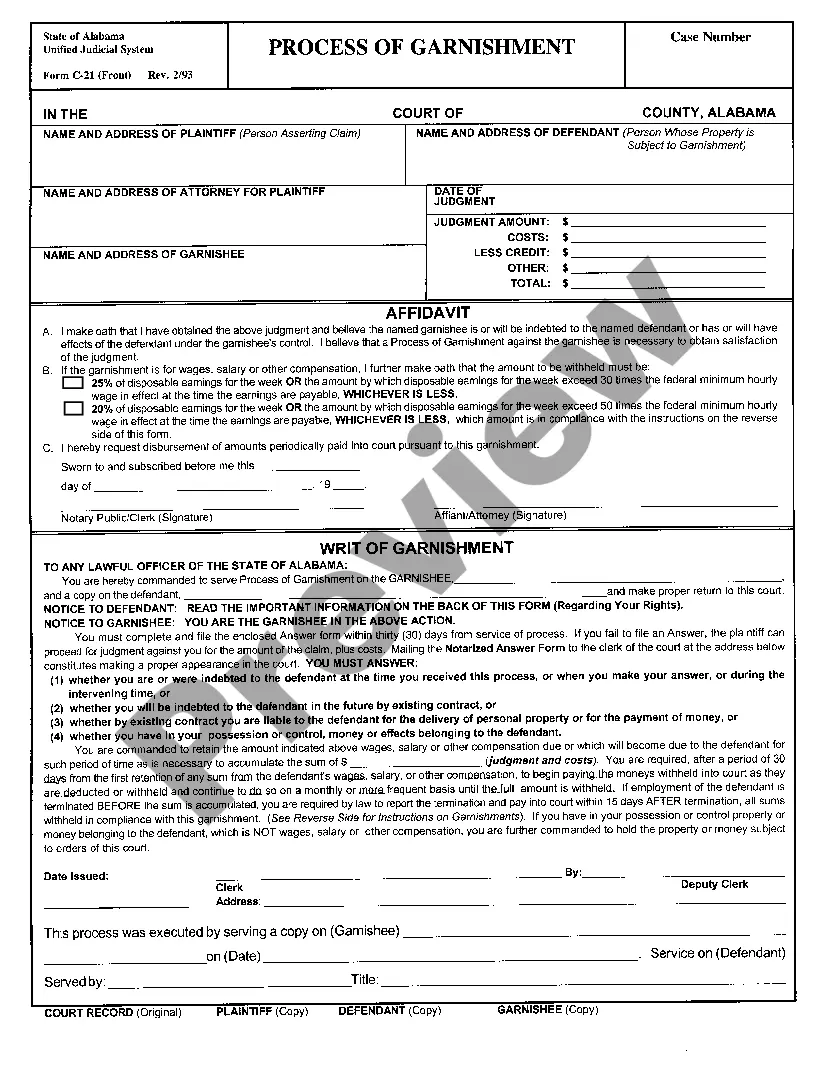

Alabama Official Form - Process of Garnishment to be served on garnishee.

Alabama Process of Garnishment

Description

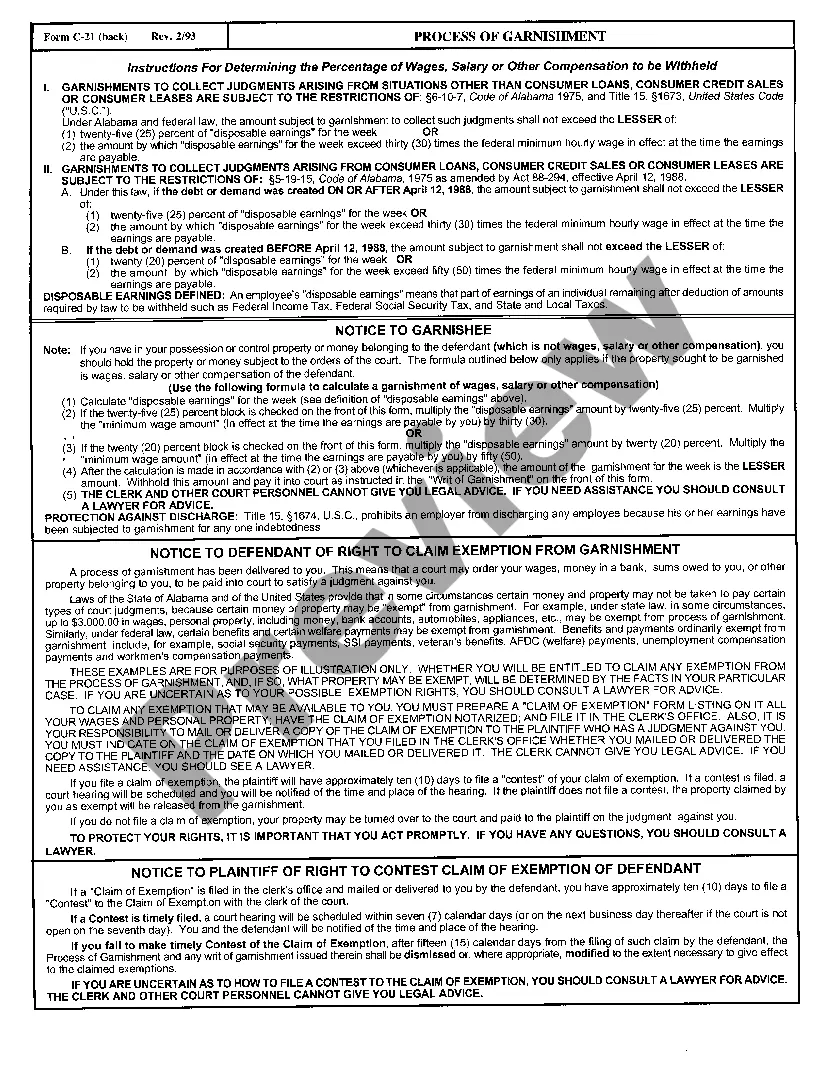

How to fill out Alabama Process Of Garnishment?

Utilizing Alabama Process of Garnishment templates crafted by skilled attorneys helps you avoid complications when filling out paperwork. Simply download the sample from our site, complete it, and have a legal expert review it. This approach will spare you significantly more time and expenses than having an attorney create a document from the ground up for you.

If you possess a US Legal Forms subscription, simply Log In to your account and return to the form section. Locate the Download button beside the templates you are examining. After you download a document, you will find your saved templates in the My documents tab.

If you lack a subscription, no worries. Just adhere to the step-by-step instructions below to register for your account online, acquire, and fill out your Alabama Process of Garnishment template.

After you’ve completed all of these steps, you will be able to fill out, print, and sign the Alabama Process of Garnishment template. Make sure to verify all entered information for accuracy before submitting it or sending it out. Minimize the time you spend on documentation with US Legal Forms!

- Double-check that you’re downloading the appropriate state-specific form.

- Utilize the Preview feature and read the description (if available) to determine if you need this particular sample and if you do, click Buy Now.

- Search for another template using the Search field if necessary.

- Choose a subscription that fits your needs.

- Begin with your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

Wages garnished prior to filing, particularly within 90 days, may be recovered by the trustee for the benefit of your creditors.

How will I be notified if an employee's wages need to be garnished? Employers are typically notified of a wage garnishment via a court order or IRS levy. They must comply with the garnishment request, and typically start withholding and remitting payment as soon as the order is received.

Wage garnishment happens when a court orders that your employer withhold a specific portion of your paycheck and send it directly to the creditor or person to whom you owe money, until your debt is resolved.Your earnings will be garnished until the debt is paid off or otherwise resolved.

2)What Happens When the Wage Garnishment is Paid? The wage garnishment continues until the debt is paid in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt. It is difficult to stop a wage garnishment after it begins.

STEP 1 File and serve the court judgment. STEP 2 Send a Demand Letter. STEP 3 File a Writ of Enforcement. STEP 4 File a Garnishee Summons. STEP 5 Serve a Garnishee. A $25.00 administration fee must be paid to the garnishee along with the Garnishee Summons at the time of service.

The employer is also required to return a statutory response form within 7 days of receiving the writ of garnishment. This form is usually sent to the employer with the garnishment order. With very few exceptions, the employer is required to complete the form indicating that they will pay the garnishment.

A garnishee order is a common form of enforcing a judgment debt against a creditor to recover money. Put simply, the court directs a third party that owes money to the judgement debtor to instead pay the judgment creditor. The third party is called a 'garnishee'.

Notify your employee of the garnishment. Withhold part of their wages. Send the garnished money to the creditor. Provide your employee with information to protest the garnishment.