Letters of Administration on the NSW Online Registry.

Typically, it takes four to six weeks after the decedent's death to appoint an executor or administrator. Even in the most routine probates, the law requires a minimum four-month wait after the Notice to Creditors has been issued before any action can be taken to distribute or close the estate.

At PKWA Law, our legal fees for applying a Grant of Letters of Administration are $1,500 (without GST and disbursements). How much are the court fees and disbursements? The court fees range from about $300 to about $600.

The fee for applying for probate or letters of administration depends on the value of the estate. You won't pay a fee if the value of the estate is less than £5,000. If the estate is valued at A£5,000 or more the fee is A£215. This is the same for both post and online applications.

Do you need a solicitor Many executors and administrators act without a solicitor. However, if the estate is complicated, it is best to get legal advice.

A letter of administration is an official document that gives the person named in the letter the legal right to access the assets, money and property of a person who's died without a will, pay their remaining taxes and settle their debts.The will is invalid. No executors are named in the will.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

Determine who has priority to serve. State law establishes the qualifications for an administrator and sets the order of priority that the court must follow in making an appointment. Prepare to file a petition to administer. Collect the necessary information. File the petition with the court.

To apply for a Letter of Administration you need to have details of everything the deceased person owned and how much this is worth, as well as their outstanding debts. You will need this information to complete the Inheritance Tax returns and calculate any Inheritance Tax that needs to be paid to HM Revenue & Customs.