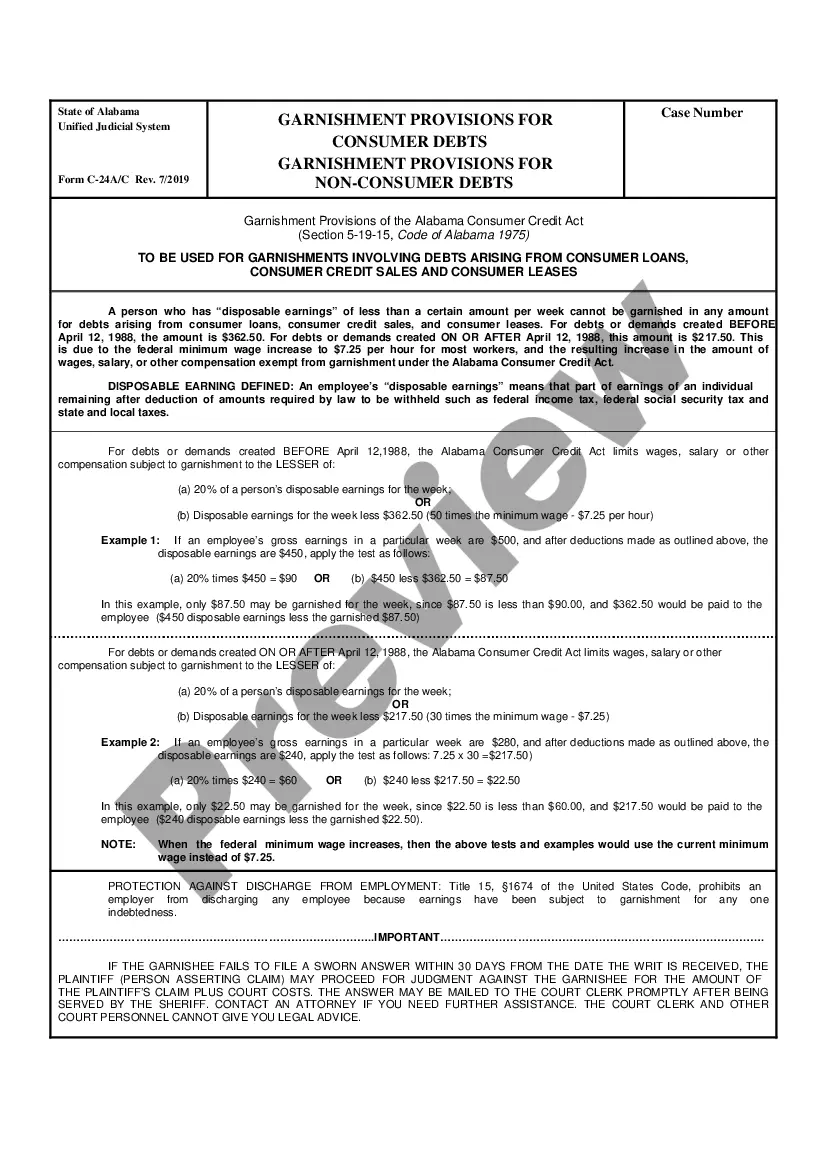

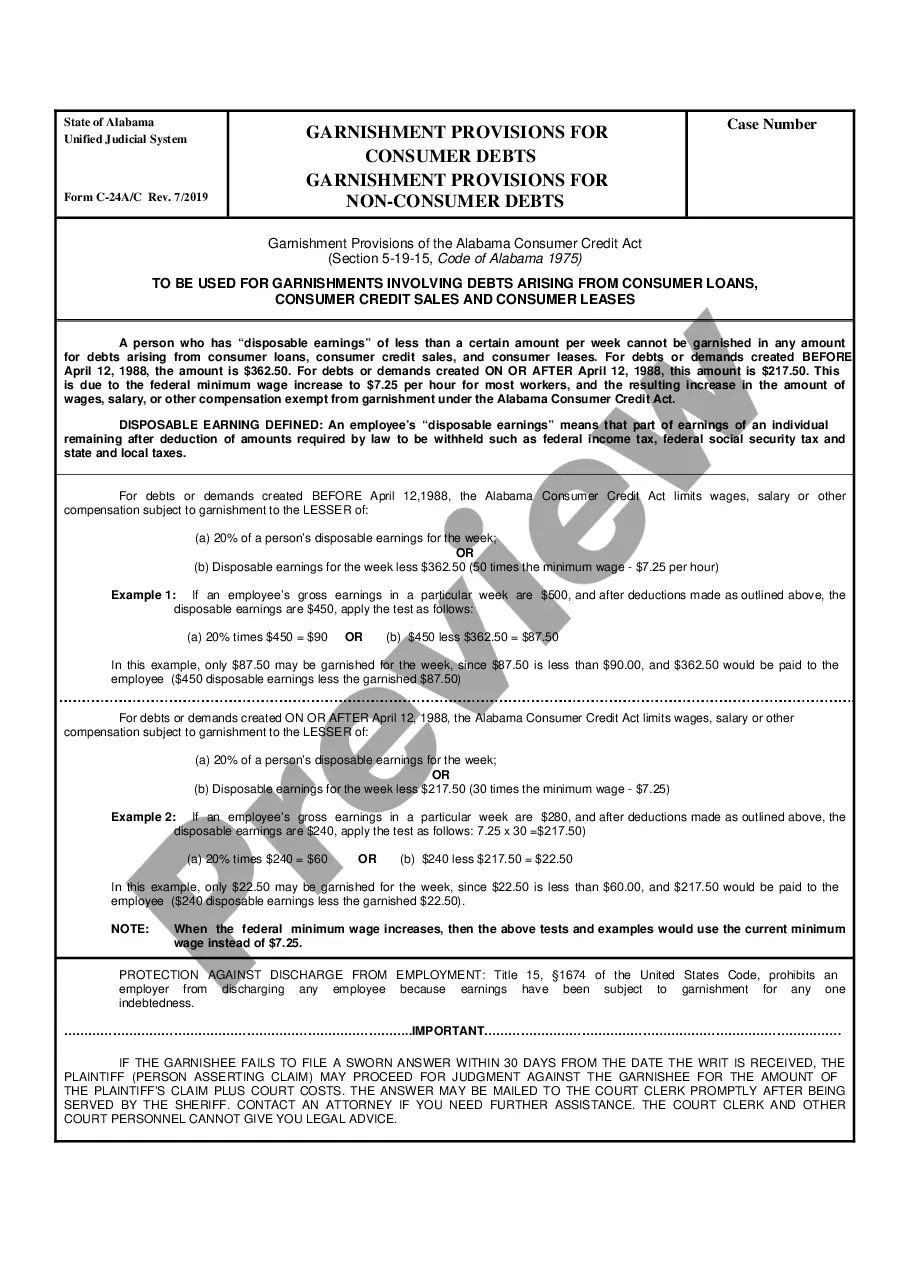

Alabama Garnishment Provisions are the laws that outline how creditors can garnish wages or other means of income of debtors who owe money. Generally, there are two categories of garnishment provisions in Alabama- those for consumer debts and those for non-consumer debts. For consumer debts, such as those from credit cards, medical debts, or personal loans, creditors must follow the Alabama Consumer Credit Act. This Act allows creditors to garnish up to 25% of a debtor’s wages or other income for debts that have not been satisfied. Creditors must also provide a debtor with written notice before garnishing wages. For non-consumer debts, such as unpaid taxes or child support, creditors can garnish up to 50% of a debtor’s wages or other income. In addition, creditors can garnish a debtor’s bank accounts without prior notice. For all types of garnishment in Alabama, creditors must follow certain procedures. These procedures include providing written notice to the debtor, obtaining a court order, and notifying the debtor's employer. Furthermore, creditors must limit their garnishment to the amount of the debt that is owed, plus any applicable interest and fees. In conclusion, Alabama Garnishment Provisions provide creditors with the legal authority to garnish wages or other income of debtors who owe money. These provisions are divided into two categories- those for consumer debts and those for non-consumer debts- and creditors must adhere to certain procedures when engaging in garnishment.

Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts

Description

How to fill out Alabama Garnishment Provisions For Consumer Debts And Non-Consumer Debts?

Creating legal documents can be quite a hassle if you lack accessible ready-made templates. With the US Legal Forms online database of official forms, you can be assured of the blanks you receive, as all of them align with federal and state regulations and are verified by our experts.

Acquiring your Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts from our collection is as simple as one-two-three. Previously registered users with a valid subscription just need to Log In and click the Download button after locating the correct template. Later, if needed, users can retrieve the same form from the My documents section of their account. However, even if you’re new to our service, signing up with a valid subscription will only take a few minutes. Here’s a brief guide for you.

Haven’t you experienced US Legal Forms yet? Sign up for our service today to acquire any official document swiftly and effortlessly whenever you need to, and maintain your paperwork organized!

- Form compliance review. You should thoroughly assess the content of the document you are considering and ensure that it meets your requirements and complies with your state regulations. Previewing your form and reviewing its general summary will assist you in doing just that.

- Alternative search option (optional). If you notice any discrepancies, navigate the library using the Search tab above until you locate a suitable template, and click Buy Now when you identify the one you wish.

- Account setup and document purchase. Register for an account with US Legal Forms. After verifying your account, Log In and choose the subscription plan that best meets your needs. Make a payment to proceed (PayPal and credit card options are available).

- Template retrieval and subsequent usage. Select the file format for your Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts and click Download to save it on your device. Print it to complete your documents manually, or utilize a multi-functional online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

To claim an exemption and stop wage garnishment in Alabama, you must file an objection with the court. This process usually requires you to provide evidence of your financial situation and your qualification for exemption under the law. Utilizing our platform can provide guidance and resources tailored to the Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts, helping you navigate this process smoothly.

The rules for garnishments in Alabama include limits on the amount that can be deducted from your wages and procedures that creditors must follow. For instance, a creditor can only garnish up to 25% of your disposable income after taxes. Familiarizing yourself with the specific Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts is crucial for understanding your rights and obligations.

In Alabama, you can claim exemption from wage garnishment by submitting a claim form to the court. This form typically requires you to detail your financial circumstances and explain why the garnishment should not apply in your case. You should reference the Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts to ensure you fulfill all necessary requirements and support your claim effectively.

To stop wage garnishment in Alabama, you may need to file a motion with the court that issued the garnishment order. Present your reasons for the request, which may include financial hardship or incorrect garnishment amounts. You might find consulting our platform helpful, as it offers templates and resources to navigate the legal process regarding Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts.

Yes, a debt collector can garnish your wages without prior notice if they have obtained a court order. However, you should receive notification of the garnishment after it has been initiated. Familiarizing yourself with the Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts can help you know your rights and legal obligations related to wage garnishment.

The garnishment of the Consumer Credit Protection Act limits the amount that creditors can garnish from your wages. This act aims to protect consumers from excessive wage deductions and ensures they have enough left for living expenses. Understanding the Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts can further clarify how these protections apply in your state.

To write a letter to stop wage garnishment, begin by addressing it to the appropriate court or collection agency. Clearly state your request to stop the garnishment, providing your identifying information, such as your name, address, and case number. Include any relevant details that support your case, such as changes in your financial situation or any errors in the garnishment process, referring to the Alabama Garnishment Provisions for Consumer Debts and Non-Consumer Debts for guidance.

In Alabama, the maximum garnishment allowed is generally 25% of your disposable earnings. However, courts may limit the amount further based on unique financial circumstances. Familiarizing yourself with Alabama garnishment provisions for consumer debts and non-consumer debts can provide clarity on how much of your wages can be garnished and help you plan your finances accordingly.

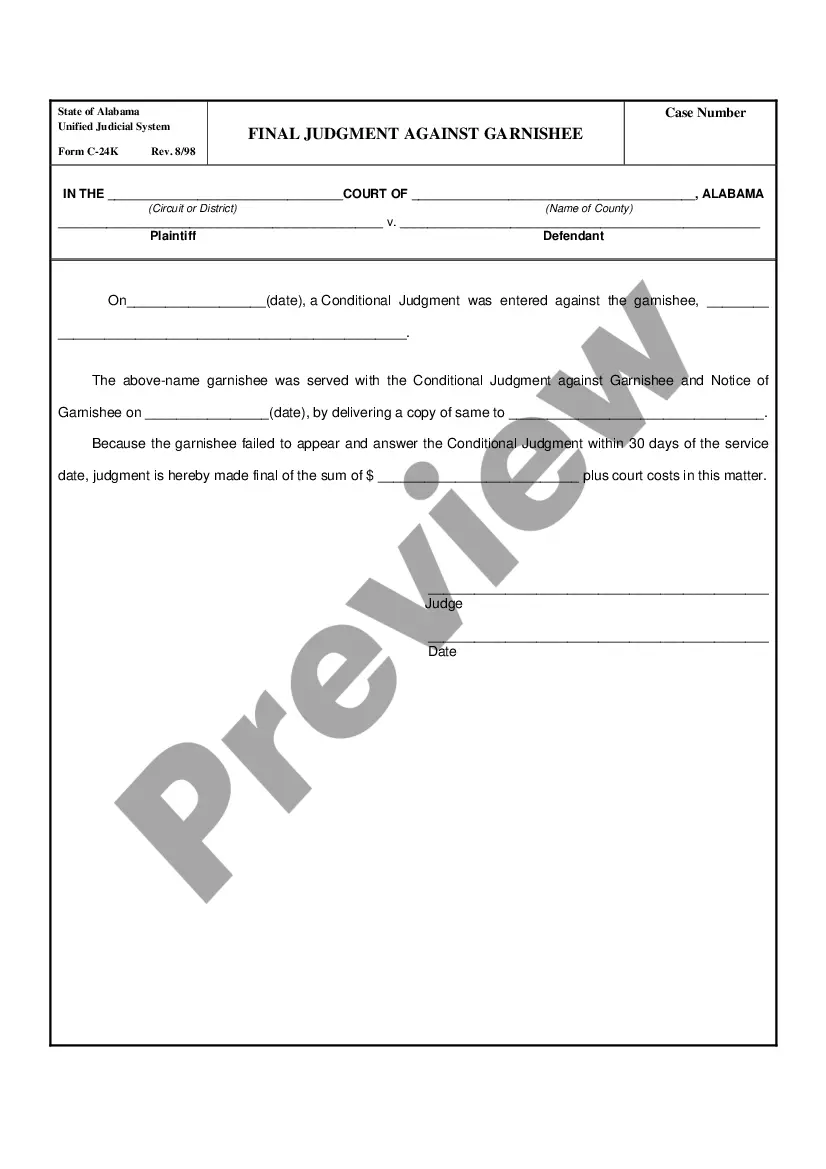

After a default judgment is granted, a creditor may begin garnishing wages immediately, but typically only after notifying the debtor. Alabama law allows for this action, highlighting the importance of timely responses to legal judgments. Understanding Alabama garnishment provisions for consumer debts and non-consumer debts can help you prepare and take proactive steps.

Yes, you can potentially stop a garnishment once it starts in Alabama by filing a claim of exemption or a motion to quash the garnishment. This may involve demonstrating financial hardship or disputing the validity of the underlying debt. Utilizing tools like UsLegalForms can simplify the process of navigating Alabama garnishment provisions for consumer debts and non-consumer debts.