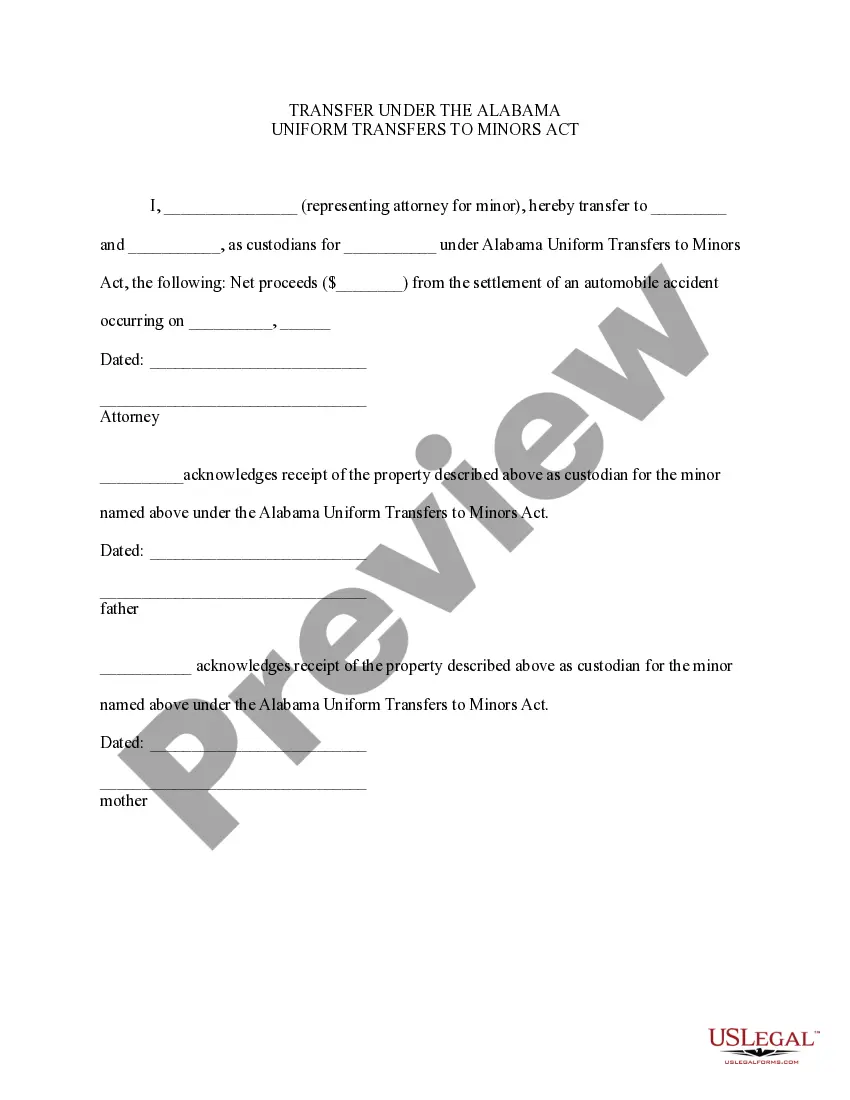

This is a sample notice of a transfer of settlement funds to custodians of a minor by the attorney who represented the minor in the litigation. The transfer is made pursuant to the Alabama Uniform Transfers to Minors Act.

Alabama Transfer of Settlement Funds

Description

How to fill out Alabama Transfer Of Settlement Funds?

Employing Alabama Transfer of Settlement Funds templates crafted by experienced lawyers helps you evade hassles when completing forms.

Simply download the document from our site, fill it in, and request legal advice to review it.

This will save you considerably more time and money than searching for an attorney to create a document from scratch according to your requirements.

Make sure to review all entered information for accuracy prior to submitting or mailing it out. Streamline the time spent on document preparation with US Legal Forms!

- If you have a US Legal Forms membership, just Log In to your profile and return to the template section.

- Locate the Download button next to the forms you are evaluating.

- After downloading a document, you will find all your saved templates in the My documents tab.

- If you don't have a subscription, no worries.

- Simply follow the detailed guide below to register for your online account, obtain, and fill out your Alabama Transfer of Settlement Funds template.

- Verify you are downloading the correct state-specific document.

Form popularity

FAQ

The form for refund direct deposit allows you to receive your Alabama tax refund directly into your bank account. Utilizing direct deposit for your Alabama Transfer of Settlement Funds can expedite access to your funds, making the process more efficient. You will need to provide your banking information on the form to ensure proper handling. Choosing this option is a smart move for those who prefer faster access to their funds.

Yes, Alabama has a tax refund offset program that can withhold your state tax refund to settle outstanding debts. This includes debts owed to state agencies, child support obligations, or unpaid taxes. If you are concerned about your Alabama Transfer of Settlement Funds being affected, it is important to check for any outstanding obligations beforehand. Understanding your situation will help you manage your expectations regarding your refund.

Alabama Form A4 is used for claiming a refund of income taxes withheld from your earnings. This form specifically assists taxpayers in retrieving funds from the state in cases where they've overpaid taxes. If you are dealing with Alabama Transfer of Settlement Funds, completing Form A4 can help streamline your refund process. Make sure to follow the instructions carefully to avoid delays.

A refund request form is a document you submit to request a return of funds that you may be owed. In the context of Alabama Transfer of Settlement Funds, this form serves as your way to communicate your desire to receive financial returns from the state. Completing this form accurately is essential to ensure timely processing of your refund request. You can often find these forms on the Alabama Department of Revenue website.

The time it takes to receive your Alabama tax refund can vary. Generally, you may expect your Alabama Transfer of Settlement Funds to be processed within 2 to 3 weeks after submitting your refund request. However, during peak filing seasons or if there are issues with your application, this may take longer. Tracking your refund status online can provide updates on the processing time.

In general, lawsuit settlements are not taxed as income in Alabama, particularly if they relate to physical injury or physical sickness. This means the funds you receive through the Alabama Transfer of Settlement Funds may not impact your tax liability. However, some portions of a settlement, such as punitive damages or interest, may be taxable. To navigate your unique circumstances, consider using uslegalforms to access reliable information.

A structured settlement typically does not count as taxable income for federal tax purposes. However, when considering the Alabama Transfer of Settlement Funds, it's important to consult a tax professional for your specific situation. You want to ensure you fully understand how your structured settlement might affect your personal finances. By utilizing platforms like uslegalforms, you can find resources that clarify any doubts.

Avoiding realty transfer tax in Alabama can involve several strategies, such as utilizing certain exemptions or understanding the nuances of property ownership transfers. Sometimes, structuring the transfer correctly can help in minimizing or eliminating the tax. For comprehensive advice and potential strategies, consult US Legal Forms, where you can find additional resources to guide you through the process.

The A4 form is essential for reporting certain transactions in Alabama, particularly those related to property transfers. To accurately complete it, you should gather all relevant information about the property as well as the parties involved. For guidance on how to fill in the A4 form, US Legal Forms provides detailed instructions and templates that can help streamline the process.

The 40NR form for Alabama is used to apply for a non-resident tax return for individuals who earn income in Alabama but do not live there. When dealing with Alabama Transfer of Settlement Funds, understanding this form can simplify tax obligations for non-residents. If you need help, you can find guidance on how to complete this form within the US Legal Forms platform, which offers comprehensive resources.