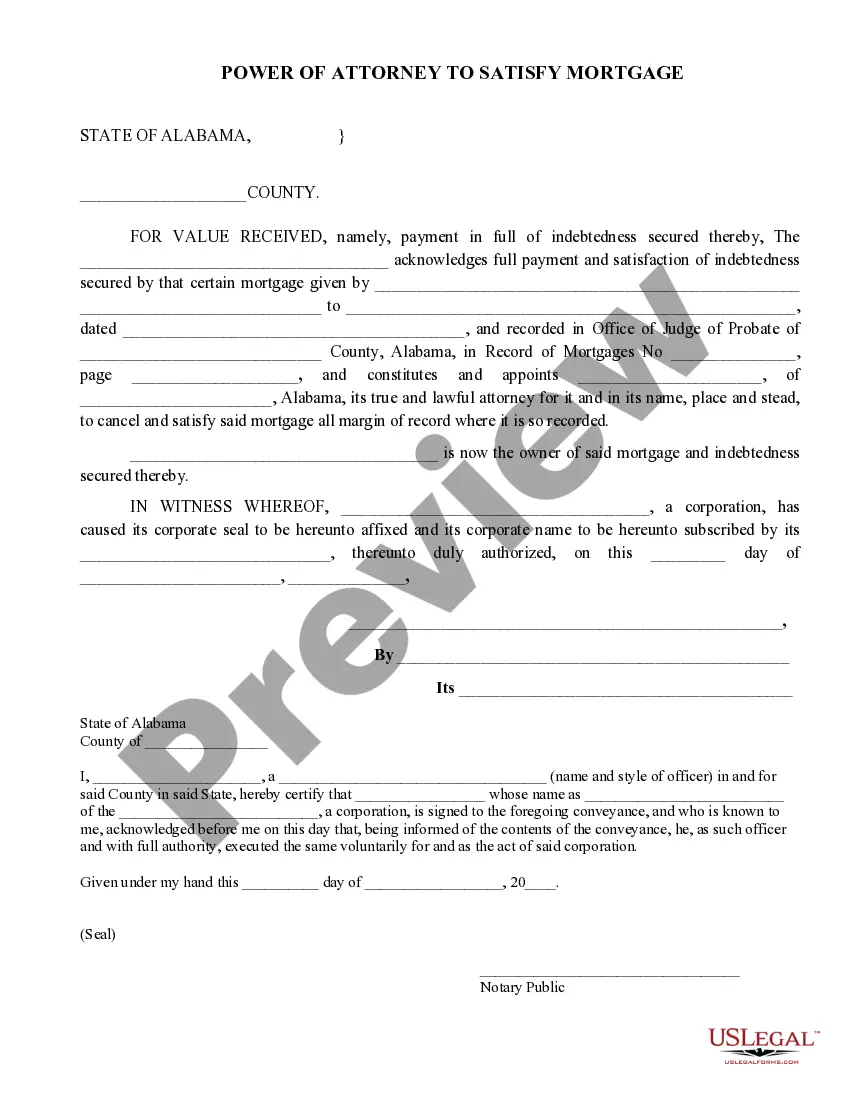

This is a sample of a Power of Attorney to Satisfy Mortgage used to acknowledge that a mortgage obligation has been satisfied and to appoint another to act on behalf of the note holder to cancel and satisfy the mortgage.

Alabama Power of Attorney to Satisfy Mortgage

Description

How to fill out Alabama Power Of Attorney To Satisfy Mortgage?

Leveraging Alabama Power of Attorney for Mortgage templates crafted by experienced lawyers enables you to evade complications when finalizing paperwork.

Simply download the example from our site, complete it, and ask a lawyer to validate it.

This can save you significantly more time and effort than having a legal expert create a document entirely from the ground up for you.

Utilize the Preview feature and examine the description (if present) to determine if you require this specific sample, and if so, just click Buy Now. Locate another template using the Search bar if necessary. Choose a subscription that suits your requirements. Begin with your credit card or PayPal. Select a file format and download your document. After completing all the steps above, you will be able to fill out, print, and sign the Alabama Power of Attorney for Mortgage template. Remember to review all entered information for accuracy before submitting or dispatching it. Reduce the time spent on document preparation with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log In to your account and revisit the form page.

- Locate the Download button adjacent to the templates you are reviewing.

- Upon downloading a template, you will find all your saved examples in the My documents section.

- If you lack a subscription, that’s not a concern.

- Merely follow the instructions below to create your account online and obtain and complete your Alabama Power of Attorney for Mortgage template.

- Ensure that you verify you are downloading the correct state-specific document.

Form popularity

FAQ

Does a Power of Attorney need to be recorded in Alabama? An Alabama Power of Attorney does need to be recorded if the Agent will be purchasing property or engaging in other transactions like that.

The power of attorney must be signed by the principal or by another adult in the principal's presence and under the direction of the principal. The power of attorney is signed and acknowledged before a notary public or is signed by two witnesses.

When a power of attorney is used to execute loan documents, the document must be examined by the lender, title company, or an attorney for one or both of those parties to ensure that it carries the appropriate authority.The language in a power of attorney must be sufficient to provide that authority.

General: Alabama has adopted the Uniform Power of Attorney Act and may be found in Ala.Execution: This power of attorney must be in writing, signed by the principal, dated and notarized. The Principal should sign the power of attorney in the presence of the notary or other person taking the acknowledgment.

For legal advice, you should call a lawyer. To apply for free legal services in Alabama, call the Legal Services Alabama office that is closest to where you live OR call toll-free 1-866-456-4995. You can also apply online HERE.

What attorneys cannot do. We cannot let attorneys run up unsecured debt in someone else's name. This means they cannot apply for credit cards, overdrafts or loans on your behalf. But they can pay off existing debt and manage mortgage payments.

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

You can get a loan on a property which can be transferred on Power of Attorney (PoA). Power of Attorney is the document which gives power and permission to your chosen agent which also includes purchasing property or getting a home loan.

If you are granted power of attorney, you may be able to sign loan agreements on behalf of the person who granted you that power. However, whether you have this right or not depends entirely on factors such as the power of attorney document itself and when you want to enter into the agreement.