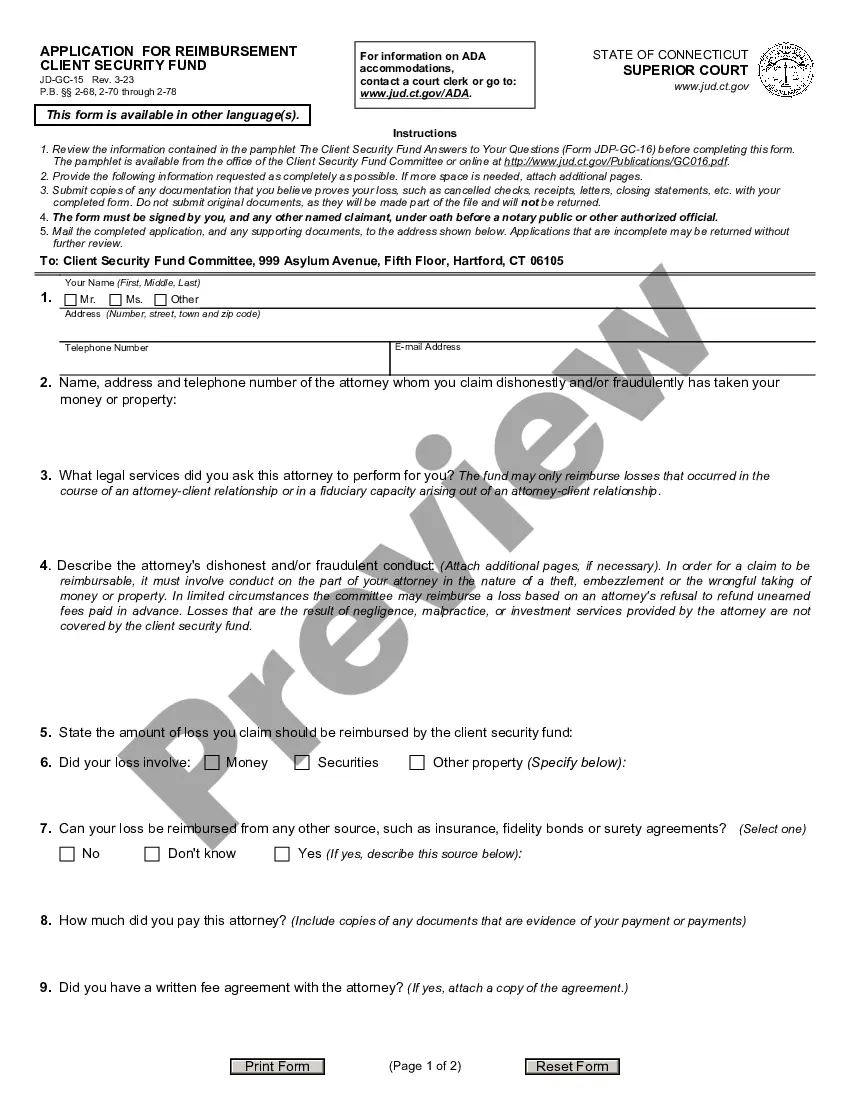

This is a sample discovery request for documents propounded to a defendant related to a violation of OSHA regulations claim.

Alabama Request for Production

Description

How to fill out Alabama Request For Production?

Employing examples of Alabama Request for Production crafted by skilled lawyers allows you to avoid troubles when completing paperwork.

Simply download the form from our site, fill it in, and ask an attorney to review it. Doing this can assist you in conserving significantly more time and energy than having an attorney create a file independently for you.

If you possess a US Legal Forms subscription, just Log In to your profile and return to the template page. Locate the Download button adjacent to the templates that you are examining. After downloading a template, all your saved documents will be accessible in the My documents section.

Once you have completed all the steps above, you will be able to fill out, print, and sign the Alabama Request for Production template. Remember to verify all entered details for accuracy before submitting or sending it out. Reduce the time you spend on document creation with US Legal Forms!

- If you lack a subscription, it’s not an issue.

- Simply adhere to the instructions below to register for your account online, obtain, and complete your Alabama Request for Production template.

- Ensure that you are acquiring the correct state-specific document.

- Utilize the Preview option and review the description (if available) to determine if this specific template is what you need, and if so, click Buy Now.

- Search for another template using the Search field if needed.

- Select a subscription that fits your requirements.

- Begin with your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

If your Letter 12C indicates that Form 8962, Premium Tax Credit was missing and not attached to your return, you will need to send the completed Form 8962 to the IRS. You do NOT need to amend your return, so there is no need to submit Form 1040-X, Amended Return.

Yes, you can obtain a copy of your Form 1095-A through the Health Care Marketplace website https://www.healthcare.gov/ or through the State HealthCare Marketplace you purchased it from.

Log in to your HealthCare.gov account. Under "Your Existing Applications," select your 2020 application not your 2021 application. Select Tax Forms from the menu on the left. Download all 1095-As shown on the screen.

Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the Marketplace during that year.

Log in to your HealthCare.gov account. Under "Your Existing Applications," select your 2020 application not your 2021 application. Select Tax Forms from the menu on the left. Download all 1095-As shown on the screen.

There is no longer a Federal Mandate to have Health Insurance and you do not have to file Form 1095-B on your 2020 Tax return: Prepare and eFile Your 2020 Taxes here on eFile.com. As stated above, there is no longer an individual mandate and you will not pay a penalty if you did not have health insurance in 2020.

What if I file but don't include Form 8962? For any year when you received advanced premium tax credits, you are required to file a federal income tax return, including Form 8962. If you fail to do this it is called failure to reconcile you may be unable to apply for premium tax credits for the following year.

Form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. Claiming the premium tax credit could reduce your tax liability for the year.

Do I need my Form 1095-C to file my taxes? No, you do not need to send a copy of your 1095-C to the IRS when filing your tax return. However, you should keep the form with your tax records.If you have additional questions about your 1095-C, please contact your employer.