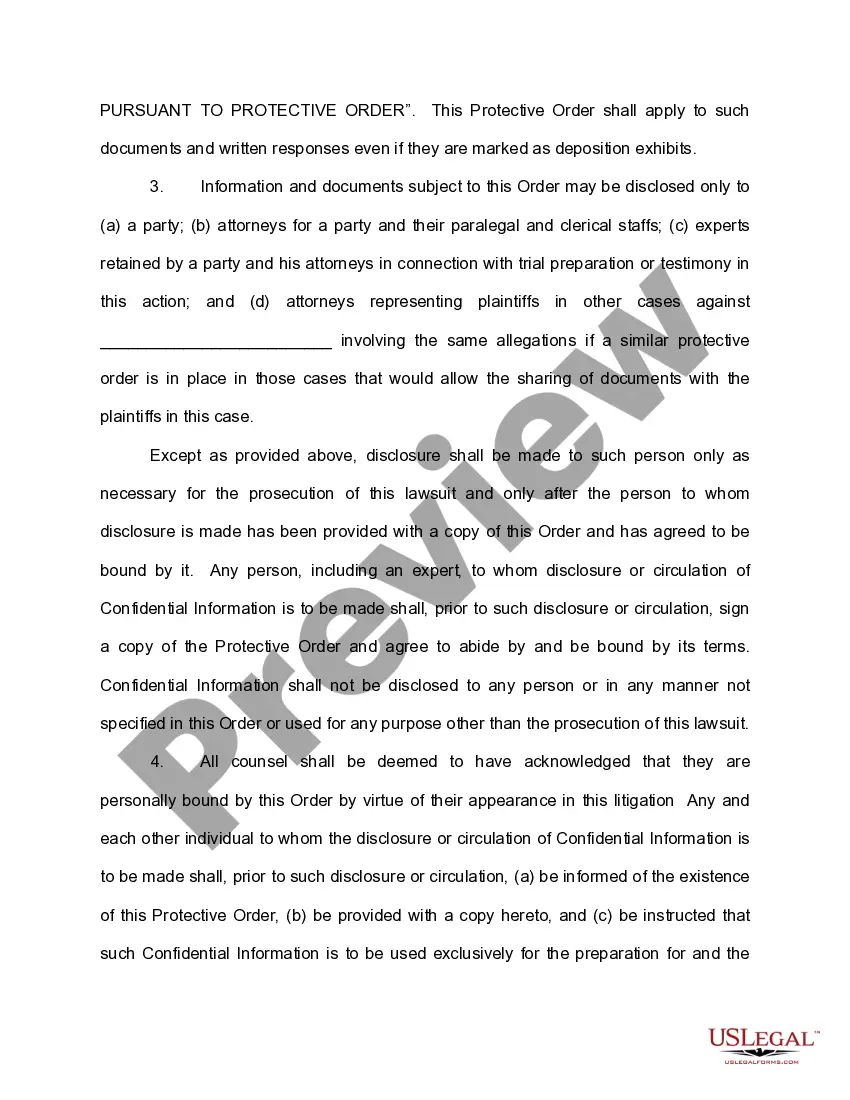

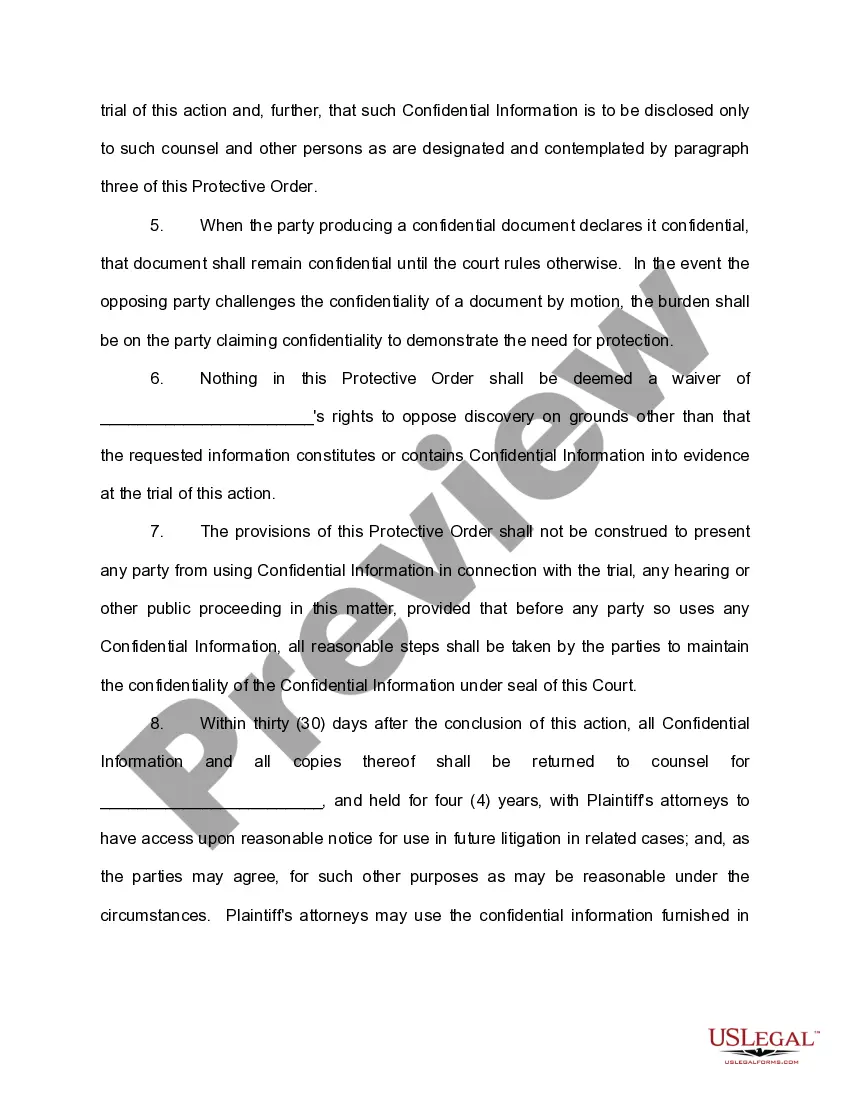

This is a sample Discovery Protective Order which addresses confidential information.

Alabama Sample Discovery Protective Order

Description Order Any Protective

How to fill out Alabama Protective File?

Utilizing Alabama Sample Discovery Protective Order templates crafted by experienced attorneys allows you to sidestep complications during document preparation. Simply download the template from our site, complete it, and request an attorney to review it.

This approach can save you significantly more time and expenses compared to having a lawyer create a document entirely from scratch based on your specifications.

If you possess a US Legal Forms subscription, simply Log In/">Log Into your account and navigate back to the sample page. Locate the Download button near the templates you are reviewing.

Once you have completed all the aforementioned steps, you will be able to finalize, print, and sign the Alabama Sample Discovery Protective Order template. Remember to double-check all entered information for accuracy before submitting or mailing it. Reduce the time spent on document completion with US Legal Forms!

- Once you've downloaded a file, you will find all your saved templates in the My documents tab.

- If you lack a subscription, that isn’t a concern. Just adhere to the step-by-step instructions below to register for an online account, acquire, and complete your Alabama Sample Discovery Protective Order template.

- Reconfirm and ensure you are downloading the appropriate state-specific form.

- Utilize the Preview function and examine the description (if provided) to determine if you need this exact template and if so, click Buy Now.

- Search for another document using the Search feature if needed.

- Choose a subscription that aligns with your needs.

- Begin the process using your credit card or PayPal.

- Select a document format and download your file.

Alabama Sample Order Form popularity

Discovery Protective Order Sample Other Form Names

Alabama Discovery Order FAQ

Log in to your HealthCare.gov account. Under "Your Existing Applications," select your 2020 application not your 2021 application. Select Tax Forms from the menu on the left. Download all 1095-As shown on the screen.

Log in to your HealthCare.gov account. Under "Your Existing Applications," select your 2020 application not your 2021 application. Select Tax Forms from the menu on the left. Download all 1095-As shown on the screen.

If you bought health insurance through one of the Health Care Exchanges, also known as Marketplaces, you should receive a Form 1095-A which provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the people in your household covered

Key Takeaways. Form 8962 is used to estimate the amount of premium tax credit for which you're eligible if you're insured through the Marketplace. You only need to complete Form 8962 if you received advance payments of premium tax credits for health insurance premiums paid.

How Do I Fill Out Form 1095-A? While Form 1095-A is not filed with your tax return, the information is needed to complete Form 8962, Premium Tax Credit. Form 8962 should be filed as part of your tax return for 2019.

Basic Information about Form 1095-A You will use the information from the Form 1095-A to calculate the amount of your premium tax credit. You will also use this form to reconcile advance payments of the premium tax credit made on your behalf with the premium tax credit you are claiming on your tax return.

You will receive Form 1095-A if you enrolled in a qualified health plan via the federal Health Insurance Marketplace or a state's exchange. The exchanges use the form to provide participants in different markets with information on their coverage. You do not have to submit Form 1095-A itself.

You can't file your federal taxes without Form 1095-A. You'll need it to "reconcile" find out if there's any difference between the premium tax credit you used in 2020 and the amount you qualify for.