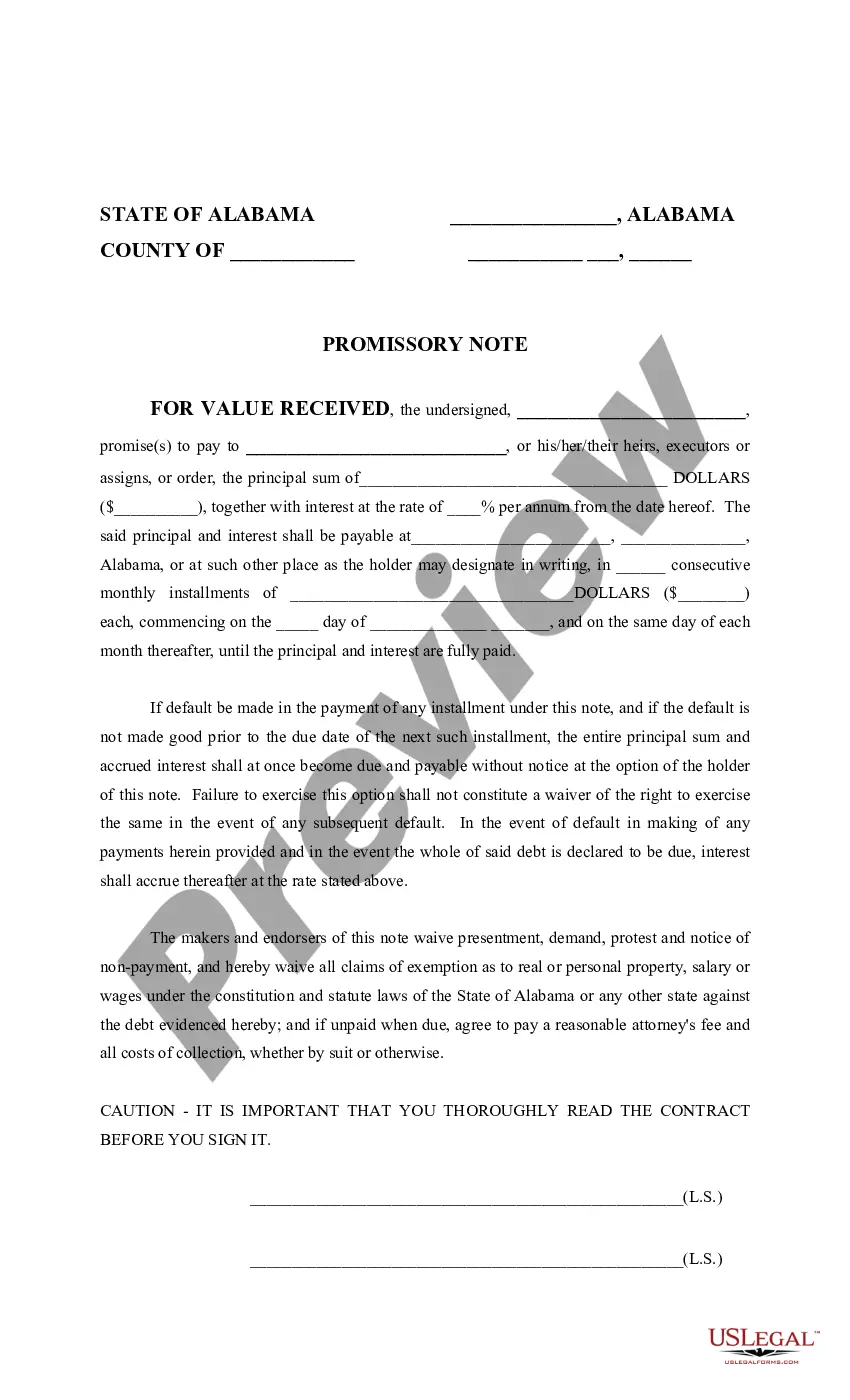

This form is a written promise to pay a debt. It is an unconditional promise to pay, on demand or at a fixed or determined future time, a particular sum of money to, or to the order of, a specified person or to the bearer.

Alabama Promissory Note

Description

How to fill out Alabama Promissory Note?

Employing Alabama Promissory Note templates crafted by experienced attorneys allows you to avoid troubles when filing paperwork. Simply download the form from our site, complete it, and ask a legal expert to review it. By doing so, you can conserve considerably more time and energy than searching for a lawyer to draft a document from scratch to meet your specifications.

If you have already acquired a US Legal Forms subscription, just sign in to your account and revisit the sample page. Locate the Download button next to the template you are examining. After downloading a document, you will find all of your saved templates in the My documents section.

If you do not possess a subscription, that’s not a major issue. Simply adhere to the following steps to enroll for an account online, obtain, and complete your Alabama Promissory Note form.

Once you have completed all the above steps, you will have the capacity to fill out, print, and sign the Alabama Promissory Note template. Remember to double-check all entered information for accuracy before submitting or mailing it. Minimize the time spent on document creation with US Legal Forms!

- Verify and ensure that you are downloading the accurate state-specific template.

- Utilize the Preview option and review the description (if accessible) to determine if this particular template is necessary, and if so, click Buy Now.

- Search for another file using the Search box if required.

- Choose a subscription that fits your needs.

- Begin by using your credit card or PayPal.

- Select a file type and download your document.

Form popularity

FAQ

Amount of repayment. Repayment terms. Interest rate. Default penalties.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.