Alabama Official Form - Notice to Defendant of Right to Claim Exemption from Garnishment.

Alabama Notice To Defendant of Right To Claim Exemption From Garnishment

Description Claim Of Exemption Wage Garnishment Alabama

How to fill out Alabama Notice To Defendant Of Right To Claim Exemption From Garnishment?

Utilizing Alabama Notice to Defendant of Right to Claim Exemption from Garnishment examples crafted by experienced attorneys provides you with the chance to avoid complications when filing documents.

Simply download the sample from our site, complete it, and seek legal advice to review it. This can save you greatly more time and energy than asking a legal expert to create a document entirely from the ground up for your needs.

If you’ve already obtained a US Legal Forms subscription, just Log In/">Log In to your account and head back to the form page. Locate the Download button next to the templates you are reviewing. Once you download a document, you will find your saved samples in the My documents section.

After you’ve completed all the steps above, you’ll be able to fill out, print, and sign the Alabama Notice to Defendant of Right to Claim Exemption from Garnishment template. Be sure to verify all entered information for accuracy before submitting it or sending it out. Minimize the time spent on filling out documents with US Legal Forms!

- If you don't have a subscription, that's not an issue.

- Simply adhere to the instructions below to register for your account online, acquire, and complete your Alabama Notice to Defendant of Right to Claim Exemption from Garnishment template.

- Double-check and ensure that you’re downloading the correct state-specific form.

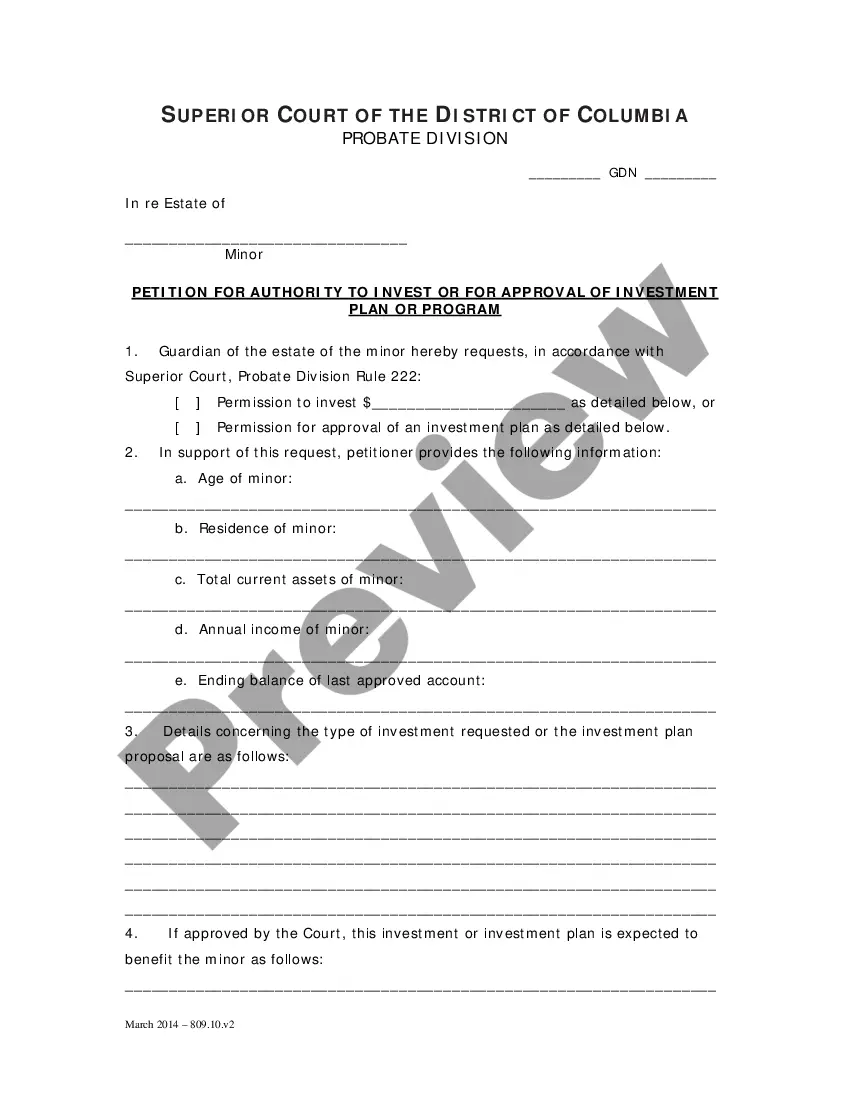

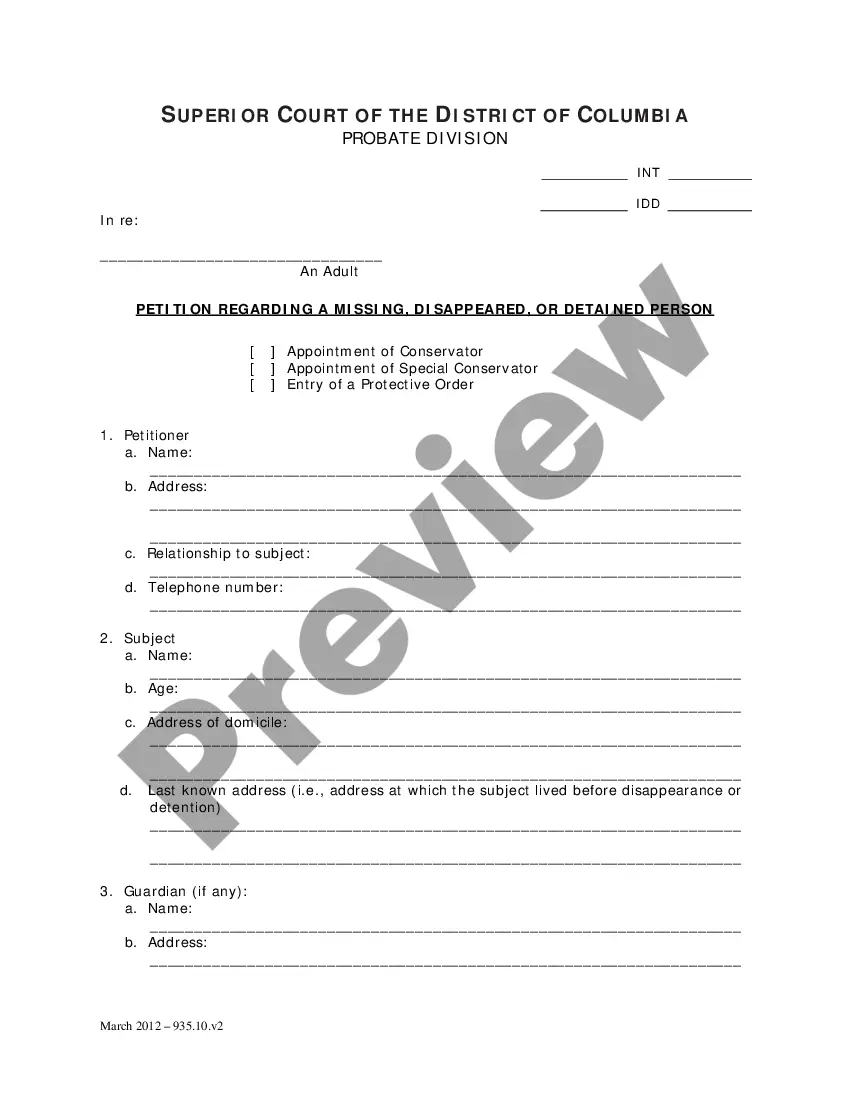

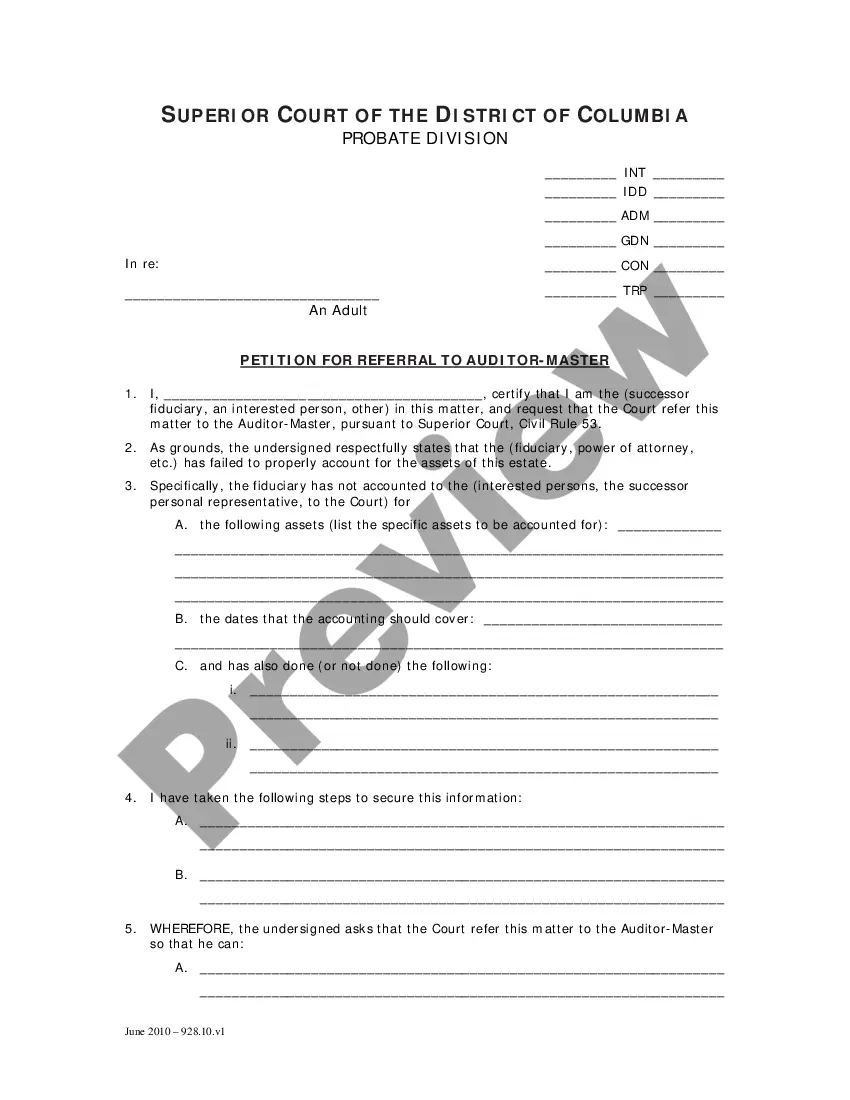

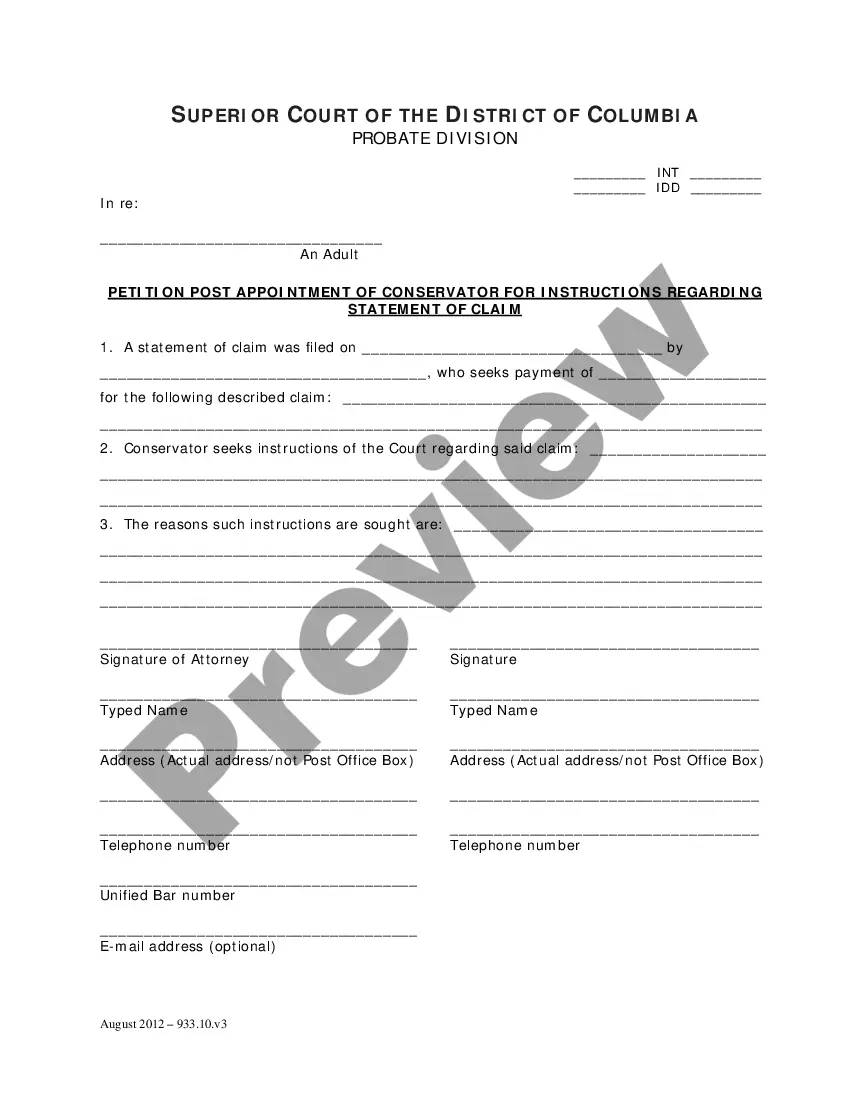

- Use the Preview function and review the description (if available) to understand if you need this particular template, and if so, just click Buy Now.

- Search for another document using the Search field if necessary.

- Select a subscription that meets your requirements.

- Initiate the process using your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

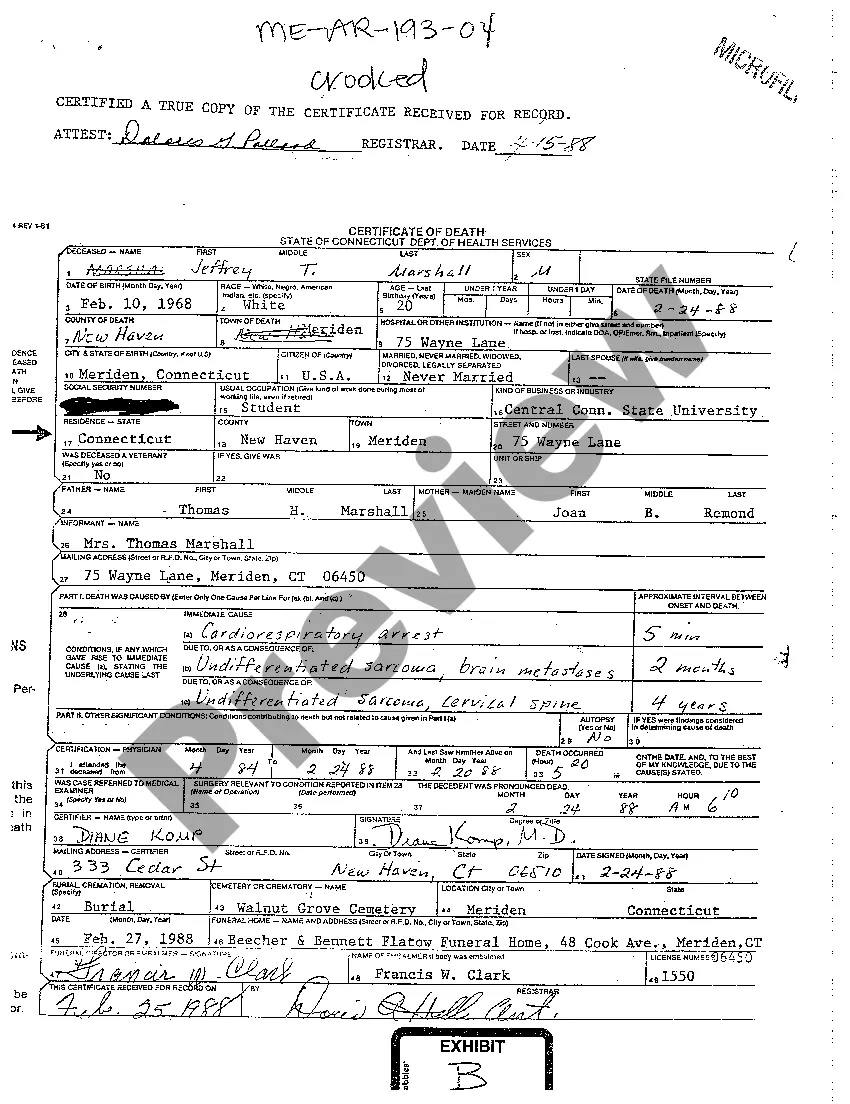

A Claim of Exemption is a form a debtor files with the levying officer (like the sheriff or marshal) explaining why the property or money that the creditor wants to take should be exempt (excluded). There are laws and rules that say which types of income or property are exempt.

TO CLAIM ANY EXEMPTION THAT MAY BE AVAILABLE TO YOU, YOU MUST PREPARE A "CLAIM OF EXEMPTION" FORM LISTING ON IT ALL YOUR WAGES AND PERSONAL PROPERTY; HAVE THE CLAIM OF EXEMPTION NOTARIZED; AND FILE IT IN THE CLERK=S OFFICE.

The exempt benefits are typically funds received from the government for a specific reason. For example, Veteran's Assistance benefits, Social Security, Workers' Compensation, Unemployment and Disability are benefits that cannot be seized in order to pay off outstanding debts.

The court order is called a garnishment. What's important to know is that federal benefits ordinarily are exempt from garnishment. That means you should be able to protect your federal funds from being taken by your creditors, although you might have to go to court to do so.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Funds Exempt from Bank Account Garnishment Social Security, and other government benefit, or payments. Monies received for child support or alimony (spousal support) Workers' compensation payments. Retirement funds, such as those from pensions or annuities.

District Court in the county in which the defendant lives or has an office. File a Statement of Claim (Complaint) form with the Clerk. A filing fee must be paid at the time of filing. Contact the Clerk for the amount of the filing fee.

Alabama law limits the amount that judgment creditors can garnish from your wages. A wage garnishment, sometimes called a wage attachment, is an order requiring your employer to withhold a certain amount of money from your pay and send it directly to one of your creditors.

You may be able to stop it by filing a claim of exemptions. This usually works if: You have bring home less than $1,000 per paycheck. For a form declaration of exemptions that you can fill in and file yourself, see the Motion to Stop Wage Garnishment (with Declaration and Claim of Exemption for Wages).