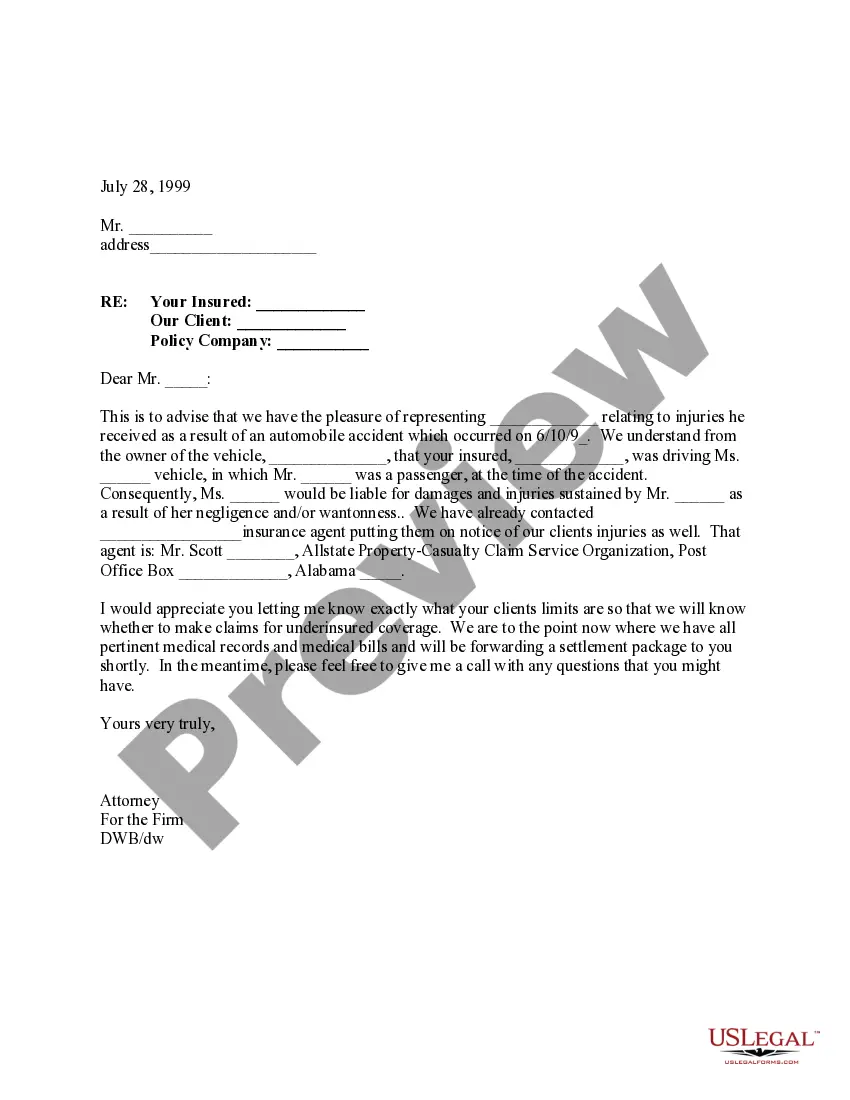

This is a letter from one attorney to another which seeks to obtain information in a motor vehicle case about the other driver's insurance policy limits for the purpose of determining if an uninsured or underinsured situation exists with his/her client.