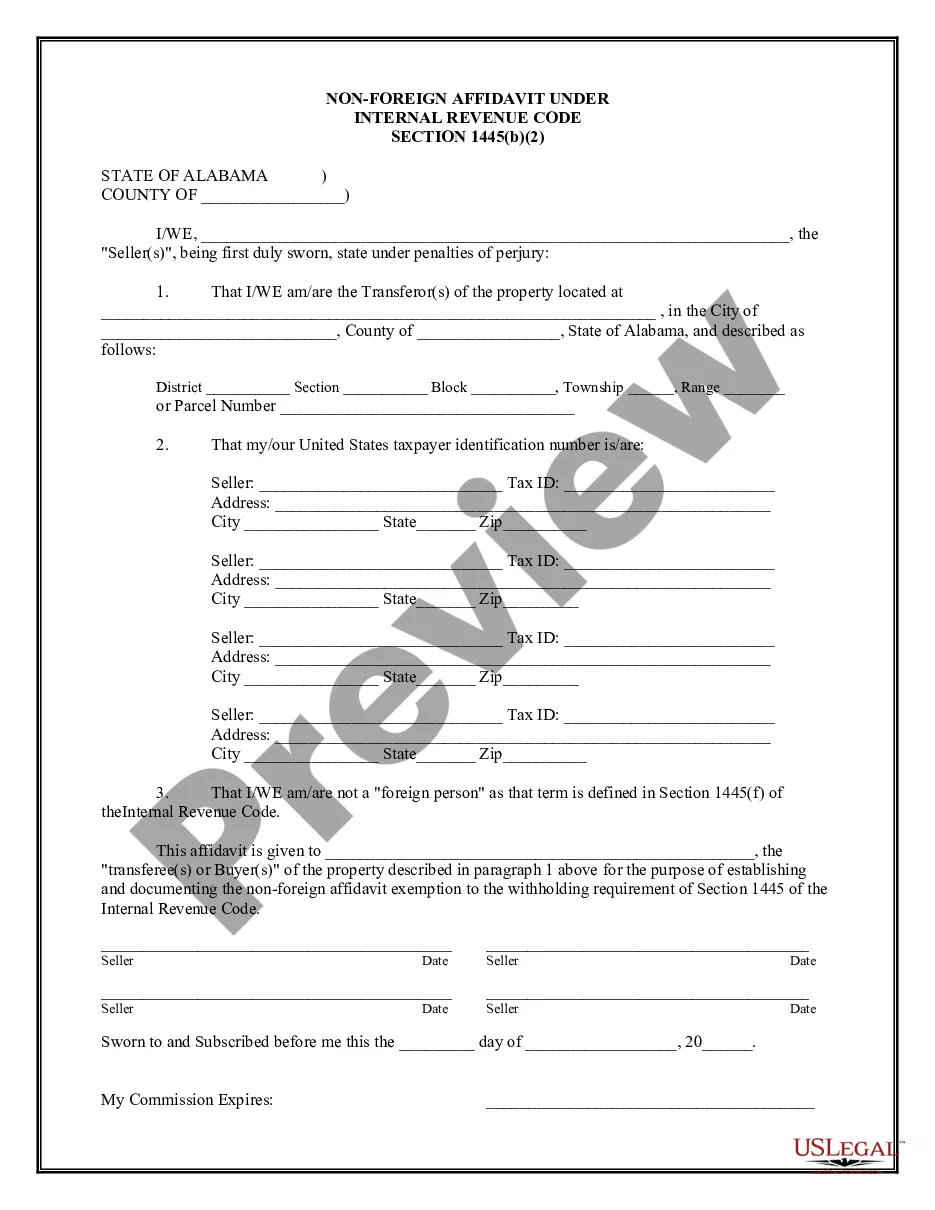

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Alabama Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Alabama Non-Foreign Affidavit Under IRC 1445?

Employing Alabama Non-Foreign Affidavit Under IRC 1445 samples created by experienced lawyers allows you to sidestep complications when filling out paperwork.

Simply download the document from our website, complete it, and ask a lawyer to confirm it.

Doing so will save you significantly more time and effort compared to seeking a lawyer to draft a document from scratch for you.

Utilize the Preview feature and read the description (if available) to determine if this specific template is necessary; if so, just click Buy Now. Look for an alternative file using the Search bar if needed. Choose a subscription that aligns with your needs. Proceed using your credit card or PayPal. Select a document format and download your file. Once you have completed all the steps outlined above, you will be able to fill out, print, and sign the Alabama Non-Foreign Affidavit Under IRC 1445 template. Remember to double-check all entered information for accuracy before submitting or dispatching it. Reduce the time spent on drafting documents with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In/">Log In to your profile and revisit the sample page.

- Locate the Download button next to the template you are reviewing.

- After downloading a document, all your saved templates can be found in the My documents section.

- If you lack a subscription, there's no need to worry.

- Simply follow the steps below to register for an account online, obtain, and complete your Alabama Non-Foreign Affidavit Under IRC 1445 template.

- Verify and ensure that you are obtaining the appropriate state-specific document.

Form popularity

FAQ

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

By Stephanie Kurose, J.D. Closing a person's estate after they die can often be a long, detailed process. This includes paying off debts, filing final tax returns, and, finally, distributing the estate's assets according to the wishes of the deceased.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

When the Estate Closes An executor cannot simply gather assets, pay bills and expenses and then distribute the remaining assets to the beneficiaries. She needs court approval for closing the estate, and in most states, this involves giving a full accounting of everything on which she spent money.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.

Closing the bank account typically is the last step after the court or beneficiaries have approved the executor's accounting and the estate is ready to close. There may be a few final bills requiring payment, such as compensation to the executor for her services.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

If no one moves to open or settle an estate, all assets in the estate could be lost, instead of being distributed to loved ones or other beneficiaries. Probate is not an automatic process. When a loved one dies, a family member or other interested party must petition the probate court to open an estate.