This form is used to release a corporation from a mortgage once full payment of the debt secured by the mortgage has bee paid. This form is available in Word and Wordperfect formats.

Alabama Corporate Satisfaction Mortgage

Description

How to fill out Alabama Corporate Satisfaction Mortgage?

Utilizing Alabama Corporate Satisfaction Mortgage templates crafted by experienced attorneys helps you avoid complications when filing paperwork.

Simply download the example from our site, complete it, and have a legal expert review it for you.

This can save you significantly more time and expenses than attempting to find a lawyer to create a document tailored to your needs.

- If you already possess a US Legal Forms subscription, just Log In to your account and go back to the sample page.

- Locate the Download button adjacent to the templates you are reviewing.

- Once you have downloaded a document, all your saved samples can be found in the My documents section.

- If you do not have a subscription, that's no issue.

- Simply follow the step-by-step instructions below to register for your account online, acquire, and fill out your Alabama Corporate Satisfaction Mortgage template.

- Verify and ensure that you are obtaining the correct state-specific form.

Form popularity

FAQ

Lending institutions are responsible for preparing and filing the satisfaction of mortgage with the appropriate county recorder, land registry office, city registrar, or recorder of deeds. Some borrowers prepay their mortgages by making extra mortgage payments in an effort to pay off their mortgages faster.

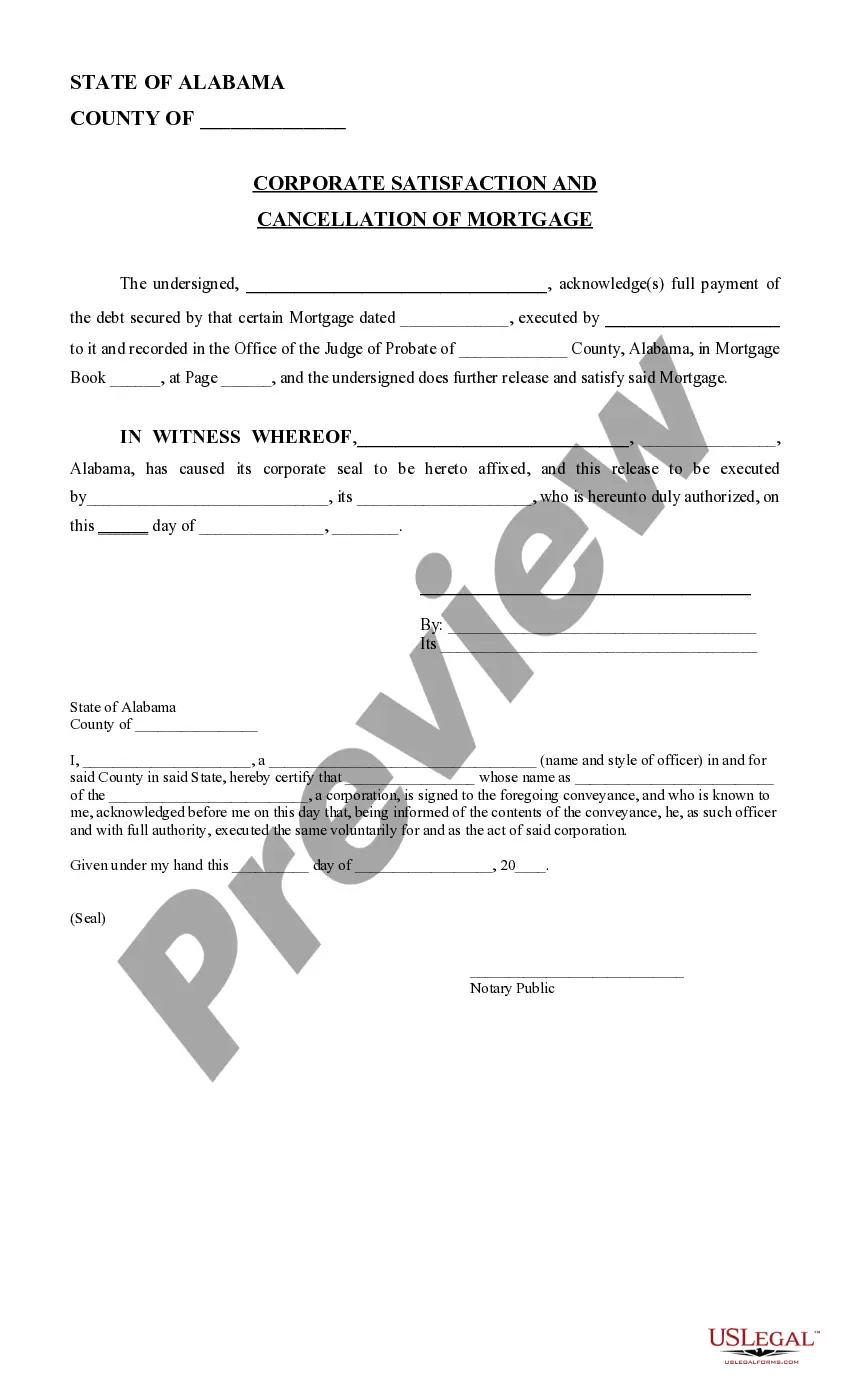

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Key Takeaways. A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

How do you get a Satisfaction of Mortgage? A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.