This state-specific corporation formation form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Alabama Articles of Incorporation for Domestic Nonprofit Corporation

Description

How to fill out Alabama Articles Of Incorporation For Domestic Nonprofit Corporation?

Utilizing Alabama Articles of Incorporation for Domestic Nonprofit Corporation samples prepared by skilled attorneys helps you dodge complications while filling out paperwork.

Simply obtain the example from our site, complete it, and seek legal advice to validate it.

This can assist you in conserving significantly more time and expenses than trying to find a legal expert to create a document entirely from the beginning to meet your requirements.

Find an alternative document using the Search box if needed. Choose a subscription that aligns with your needs. Begin using your credit card or PayPal. Pick a file format and download your document. Once you have completed all the above steps, you will be able to fill out, print, and sign the Alabama Articles of Incorporation for Domestic Nonprofit Corporation template. Remember to double-check all entered information for accuracy before submitting or mailing it. Minimize the time you spend on document completion with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your profile and navigate back to the forms webpage.

- Locate the Download button near the template you’re reviewing.

- After downloading a template, your stored samples can be found in the My documents section.

- If you lack a subscription, no worries. Just adhere to the steps outlined below to register for your account online, obtain, and complete your Alabama Articles of Incorporation for Domestic Nonprofit Corporation template.

- Verify and confirm that you are downloading the appropriate state-specific document.

- Utilize the Preview function and read the summary (if provided) to determine if this specific template is necessary for you, and if so, simply click Buy Now.

Form popularity

FAQ

To obtain 501(c)(3) status, a nonprofit corporation must apply to the Internal Revenue Service for recognition of tax exemption by filing IRS Form 1023.

There isn't any difference between Certificate of Incorporation and Articles of Incorporation. Both the documents refer to the charter filed with the state agency for creating a corporation. In some states, Articles of Incorporation are known as Certificate of Incorporation.

How much is the user fee for an exemption application? The user fee for Form 1023 is $600. The user fee for Form 1023-EZ is $275. The user fees must be paid through Pay.gov when the application is filed.

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

They are sometimes referred to as the certificate of incorporation or the corporate charter, or if the business is Limited Liability Companies (LLCs) they are called Articles of Organization.

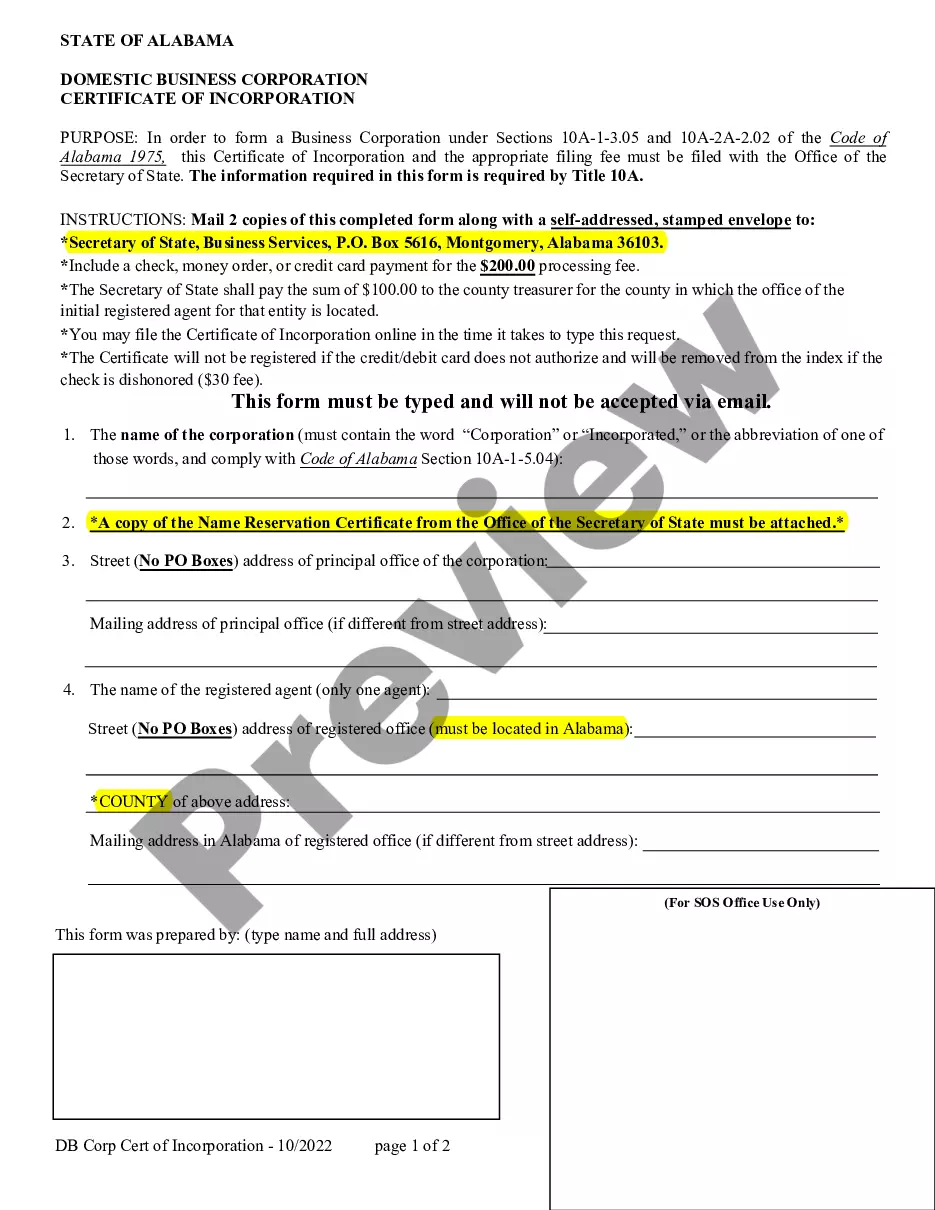

Submit your articles of incorporation to the Office of the Judge of Probate in the county where the corporation's initial registered office is located. You must submit a packet containing the original articles of incorporation (also called Certificate of Formation), two copies, and the Certificate of Name Reservation.

To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application. The application must be submitted electronically on www.pay.gov and must, including the appropriate user fee.

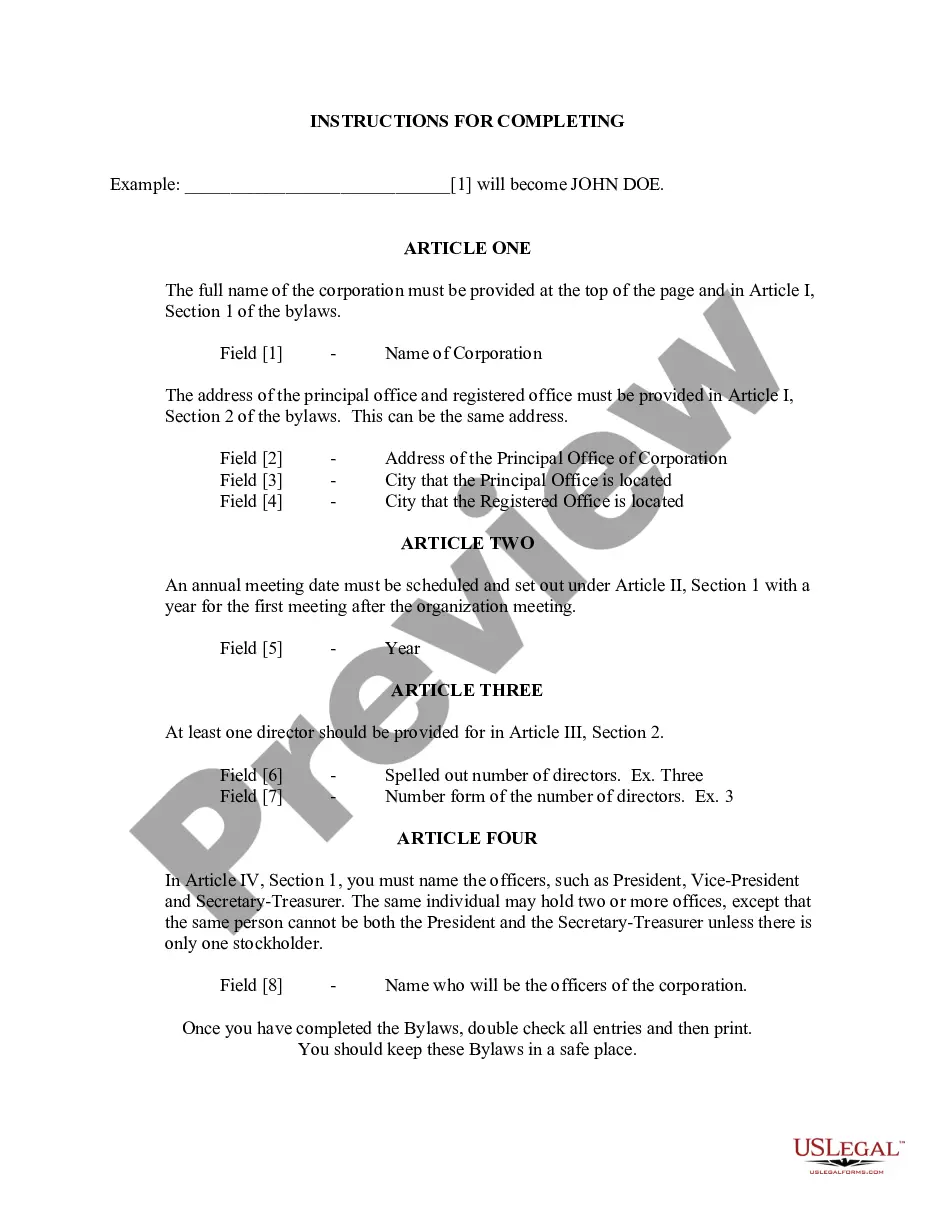

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

Avoid any purpose that praises or calls for discrimination; Must have obtained an official status as an association, corporation, or trust; Provide a reason for their desire to seek tax exemption; Three-years of existence before applying;