Conditional Judgment Against Employer, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Alabama Conditional Judgment Against Employer

Description

How to fill out Alabama Conditional Judgment Against Employer?

Employing Alabama Conditional Judgment Against Employer templates crafted by professional attorneys enables you to steer clear of complications when submitting paperwork.

Simply download the form from our website, complete it, and ask an attorney to review it.

It can save you significantly more time and expenses than having to request legal advice to prepare a document for yourself.

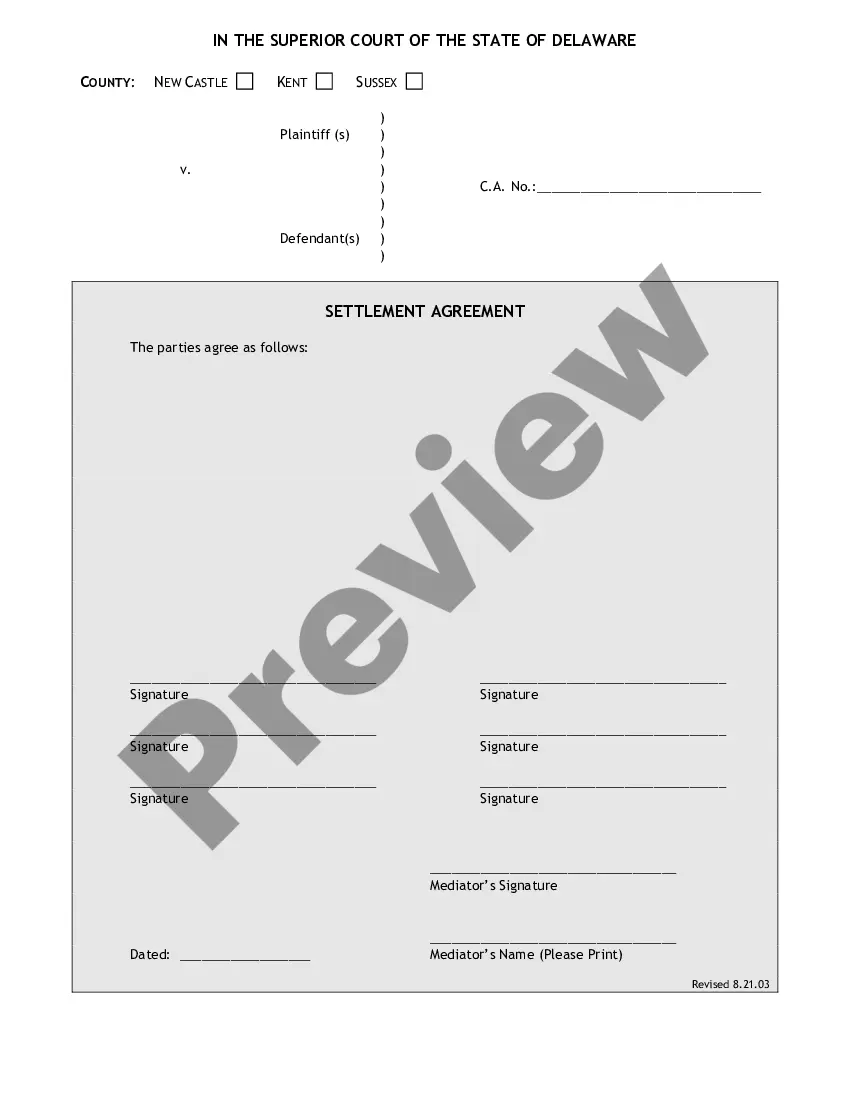

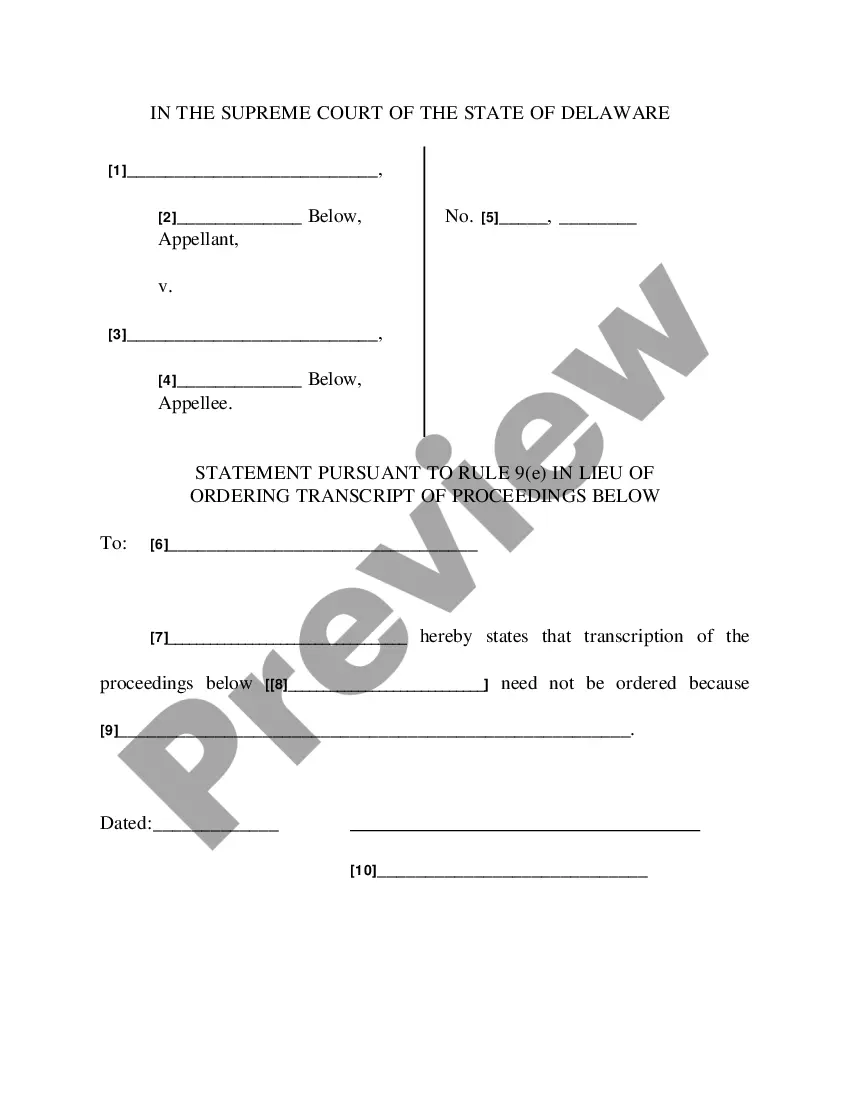

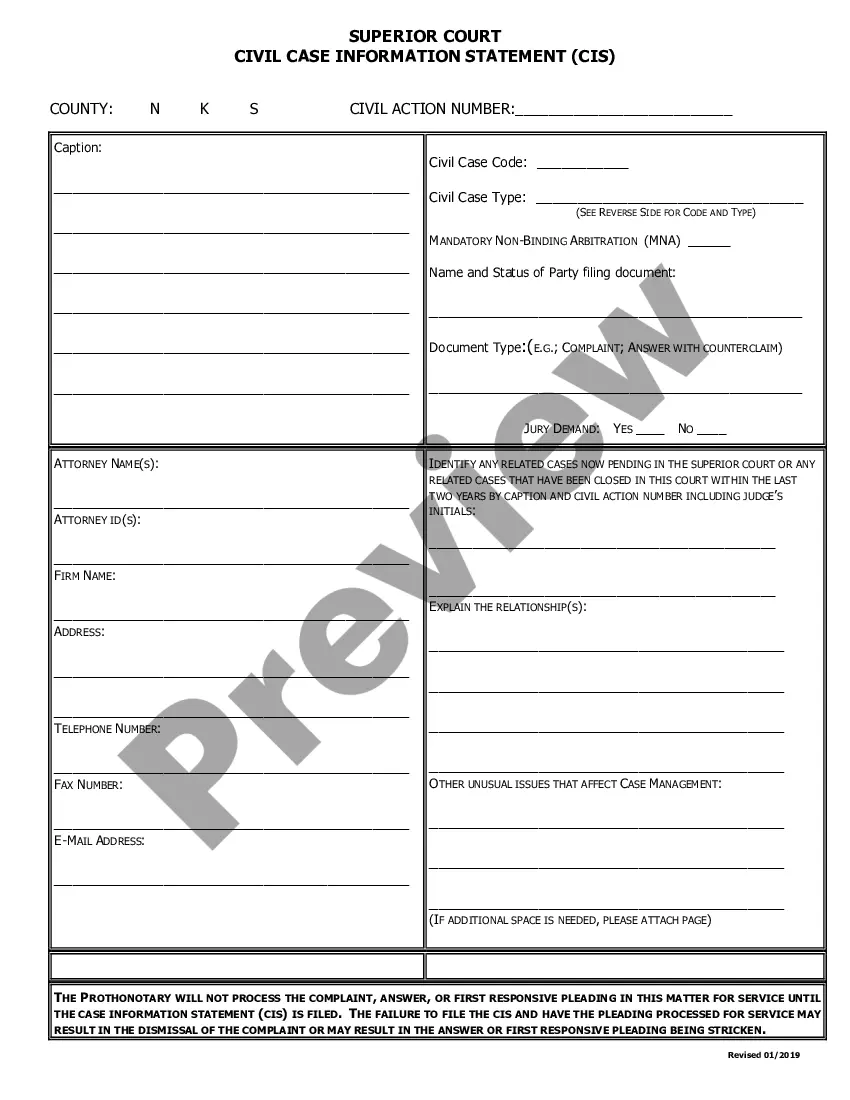

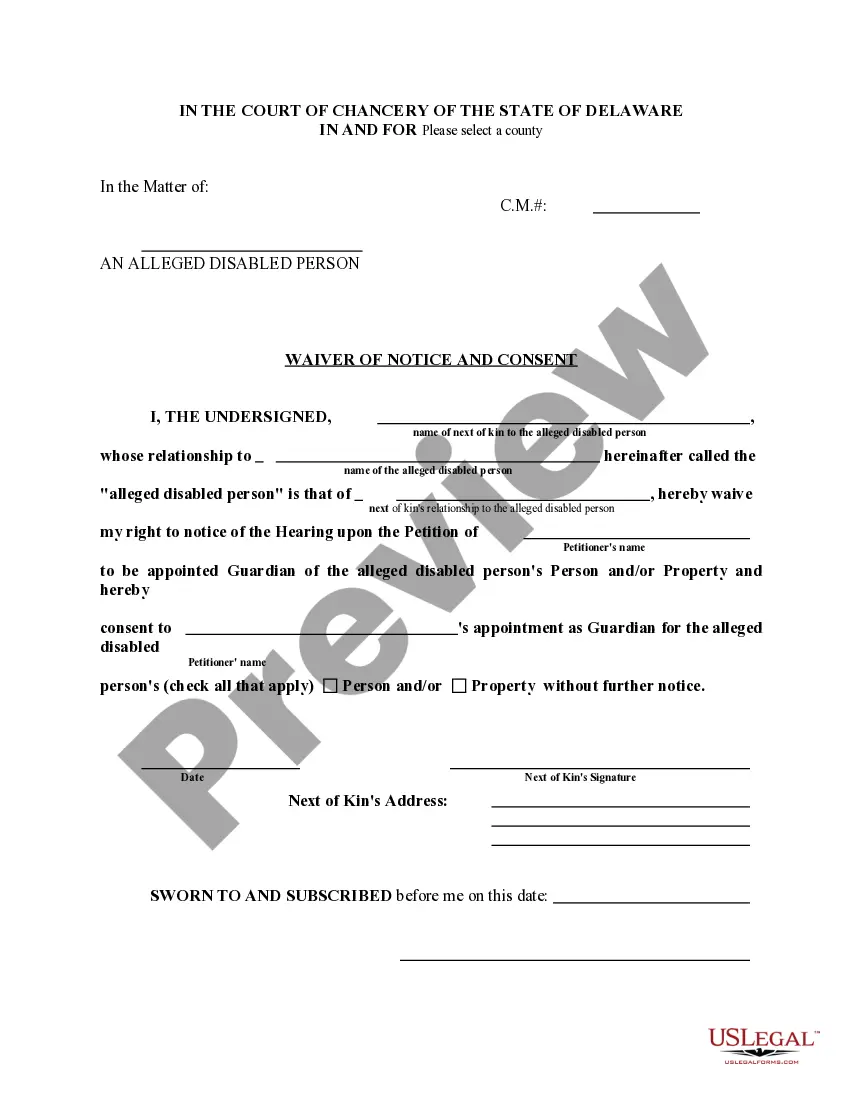

Use the Preview feature and review the description (if present) to determine if you need this specific example; if so, click Buy Now.

- If you've already obtained a US Legal Forms subscription, just sign in to your account and navigate back to the form page.

- Locate the Download button near the template you are examining.

- After downloading a document, all your saved samples will be available in the My documents section.

- If you lack a subscription, that's not a major issue.

- Just follow the instructions below to create an account online, retrieve, and fill out your Alabama Conditional Judgment Against Employer template.

- Double-check to ensure you are downloading the right state-specific form.

Form popularity

FAQ

If the employer still refuses to comply, the creditor can file an action against the employer for contempt.After the EWO is served, the creditor can determine the amount of wages garnished by reviewing the memorandum of garnishee completed and returned by the employer.

Unfortunately, by ignoring the proper Writ of Garnishment, your employer can get in trouble and Debbie may get fired.and the creditor finds out, your employer may end up going to court on an Order to Show Cause, where they have to explain to the judge why they ignored the court documents.

Post Judgment The creditor must then wait for a specific period, such as 15 days after the mailing, before filing the wage garnishment. Depending on your state, the court may allow the creditor to file the garnishment after it obtains the judgment, without notifying you first.

Post Judgment The creditor must then wait for a specific period, such as 15 days after the mailing, before filing the wage garnishment. Depending on your state, the court may allow the creditor to file the garnishment after it obtains the judgment, without notifying you first.

Employers are typically notified of a wage garnishment via a court order or IRS levy. They must comply with the garnishment request, and typically start withholding and remitting payment as soon as the order is received.Employers are required to comply with every garnishment request.

The judgment creditor sends the garnishment order to your employer. Your employer will then withhold a portion of your wages each pay period and send that money directly to your creditor. The garnishment will end when you have paid the entire judgment or you reach a separate settlement on the debt with the creditor.

There are some creditors that may garnish your wages without a judgment. Those are: collectors of federally-guaranteed student loans. people and agencies to whom you owe child support or alimony, and.

Generally speaking, a conditional judgment is one that depends upon contingent future events. An example of this might be when a court uses a conditional judgment as a threat for the purpose of coercion, as with, If the party does not appear in court by the date specified, then this judgment will become final.

The employer is also required to return a statutory response form within 7 days of receiving the writ of garnishment. This form is usually sent to the employer with the garnishment order. With very few exceptions, the employer is required to complete the form indicating that they will pay the garnishment.