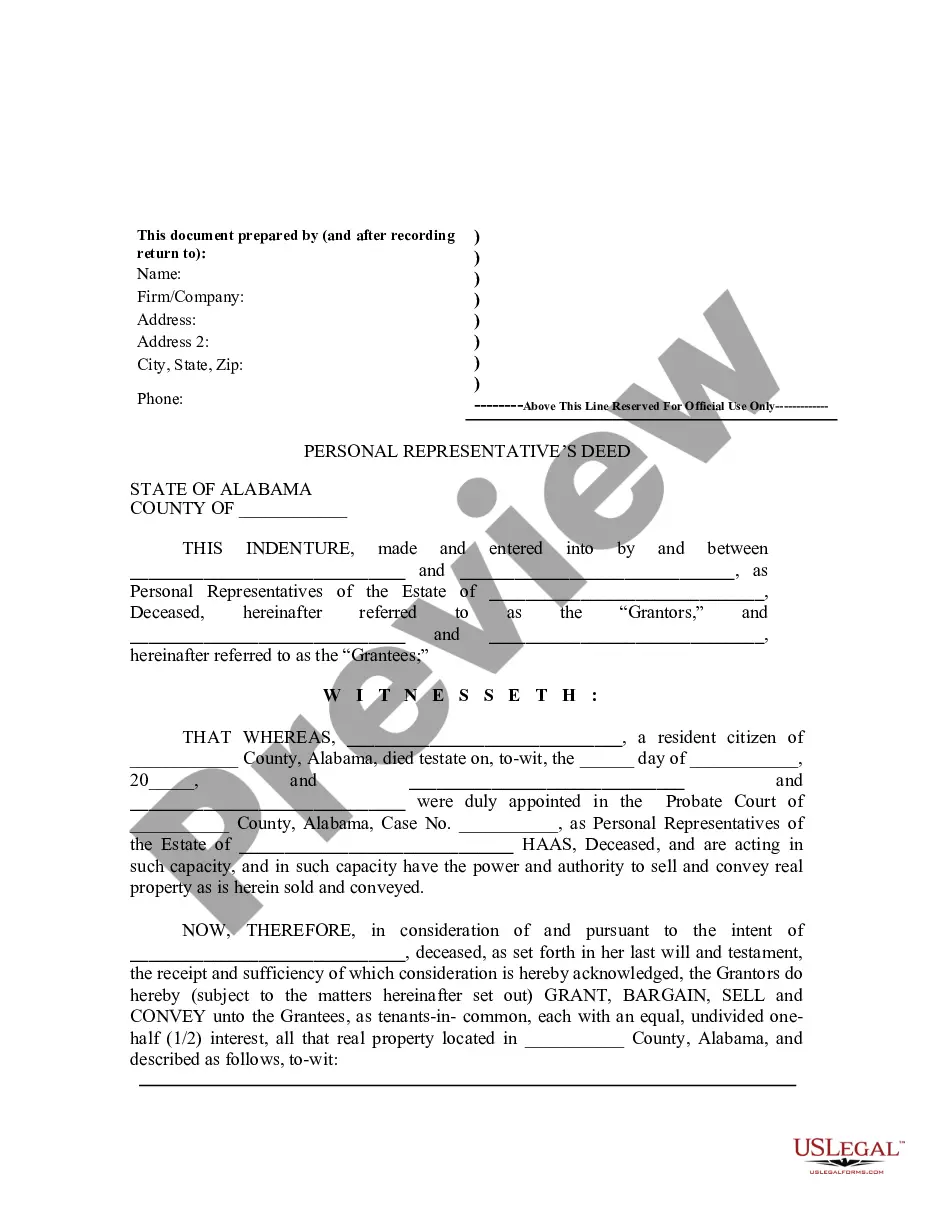

Alabama Personal Representative's Deed

Description Personal Representative Deed Example

Understanding Personal Representative's Deed in Real Estate Transactions

Personal representative's deed is a legal document used by the executor of an estate to transfer property ownership under the realm of a will or trust. This type of deed is critical in the context of California real estate law and is often leveraged amidst the complexities of estate planning and transfer of ownership scenarios.

How Personal Representative's Deed Works

- The personal representative (executor) is appointed either by a will or by a court in the absence of a will.

- Upon appointment, they gain personal representatives authority to manage and dispose of estate properties.

- The deed is then used to transfer property to the beneficiaries as outlined by the will or trust, thus facilitating the transfer of ownership.

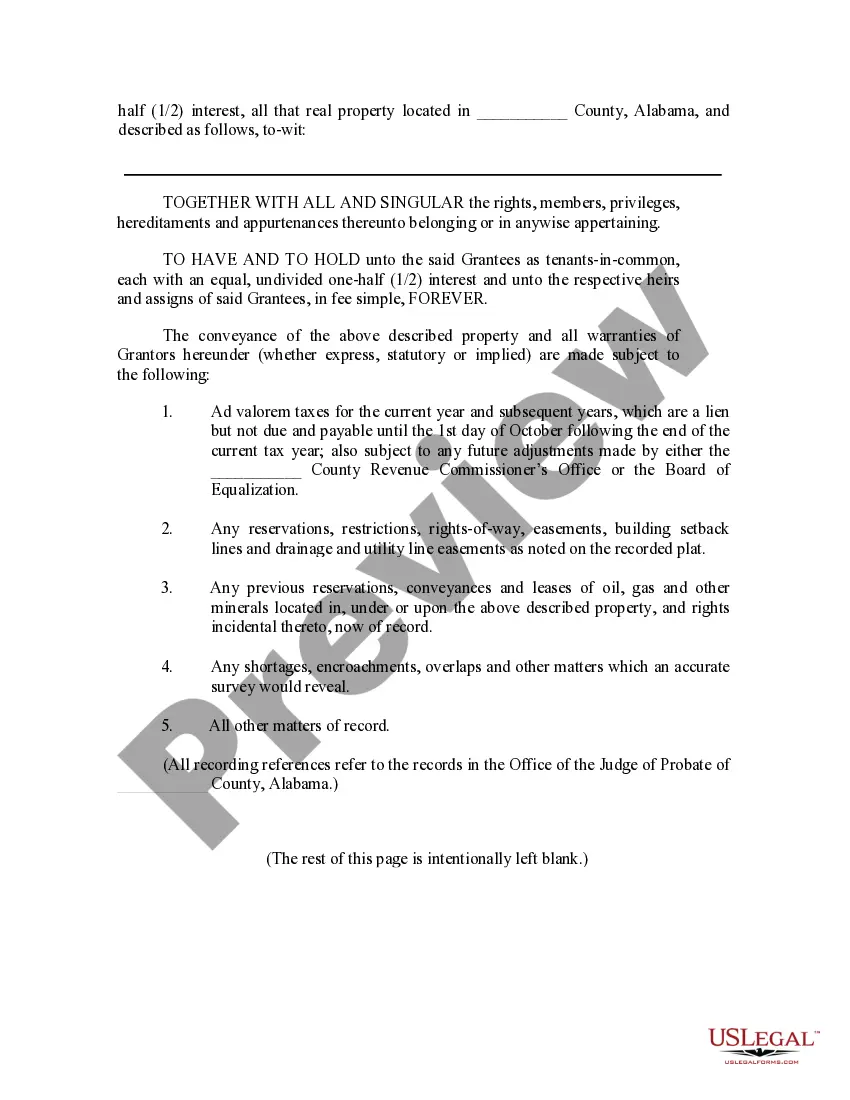

Key Differences Between Personal Representative's Deed, Quitclaim Deed, and Warranty Deed

| Type of Deed | Key Features | Common Uses |

|---|---|---|

| Personal Representative's Deed | Transfers property on behalf of an estate, minimal guarantees about title | Estate settlement |

| Quit Claim Deed | Transfers interest in property with no warranties regarding the title | Transferring property within family or between spouses |

| Warranty Deed | Provides the grantee with covenants that assure good title against the claims | Sale of property in a traditional real estate transaction |

Challenges and Disputes with Personal Representative's Deed

- Real estate challenges: Disputes can arise due to ambiguities in the will or the incorrect interpretation of the estate's scope leading to potential conflicts between beneficiaries.

- Quitclaim disputes often emerge when there is a perceived overlap between the property handled under a personal representative’s deed and one transferred via a quitclaim deed.

- Challenges related to warranty deed claims may occur if a beneficiary believes that the property was improperly managed or transferred, alleging that their rights were violated under the previous warranty deeds.

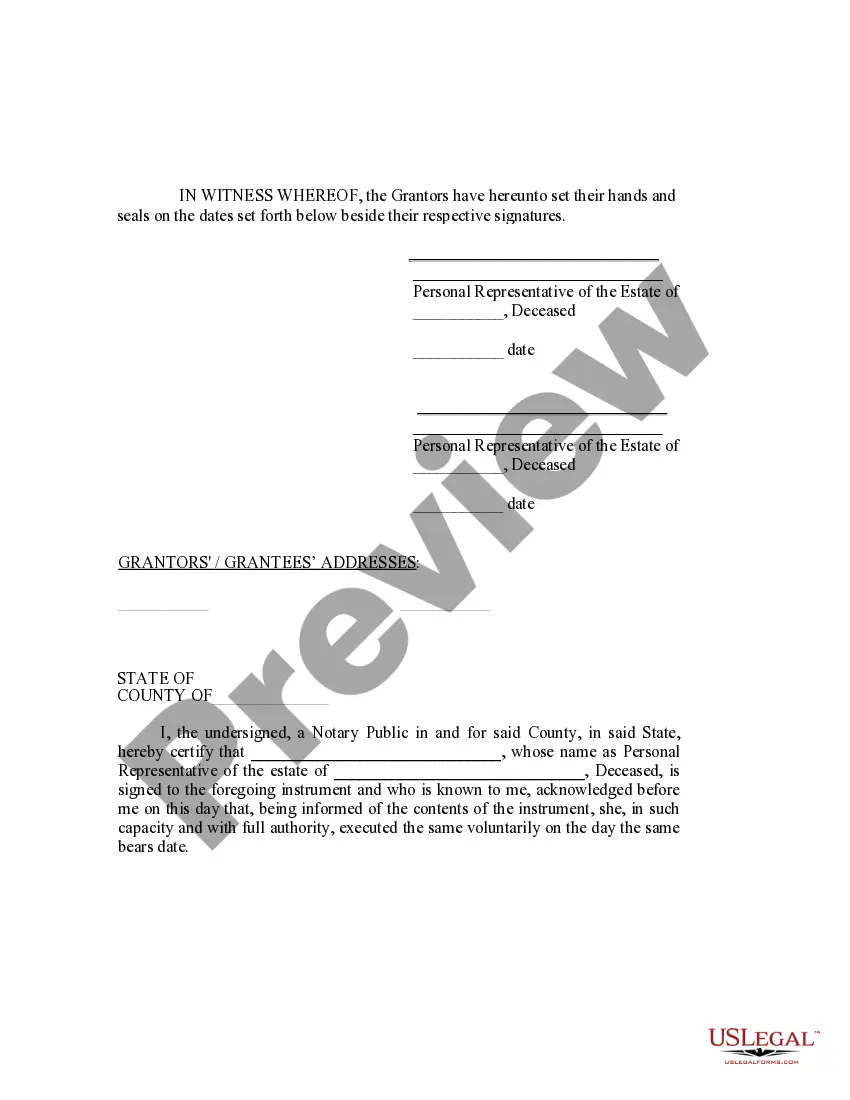

Legal Implications Under California Real Estate Law

In the context of California real estate law, it is crucial to ensure that the execution of a personal representative’s deed adheres strictly to legal standards. This typically includes confirmation of the personal representative's authority, accurate and detailed documentation, and compliance with state-specific formalities. Consulting an experienced real estate attorney is advised to navigate these complex legal landscapes and to mitigate the risks associated with estate transfers.

Best Practices for Handling Personal Representative's Deed

- Ensure clarity and precision in the estate documents and the representative’s powers.

- Engage professionals such as an experienced real estate attorney to review all documents and actions taken under the deed.

- Communicate effectively with all beneficiaries to prevent misunderstandings and disputes.

- Prioritize comprehensive understanding trusts and their implications on property transfer.

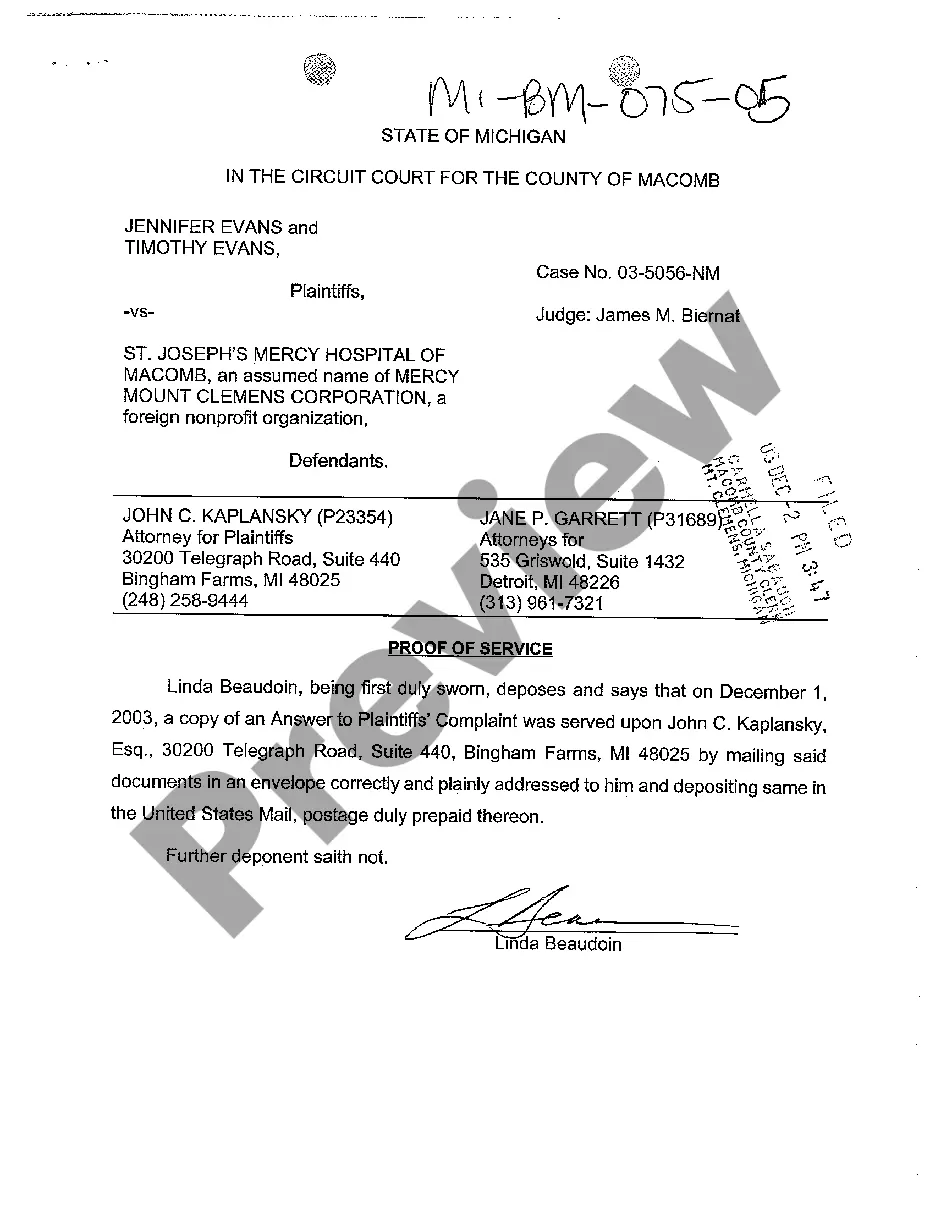

How to fill out Alabama Personal Representative's Deed?

Utilizing Alabama Personal Representative's Deed templates crafted by experienced lawyers helps you avert complications when filing paperwork.

Simply acquire the template from our site, complete it, and request a lawyer to verify it.

This approach will conserve significantly more time and expenses compared to having an attorney generate a document from scratch for you.

Use the Preview feature and review the description (if available) to determine if you require this specific sample, and if so, click Buy Now.

- If you've already purchased a US Legal Forms subscription, just Log In to your profile and return to the form section.

- Locate the Download button close to the template you are reviewing.

- After downloading a document, all of your saved templates can be found in the My documents section.

- If you don’t possess a subscription, that’s not a major issue.

- Simply adhere to the instructions below to register for an online account, obtain, and complete your Alabama Personal Representative's Deed template.

- Double-check and ensure that you are downloading the correct state-specific form.

What Is A Personal Representative Deed Form popularity

Personal Representatives Deed Other Form Names

Personal Representative Deed Template FAQ

In order to settle a California estate, the personal representative or heir must obtain the court's authority to act as such.Instead, this individual must petition the court for an order granting them the authority to settle the estate. This order is commonly called letters testamentary or letters administration.

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

Alabama does not allow real estate to be transferred with transfer-on-death deeds.

Find the local probate court or surrogate's court, as it's sometimes called. File the will and a certified copy of the testator's death certificate . Fill out the necessary paperwork , like a petition form, and provide any additional documents.

To get letters testamentary in Alabama, an estate must be opened in probate court and an executor must be appointed for the estate. If there is already an estate proceeding in another state, it may be possible to have letters testamentary issue from an Alabama probate court, if necessary, through an ancillary estate.

Used to transfer property rights from a deceased person's estate. Involves Probate Court. Like a Quit Claim deed, there are no warranties. Generally, the Personal Representative is unwilling to warrant or promise anything relating to property that he/she has never personally owned.

A personal representative deed and warranty deed are the same only in that they both convey ownership of land. The types of title assurance that the different deeds provide to the new owner are very different.

There are two components of letter of testamentary cost: the court fee and the attorney's fees. The court fee ranges from $45 to $1,250, depending on the gross value of the estate. The attorney's fees start at about $2,500 and can go up depending on the complexity of the case.

Find the most recent deed to the property. Create the new deed. Sign and notarize the deed. Record the signed, notarized original deed with the Office of the Judge of Probate.