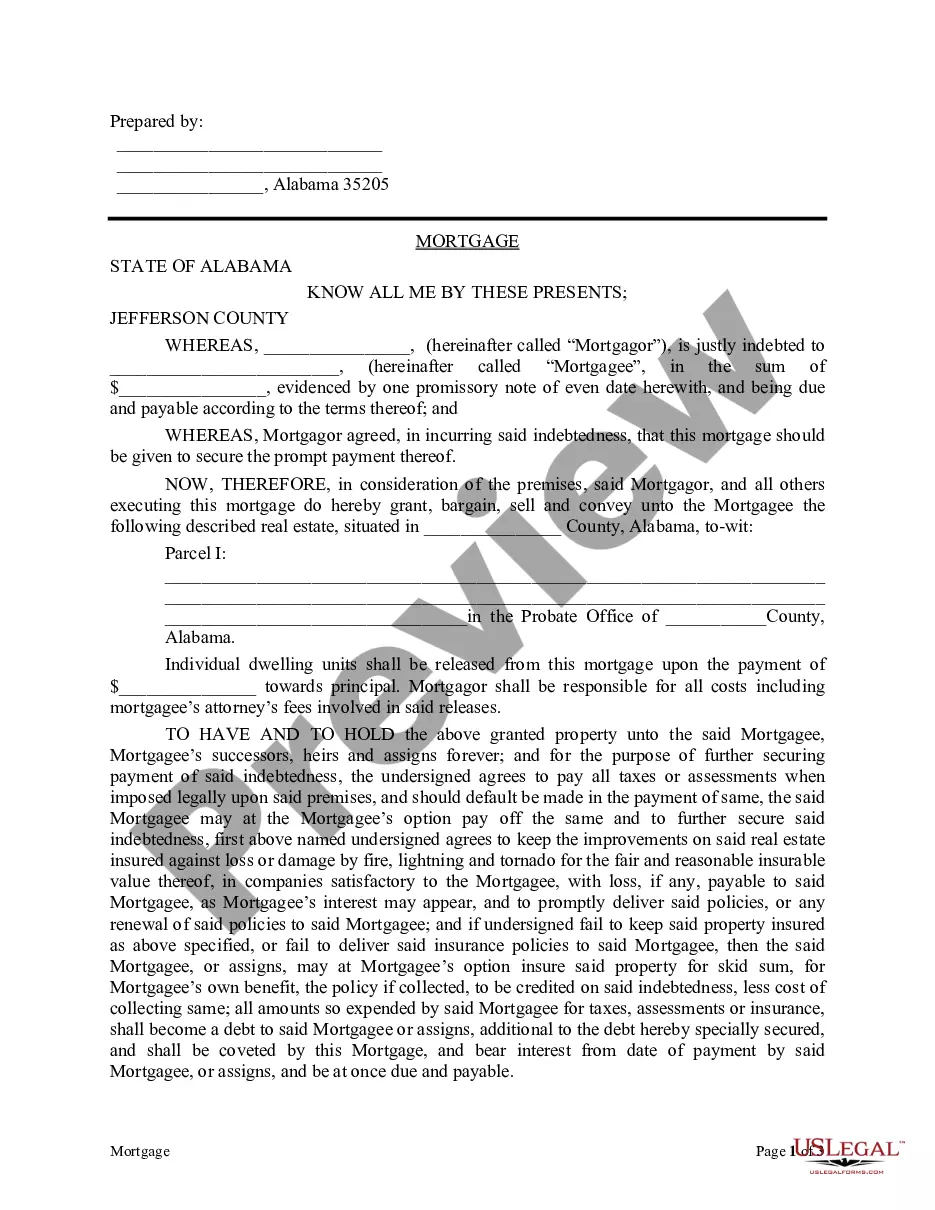

This is a sample mortgage in simple form for the State of Alabama which provides that certain real estate will be held by lender as security for a promissory note.

Alabama Mortgage - Simple Form

Description Alabama Mortgage Form Document

How to fill out Alabama Simple?

Utilizing Alabama Mortgage - Simple Form samples prepared by experienced lawyers allows you to avert complications when completing paperwork.

Simply obtain the example from our site, fill it out, and request legal advice to review it. This can assist you in saving considerably more time and expenses than searching for legal advice to draft a document from the ground up to meet your requirements would.

If you have already acquired a US Legal Forms subscription, simply Log Into your account and return to the template page. Locate the Download button next to the forms you are reviewing.

After completing all the steps above, you will be able to fill out, print, and sign the Alabama Mortgage - Simple Form sample. Remember to double-check all entered information for accuracy before submitting it or mailing it out. Reduce the time you spend on filling out forms with US Legal Forms!

- After downloading a document, you will find all of your saved samples in the My documents section.

- If you do not have a subscription, that’s not an issue. Just follow the step-by-step guide below to register for your account online, obtain, and complete your Alabama Mortgage - Simple Form template.

- Verify to ensure that you’re downloading the correct state-specific form.

- Utilize the Preview feature and examine the description (if available) to determine if you need this particular sample and if so, simply click Buy Now.

- Search for another file using the Search field if needed.

- Select a subscription that fulfills your requirements.

- Begin using your credit card or PayPal.

Mortgage Form Deeds Document Form popularity

Alabama Mortgage Form Order Other Form Names

Mortgage Simple Form Deeds FAQ

The Mortgage or Deed of Trust is a legal document in which the borrower transfers the title to a third party (trustee) to hold as security for the lender.If the borrower defaults on the loan, the property can be sold to pay off the mortgage debt.

Usually what works is a letter signed by you stating it's owned free & clear, combined with insurance docs for those properties showing no mortgagee. If you don't have insurance on them then you also have to write & sign a letter about that, too.

A private mortgage You could offer a loan secured against the property in exchange for monthly repayments, just like a bank. If the child defaulted on the payments, you would assume ownership of the property. Pitfalls: If you charge interest on the loan, it will be liable to income tax.

The Short Form Security Instrument is the Mortgage or Deed of Trust recorded for each individual Mortgage made and recorded in the recording jurisdiction where the Master Form Security Instrument is recorded; the Short Form Security Instrument contains loan-specific information and incorporates by reference the

If you own a computer and have a sheet of paper, you can create your own mortgage to finance the purchase of real estate. No one checks your credit, and you don't need a cash down payment.There is a huge market of investors who buy privately created mortgages and trust deeds (often referred to as paper).

A "Short Form Deed of Trust" is a document that is used to secure a promissory note by using real estate as collateral.With a Short Form Deed of Trust, a lender can foreclose on the property if the borrower defaults on making the loan payments.

Write the title. Begin the document with the official title, "Loan Agreement" and the current date. Then state who the loan agreement is between; list the borrowers' first with their middle and last names, followed by the lender. Indicate each party with the designation "Borrower" and "Lender" after each name.

A fictitious/master deed of trust is a blank, unsigned long form deed of trust with a cover sheet attached, requesting recording for reference purposes only. By referencing the recorded instrument information on the fictitious DOT, all rights and obligations of the parties are preserved.

The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.