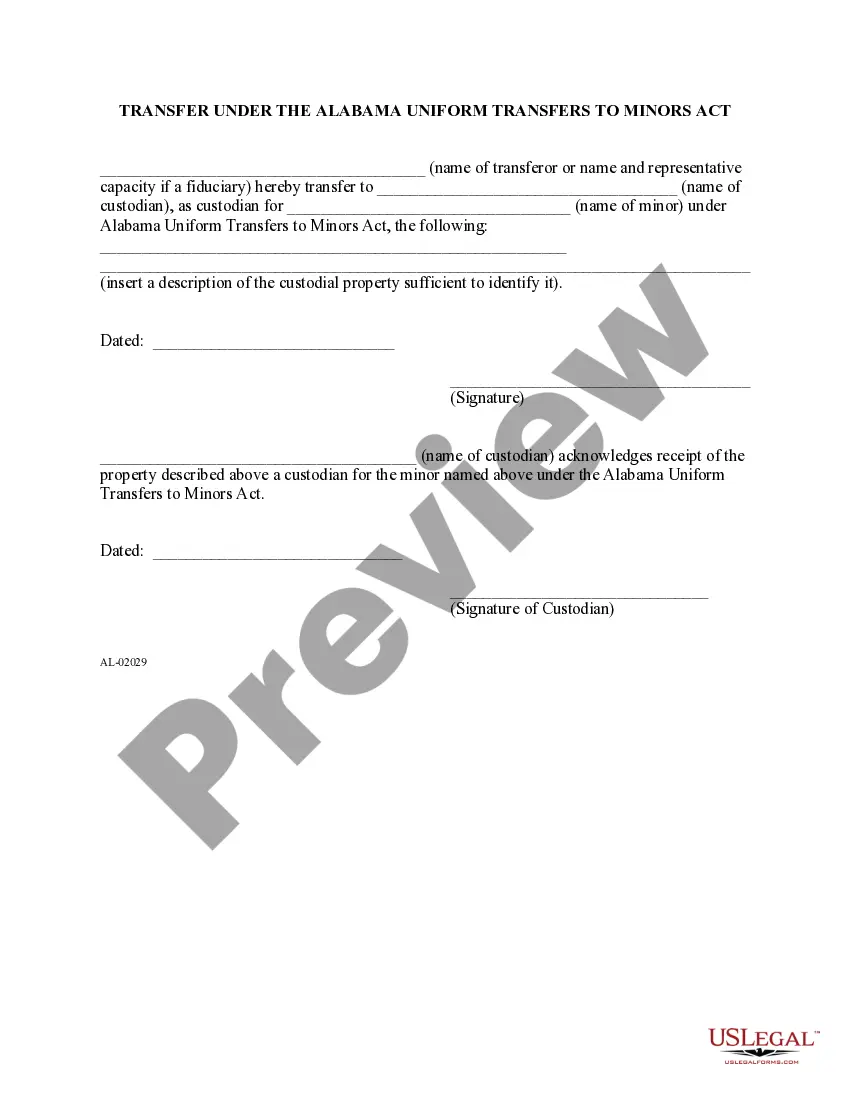

With this Transfer under the Uniform Transfers to Minors Act form, the owner of property declares that he/she transferred, to the custodian of a minor, certain property pursuant to the Uniform Transfers to Minors Act. The custodian also acknowledges receipt of the property.

Alabama Transfer under the Uniform Transfers to Minors Act

Description Alabama Uniform Transfers To Minors Act

How to fill out Alabama Transfer Under The Uniform Transfers To Minors Act?

Utilizing Alabama Transfer under the Uniform Transfers to Minors Act forms developed by proficient attorneys allows you to avert complications while finalizing paperwork.

Simply download the document from our site, complete it, and request a lawyer to verify it.

This can assist you in conserving significantly more time and effort than seeking legal advice to create a document tailored to your specifications from the beginning.

Utilize the Preview option and examine the details (if present) to determine if this specific template is necessary and if so, click Buy Now. Search for another template using the Search bar if required. Choose a subscription that suits your requirements. Begin using your credit card or PayPal. Choose a file format and download your paperwork. After completing all the steps outlined above, you will be able to fill out, print, and sign the Alabama Transfer under the Uniform Transfers to Minors Act template. Remember to carefully check all entered data for accuracy before submitting it or sending it out. Reduce the time spent on document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your profile and revisit the sample page.

- Locate the Download button adjacent to the templates you are reviewing.

- Once you've downloaded a file, you can discover your saved documents in the My documents section.

- If you lack a subscription, that's alright.

- Simply adhere to the instructions below to register for an online account, obtain, and fill out your Alabama Transfer under the Uniform Transfers to Minors Act form.

- Ensure you are downloading the accurate state-specific document.

Utma Age Of Majority By State Form popularity

FAQ

When children reach the age of majority, the account can be transferred into their name only with custodian consent. Otherwise, they can remove the custodian from the account at the age of termination.

Generally, the UTMA account transfers to the beneficiary when he or she becomes a legal adult, which is usually 18 or 21. However, the age of adulthood may be defined differently for custodial accounts, like UTMAs or 529 plans, depending on your state.

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child'susually lowertax rate, rather than the parent's rate.Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate. Any earnings over $2,100 are taxed at the parent's rate.

The Uniform Gifts to Minors Act (UGMA) provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point he assumes control of the account.

UGMA and UTMA accounts allow parents to save money and invest, maintain full control until their child is an adult. UTMA stands for Uniform Transfers to Minors Act, and UGMA stands for Universal Gifts to Minors Act. Both accounts allow you to transfer financial assets to a minor without establishing a trust.

You can move money from a custodial account, such as a UGMA (Uniform Gifts to Minors Act) or a UTMA (Uniform Transfers to Minors Act), to a 529 plan.

The Uniform Transfers To Minors Act (UTMA) is a uniform act drafted and recommended by the National Conference of Commissioners on Uniform State Laws in 1986, and subsequently enacted by most U.S. States, which provides a mechanism under which gifts can be made to a minor without requiring the presence of an appointed

Virtually all states have adopted some form of UTMA that allows you to make gifts to a minor to be held in the name of a custodian during the age of minority. On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee.The donor can name a custodian who has the fiduciary duty to manage and invest the property on behalf of the minor until the minor becomes of legal age.