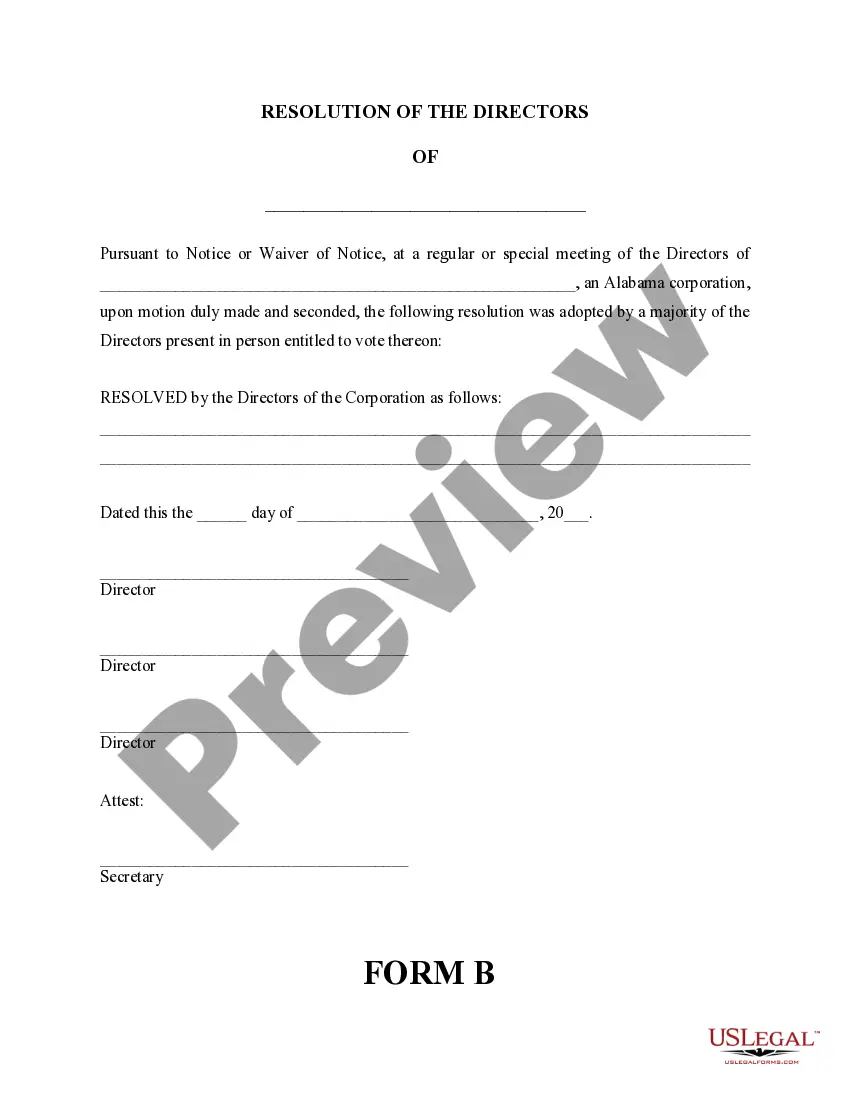

The dissolution of a corporation package contains all forms to dissolve a corporation in Alabama, step by step instructions, addresses, transmittal letters, and other information.

Alabama Dissolution Package to Dissolve Corporation

Description

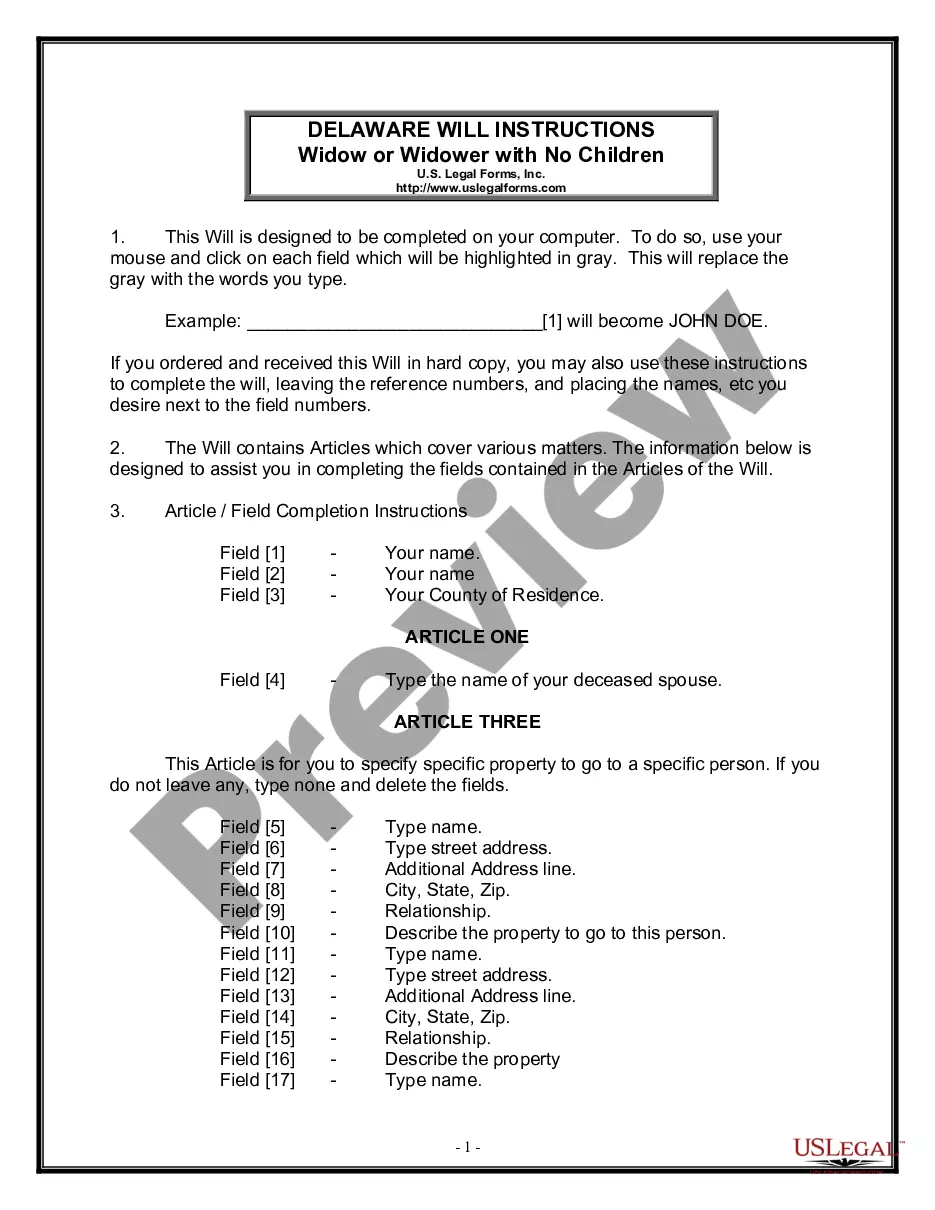

How to fill out Alabama Dissolution Package To Dissolve Corporation?

Utilizing the Alabama Dissolution Kit to Terminate Corporation templates designed by skilled lawyers provides you the opportunity to evade complications when filing paperwork.

Merely download the example from our site, complete it, and seek legal advice to review it.

By doing this, you will conserve significantly more time and energy than attempting to find a lawyer to create a document entirely from the beginning to meet your requirements.

Following these steps, you'll be able to fill out, print, and sign the Alabama Dissolution Kit to Terminate Corporation sample. Be sure to verify all entered information for accuracy before submitting it or sending it out. Reduce the time you spend on document preparation with US Legal Forms!

- If you possess a US Legal Forms membership, simply Log In to your profile and return to the example web page.

- Locate the Download button adjacent to the template you are reviewing.

- Upon downloading a template, all your saved examples can be found in the My documents section.

- If you lack a subscription, it's not a major issue.

- Just follow the guide below to register for an account online, acquire, and complete your Alabama Dissolution Kit to Terminate Corporation template.

- Reconfirm and verify that you are downloading the appropriate state-specific form.

Form popularity

FAQ

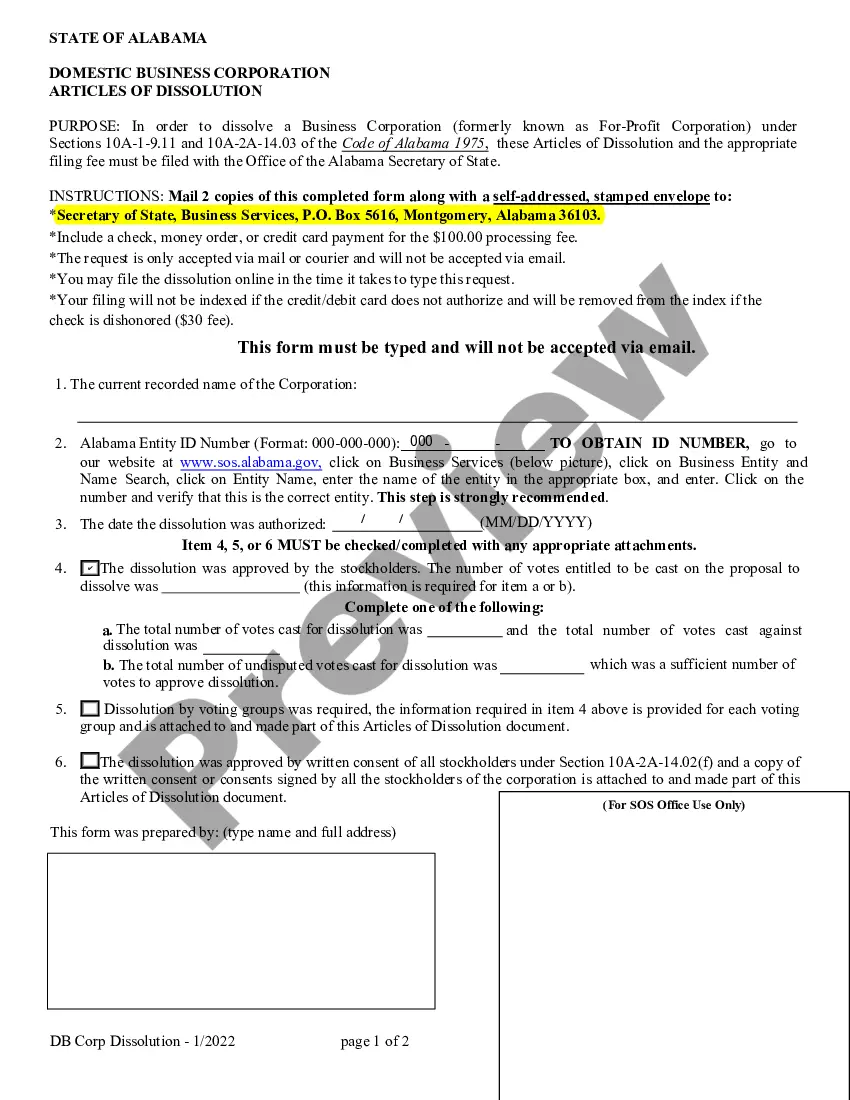

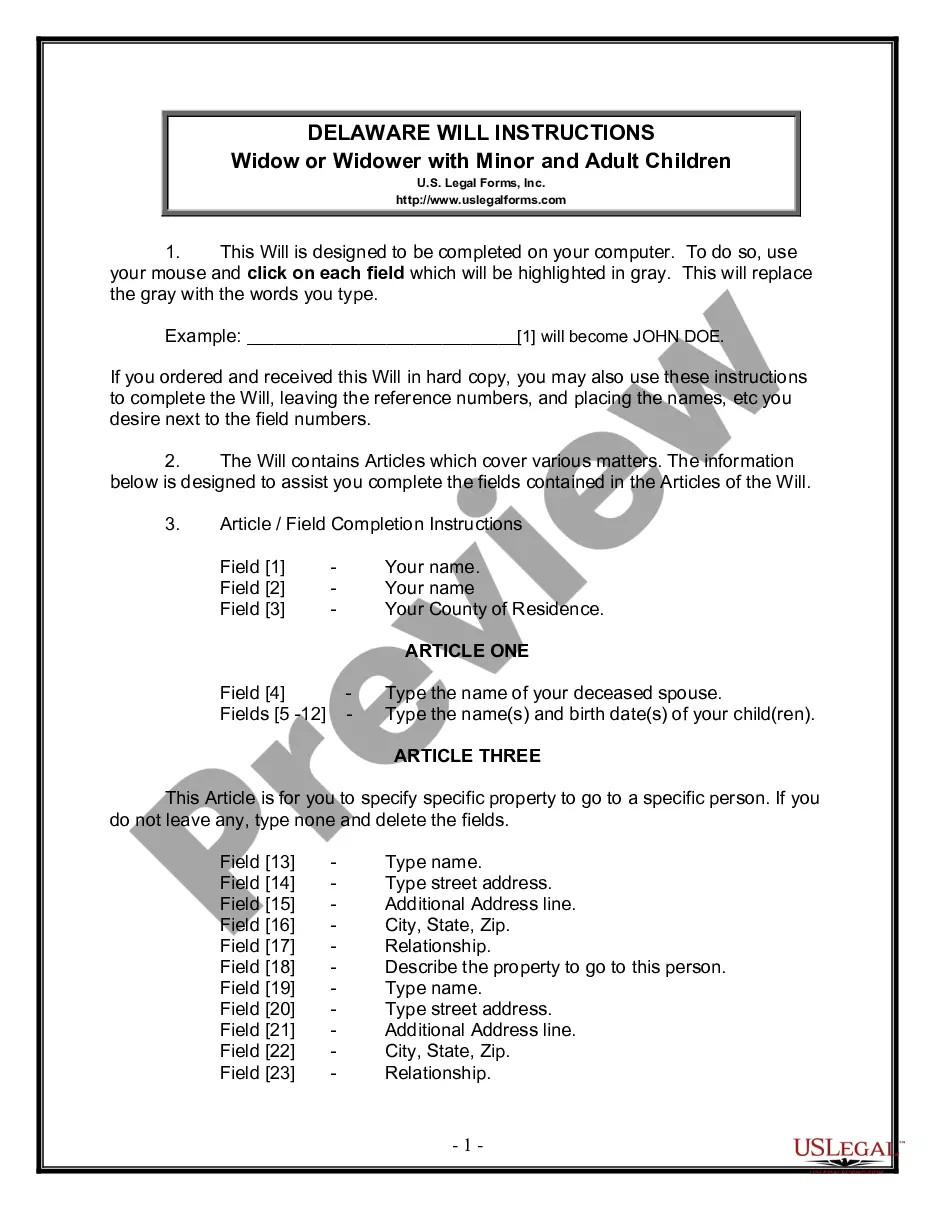

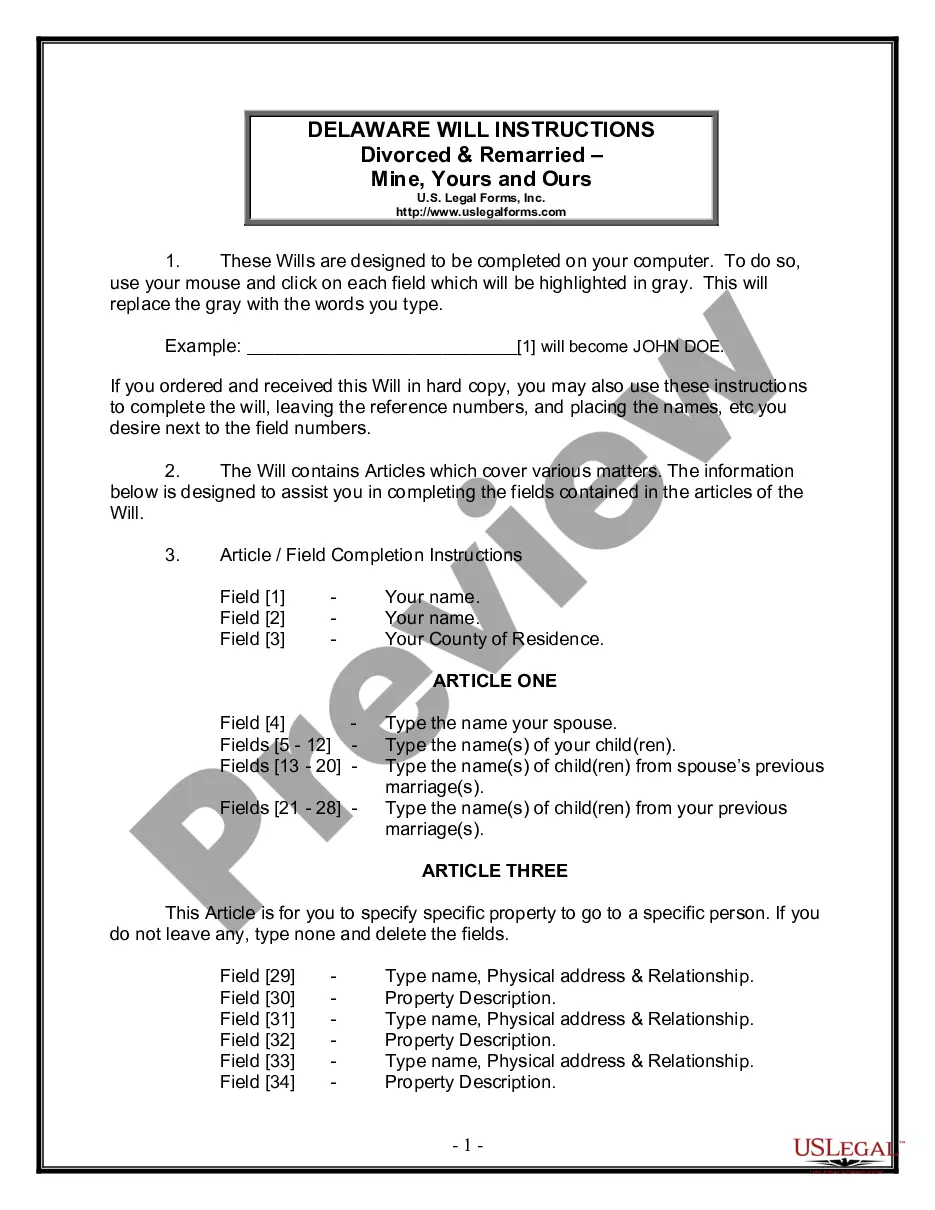

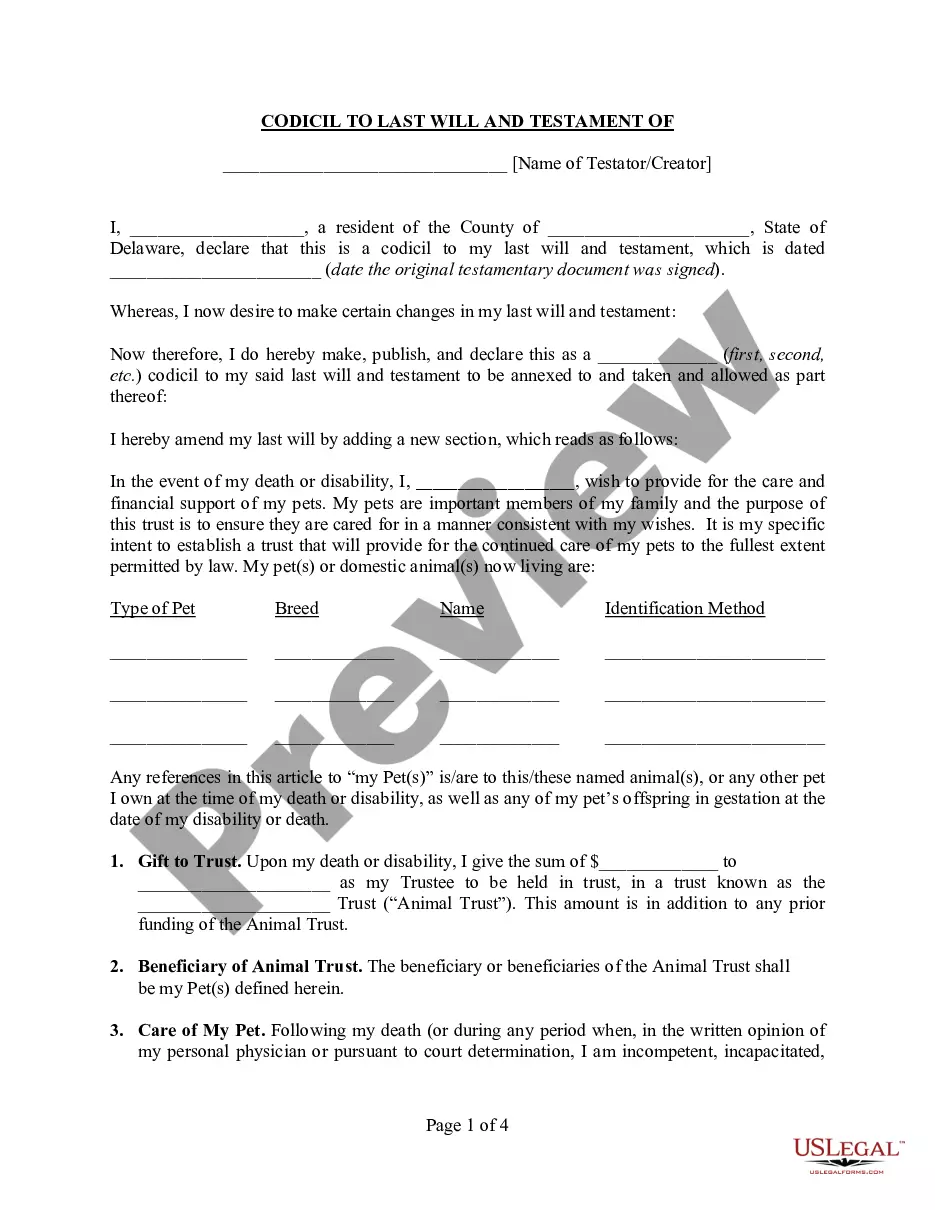

To fill out an articles of dissolution form, gather all necessary information about your corporation, including its legal name and registration details. Carefully complete the sections regarding the announcement of dissolution and confirm that all business obligations have been resolved. The Alabama Dissolution Package to Dissolve Corporation provides useful resources and step-by-step instructions to help you fill out this form correctly.

A notice of dissolution should clearly communicate the decision to dissolve the corporation to all stakeholders. Outline the corporation’s name, effective date of dissolution, and any relevant instructions for creditors and shareholders. For a more streamlined experience, the Alabama Dissolution Package to Dissolve Corporation offers templates and guidance for effective notice writing.

To write a dissolution letter, start by clearly stating your intention to dissolve the corporation and include the effective date. Mention any steps taken, such as board resolutions or shareholder approvals, to support your decision. Consider using the Alabama Dissolution Package to Dissolve Corporation to access sample letters and ensure you're meeting all legal requirements.

Filling out an articles of dissolution form involves providing essential information about your corporation, including its name, address, and the effective date of dissolution. You'll also need to state that all debts have been settled and that the necessary shareholder approvals have been obtained. Using the Alabama Dissolution Package to Dissolve Corporation makes this process easier, as it provides a comprehensive guide and template to help you succeed.

The articles of dissolution is a legal document filed with the state to formally dissolve your corporation. This document sets forth the entity's decision to cease operations and outlines the terms of dissolution. If you're considering the Alabama Dissolution Package to Dissolve Corporation, these articles are a crucial step to ensure your business is properly closed and avoid future liabilities.

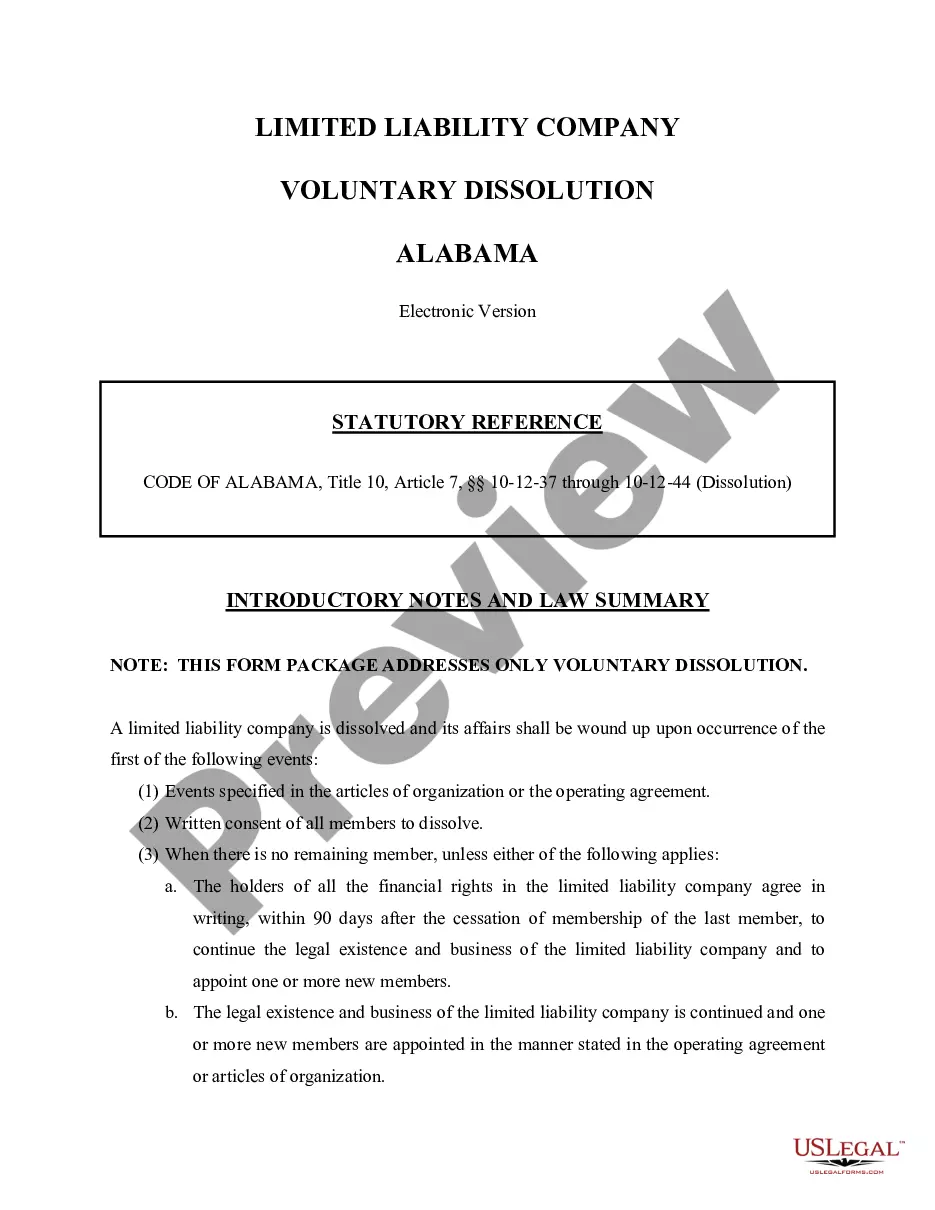

Deciding whether to dissolve your LLC or keep it depends on your business goals. If your business is no longer viable or you want to pursue other opportunities, dissolving your LLC might be the best option. However, if you anticipate future profits or need the business structure, it may be worth maintaining. The Alabama Dissolution Package to Dissolve Corporation can help you navigate this decision with clarity.

Yes, you can dissolve your LLC online in Alabama through the Secretary of State's official website. This process is efficient, ensuring that you complete all necessary filings with ease. Utilizing the Alabama Dissolution Package to Dissolve Corporation allows you to manage your dissolution seamlessly and comply with state requirements.

The easiest way to close a business is to take advantage of the online dissolution options offered by your state. In Alabama, you can use the Alabama Dissolution Package to Dissolve Corporation for a straightforward process. Gather required documentation, follow the steps online, and ensure that you report any taxes or liabilities before finalizing your closure.

You can close your business in Alabama online by visiting the Secretary of State's website. There, you will find the necessary forms to complete the dissolution process. Make sure you have your corporation's information ready, as well as the full details required for the Alabama Dissolution Package to Dissolve Corporation. This option saves time and helps streamline your closure.

In Alabama, you can dissolve a corporation through either voluntary or involuntary dissolution. Voluntary dissolution occurs when the corporation's owners decide to close the business. Involuntary dissolution happens due to legal actions or failure to comply with state regulations. Using the Alabama Dissolution Package to Dissolve Corporation can simplify this process.