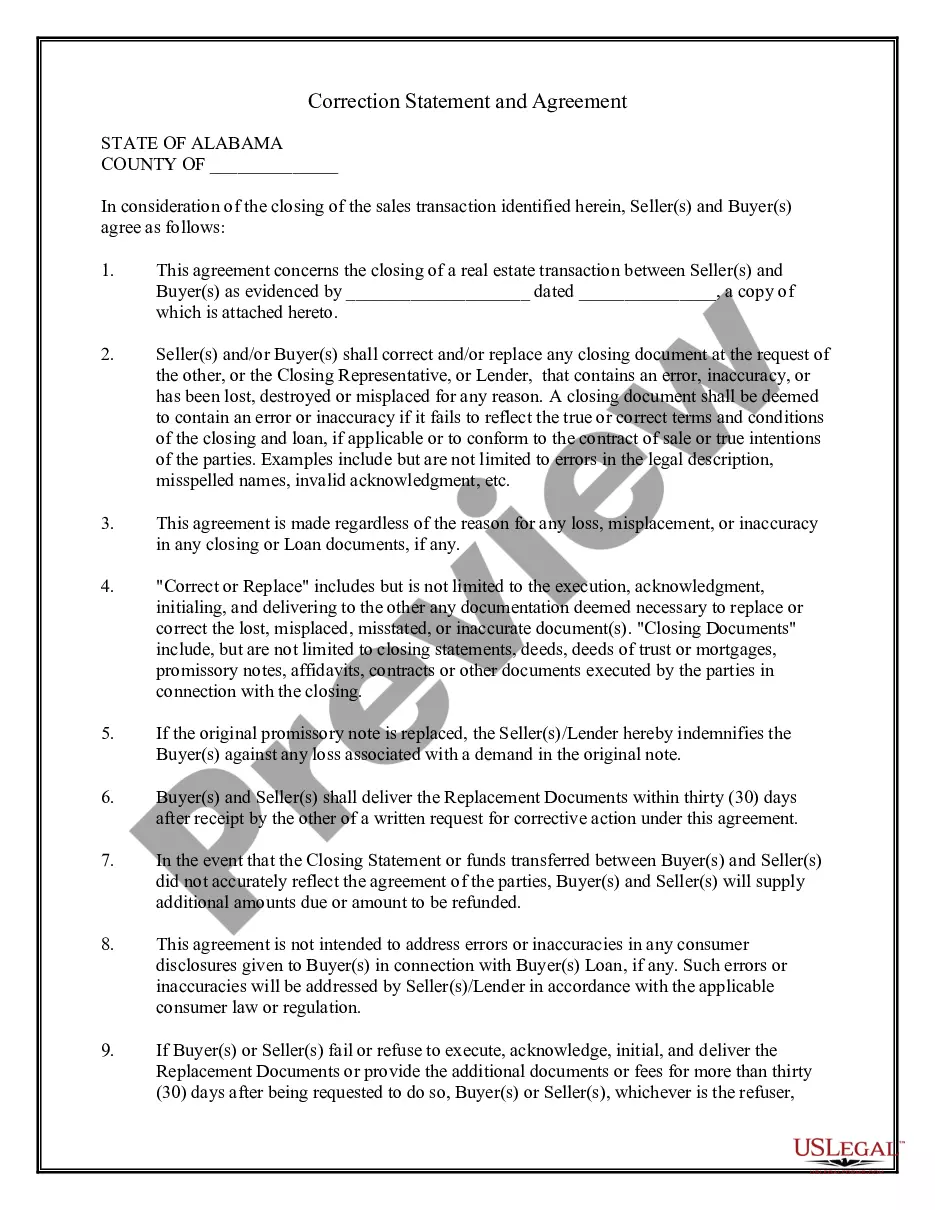

This Correction Statement and Agreement form is for a buyer and seller to sign at the closing for a loan or purchase of real property agreeing to execute corrected documents in the event of certain errors. It also is used to provide replacement documents in the event any documents are lost or misplaced.

Alabama Correction Statement and Agreement

Description

How to fill out Alabama Correction Statement And Agreement?

Employing Alabama Correction Statement and Agreement forms crafted by proficient attorneys enables you to avert complications when filing documents.

Simply download the template from our site, complete it, and seek legal advice to review it. This approach can conserve you significantly more time and effort compared to having legal representation create a document for you.

If you possess a US Legal Forms subscription, simply Log In/">Log In to your profile and navigate back to the form webpage. Locate the Download button beside the templates you are assessing. Once you download a document, all your saved templates will be accessible in the My documents section.

Upon completing all of the steps outlined above, you will be able to fill out, print, and sign the Alabama Correction Statement and Agreement template. Remember to carefully verify all entered information for accuracy before submitting or sending it out. Minimize the time you spend on document completion with US Legal Forms!

- If you lack a subscription, that’s not an issue.

- Follow the step-by-step guide below to register for an account online, obtain, and fill out your Alabama Correction Statement and Agreement form.

- Verify and ensure that you are downloading the correct state-specific template.

- Utilize the Preview feature and review the description (if available) to determine if you require this specific template, and if so, simply click Buy Now.

- Search for another template using the Search field if necessary.

- Select a subscription that suits your requirements.

- Begin using your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

At your mortgage closing, you meet with various legal representatives to sign your mortgage and other documents, make any required payments and receive the keys to your new property.You give a certified or cashier's check to cover the down payment (if applicable), closing costs, prepaid interest, taxes and insurance.

Both buyers (if a married couple), or notarized power of attorney documentation permitting the present buyer to sign for the non-present one. Photo ID (passport or state-issued ID) List of your residences over the past 10 years. Sufficient payment to cover closing costs (usually a bank check or wire transfer)

If that date passes and the sale has not closed, either party can back out of the deal. For example, a buyer's penalty for missing the closing date might include paying a portion of the seller's mortgage to compensate the seller for keeping her property longer than planned.

Seller's real estate agentYour agent is tasked with facilitating the closing process and making sure that both parties have taken care of unfinished businesssometimes including pre-signing documentationbefore coming to the table at closing.