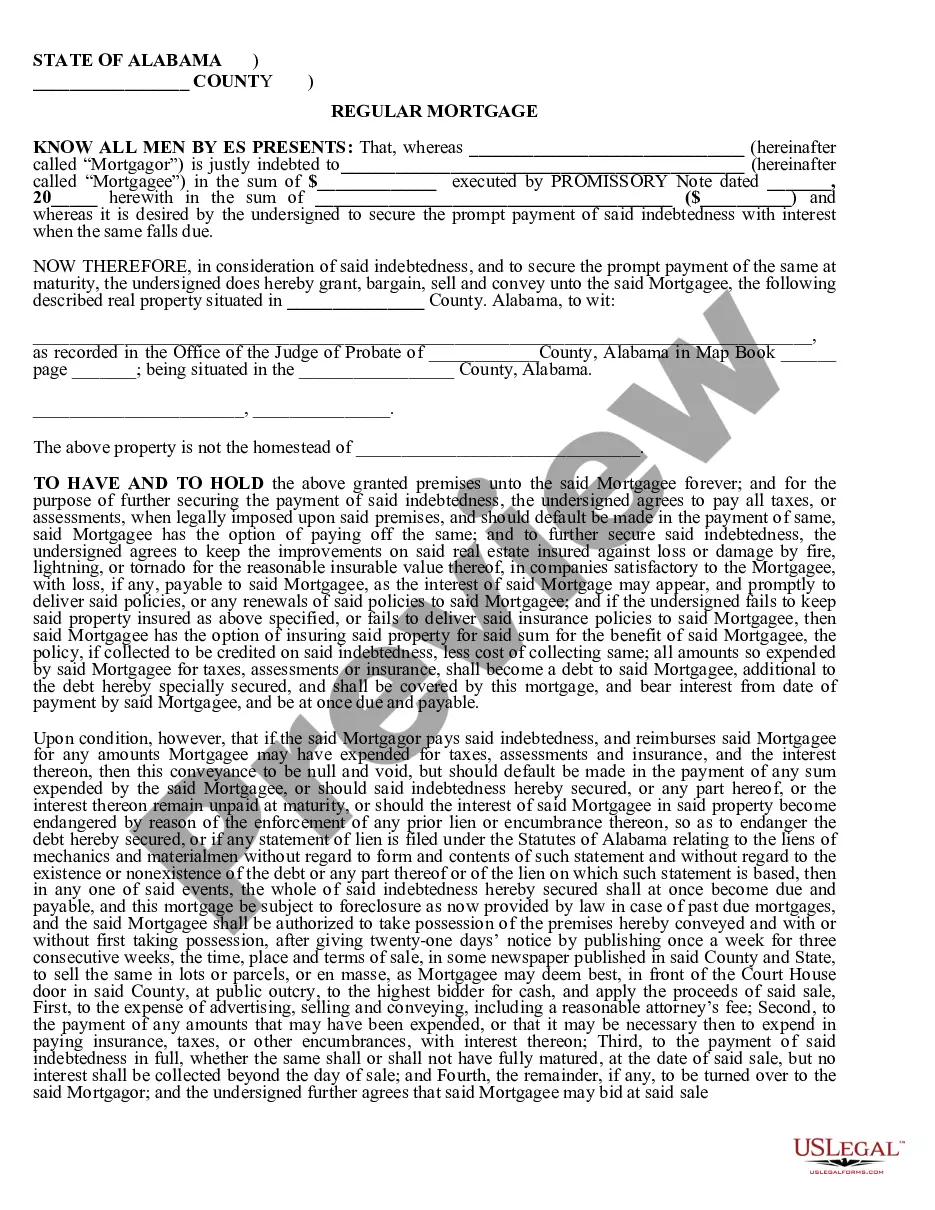

This is a Regular Mortgage by Corporation where the mortgagor is not claiming the secured real property as a homestead.

Alabama Regular Mortgage by Corporation

Description

How to fill out Alabama Regular Mortgage By Corporation?

Utilizing Alabama Standard Mortgage by Corporation instances generated by experienced lawyers allows you to evade hassles during document submission.

Simply obtain the form from our website, complete it, and ask an attorney to verify it.

This approach can assist you in conserving considerably more time and energy than having a lawyer create a document from scratch for you.

Remember to review all provided information for accuracy before submitting or mailing it out. Reduce the time you spend on filling out documents with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your account and navigate back to the form section.

- Locate the Download button next to the template you are reviewing.

- After downloading a file, you can find all of your saved documents in the My documents tab.

- If you lack a subscription, that's not an issue.

- Simply adhere to the instructions below to register for an account online, obtain, and complete your Alabama Standard Mortgage by Corporation template.

- Verify that you are downloading the correct state-specific form.

Form popularity

FAQ

Lender Summary NewRez LLC (NewRez), formerly New Penn Financial, LLC, is a leading nationwide lender that focuses on offering a breadth of industry-leading products, supported by a loan process that blends both human interaction and the benefits of technology into an unparalleled customer experience.

A mortgage company is a firm engaged in the business of originating and/or funding mortgages for residential or commercial property.Because they weren't funding most of the loans, they had few assets of their own, and when the housing markets dried up, their cash flows quickly evaporated.

A mortgage company is often just the originator of a loan; it markets itself to potential borrowers and seeks funding from one of several client financial institutions that provide the capital for the mortgage itself.

They are a publicly-traded company worth billions of dollars that has quickly become a top-20 mortgage lender nationwide.It provides mortgage financing to home buyers represented by real estate brokerage First Team Real Estate in Southern California.

Here are four types of mortgage loans for home buyers today: fixed rate, FHA mortgages, VA mortgages and interest-only loans.

Conventional / Fixed Rate Mortgage. Conventional fixed rate loans are a safe bet because of their consistency the monthly payments won't change over the life of your loan. Interest-Only Mortgage. Adjustable Rate Mortgage (ARM) FHA Loans. VA Loans. Combo / Piggyback. Balloon. Jumbo.

NewRez LLC is a national mortgage lender headquartered in Fort Washington, Pa., near Philadelphia. It was founded in 2008 under the name New Penn Financial, and rebranded in early 2019.NewRez offers mortgage servicing capabilities through its NewRez and Shellpoint Mortgage Servicing divisions.

NewRez LLC is a national mortgage lender headquartered in Fort Washington, Pa., near Philadelphia. It was founded in 2008 under the name New Penn Financial, and rebranded in early 2019.

In hopes of a quicker profit, lenders will often sell the loan. If servicing a loan costs more than the money it brings in, lenders may attempt to sell the servicing of it to lower their costs. The lender may also sell the loan itself to free up money in order to make more loans.