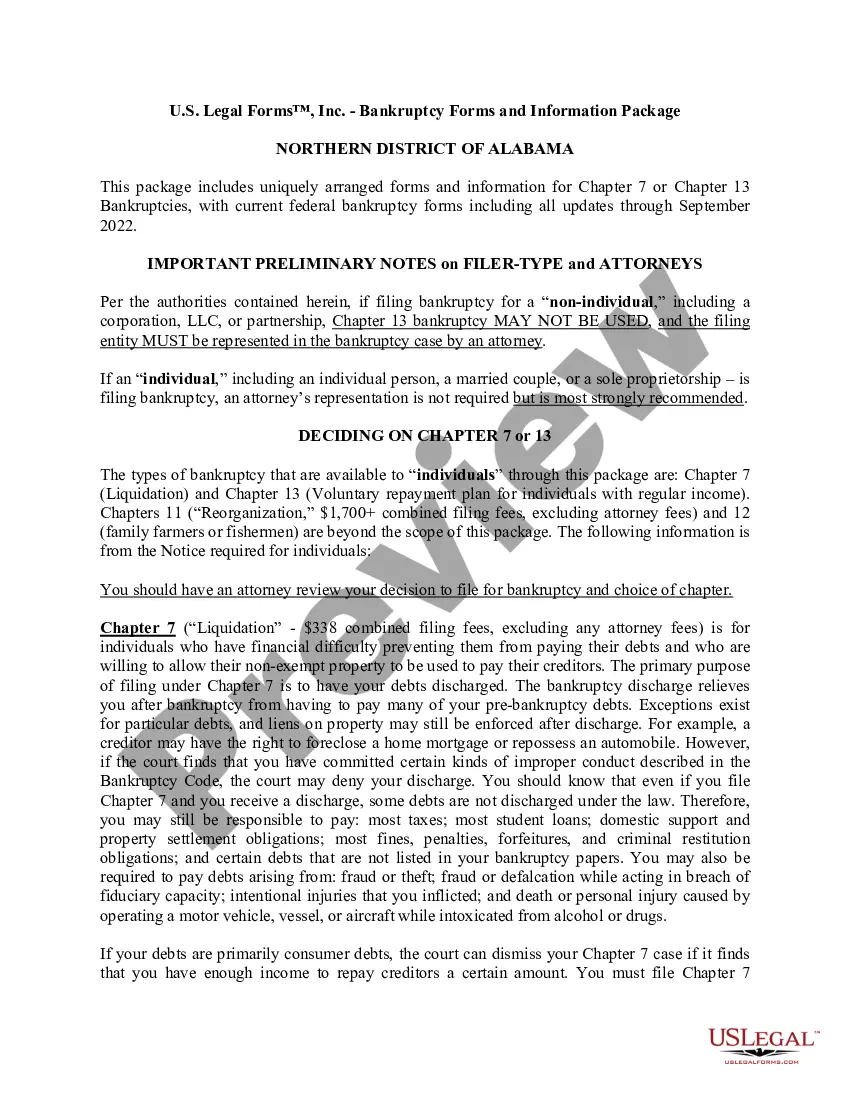

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. All included forms available in .pdf format. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Alabama Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out Alabama Southern District Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

Utilizing the Alabama Southern District Bankruptcy Manual and Document Bundle for Chapters 7 or 13 samples crafted by expert attorneys enables you to circumvent difficulties when filing paperwork.

Simply obtain the form from our site, complete it, and seek legal advice to review it.

Doing so can aid you in conserving significantly more time and energy than asking a lawyer to produce a document from scratch for you.

Utilize the Preview feature and read the description (if provided) to determine if you need this specific template, and if so, just click Buy Now. Search for another file using the Search field if needed. Choose a subscription that fits your needs. Begin with your credit card or PayPal. Choose a file format and download your document. After completing all these steps, you will be able to fill out, print, and sign the Alabama Southern District Bankruptcy Manual and Document Bundle for Chapters 7 or 13 template. Remember to double-check all entered information for accuracy before submitting or dispatching it. Reduce the time spent on document creation with US Legal Forms!

- If you’ve previously purchased a US Legal Forms subscription, just sign in to your account and navigate back to the form page.

- Locate the Download button adjacent to the templates you're reviewing.

- After downloading a template, you can find all your saved documents in the My documents section.

- If you lack a subscription, don't worry.

- Simply follow the instructions below to register for an online account, obtain, and complete your Alabama Southern District Bankruptcy Manual and Document Bundle for Chapters 7 or 13 template.

- Double-check and ensure that you are downloading the correct state-specific form.

Form popularity

FAQ

A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

Although a secured creditor does not need to file a proof of claim in a chapter 7 case to preserve its security interest or lien, there may be other reasons to file a claim. A creditor in a chapter 7 case who has a lien on the debtor's property should consult an attorney for advice.

If the unsecured creditor fails to do so, the creditor is not entitled to receive any distribution on its claim in such cases.An exception to this requirement is in a chapter 11 case in which a creditor's claim is not scheduled as being contingent, unliquidated or disputed.

A proof of claim is a form creditors file with the court to substantiate their claims in bankruptcy.If a creditor doesn't file a proof of claim, it can't get paid through your bankruptcy. In a no-asset Chapter 7 case, creditors won't file proof of claim forms because there won't be any assets to distribute.

Why Would a Creditor Not File a Proof of Claim?A creditor might not file a proof of claim in your bankruptcy if: you have a no-asset Chapter 7 bankruptcy (meaning you don't have any property the bankruptcy trustee can distribute to your creditors, so they won't get paid) you owe the creditor a very small sum, or.

A claim may be secured or unsecured. A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

Most Proof of Claim forms that are filed after the Bar Date are rejected and not given any consideration by the Court. For this reason, it is advisable to file a Proof of Claim well before the Bar Date so as to not risk the court's consideration on the validity of the Proof of Claim.

Chapter 11 creditors are not required to file a Proof of Claim because the debtor is required to file a Schedule of Assets and Liabilities.If it is not filed, the Bankruptcy Court will consider the customer's Schedule of Liabilities as accurate and make any distributions accordingly.

Although a secured creditor does not need to file a proof of claim in a chapter 7 case to preserve its security interest or lien, there may be other reasons to file a claim. A creditor in a chapter 7 case who has a lien on the debtor's property should consult an attorney for advice.