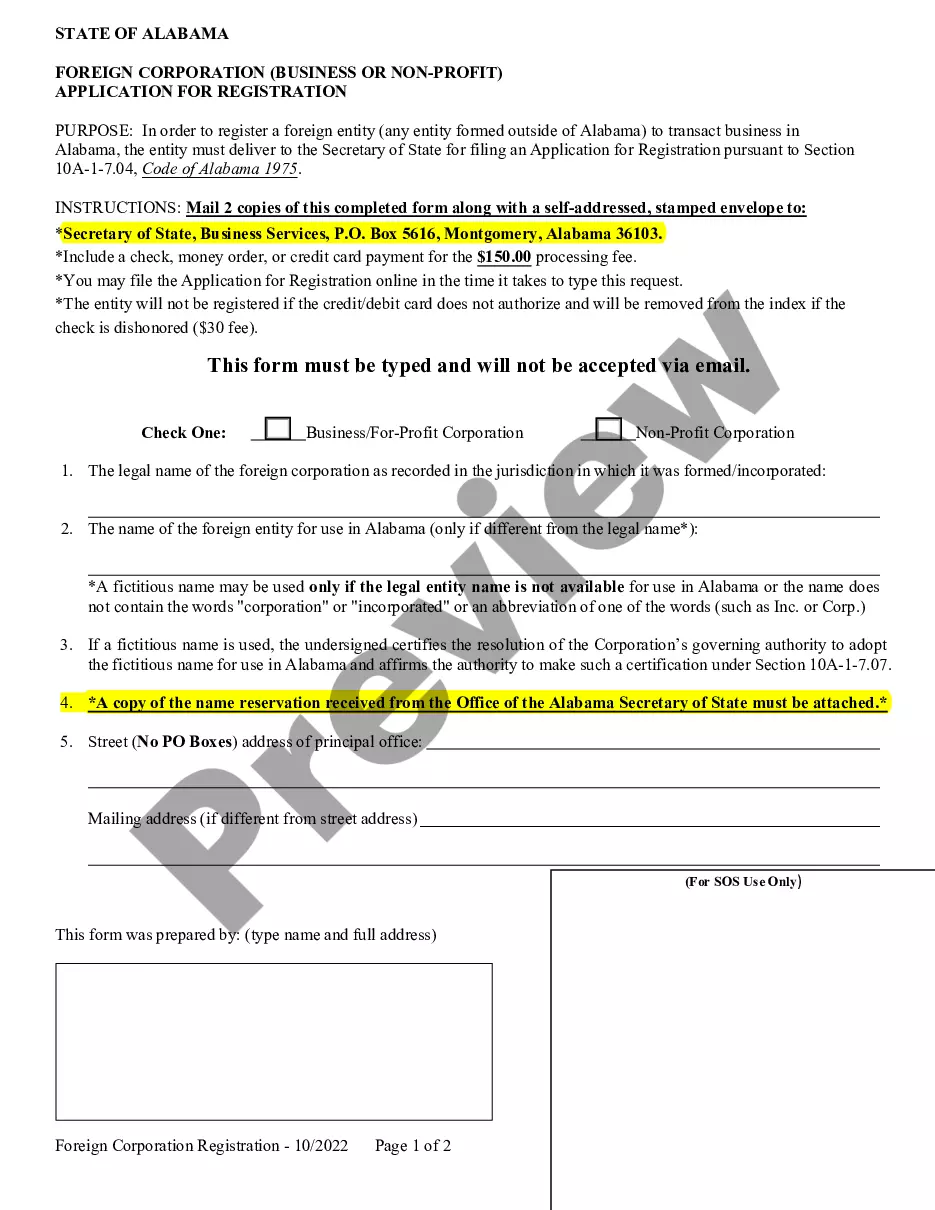

Alabama Registration of Foreign Corporation

Description Alabama Foreign Corporation

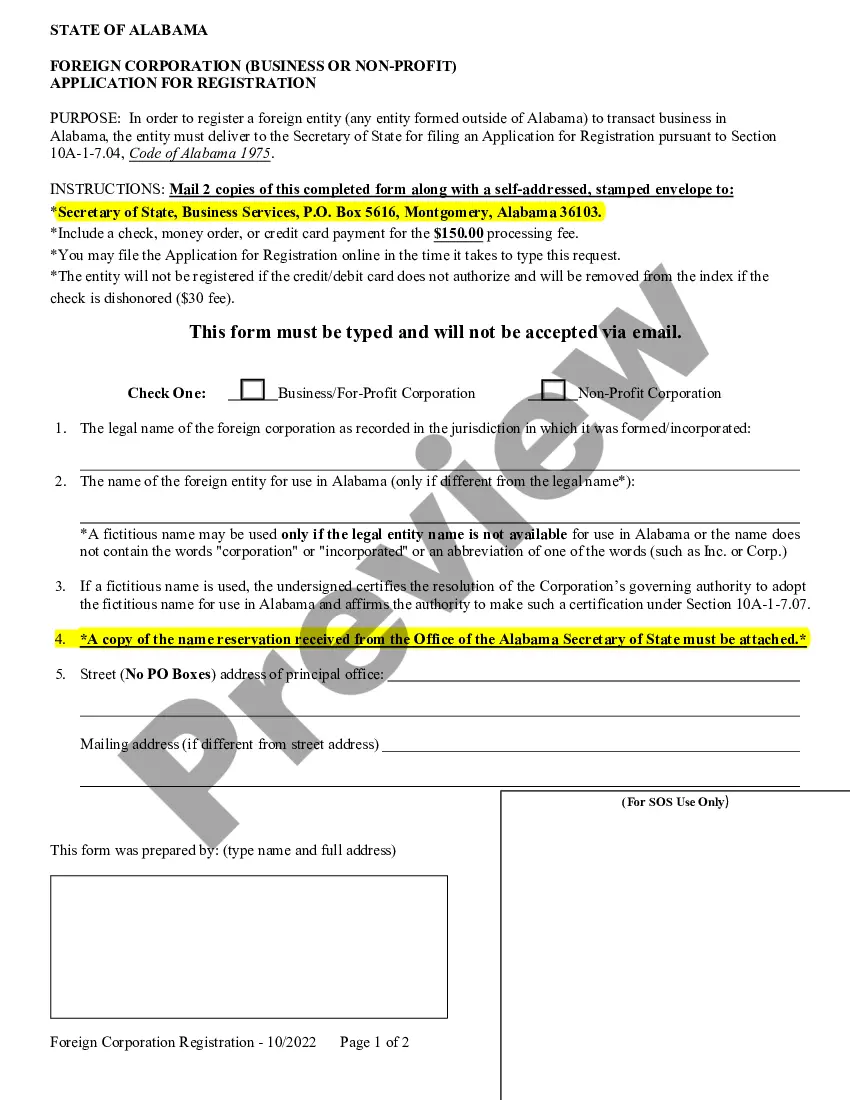

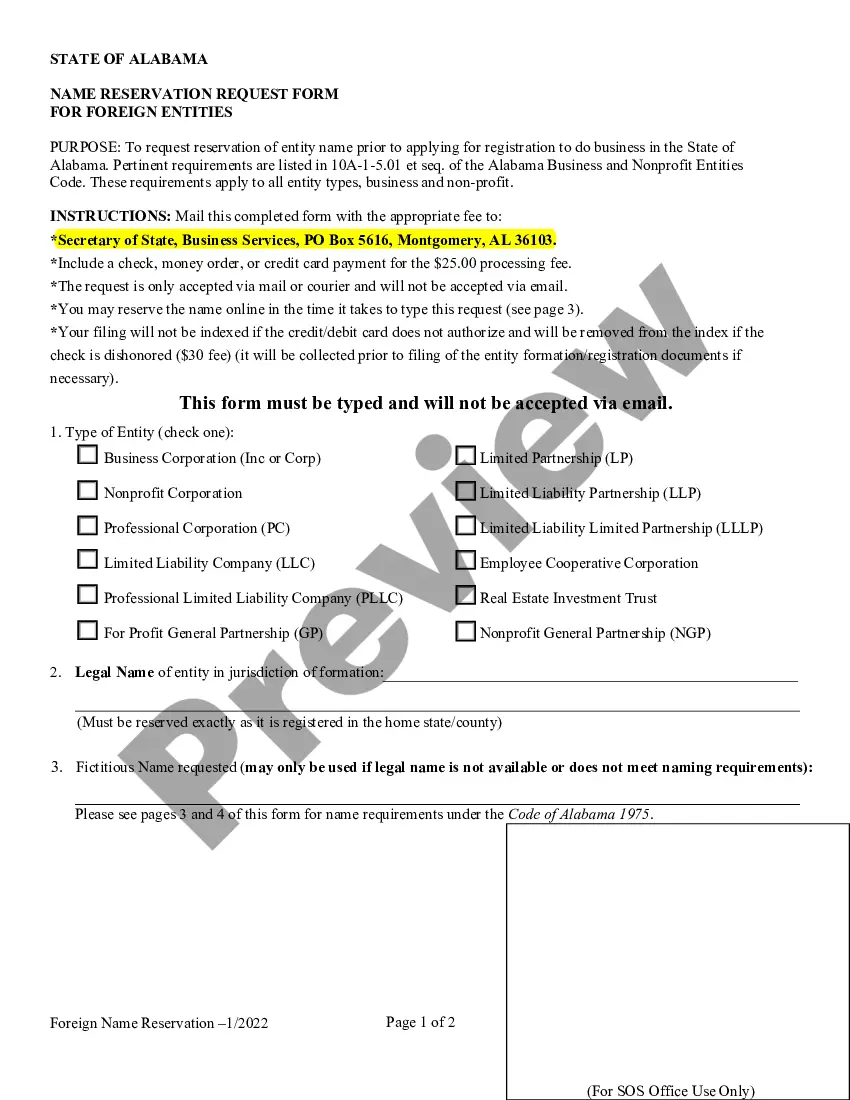

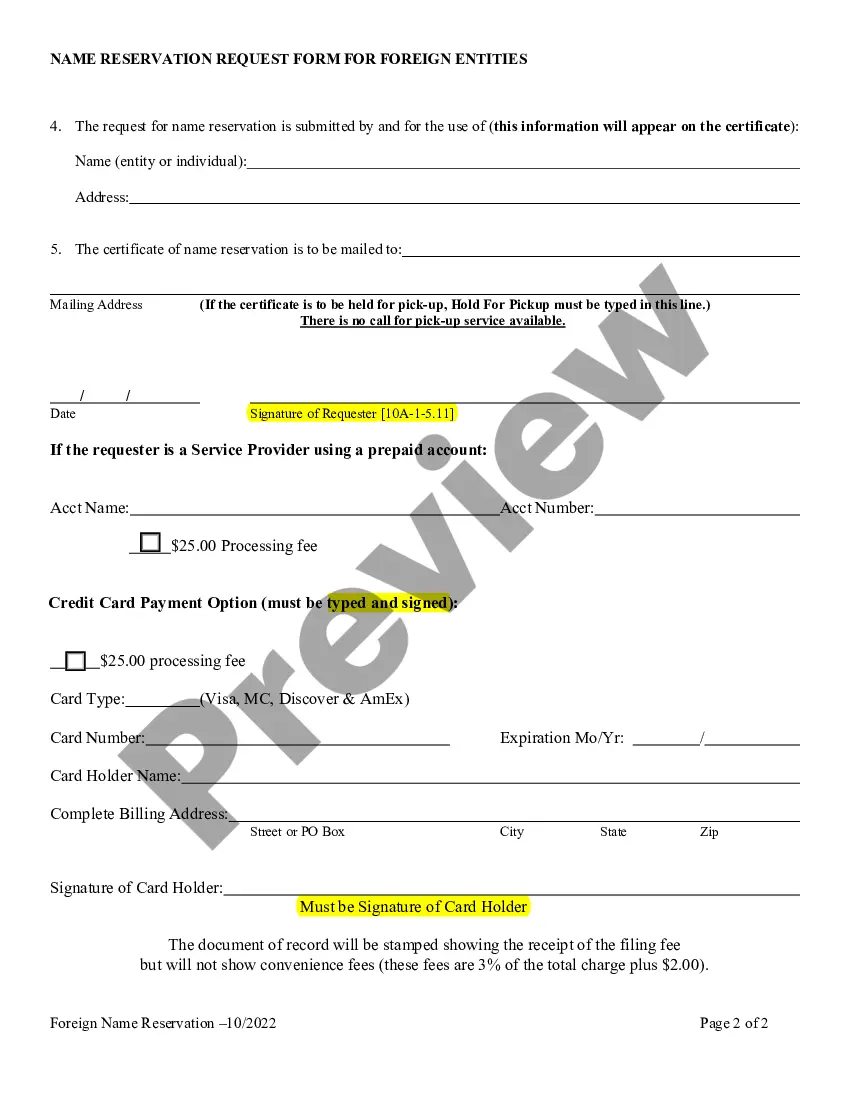

How to fill out Alabama Registration Of Foreign Corporation?

Leveraging Alabama Registration of Foreign Corporation templates crafted by experienced attorneys allows you to steer clear of complications when finalizing paperwork.

Simply download the example from our site, complete it, and ask a lawyer to verify it.

This approach can significantly save you more time and expenses compared to seeking an attorney to create a document tailored to your requirements independently.

Utilize the Preview feature and read the description (if available) to determine if you need this specific example, and if so, click Buy Now. Search for another file using the Search field if necessary. Choose a subscription that meets your needs. Begin using your credit card or PayPal. Select a file format and download your document. After following all the aforementioned steps, you will be able to fill out, print, and sign the Alabama Registration of Foreign Corporation template. Ensure to verify all entered information for accuracy before submitting or dispatching it. Minimize the time spent on completing documents with US Legal Forms!

- If you already possess a US Legal Forms subscription, simply Log In/">Log In to your account and revisit the sample webpage.

- Locate the Download button adjacent to the template you are reviewing.

- Once you download a file, your saved samples will be accessible in the My documents section.

- If you lack a subscription, it's not an issue.

- Just follow the instructions below to register for an account online, obtain, and complete your Alabama Registration of Foreign Corporation template.

- Thoroughly confirm that you are downloading the correct state-specific form.

Form popularity

FAQ

Choose a business name. File a trade name (optional). Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number. Choose a Business Name.

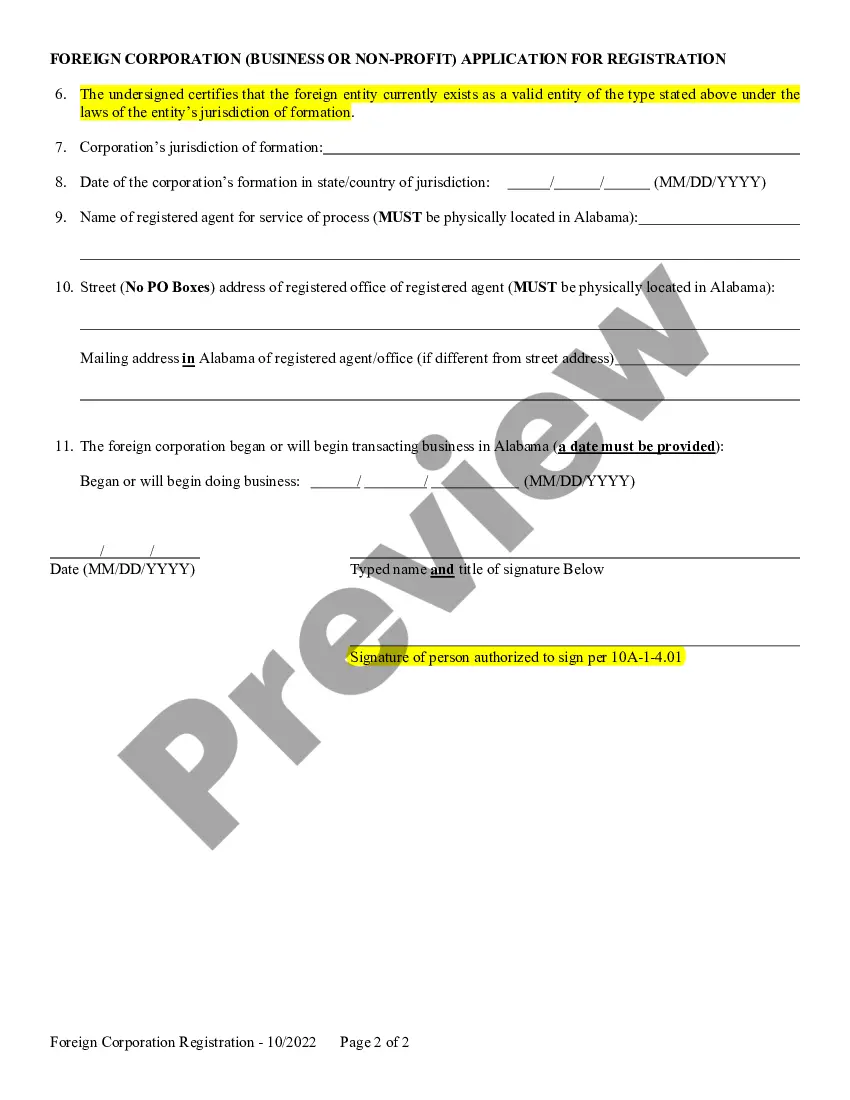

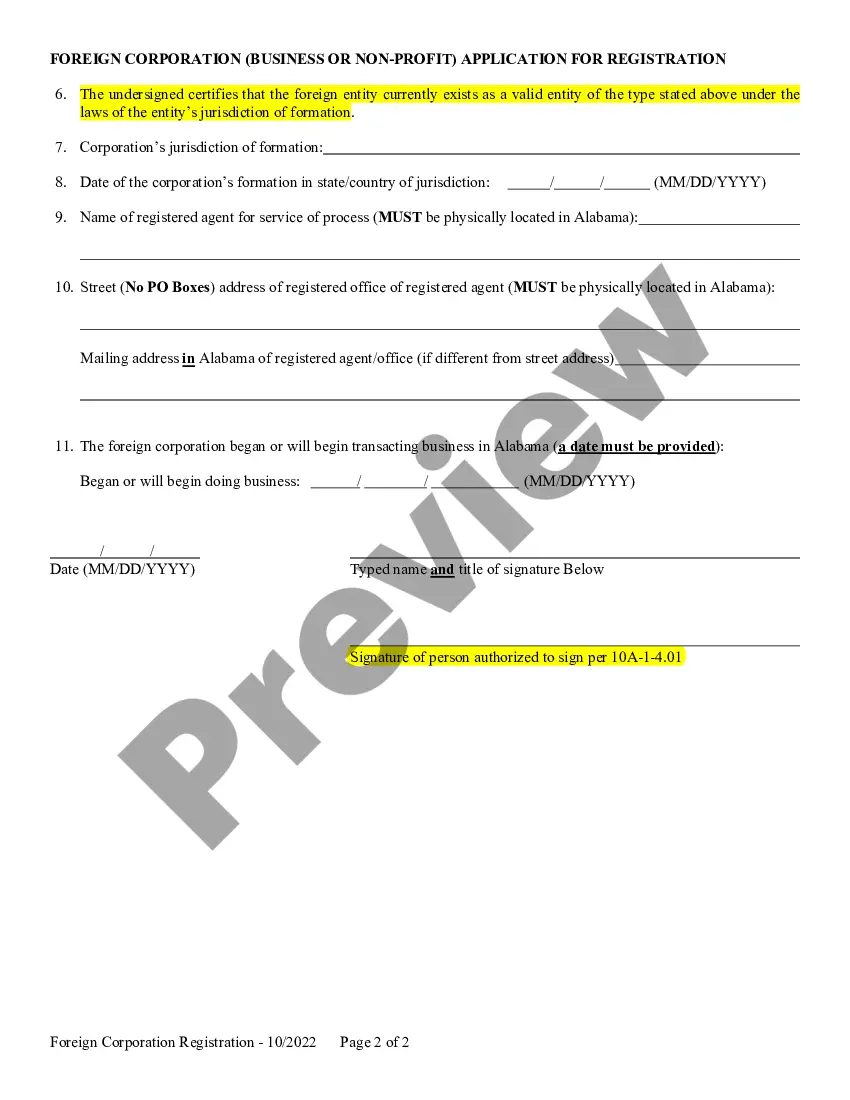

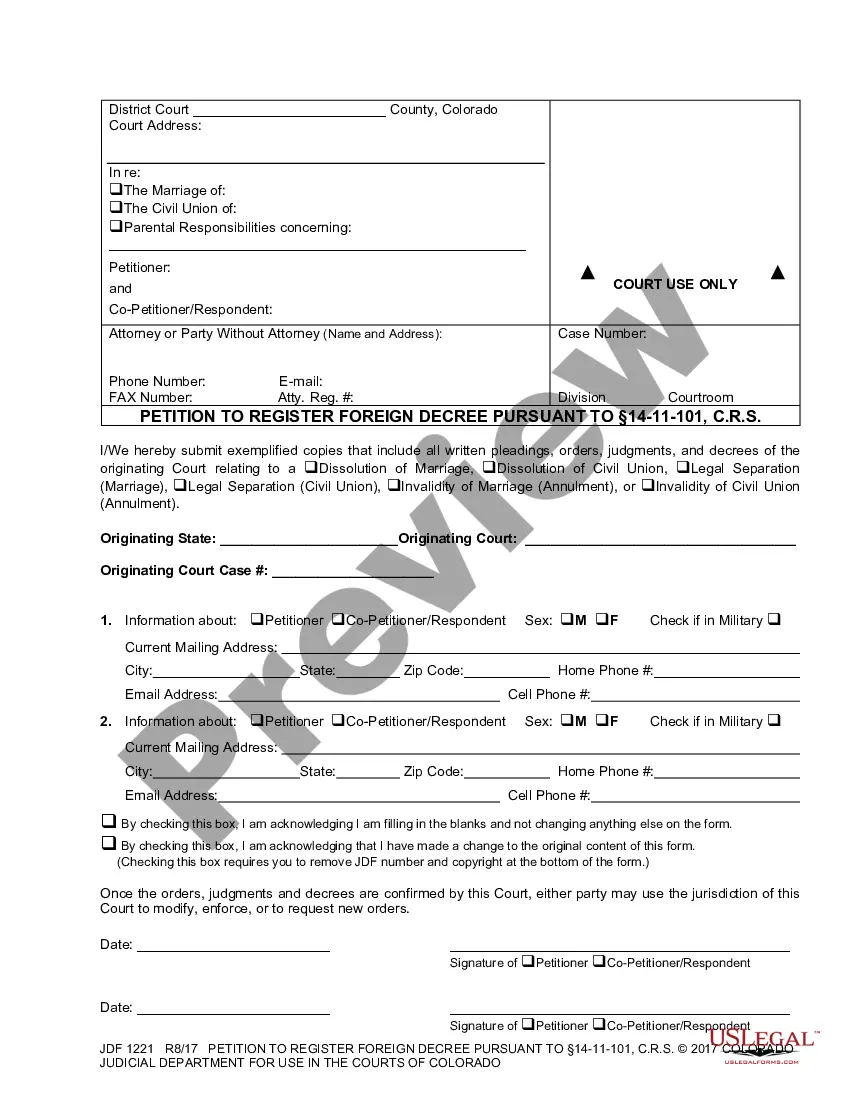

A domestic corporation is one formed in the state in which it is doing business. A foreign corporation is one incorporated in another state or country and does business across state lines. The process of setting up a company in a foreign state is called foreign qualification.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

Foreigner registration is a mandatory requirement by the Government of India under which all foreign nationals (excluding overseas citizens of India) visiting India on a long term visa (more than 180 days) are required to register themselves with a Registration Officer within 14 days of arriving in India.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Facts to be considered include but are not limited to: the business purpose of the business entity in its state of origin; the business activities of the business entity in other states; the activities performed in the state of Alabama; the property owned in the state of Alabama; and, whether a profit motive exists for

Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.