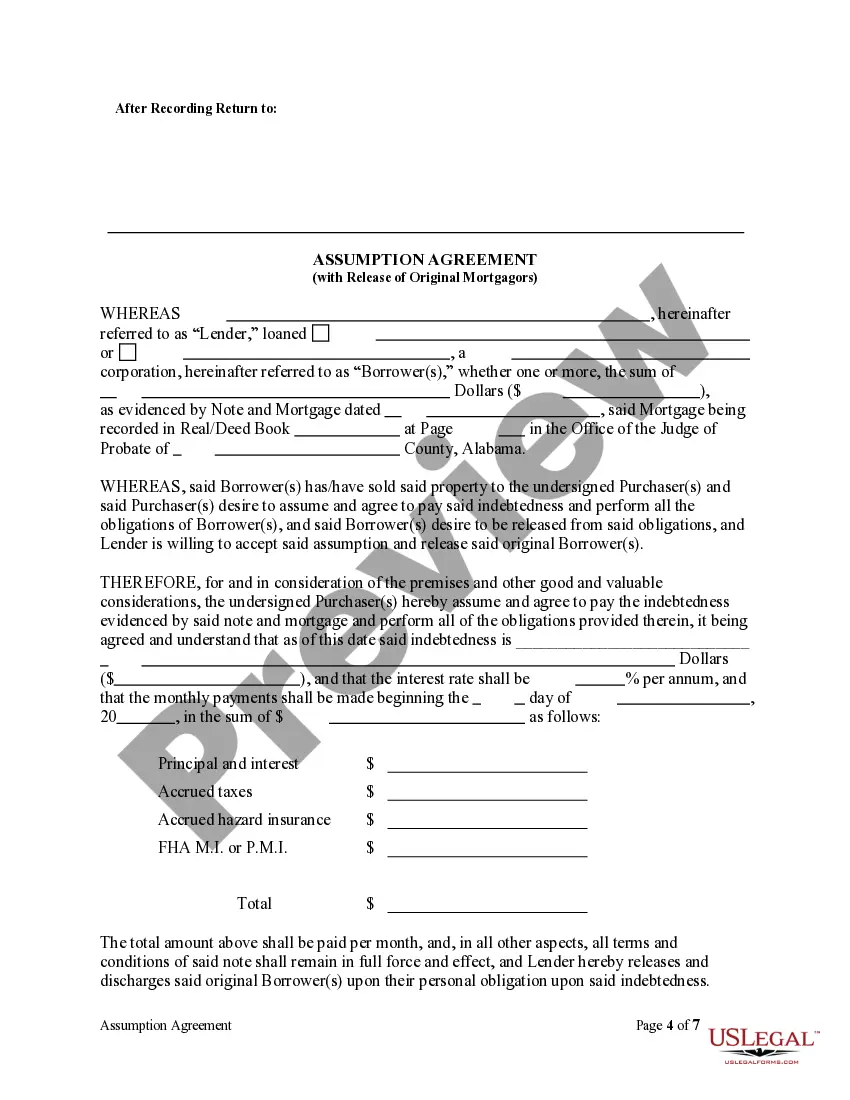

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors

Description Assumption Agreement Mortgagors

How to fill out Alabama Assumption Mortgage?

Utilizing Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors templates crafted by professional lawyers enables you to sidestep complications when filling out documents.

Just download the template from our site, complete it, and request an attorney to review it. This approach can significantly save you more time and effort than seeking a legal expert to prepare a document for you.

If you possess a US Legal Forms membership, simply Log In to your profile and return to the sample page. Locate the Download button adjacent to the template you are examining. After downloading a template, all your saved samples will be found in the My documents section.

Once you have completed all the steps mentioned above, you will be able to fill out, print, and sign the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors template. Remember to double-check all entered information for accuracy before submitting or dispatching it. Minimize the time taken to complete documents with US Legal Forms!

- When you lack a subscription, it's not an issue.

- Just adhere to the comprehensive instructions below to register for an account online, acquire, and fill out your Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors template.

- Verify and ensure that you are obtaining the correct state-specific template.

- Utilize the Preview functionality and review the description (if accessible) to determine if you require this particular template and if so, simply click Buy Now.

- Search for another template using the Search field if necessary.

- Select a subscription that suits your preferences.

- Commence using your credit card or PayPal.

- Choose a file format and download your document.

Alabama Agreement Mortgage Form popularity

Mortgage Form Online Other Form Names

Agreement Mortgage Release FAQ

The charge can also be called a termination or settlement fee. A recorded mortgage discharge certifies that the mortgage has been satisfied and legally releases the interest of the lender in the property and thereby clears the title.

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

People can just let the home go to foreclosure, and this will affect their scores for seven years. Or they can do a deed in lieu of foreclosure. With a deed in lieu, you voluntarily give your home to the lender in exchange for the cancellation of your loan. This, too, can create a negative mark on your credit history.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

Give your lender reasonable time, possibly two to three weeks, to release its lien. Then call or visit your lender. Advise the lender that you have yet to receive its "release of lien" document.

Often, it is filed directly by the bank or a settlement attorney. However, in some cases, the discharge may be transmitted directly to the person who is paying off the mortgage upon making a final mortgage payment, and that person needs to record the discharge so that clear title can be conveyed to someone else.