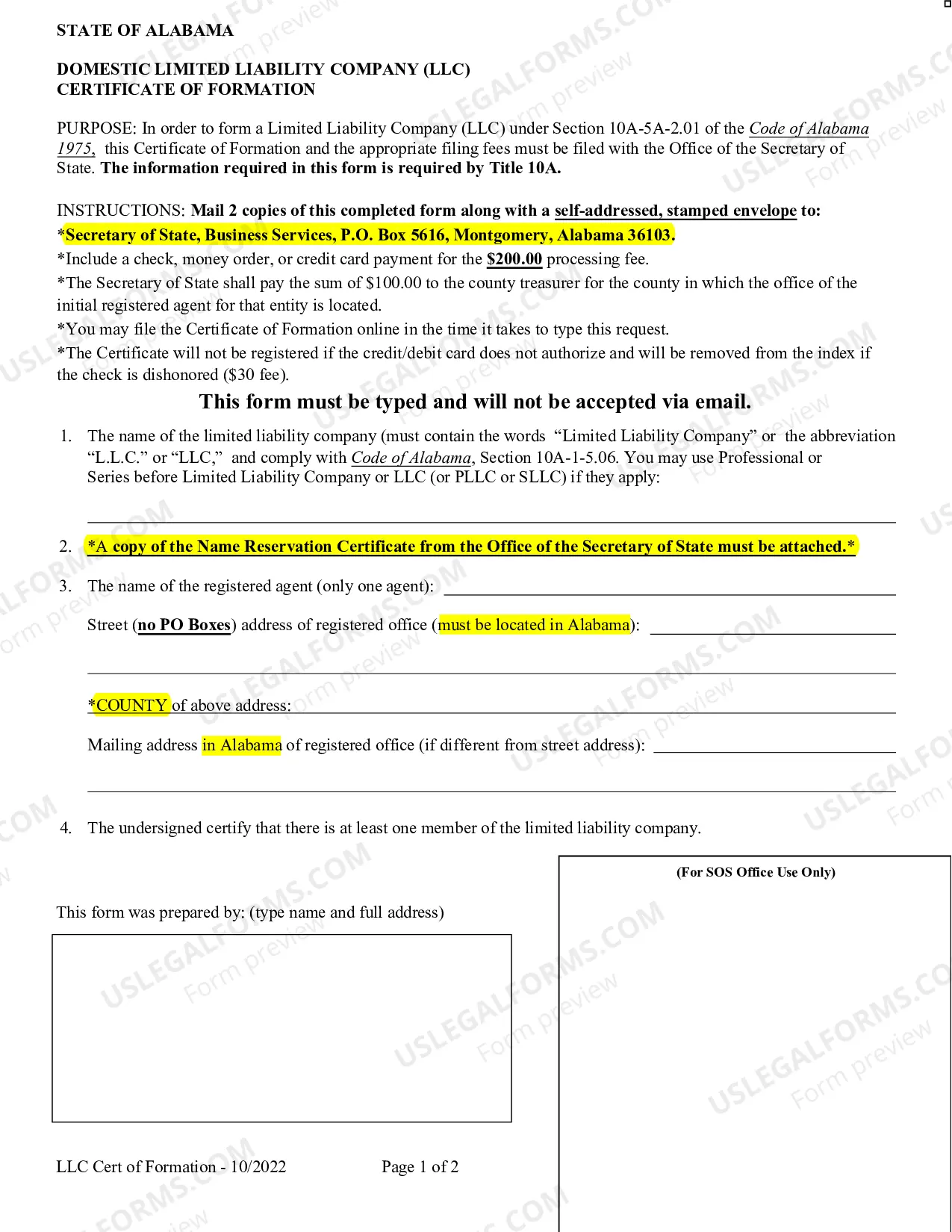

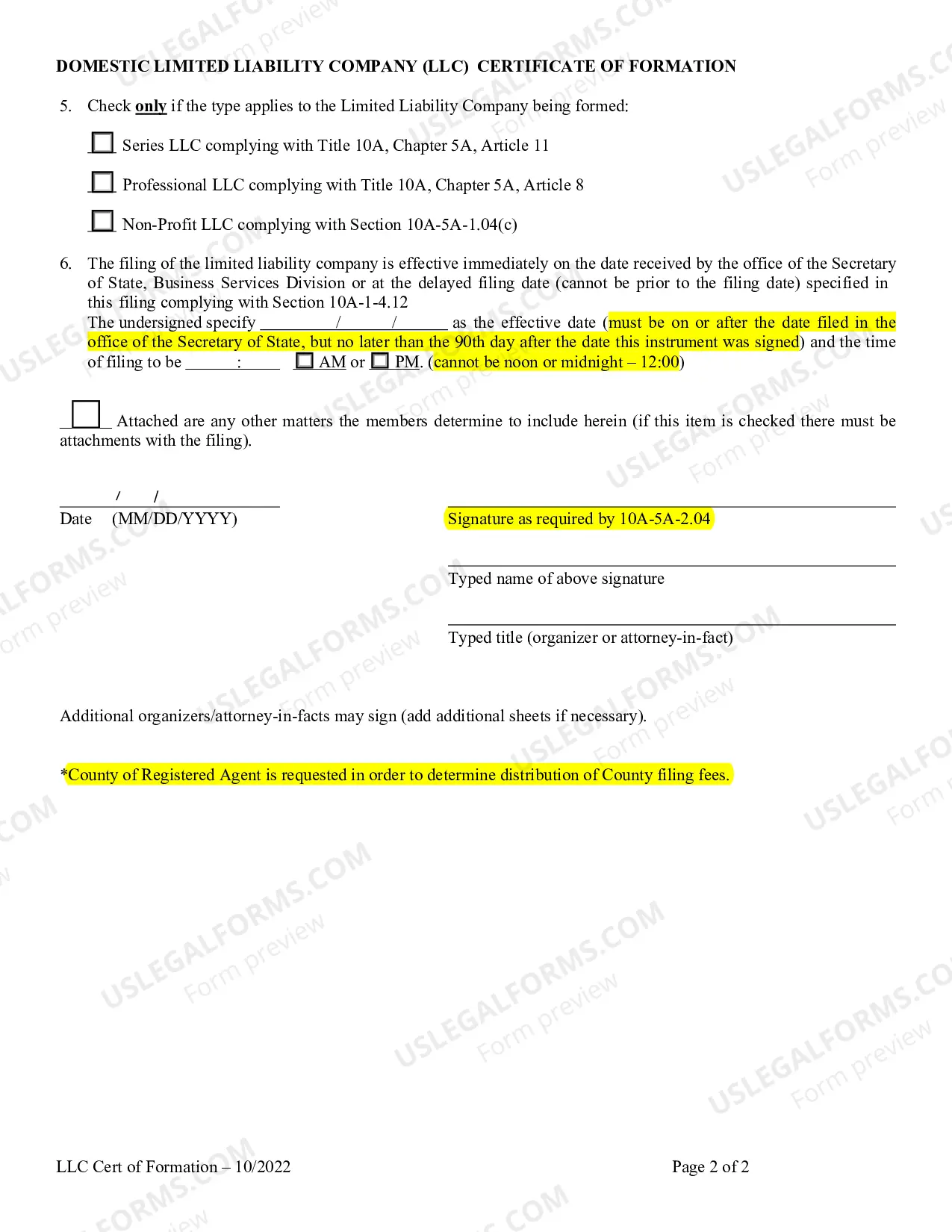

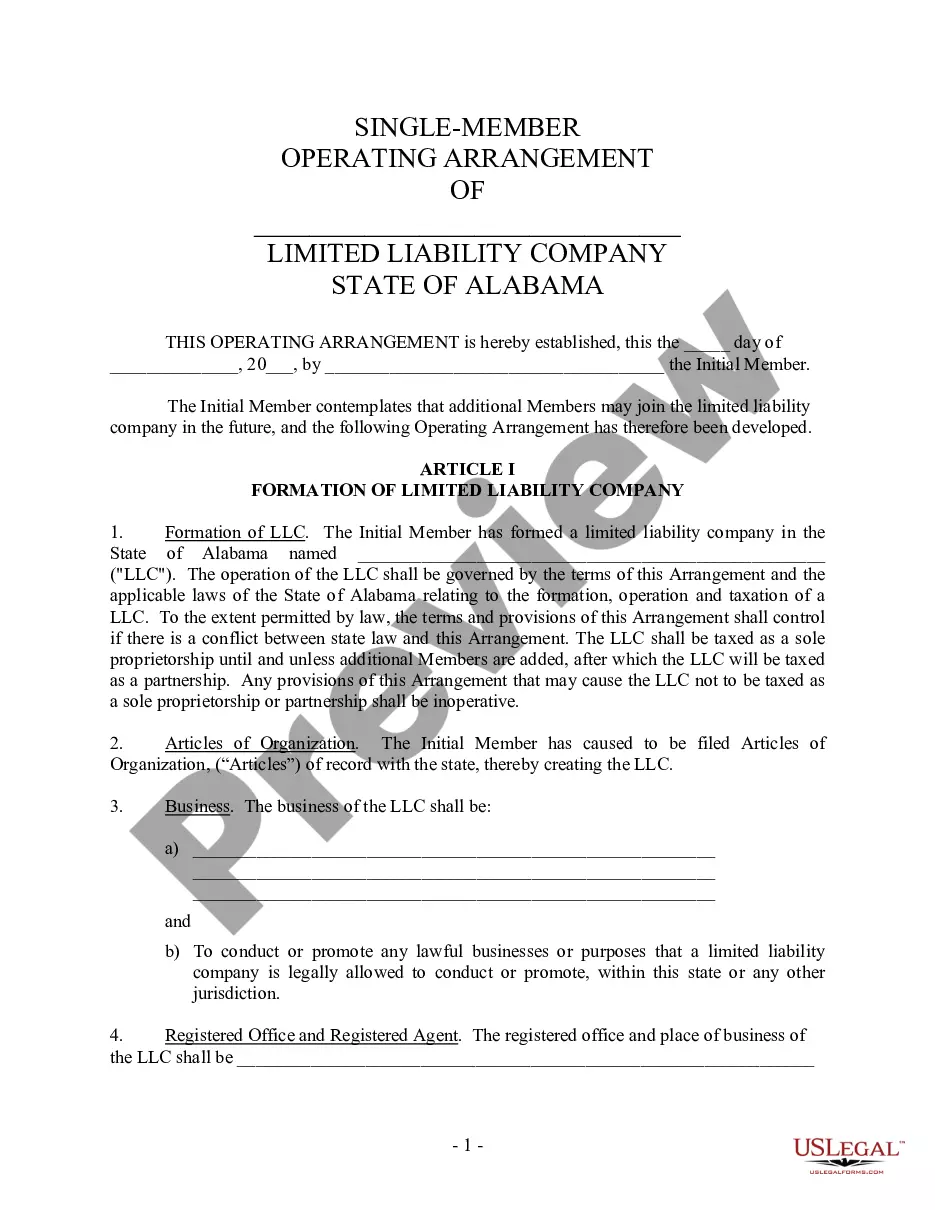

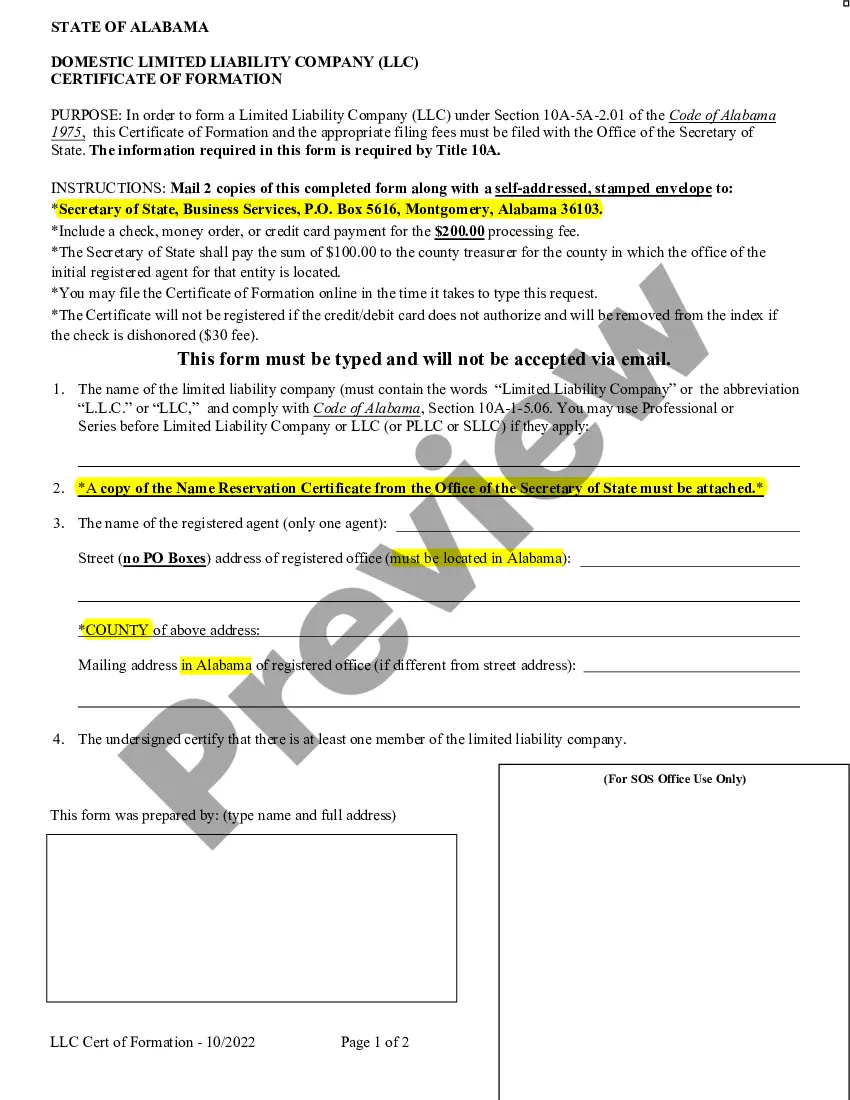

This Professional Limited Liability Company - LLC Formation Package state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new Limited Liability Company for professional services. The form contains basic information concerning the professional LLC, normally including the LLC's name, purpose of the LLC, the registered address, registered agent, and related information.

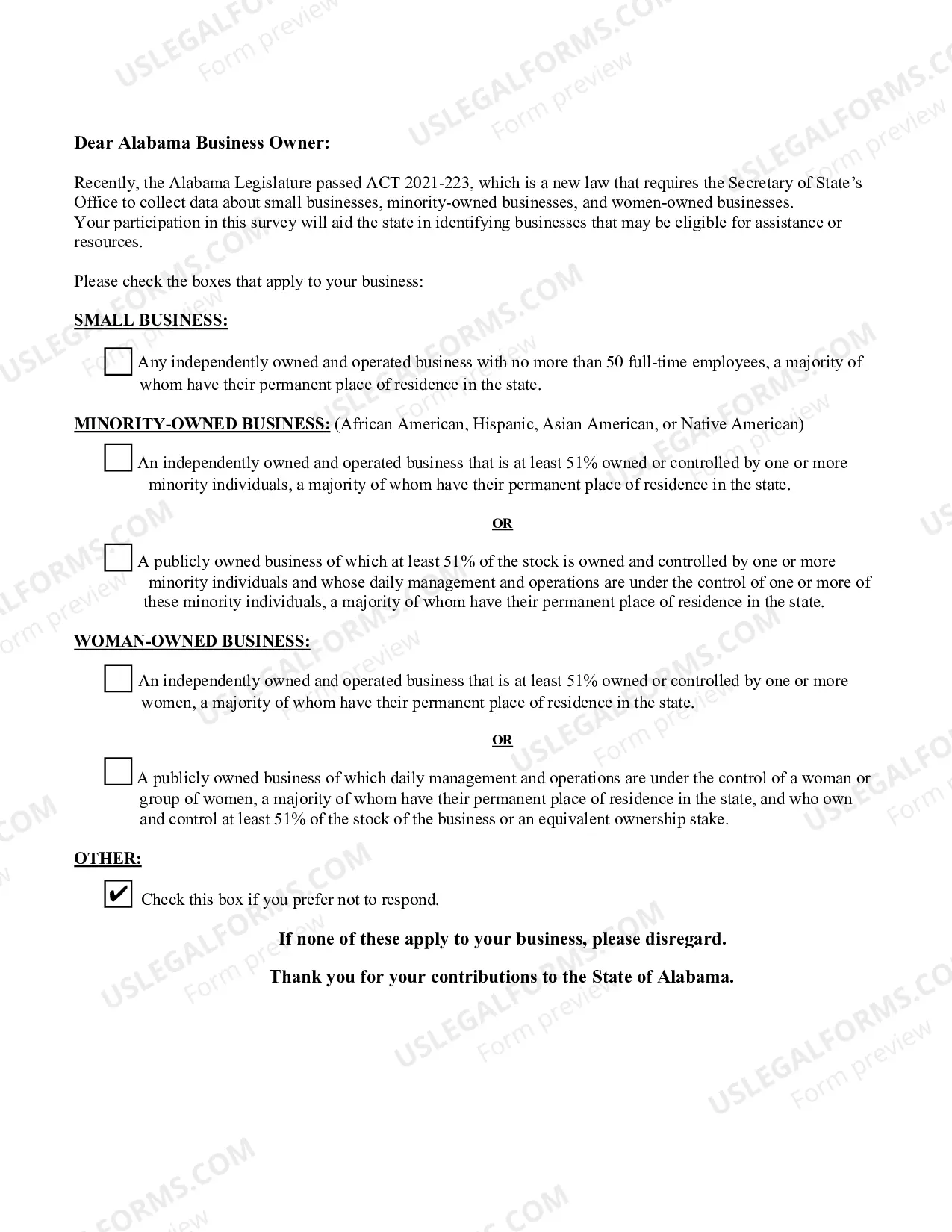

Alabama Professional Limited Liability Company PLLC Formation Package

Description

How to fill out Alabama Professional Limited Liability Company PLLC Formation Package?

Utilizing samples from the Alabama Professional Limited Liability Company PLLC Formation Package generated by experienced attorneys provides you the chance to sidestep difficulties while filling out paperwork.

Just download the form from our site, complete it, and have legal advisors review it.

This approach can save you significantly more time and money than having an attorney create a document from scratch to meet your requirements.

Use the Preview feature and read the description (if applicable) to determine if you require this particular template, and if so, simply click Buy Now.

- If you’ve already purchased a US Legal Forms subscription, simply Log In to your account and revisit the sample page.

- Locate the Download button next to the template you are reviewing.

- After downloading a template, your saved samples will appear in the My documents tab.

- If you do not have a subscription, it’s not a significant issue.

- Just adhere to the step-by-step instructions below to register for your online account, access, and complete your Alabama Professional Limited Liability Company PLLC Formation Package template.

- Confirm that you are downloading the correct state-specific form.

Form popularity

FAQ

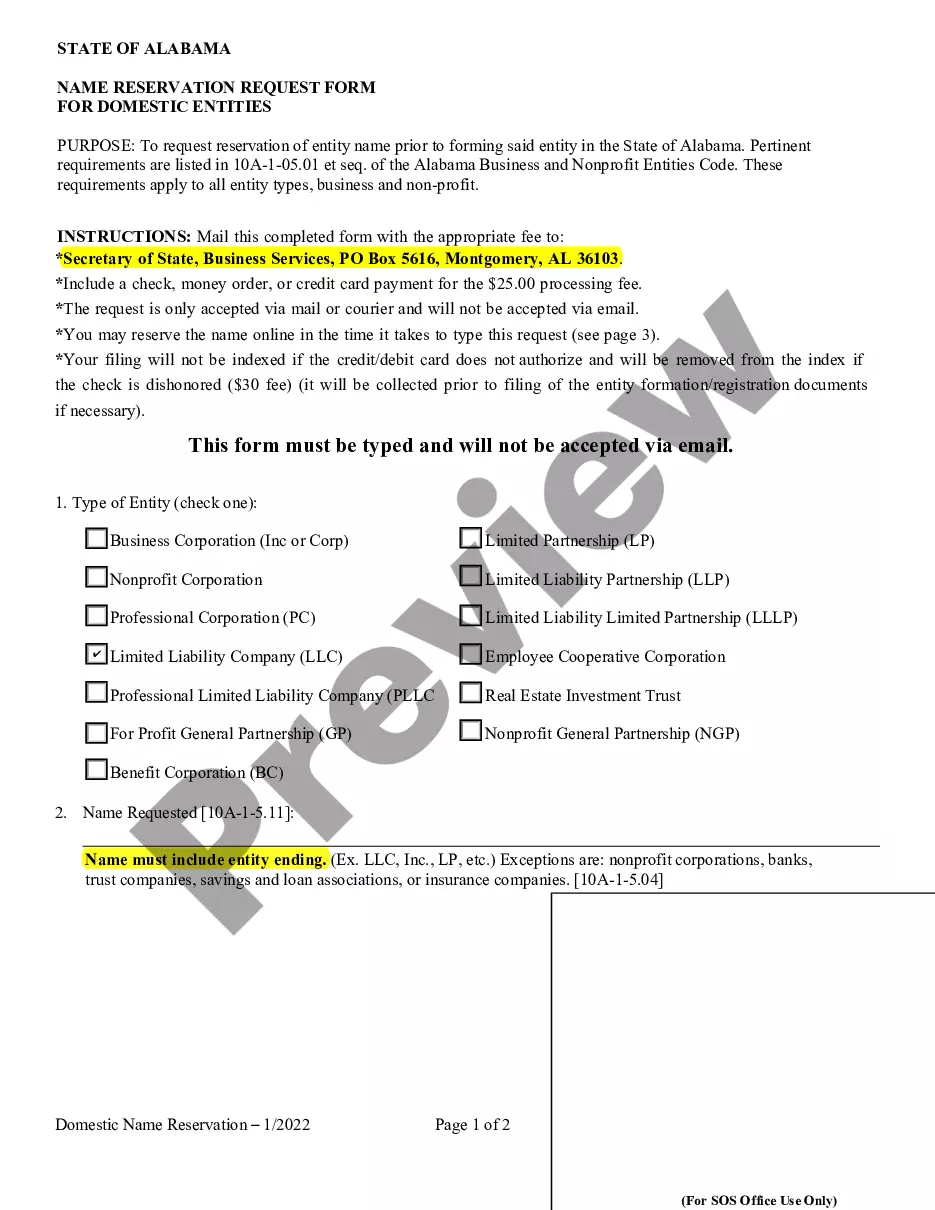

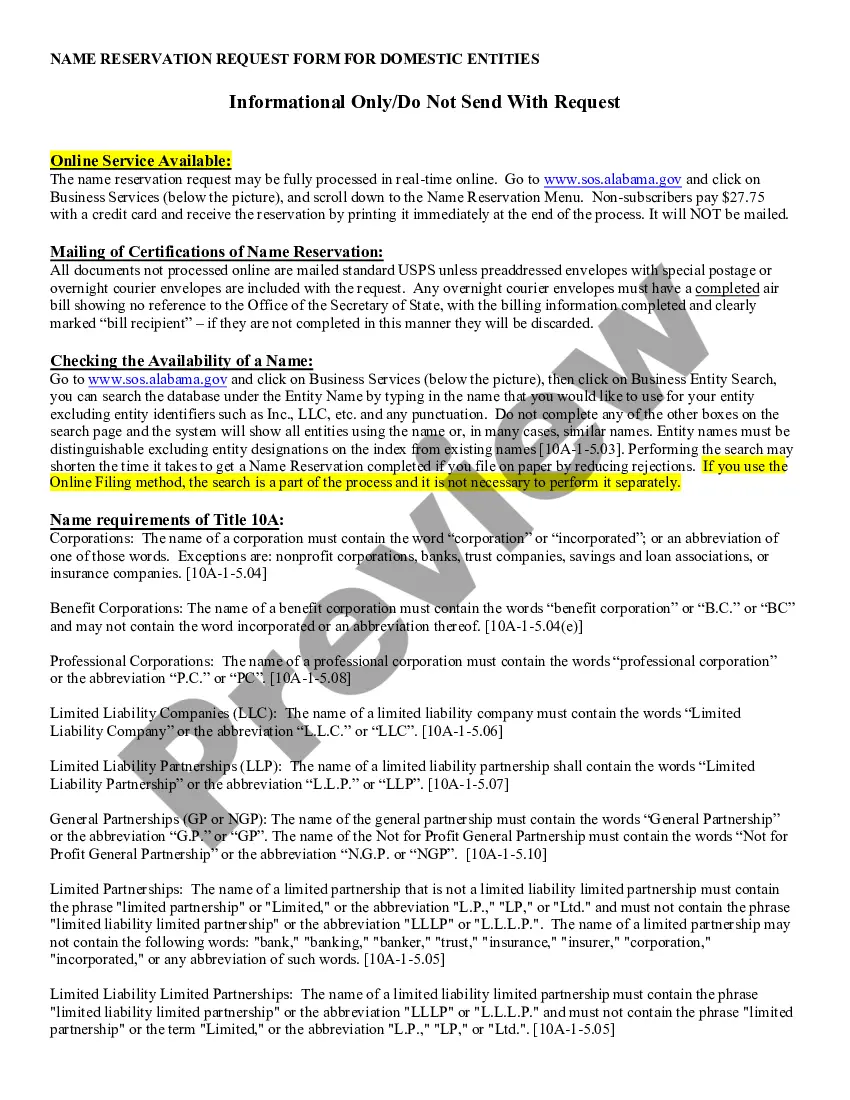

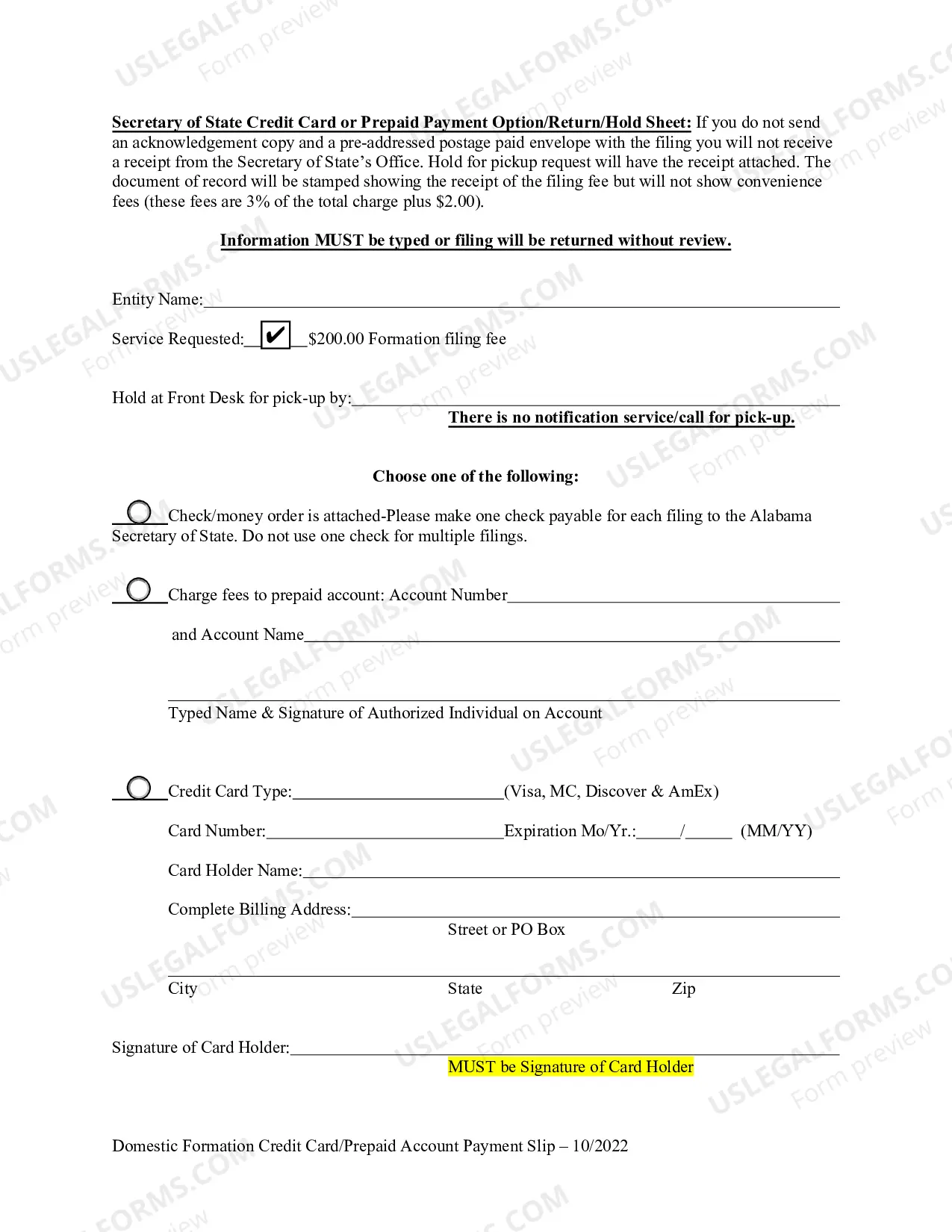

The Alabama Secretary of State charges a $100 fee to file the Certificate of Formation. You must also pay a separate Probate Court filing fee, which is at least $50. You must reserve your business name by filing an LLC name reservation. It costs $28 to file online and $10 if filed by mail.

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

A certified public accountant (CPA) cannot provide legal advice, but can guide you through the paperwork and decision-making process of setting up an LLC for an average cost of $400-$900 or more, depending on location and complexity. That's in addition to state fees and expenses.

The usual processing time for business forms and documents is between three to five business days after receipt of filing request. However, when taking into consideration the filing requirements with the judge of probate, turnaround times for LLC forms may take up to two weeks or 14 business days.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

STEP 1: Name Your Alabama LLC. STEP 2: Choose a Registered Agent in Alabama. STEP 3: File the Alabama LLC Certificate of Formation. STEP 4: Create Your Alabama LLC Operating Agreement. STEP 5: Get an Alabama LLC EIN.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.