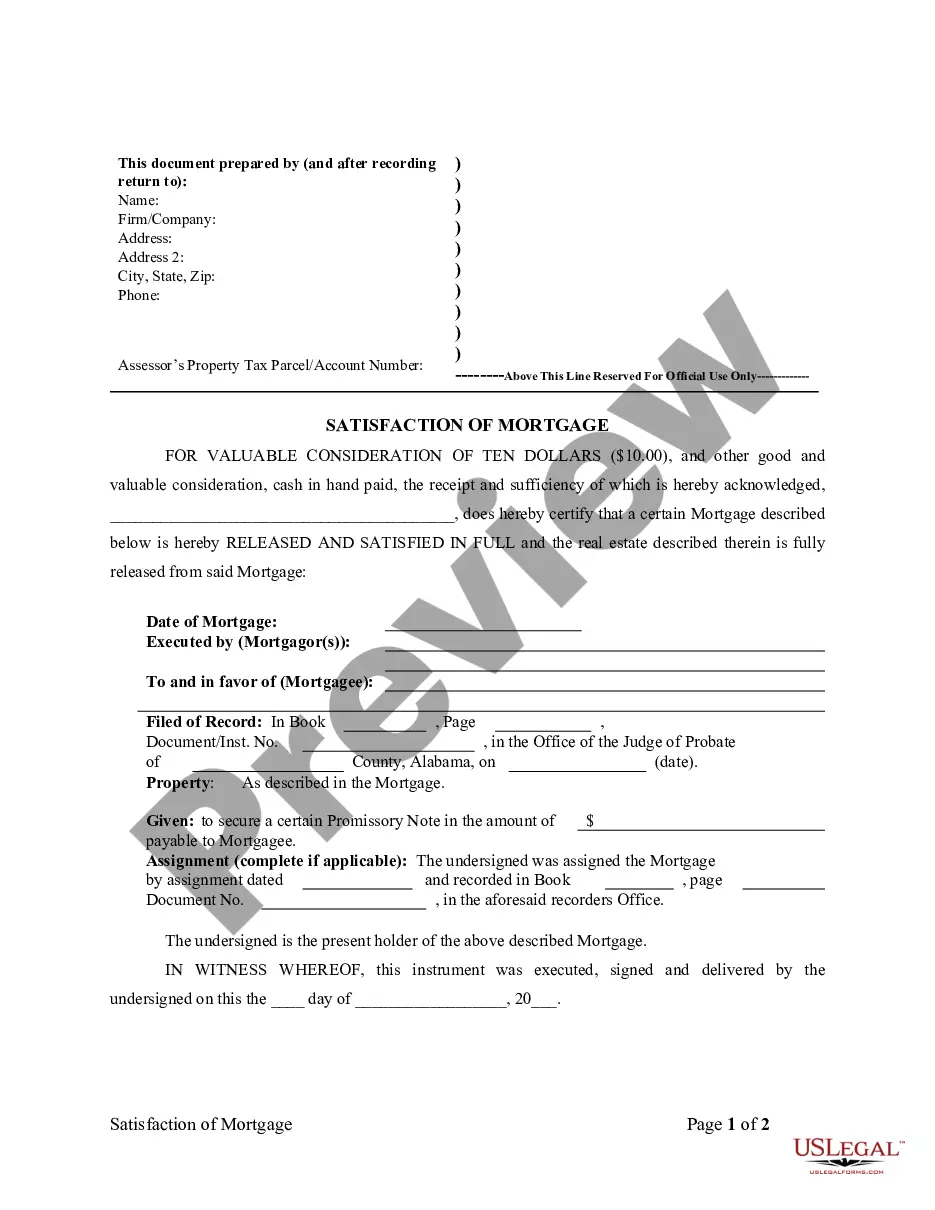

This is a satisfaction or release of a deed of trust or mortgage, for the state of Alabama, by an individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Alabama Satisfaction, Release or Cancellation of Mortgage by Individual

Description Alabama Release Mortgage

How to fill out Mortgagor Parcel Valuable?

Utilizing Alabama Satisfaction, Release or Cancellation of Mortgage by Individual examples crafted by skilled lawyers offers you the chance to bypass complications when filing documents.

Simply download the form from our site, complete it, and ask a legal expert to validate it. This approach will conserve you considerably more time and expenses compared to hiring an attorney to draft a document tailored to your requirements.

If you already possess a US Legal Forms membership, just Log In to your account and navigate back to the form page. Locate the Download button adjacent to the templates you are reviewing. Once you download a document, all your saved examples will be accessible in the My documents section.

After you have completed all the above steps, you will have the capability to fill out, print, and sign the Alabama Satisfaction, Release or Cancellation of Mortgage by Individual template. Ensure to double-check all entered information for accuracy before submitting it or sending it out. Minimize the time spent on document creation with US Legal Forms!

- If you do not have a subscription, it’s not an issue.

- Just adhere to the instructions below to register for your online account, obtain, and finalize your Alabama Satisfaction, Release or Cancellation of Mortgage by Individual template.

- Confirm that you’re downloading the appropriate form specific to your state.

- Use the Preview feature and read the description (if provided) to ascertain if you require this particular template and if so, click Buy Now.

- If needed, find another document using the Search field.

- Select a subscription that fits your requirements.

- Initiate the process with your credit card or PayPal.

- Select a file format and download your document.

Mortgagee Released Mortgage Form popularity

Alabama Release Mortgage Form Other Form Names

Released Mortgage Valuable FAQ

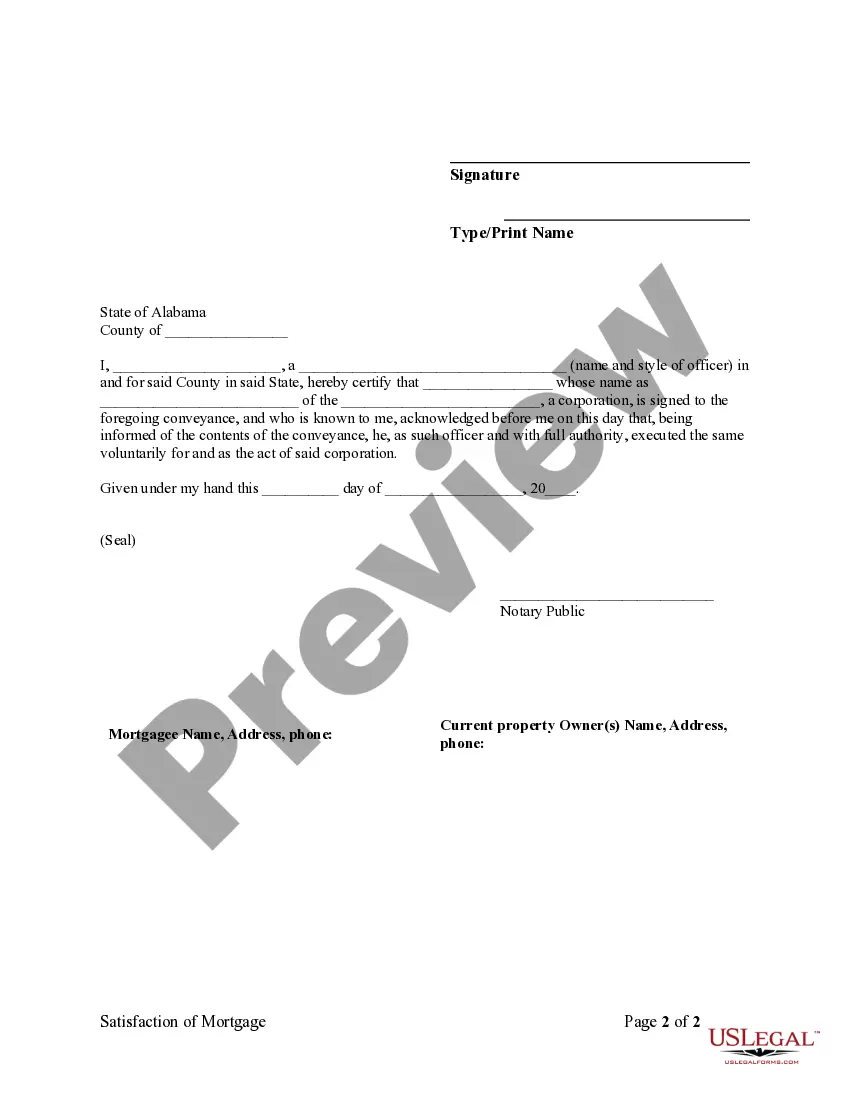

Register the discharge of mortgage Once you return the Discharge Authority form, your bank would prepare a Discharge of Mortgage document. This document must be registered at the Land Titles office.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

If you can't find out which company took over, call the Federal Deposit Insurance Corporation's (FDIC) lien release number at (888) 206-4662 (toll free) or visit the Closed Banks and Asset Sales section on the FDIC's "Contact Us" page.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.