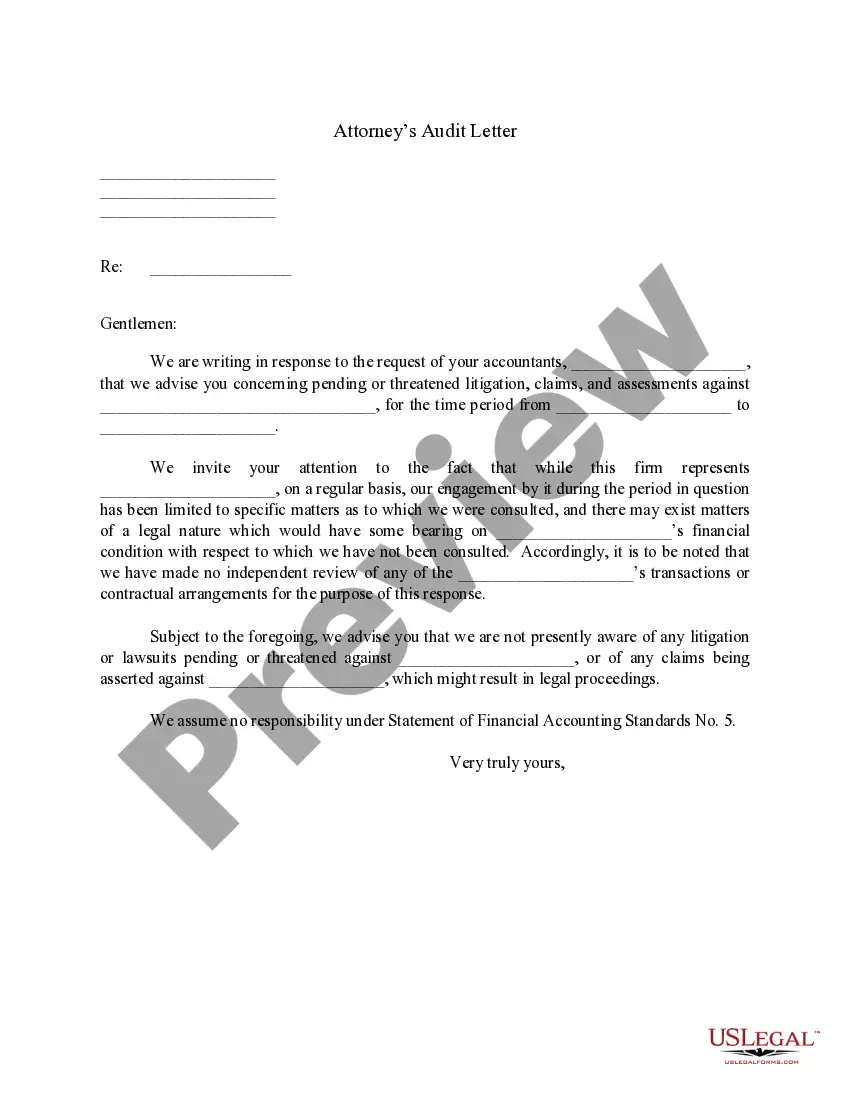

This form is an examination of an attorney's financial records and documents and other evidence by a trained accountant with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books.

Alabama Attorney's Audit Letter

Description

How to fill out Alabama Attorney's Audit Letter?

Utilizing Alabama Attorney's Audit Letter examples crafted by experienced lawyers helps you evade complications when filing paperwork.

Just download the sample from our site, complete it, and ask for legal advice to review it.

Doing so will save you considerably more time and money compared to seeking an attorney to draft a document from scratch for you.

Find an alternative template using the Search bar if necessary.

- If you already possess a US Legal Forms subscription, simply Log In to your account and revisit the form page.

- Locate the Download button adjacent to the templates you are considering.

- Upon downloading a template, all your saved samples will be accessible in the My documents section.

- If you lack a subscription, don’t worry. Just adhere to the instructions below to register for your account online, obtain, and fill out your Alabama Attorney's Audit Letter example.

- Verify to ensure that you are downloading the correct state-specific document.

- Leverage the Preview function and review the description (if available) to determine if you require this particular template; if so, simply click Buy Now.

Form popularity

FAQ

This letter requests additional information due to a review of our member's 1040 tax return.If you received a letter similar to this one or any notice from a state taxing agency or the IRS we can help you!

Auditors are trained to identify fraud, including attempts to conceal bank accounts and income. If you are audited, the auditor will compare the income you reported on your tax return to your bank account statements to ensure your taxes are assessed accurately.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

Almost every IRS auditor is going to want to investigate whether you have reported all of your income on your tax return.A bank deposit analysis involves the IRS adding up every deposit in your bank account and comparing it to the income you reported on your tax return.

It's just the fact that they're late about processing their tax return. If you haven't received your return or been notified of review, contact the Alabama Department of Revenue at 334-242-1170 or 1-800-535-9410.

Time Limitations from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due. A taxpayer also generally has three years to claim a refund of any tax overpaid.

Unreported income. Filing status. Dependents. Itemized deductions. Eligibility for credits.

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Where's My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.