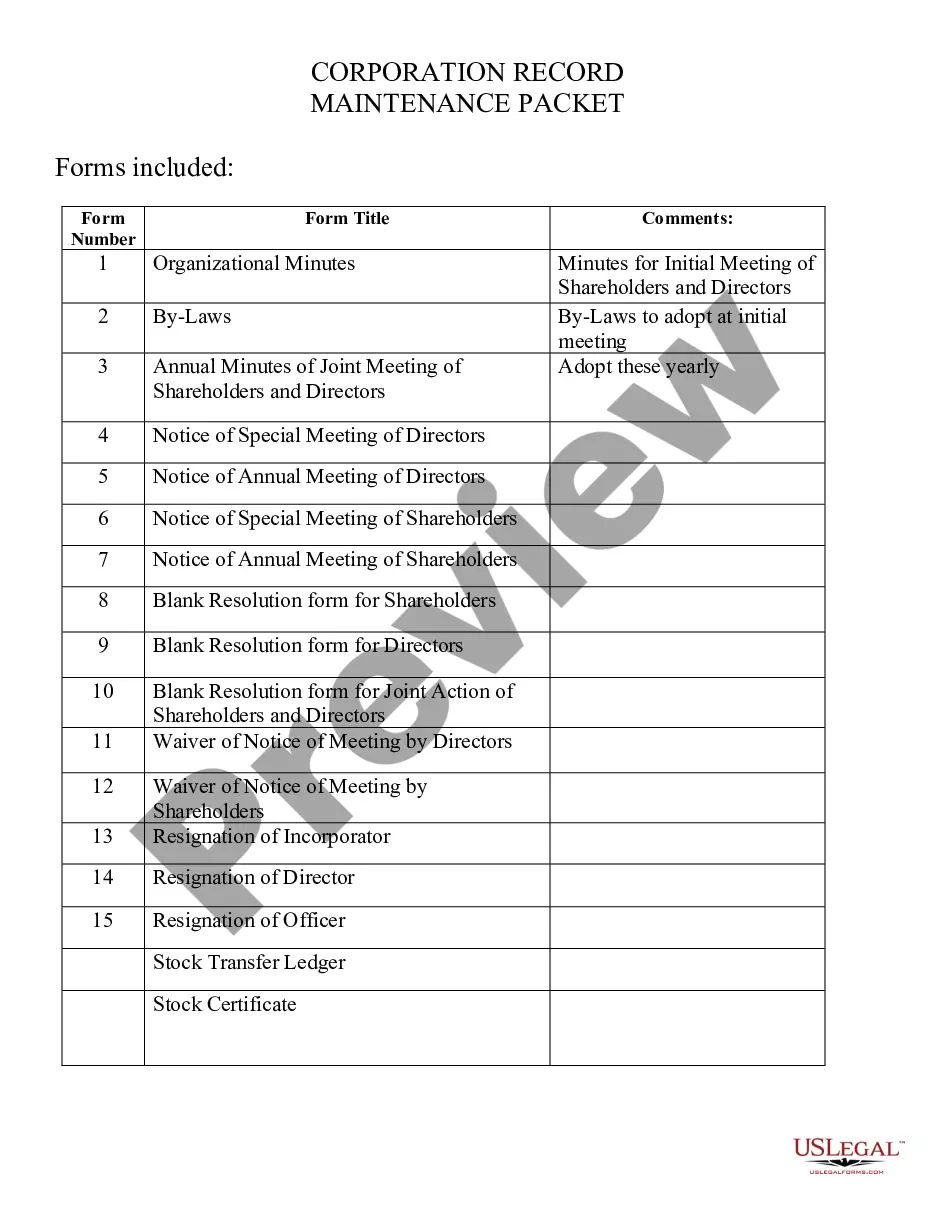

This Professional Corporations Package contains all forms and directions for filing needed in order to incorporate a Professional Corporation in your particular state. The forms included are as follows: articles on incorporation, by-laws, any other forms needed for creation and maintenance of the corporation.

Alabama Professional Corporation Package for Alabama

Description

How to fill out Alabama Professional Corporation Package For Alabama?

Amid numerous free and paid templates available online, you cannot be assured of their precision.

For instance, who created them or if they possess the necessary skills to manage your requirements.

Always remain composed and take advantage of US Legal Forms!

Click Buy Now to initiate the purchasing process or search for another example using the search bar in the header. Choose a pricing tier, create an account, pay for the subscription using your credit/debit card or Paypal, and download the form in the preferred format. Once you have registered and settled your subscription fee, you can use your Professional Corporation Package for Alabama as frequently as needed or as long as it is valid in your area. Modify it in your favorite online or offline editor, complete it, sign it, and make a physical copy. Achieve more for less with US Legal Forms!

- Explore Professional Corporation Package for Alabama templates designed by experienced attorneys and steer clear of the expensive and lengthy process of searching for a lawyer and then needing to compensate them to draft papers that you can easily access yourself.

- If you already possess a subscription, Log In to your account and locate the Download button alongside the form you seek.

- You will also be enabled to retrieve all previously downloaded documents in the My documents section.

- If you are utilizing our service for the first time, adhere to the following instructions to easily obtain your Professional Corporation Package for Alabama.

- Ensure that the document you view is relevant to your location.

- Review the file by examining the description through the Preview feature.

Form popularity

FAQ

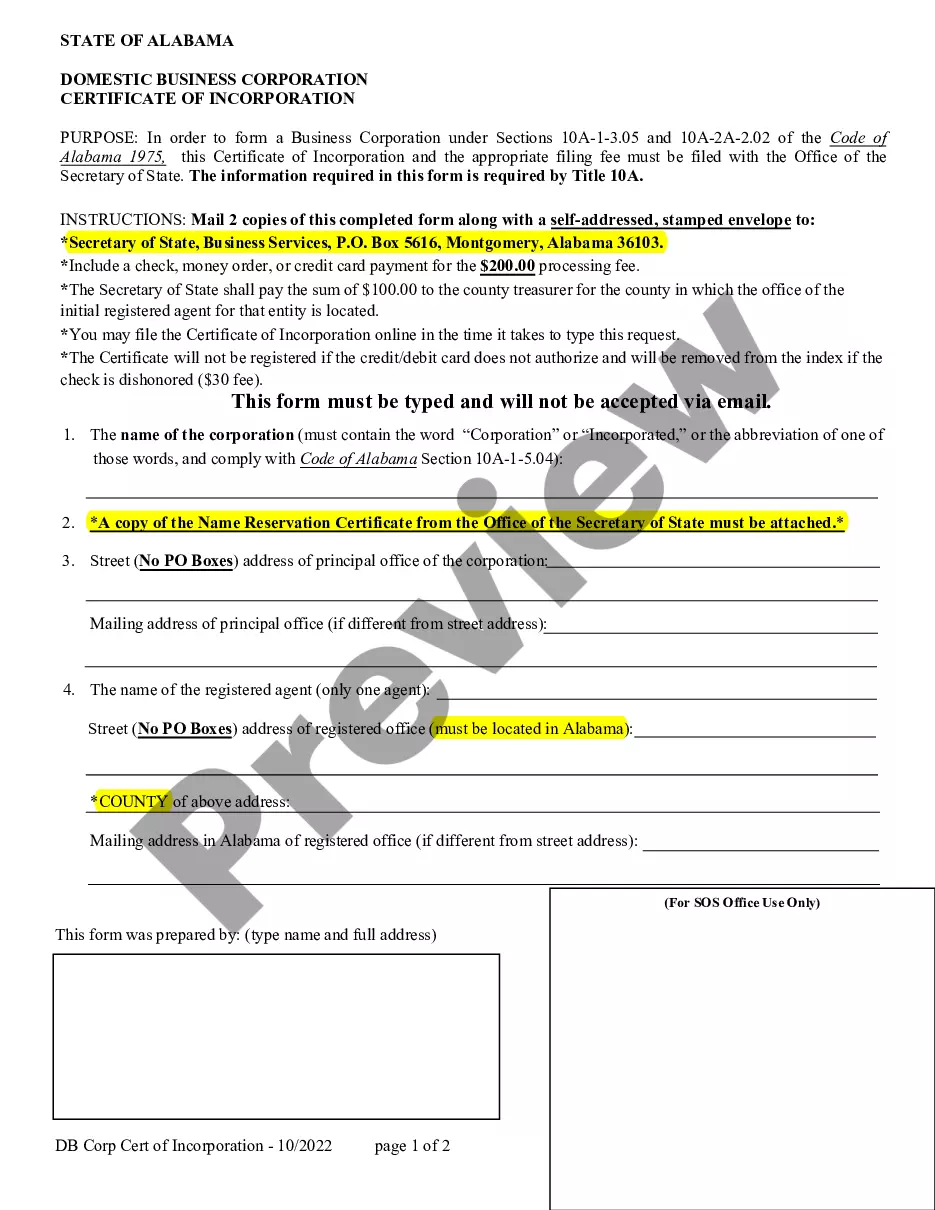

To incorporate in Alabama, you must file the articles of incorporation, also known in Alabama as the Domestic Business Corporation Certificate of Formation, and a Certificate of Name Reservation in the office of the probate judge in the county where your corporation's business offices are located.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

A series LLC is a unique form of limited liability company ("LLC") in which the articles of formation specifically allow for unlimited segregation of membership interests, assets, and operations into independent series.A series LLC may have different members and managers in each series.

An Alabama PLLC is an LLC formed specifically by people who will provide Alabama licensed professional services.Like other LLCs, PLLCs protect their individual members from people with claims for many (but not all) types of financial debts or personal injuries.

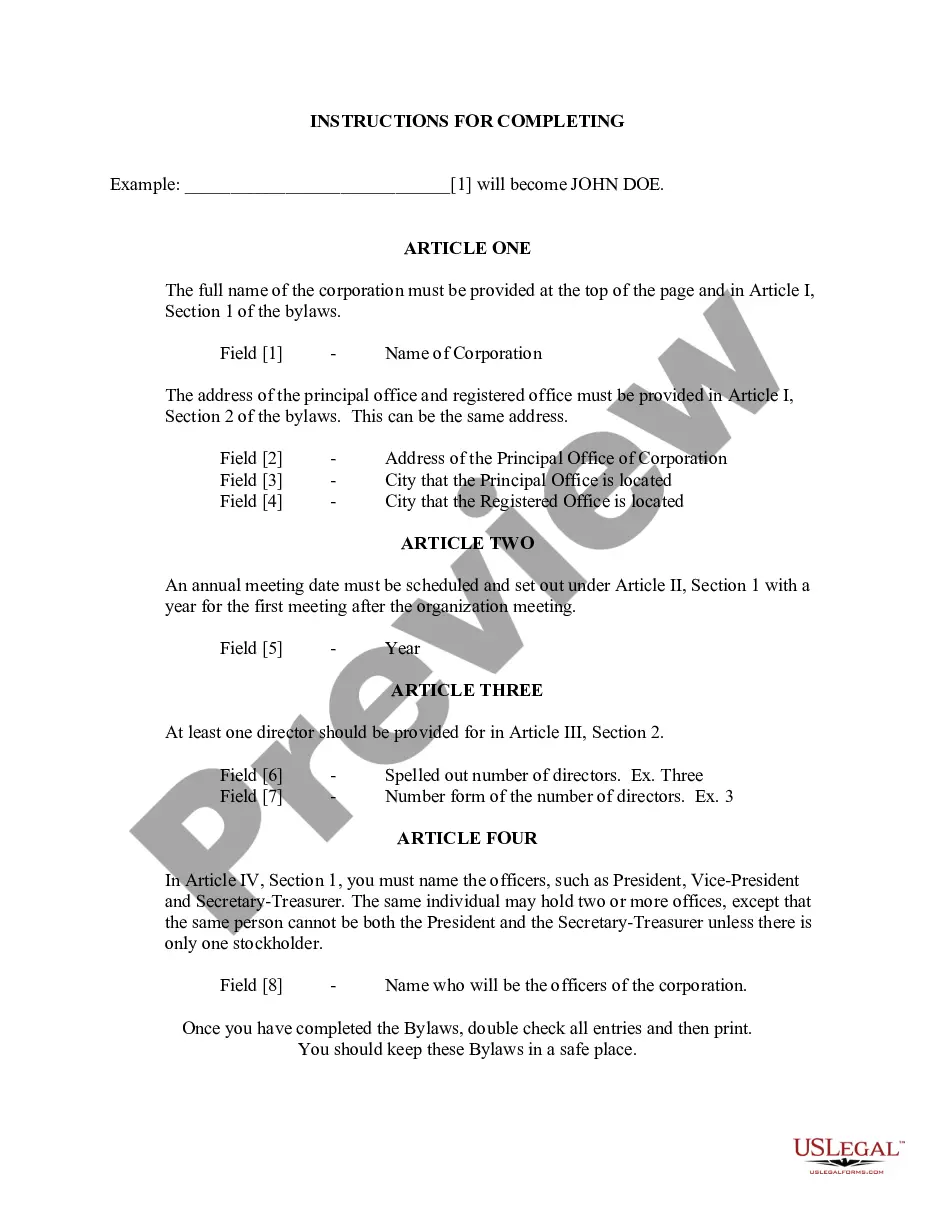

1Choose a Corporate Name.2Prepare a Certificate of Formation.3Appoint a Registered Agent.4Set Up a Corporate Records Book.5Prepare Corporate Bylaws.6Initial Corporate Directors.7Hold Your First Board of Directors Meeting.8Issue Stock.How to Form a Corporation in Alabama Nolo\nwww.nolo.com > legal-encyclopedia > how-form-corporation-alabama

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

A professional limited liability company (PLLC) is a business entity designed for licensed professionals, such as lawyers, doctors, architects, engineers, accountants, and chiropractors.In these states, licensed professionals who want the benefits of an LLC must form a PLLC instead.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.