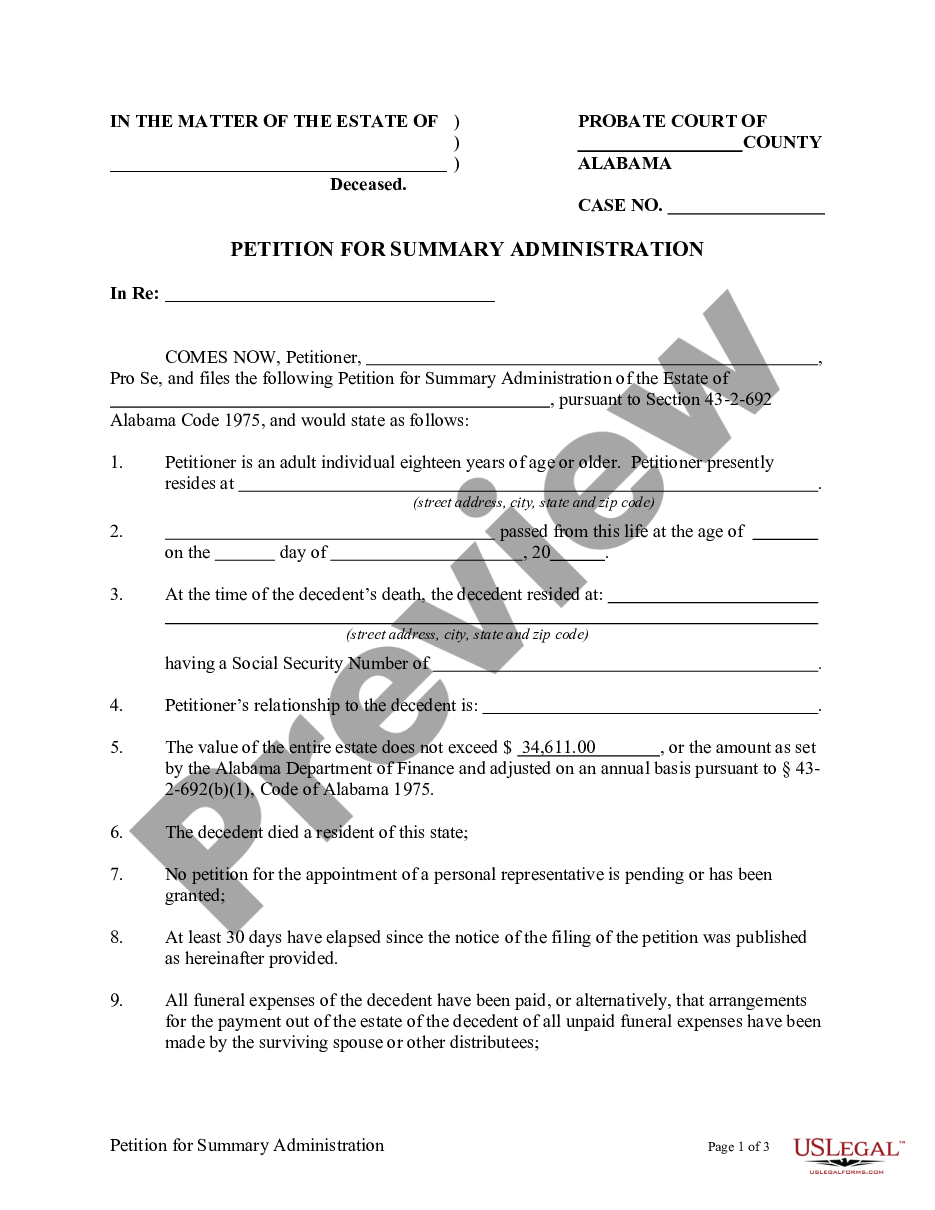

Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates

Description Alabama Summary Estates Small

How to fill out Estate Alabama Code?

Utilizing Alabama Summary Administration for Estates Not Exceeding $30,245.00- Minor Estates samples crafted by experienced attorneys allows you to evade difficulties when completing paperwork.

Merely download the form from our site, complete it, and ask a lawyer to review it.

By doing this, you will conserve significantly more time and effort than seeking a lawyer to generate a document entirely from the ground up for you.

Utilize the Preview feature and examine the description (if accessible) to determine if you need this specific template and if so, click Buy Now.

- If you possess a US Legal Forms subscription, simply Log In to your account and navigate back to the form page.

- Locate the Download button adjacent to the template you are examining.

- After downloading a file, you will find your saved examples in the My documents section.

- If you lack a subscription, it’s not an issue.

- Just adhere to the detailed instructions below to register for an account online, acquire, and complete your Alabama Summary Administration for Estates Not Exceeding $30,245.00- Minor Estates template.

- Thoroughly verify and ensure that you are obtaining the correct state-specific form.

Alabama Summary Distribution Of Small Estates Form popularity

Alabama Estates Other Form Names

Alabama Administration Estates FAQ

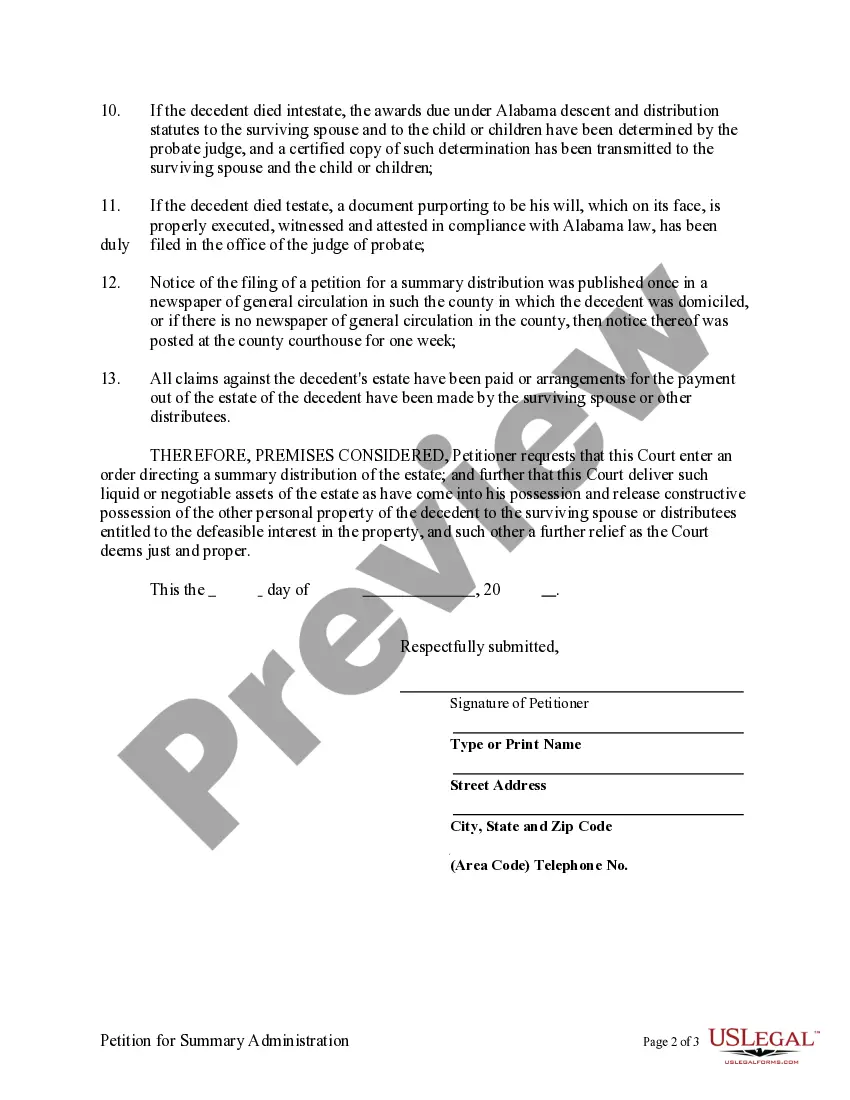

The executor can sell property without getting all of the beneficiaries to approve.The administrator will come in with a buyer and a contract and if someone else in court wants to pay more for the property than that contract price then the judge will allow that.

Godoy. After someone dies, anyone who thinks they are owed money or property by the deceased can file a claim against the estate. Estate claims range from many different types of debts, such as mortgages, credit card debt, loans, unpaid wages, or breach of contract.

You can use the simplified small estate process in Alabama if the estate has no real estate and a value of no more than $25,000.

In the claim, you'll state under oath that the debt is owed and provide details on the amount of the debt and any payments the decedent made. If you have written documentation, you can attach it to your claim.

Paying any debts and liabilities of the estate, owing prior to death; defending the Will of the deceased if litigation is started against the deceased's estate; attending to tax returns for the deceased and their estate; distributing the estate in accordance with the deceased's Will.

Can the administrator-child withdraw cash from the estate and say that he is just withdrawing his own cash? The answer to that is absolutely not. Even though the administrator is one of the beneficiaries of the estate account, at the end of the day the account is not his. The estate belongs to all the beneficiaries.

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.

In Alabama, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.