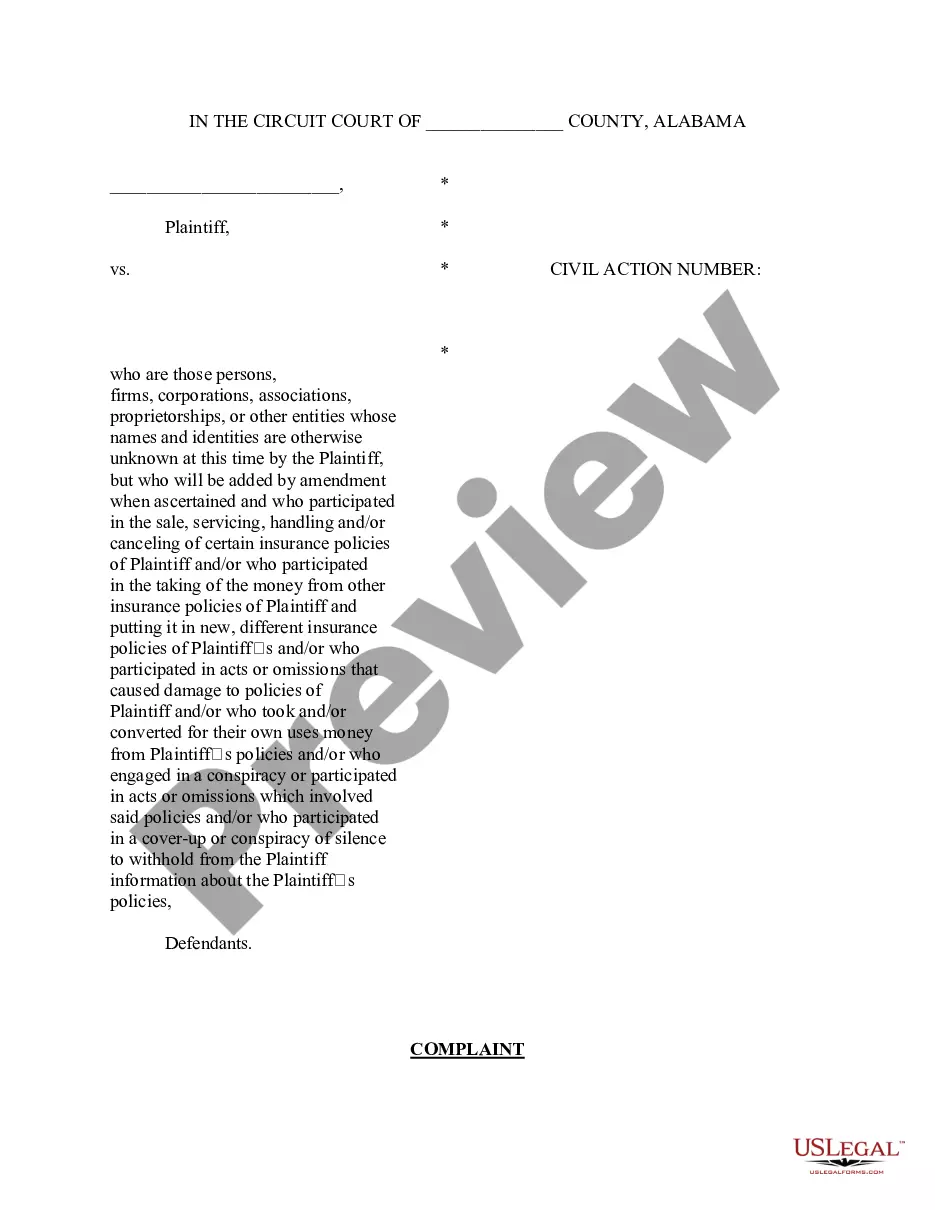

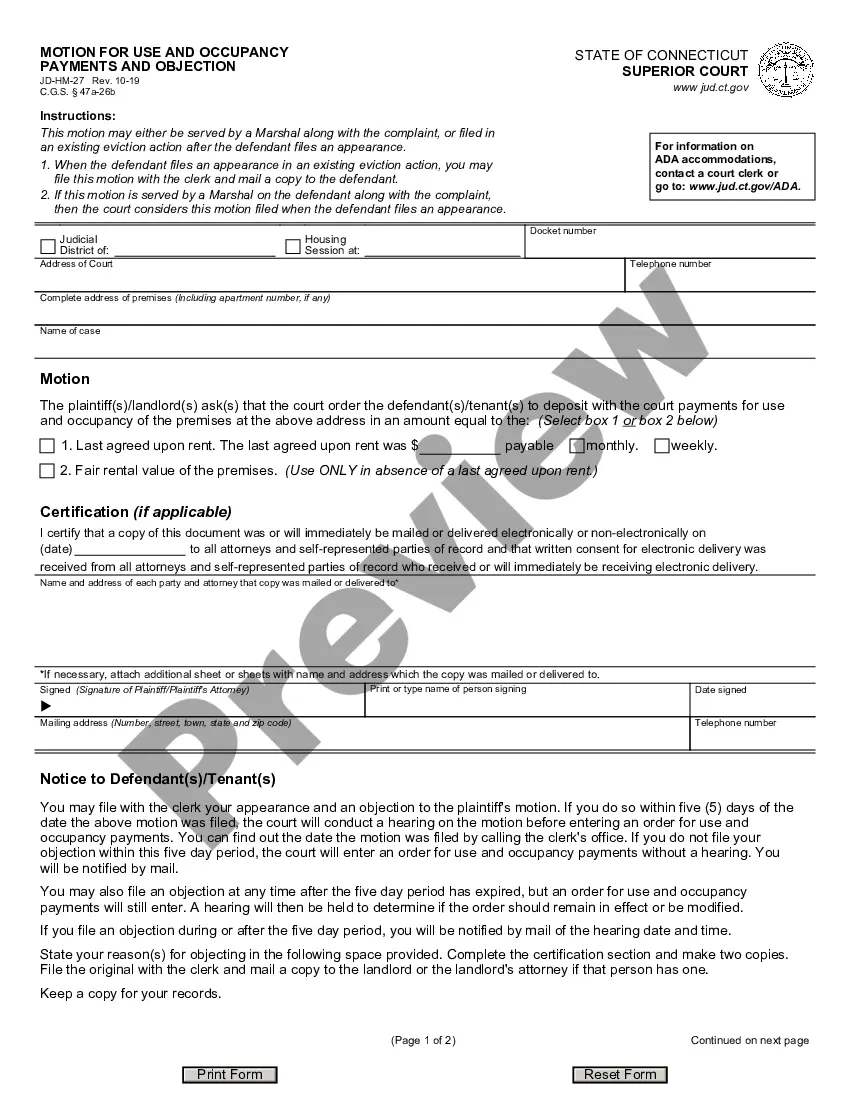

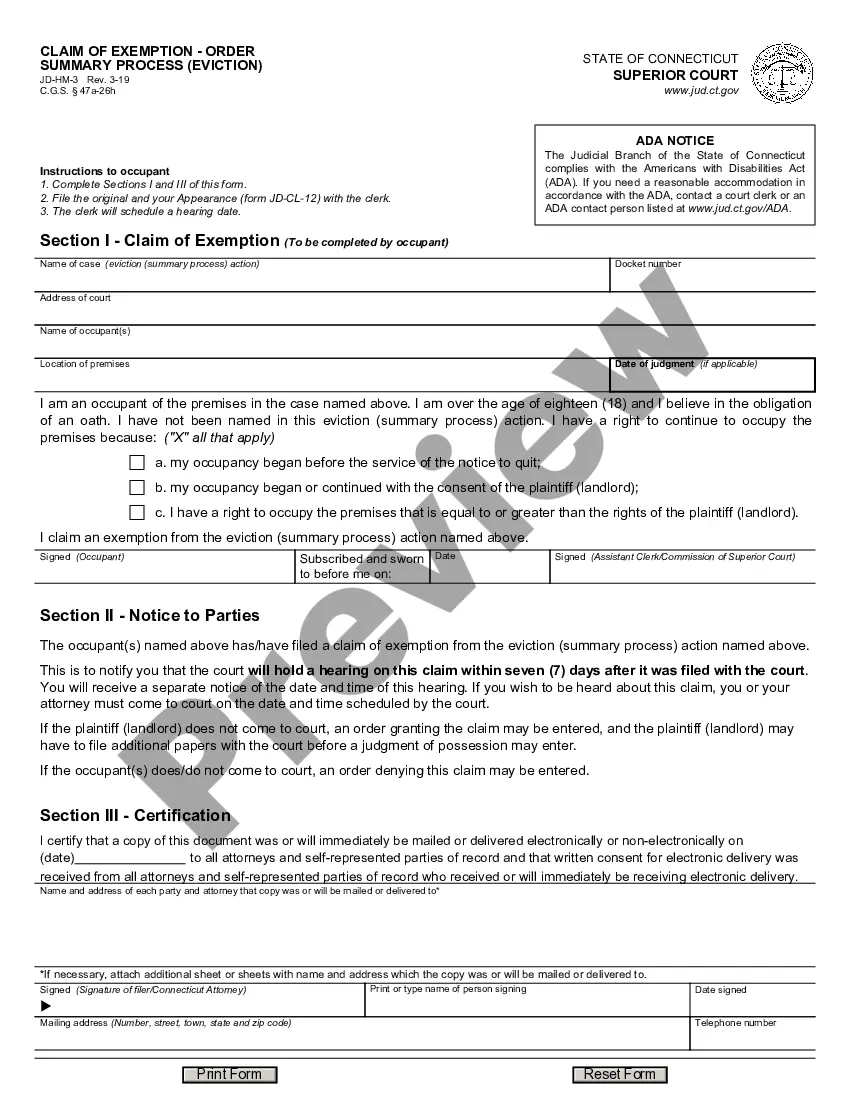

This is a sample complaint against an insurance company alleging acts of fraud. It is written in the form for a female plaintiff.

Alabama Complaint for Insurance Fraud - Female Plaintiff form

Description

How to fill out Alabama Complaint For Insurance Fraud - Female Plaintiff Form?

Using Alabama Complaint for Insurance Fraud - Female Plaintiff template examples crafted by experienced attorneys allows you to sidestep frustrations while completing paperwork.

Simply download the example from our site, fill it in, and have a legal professional review it.

This approach will conserve considerably more time and energy compared to asking legal counsel to draft a document from scratch to meet your specifications.

Utilize the Preview option and examine the description (if available) to determine if you need this specific template, and if so, just click Buy Now. Search for another document using the Search function, if necessary. Select a subscription that fits your requirements. Begin with your credit card or PayPal. Select a file format and download your document. Once you complete all the steps outlined, you will have the ability to fill out, print, and sign the Alabama Complaint for Insurance Fraud - Female Plaintiff form example. Remember to review all entered information for accuracy before submitting or mailing it. Minimize the time spent on document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log In to your profile and go back to the form page.

- Locate the Download button adjacent to the templates you’re examining.

- After downloading a template, you will find all your saved examples in the My documents section.

- If you lack a subscription, it’s not a major issue.

- Just follow the instructions listed below to register for your account online, acquire, and fill out your Alabama Complaint for Insurance Fraud - Female Plaintiff document template.

- Verify that you are downloading the right form specific to your state.

Form popularity

FAQ

Insurance fraud investigators combat fraudulent activities by investigating the circumstances of certain suspicious claims, activities related to new customers, buying insurance products and premium calculations.

Receives and processes consumer complaints. The CDI toll-free hotline number is: 1-800-927-HELP (4357). Be aware that when you file a formal complaint the CDI contacts your insurance company, tells them about your complaint, and gets their side of the story.

The new law defines Alabama criminal insurance fraud in which the loss or potential loss exceeds $1,000.00 as a Class B Felony, punishable by 2 to 20 years in prison. Loss or potential loss less than $1,000.00 is a Class C felony which carries a penalty of up to 10 years in prison.

Report Suspected Fraud. The State Fire Marshals Office invites anyone with information regarding Insurance Fraud to submit information about the crime through this website online tip form. The information will be relayed directly to the Insurance Fraud Bureau.

The Alabama Commissioner of Insurance is a state executive position in the Alabama government. The commissioner is the chief executive of the Alabama Department of Insurance, which regulates insurance companies operating in Alabama.

The monetary penalties can be under both civil and criminal procedures and prison terms can reach up to twenty years in the most extreme cases when bodily injury is involved, but is otherwise up to five years per false claim. A penalty can be up to $250,000 per incident.