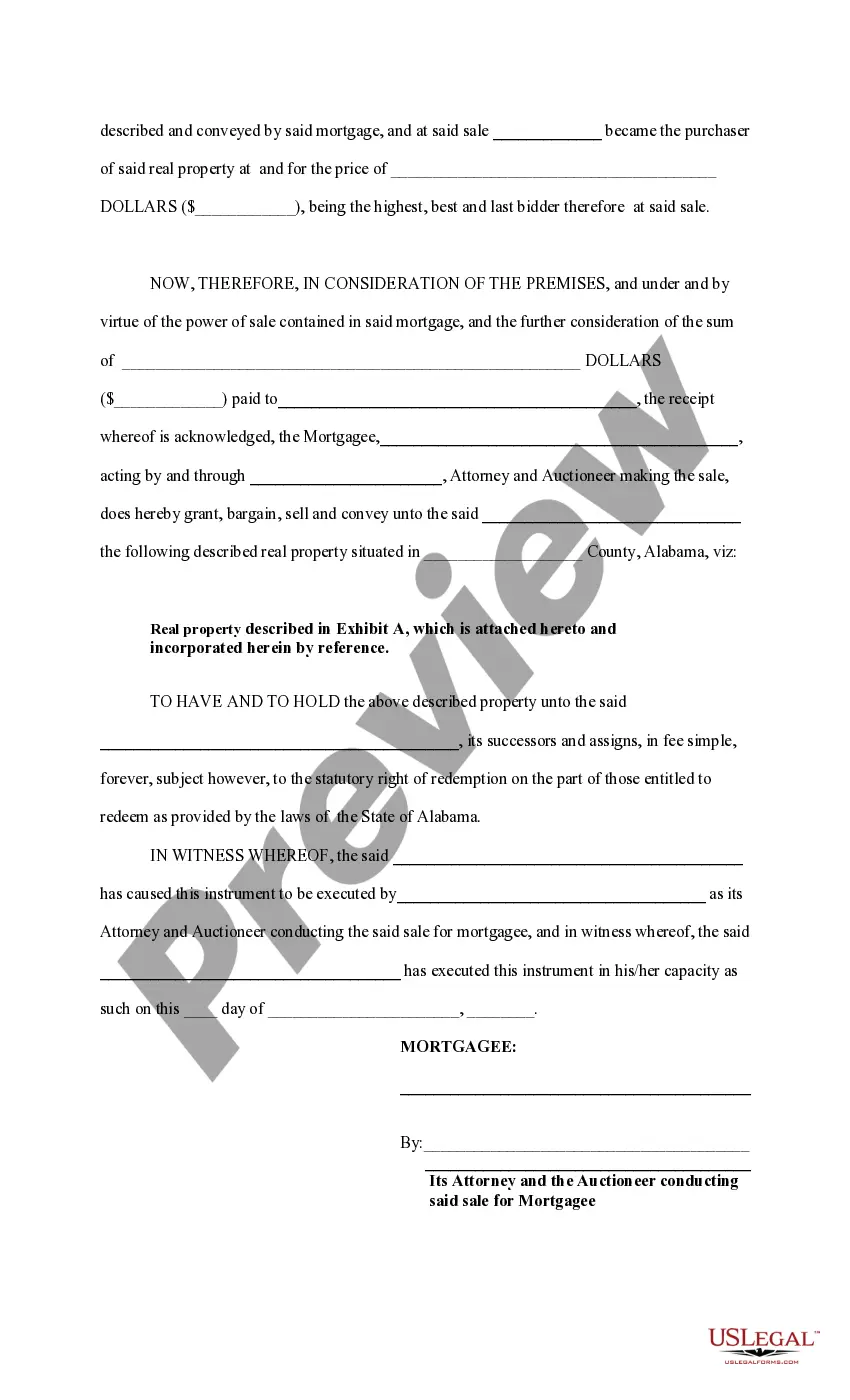

This form is a deed that is used when a mortgage loan is in default and the sale of the mortgaged property is performed in order to satisfy the unpaid debt. This form is available in Word and Wordperfect formats.

Alabama Mortgage Foreclosure Deed

Description Mortgage Foreclosure Deed

How to fill out Alabama Mortgage Foreclosure Deed?

Employing Alabama Mortgage Foreclosure Deed templates crafted by experienced legal professionals allows you to evade complications when finalizing paperwork.

Simply download the form from our website, complete it, and have an attorney verify it. This will save you significantly more time and effort than having a lawyer create a document from scratch for you.

If you possess a US Legal Forms subscription, just Log In/">Log In to your account and return to the form page. Locate the Download button next to the templates you are reviewing. After downloading a document, you will find all your saved templates in the My documents section.

Once you have completed all the steps above, you will be able to fill out, print, and sign the Alabama Mortgage Foreclosure Deed template. Remember to thoroughly check all entered information for accuracy before submitting or sending it out. Streamline the process of completing documents with US Legal Forms!

- If you lack a subscription, it's not a major concern.

- Just adhere to the instructions below to register for your account online, obtain, and fill out your Alabama Mortgage Foreclosure Deed template.

- Verify and ensure that you are downloading the correct state-specific document.

- Use the Preview feature and review the description (if present) to determine if you require this particular template; if so, simply click Buy Now.

- Search for another file using the Search field if necessary.

- Select a subscription that suits your needs.

- Begin by using your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

Lenders will seize the home, which is typically used as collateral for the loan and will put the property up for sale to try and recoup losses. The foreclosure process from beginning to end typically takes a lender about 18 months to foreclose on a property during normal times.

Notice Of Default The lender will also give public notice to the County Recorder's office or file a lawsuit with the court. This officially begins the preforeclosure process, which can last 3 10 months.

In most areas, you'll have about thirty days to catch up on your mortgage before the lender can take further action to foreclose on your home. After you have been sent a notice and the waiting period has expired, the lender can set a date to sell your house at a foreclosure auction.

Foreclosure is what happens when a homeowner fails to pay the mortgage. More specifically, it's a legal process by which the owner forfeits all rights to the property. If the owner can't pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction.

In Alabama, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

Initial contact. Lenders will usually initiate communication on a first missed payment. Demand letter. Filing of a foreclosure claim. Borrowers Potential Actions in the Face of Foreclosure. Redemption Period. Sale ordered by the court. Order for foreclosure.

Alabama law generally gives homeowners a one-year redemption period after a foreclosure sale. But state law gives homeowners a 180-day redemption period after the foreclosure sale for homestead propertiesif proper notice about the right to redeem was given and the mortgage was taken out on or after January 1, 2016.

Generally, homeowners have to be more than 120 days delinquent before a foreclosure can begin. If you're behind in mortgage payments, you might be wondering how soon a foreclosure will start. Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.