This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Alabama Single Member Limited Liability Company LLC Operating Agreement

Description

Key Concepts & Definitions

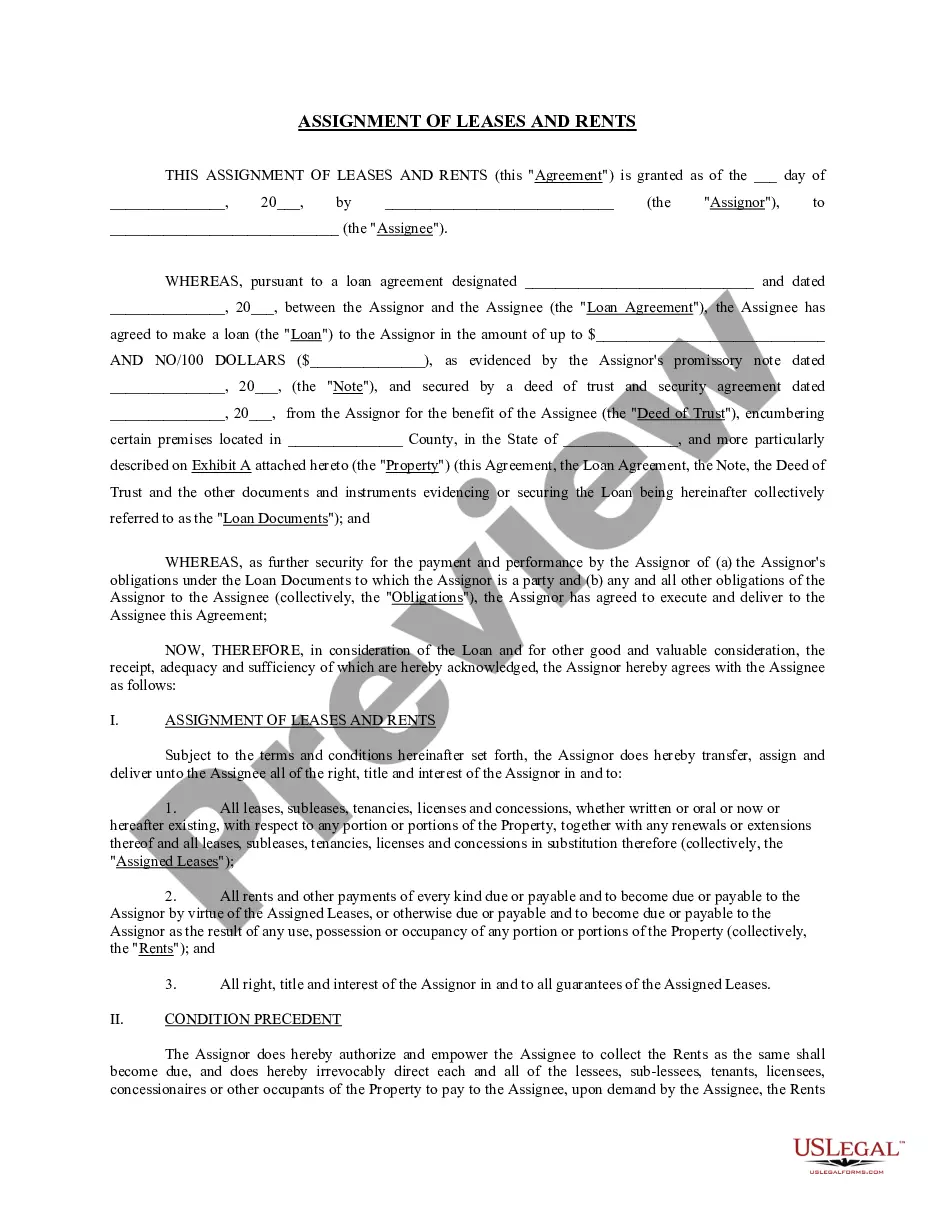

Single Member Limited Liability Company (LLC): A business structure allowed by state statute that is owned by one individual or entity. It is characterized by limited liability, meaning the owner's personal assets are protected from business debts and liabilities.

Sole Proprietorship: A straightforward business owned and operated by one person without forming a corporation or a limited liability company.

Registered Agent: An individual or business designated to receive service of process when a business entity is a party in a legal action.

Disregarded Entity: A separate entity for business purposes but not recognized as separate from its owner for tax purposes.

Step-by-Step Guide to Forming a Single Member LLC

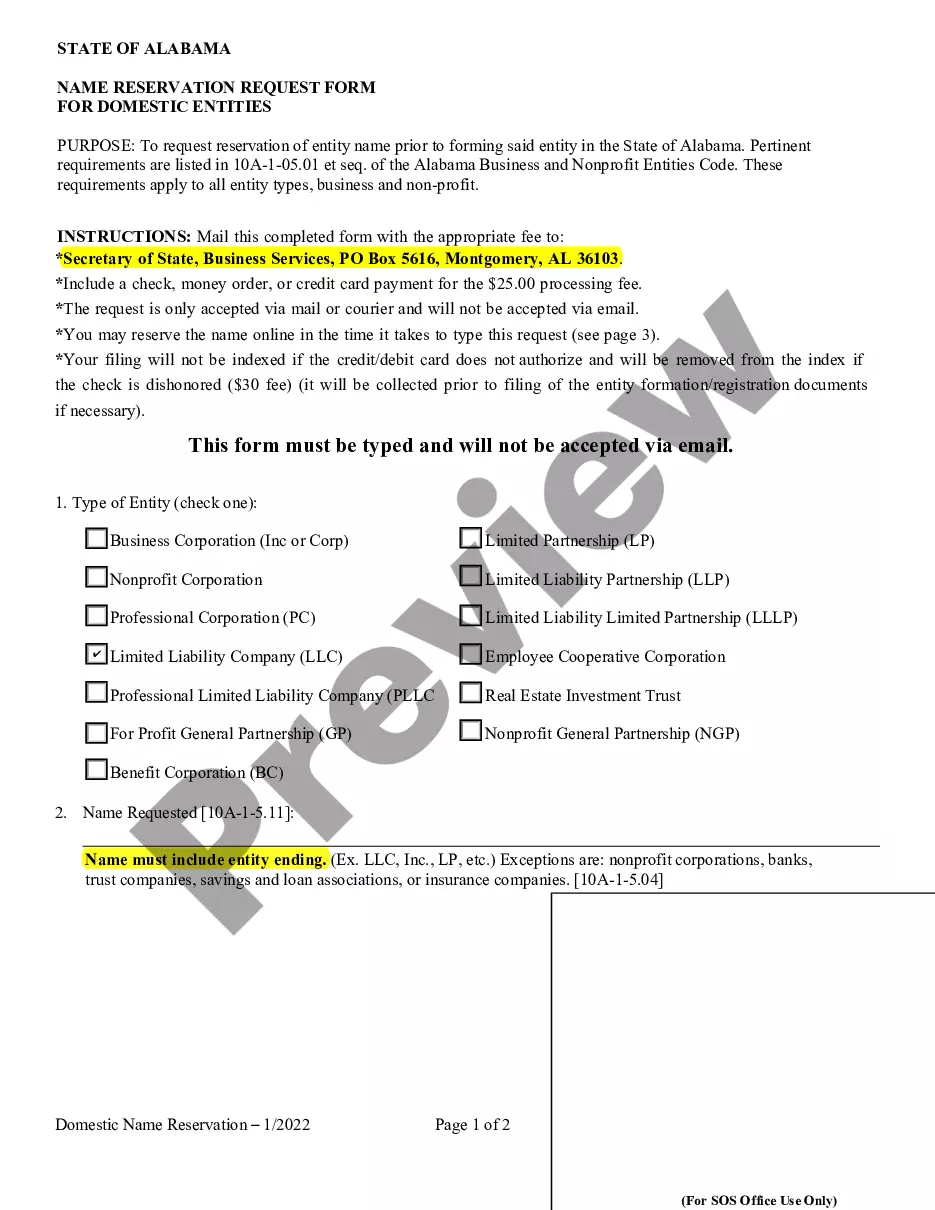

- Choose a Business Name: Ensure the name complies with your state's LLC regulations.

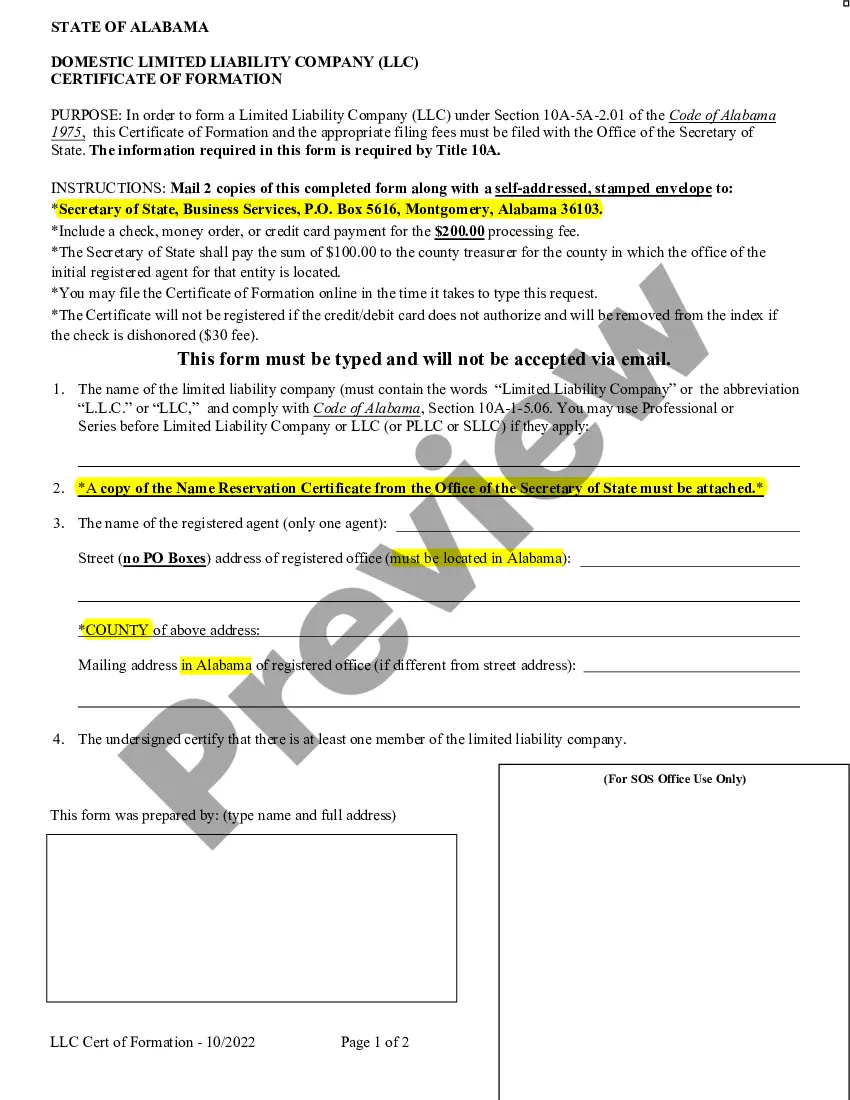

- File Articles of Organization: Submit the required documents to your state's business filing agency, usually the Secretary of State.

- Appoint a Registered Agent: Designate an agent for service of process.

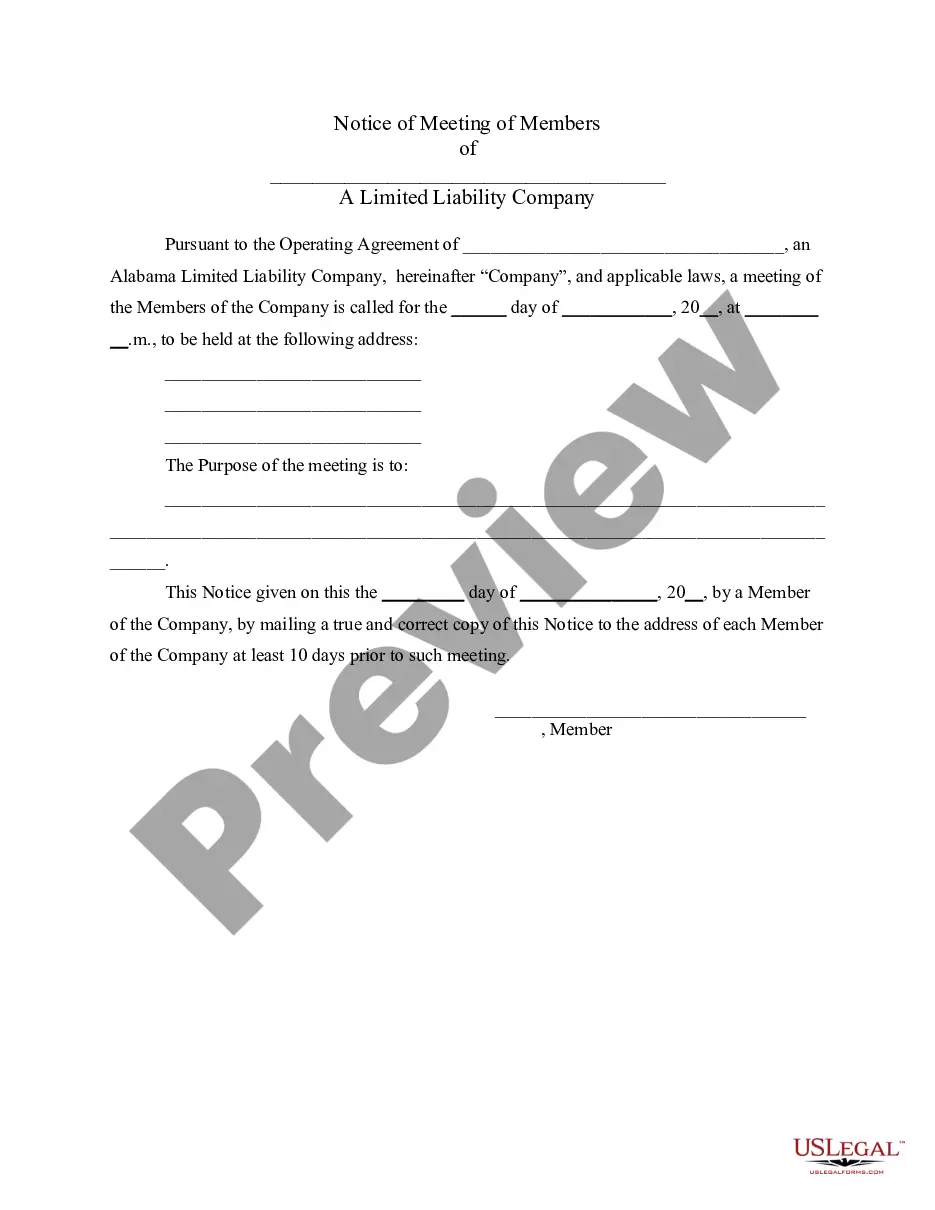

- Draft an Operating Agreement: Although not mandatory, creating an operating agreement is recommended to outline the operations and financial decisions.

- Obtain Necessary Permits and Licenses: Check local requirements for running a business.

- Apply for an EIN: Secure an Employer Identification Number from the IRS for tax purposes.

Risk Analysis

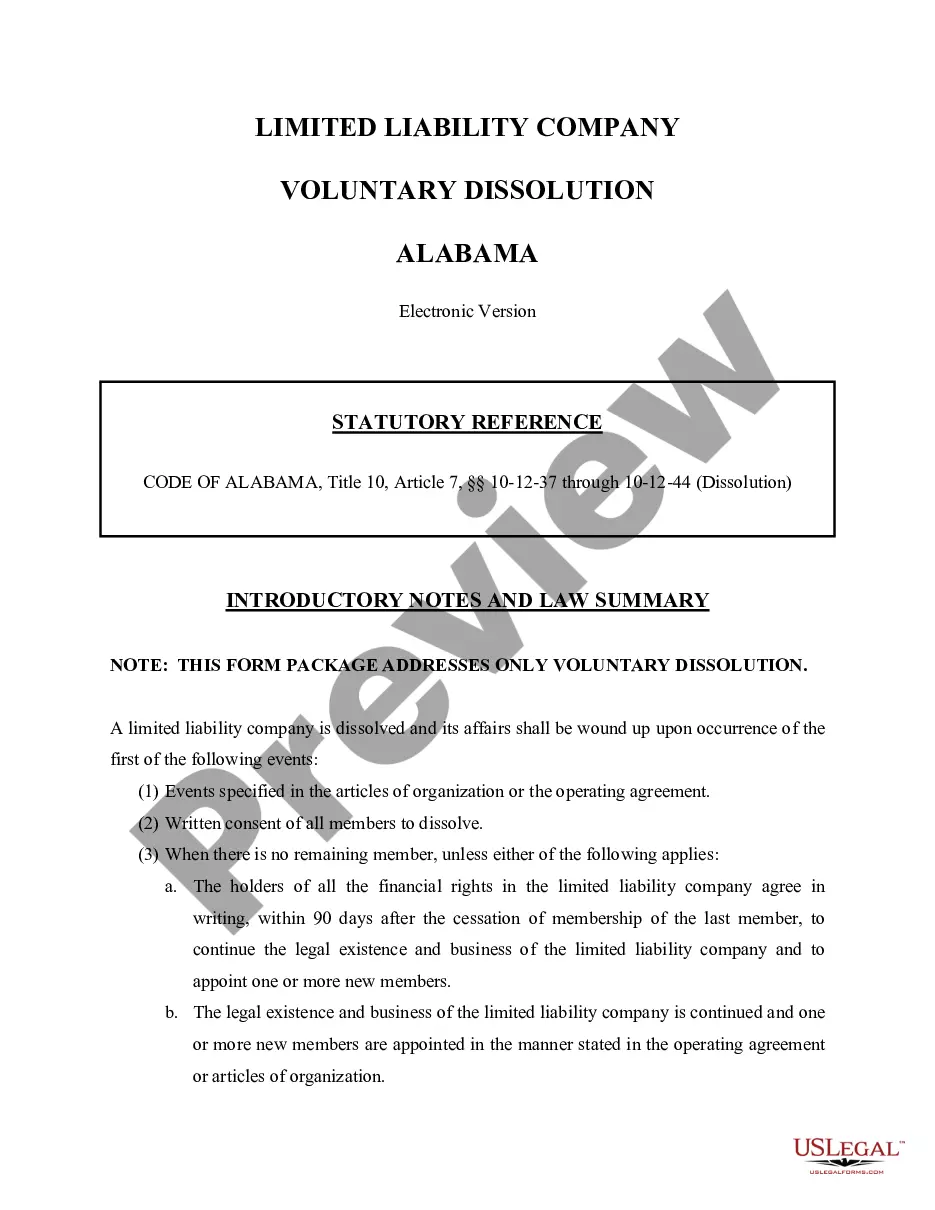

Forming and operating a single member LLC comes with certain risks such as potential for state-specific compliance requirements, misunderstanding of personal asset protection which can lead to legal complications, or mismanagement of financial accounts that could undermine the limited liability structure.

Pros & Cons

- Pros:

- Limited liability protection

- Flexibility in management and operations

- Pass-through taxation benefits

- Cons:

- Potential for increased paperwork and regulations

- Costs associated with formation and ongoing compliance

- Risk of piercing the corporate veil if formalities not maintained

Best Practices

Maintain clear separation of personal and business finances to uphold the integrity of the limited liability protection. Regularly update the operating agreement and ensure compliance with local and federal laws. Consider consulting with a tax professional to optimize tax benefits effectively.

Common Mistakes & How to Avoid Them

A common mistake is commingling personal and business expenses, which can lead to legal issues. To avoid this, establish separate bank and credit accounts for your business. Failing to follow formalities like annual reporting can also jeopardize your LLC status, so stay informed about your states requirements.

FAQ

Can I convert my sole proprietorship to a single member LLC? Yes, you can convert by filing the necessary articles of organization in your state and fulfilling other formalities.

Is an operating agreement required for a single member LLC? While not always legally required, it is advisable to have one to clarify the business operations and structure.

How to fill out Alabama Single Member Limited Liability Company LLC Operating Agreement?

Utilizing Alabama Single Member Limited Liability Company LLC Operating Agreement samples crafted by experienced attorneys allows you to avoid hassles when finalizing paperwork.

Simply download the template from our site, complete it, and have a lawyer review it.

Doing so can save you significantly more time and expenses than having legal assistance draft a document from beginning to end for you would.

After completing all the steps listed, you will be able to fill out, print, and sign the Alabama Single Member Limited Liability Company LLC Operating Agreement template. Remember to double-check all entered details for accuracy before submitting or dispatching it. Minimize the time you invest in completing documents with US Legal Forms!

- Verify that you are downloading the correct state-specific form.

- Utilize the Preview feature and examine the description (if available) to determine if you need this specific template; if so, just click Buy Now.

- Look for another sample using the Search bar if required.

- Choose a subscription that suits your needs.

- Begin with your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

It can secure your liability protection. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.In order to keep this liability protection, you need to keep your business affairs and personal affairs separate.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

There is no State requirement in Alabama to have an operating agreement, however, it is still highly recommended to have one in order to state the purpose of the business as well as the ownership interest of the members (if a multi-member LLC).

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

The single-member LLC articles of organization is a document that you need to file with the state when forming your LLC. LLC stands for limited liability company, and it is a business structure that state law allows you to form.A single-member LLC has special consideration, however, since it is a one-owner company.