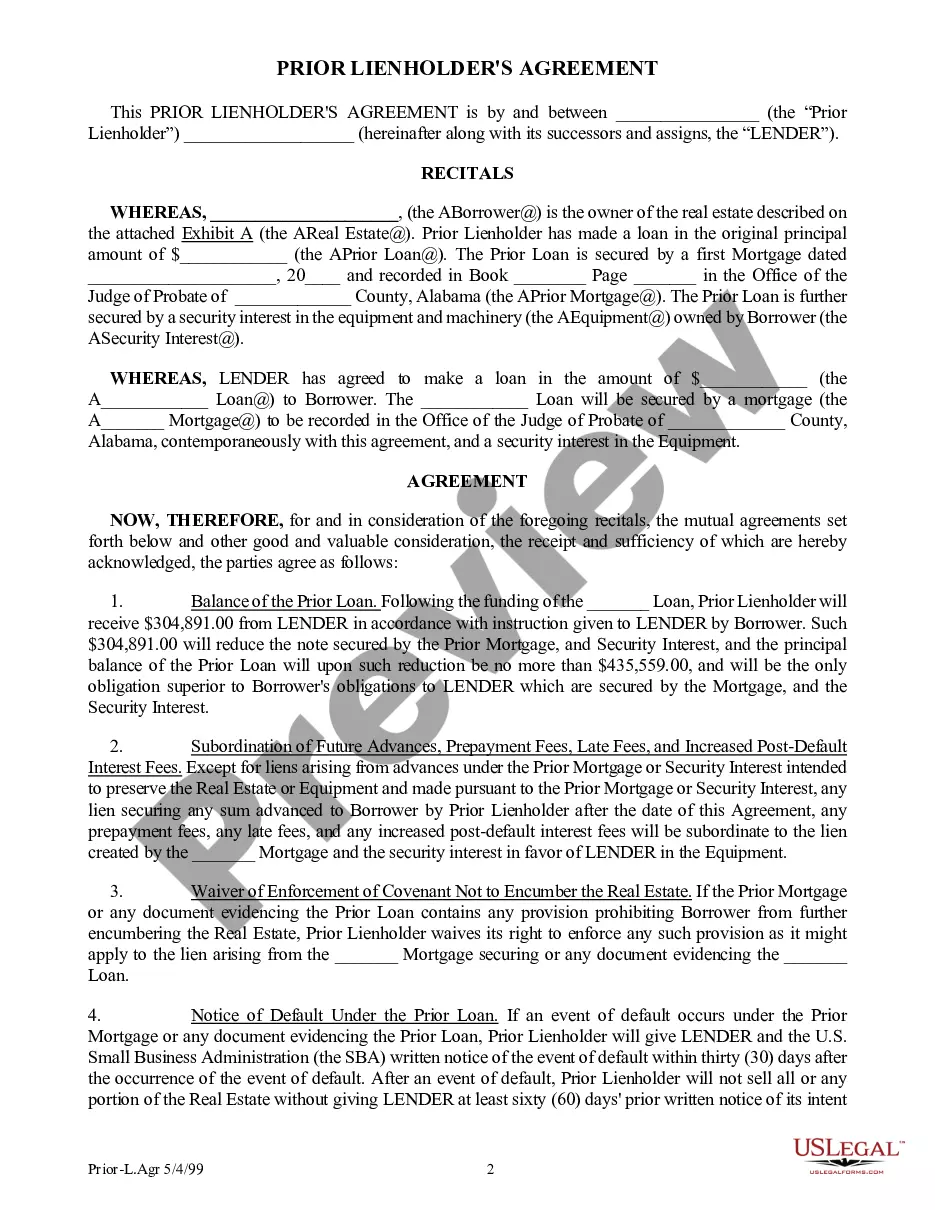

This is a sample form of a prior lienholder's agreement and subordination of interest in real property to another lender. As part of this agreement, the prior lienholder accepts partial payment of his/her/its debt in exchange for allowing the prior lien to become subordinate to the new lien.

Alabama Prior Lienholder's Agreement and subordination

Description

How to fill out Alabama Prior Lienholder's Agreement And Subordination?

Utilizing Alabama Prior Lienholder's Agreement and subordination templates crafted by expert attorneys helps you evade complications when filing paperwork. Simply download the form from our site, complete it, and request a legal expert to validate it. This approach will save you significantly more time and expenses than asking a legal professional to create a document from scratch tailored to your requirements.

If you possess a US Legal Forms membership, just Log In to your profile and return to the form webpage. Locate the Download button adjacent to the templates you are reviewing. After downloading a template, your saved versions will be in the My documents section.

If you lack a subscription, it's not a major issue. Simply adhere to the instructions below to register for an account online, obtain, and finalize your Alabama Prior Lienholder's Agreement and subordination template.

Once you’ve completed all the steps above, you'll be able to fill out, print, and sign the Alabama Prior Lienholder's Agreement and subordination template. Remember to recheck all entered information for accuracy before submitting or mailing it. Streamline the process of document creation with US Legal Forms!

- Verify that you're downloading the correct state-specific form.

- Use the Preview feature and examine the description (if available) to determine if you need this specific template; if so, click Buy Now.

- Search for another template using the Search box if necessary.

- Choose a subscription that suits your requirements.

- Begin with your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Unless there is a subordination agreement, it is virtually impossible to refinance your first mortgage. The document agreeing to the subordination must be signed by the lender and the borrower and requires notarization.

A subordination fee is a fee directly related to the credit transaction. There is no comparable cash transaction to compare it to and a subordination is not a required document to perfect your lien. It's only required to perfect your lien in the position that you required as a condition of making the loan.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

A subordination agreement acknowledges that one party's claim or interest is superior to that of another party in the event that the borrower's assets must be liquidated to repay the debts.

What is a Subordinate Mortgage? Subordinate mortgages are loans that have a lower priority status than any other recorded liens (or debts) against a property. When you get the loan you need to purchase your home, this loan is typically recorded as the first repayment priority on your deed after closing.