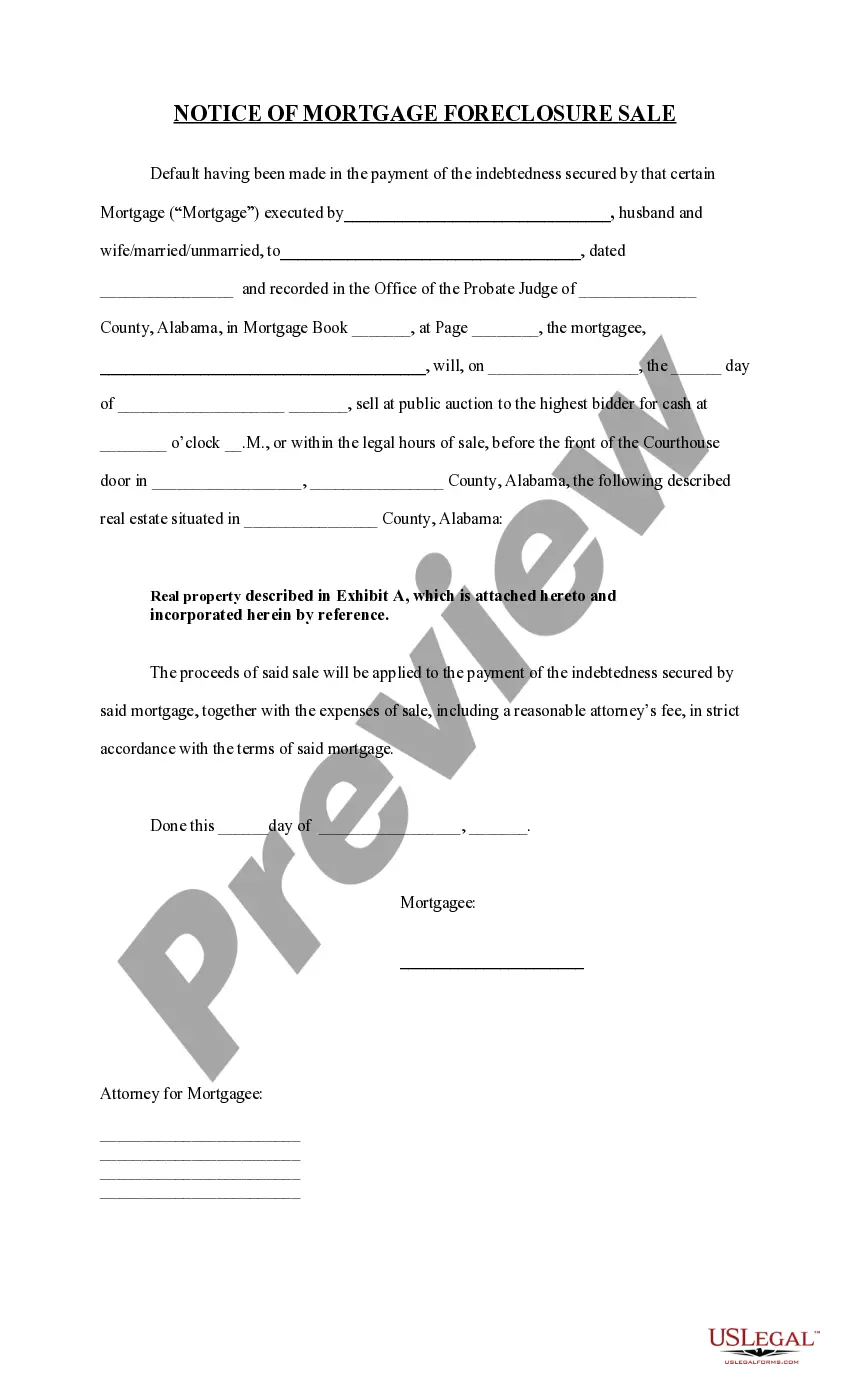

This form is a notice to terminate a mortgagor's interest in property to force a sale in order to satisfy the unpaid debt secured by the property. This form is available in Word and Wordperfect formats.

Alabama Notice of Mortgage Foreclosure Sale

Description

How to fill out Alabama Notice Of Mortgage Foreclosure Sale?

Utilizing Alabama Notice of Mortgage Foreclosure Sale templates crafted by experienced legal professionals allows you to evade complications when submitting paperwork.

Simply download the example from our site, complete it, and have an attorney verify it.

By doing this, you will conserve significantly more time and energy than requesting a legal expert to create a file from scratch.

Utilize the Preview feature and read the description (if available) to determine if you require this specific template; if so, just select Buy Now. Find another document using the Search field if needed. Choose a subscription that fits your requirements. Begin with your credit card or PayPal. Select a file format and download your document. After completing all the aforementioned steps, you will be able to fill out, print, and sign the Alabama Notice of Mortgage Foreclosure Sale template. Remember to confirm all entered information for accuracy before submitting or sending it out. Reduce the time spent on completing paperwork with US Legal Forms!

- If you already possess a US Legal Forms subscription, just Log In to your account and revisit the sample page.

- Locate the Download button adjacent to the templates you are reviewing.

- Once you've downloaded a document, your saved samples will appear in the My documents tab.

- If you do not have a subscription, it isn’t an issue.

- Simply adhere to the instructions below to register for your account online, acquire, and complete your Alabama Notice of Mortgage Foreclosure Sale template.

- Verify that you are downloading the appropriate state-specific form.

Form popularity

FAQ

In Alabama, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

Catch Up on the Mortgage. Pay the mortgage arrears in full, plus all legal fees that the lender incurred. Enter Into a Forbearance Agreement. Contact your lender if you cannot pay in full. Try a Loan Modification. Ask the lender for a loan modification. Get Permission for a Short Sale. Do a Deed in Lieu of Foreclosure.

If a foreclosure sale is scheduled to occur in the next day or so, the best way to stop the sale immediately is by filing for bankruptcy. The automatic stay will stop the foreclosure in its tracks. Once you file for bankruptcy, something called an "automatic stay" immediately goes into effect.

In case of judicial foreclosure by a bank, you may redeem the property by paying the amount due under the mortgage deed, with interest at the rate specified in the mortgage, and all the costs and expenses incurred by the bank or institution from the sale and custody of said property less the income derived therefrom (

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

The auction notice, or Notice of Sale, is your final notice that the lender intends to sell the property at auction. The county prints the location, time and date of the trustee's auction on the Notice of Sale. It also contains the name and contact information for the trustee in charge of the sale.

The automatic stay will stop the foreclosure in its tracks. The bank may file a motion for relief from the stay. Benefits of a Chapter 13 bankruptcy.