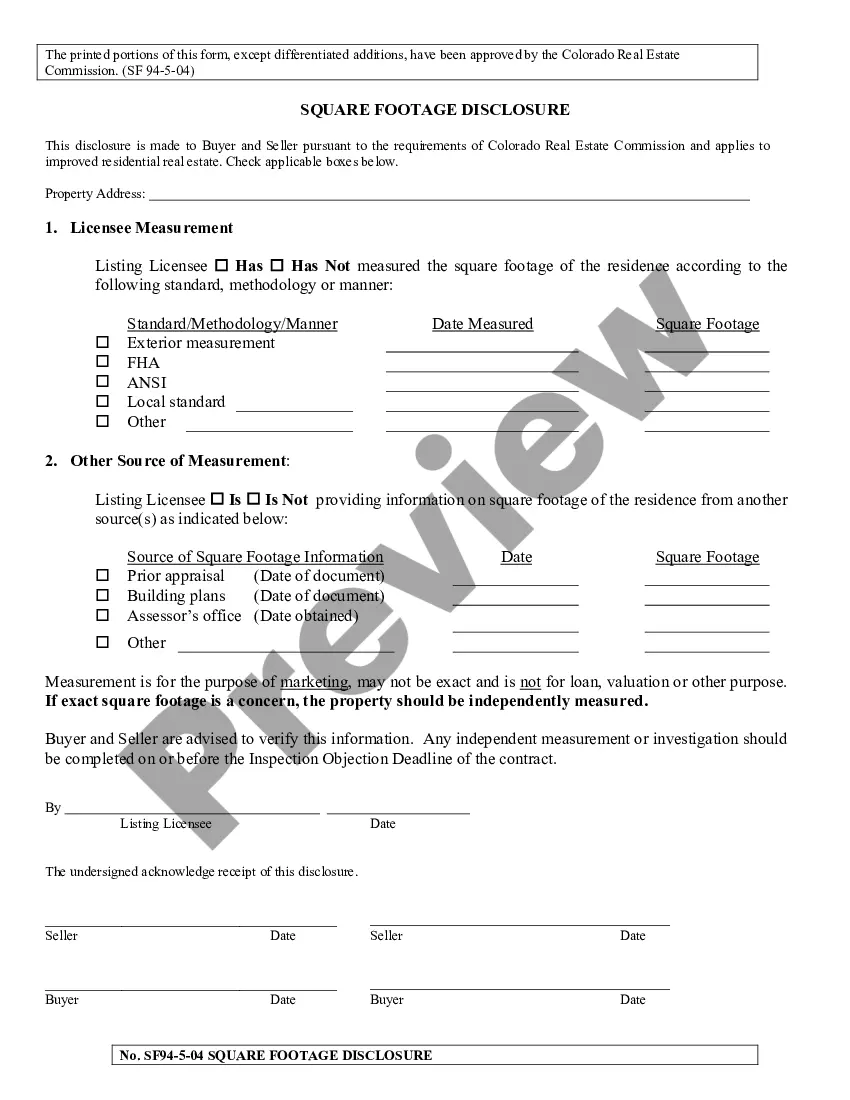

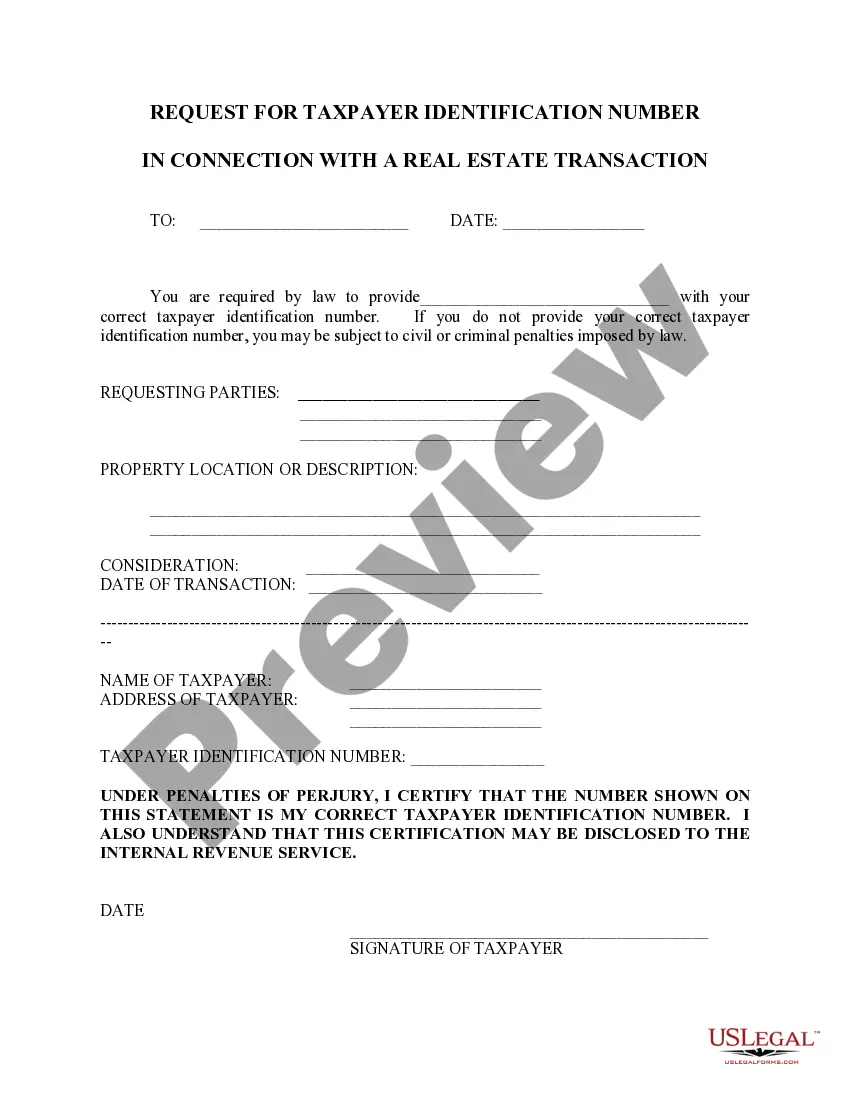

This form is a request for taxpayer identification number to be used in a real estate transaction. This form is available in Word and Wordperfect formats.

Alabama Request For Taxpayer ID Number in Connection with Real Estate Transaction

Description

How to fill out Alabama Request For Taxpayer ID Number In Connection With Real Estate Transaction?

Utilizing Alabama Request For Taxpayer ID Number related to Real Estate Transaction templates crafted by skilled attorneys helps you prevent stress when completing paperwork.

Simply download the template from our site, complete it, and request legal advice to review it.

This approach can save you significantly more time and effort than having legal counsel create a document tailored to your requirements.

Remember to verify all entered information for accuracy before sending it or mailing it out. Streamline the document creation process with US Legal Forms!

- If you’ve previously purchased a US Legal Forms subscription, just sign in to your account and navigate back to the form web page.

- Locate the Download button next to the template you’re reviewing.

- Once you've downloaded a document, all your saved templates will be in the My documents section.

- If you lack a subscription, no worries.

- Simply adhere to the instructions below to register for your online account, obtain, and complete your Alabama Request For Taxpayer ID Number related to Real Estate Transaction template.

- Ensure that you are retrieving the correct state-specific document.

Form popularity

FAQ

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN).

Applying for an EIN for your LLC is free ($0) Applying for an EIN for your Alabama LLC is completely free. The IRS doesn't charge anything for applying for an EIN.

To replace your Alabama ID card, you may apply online or visit your local ALEA office and bring acceptable identification.

A Alabama Federal Tax ID Number which is also known as an Employer ID Number (EIN) or Federal Tax Identification Number is a unique, nine-digit ID assigned by the Internal Revenue Service for tax purposes for businesses as well as Non-Profit organizations, Trusts and Estates.

If you're an independent contractor, you can find this number in the Payer's Federal Identification Number box on Form 1099. If you're an employee of a company and have been unable to find your company's EIN, you may call or e-mail the Department of Revenue for your state.

To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual.

To obtain your Tax ID (EIN) in Alabama start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.

Apply for an FEIN online or contact the IRS at 1-800-829-1040. Is an FEIN needed to apply for an alabama tax account? Yes, an FEIN is required to apply for an Alabama tax account, if the entity is a Corporation, Partnership, Single Member LLC, etc.