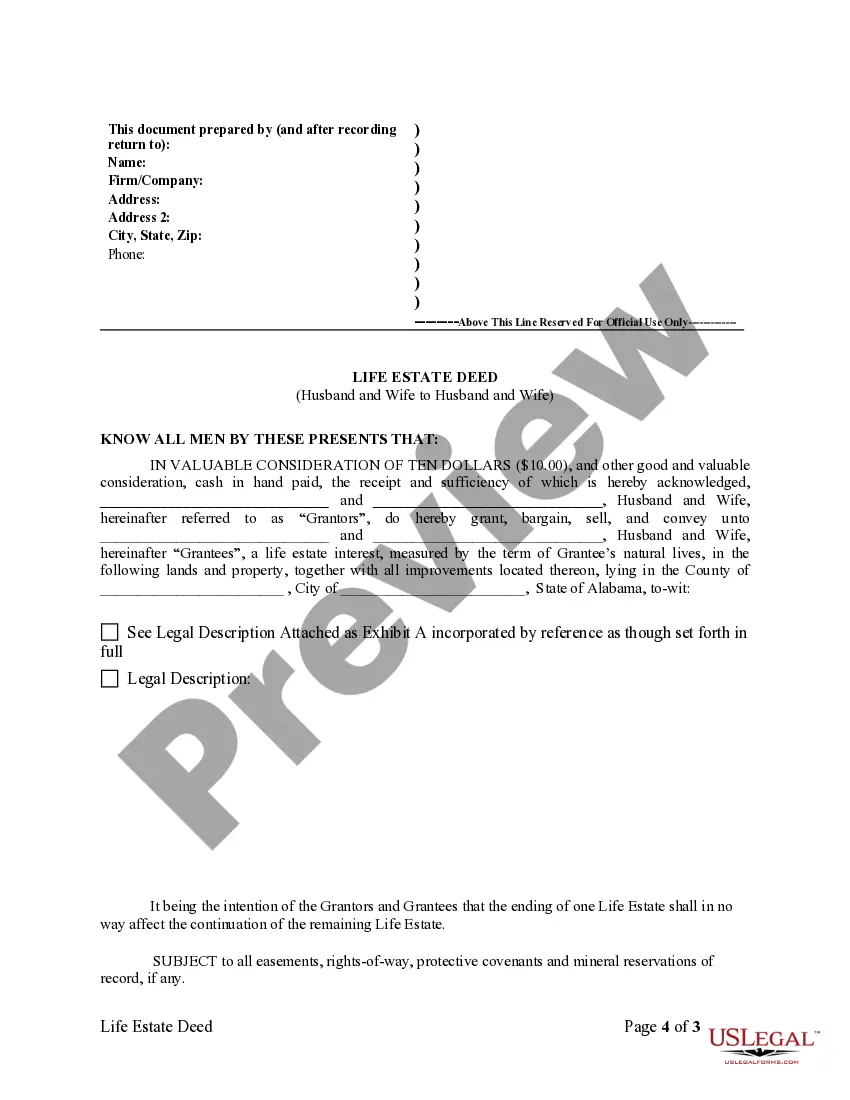

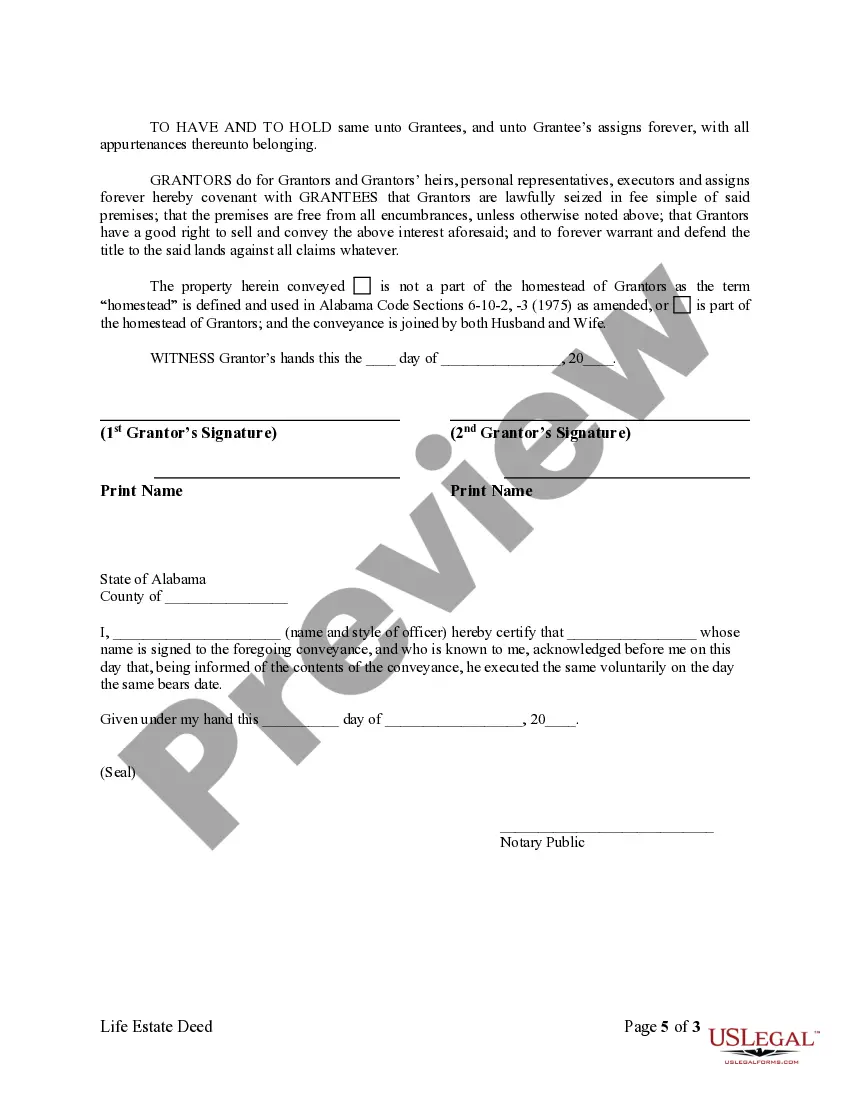

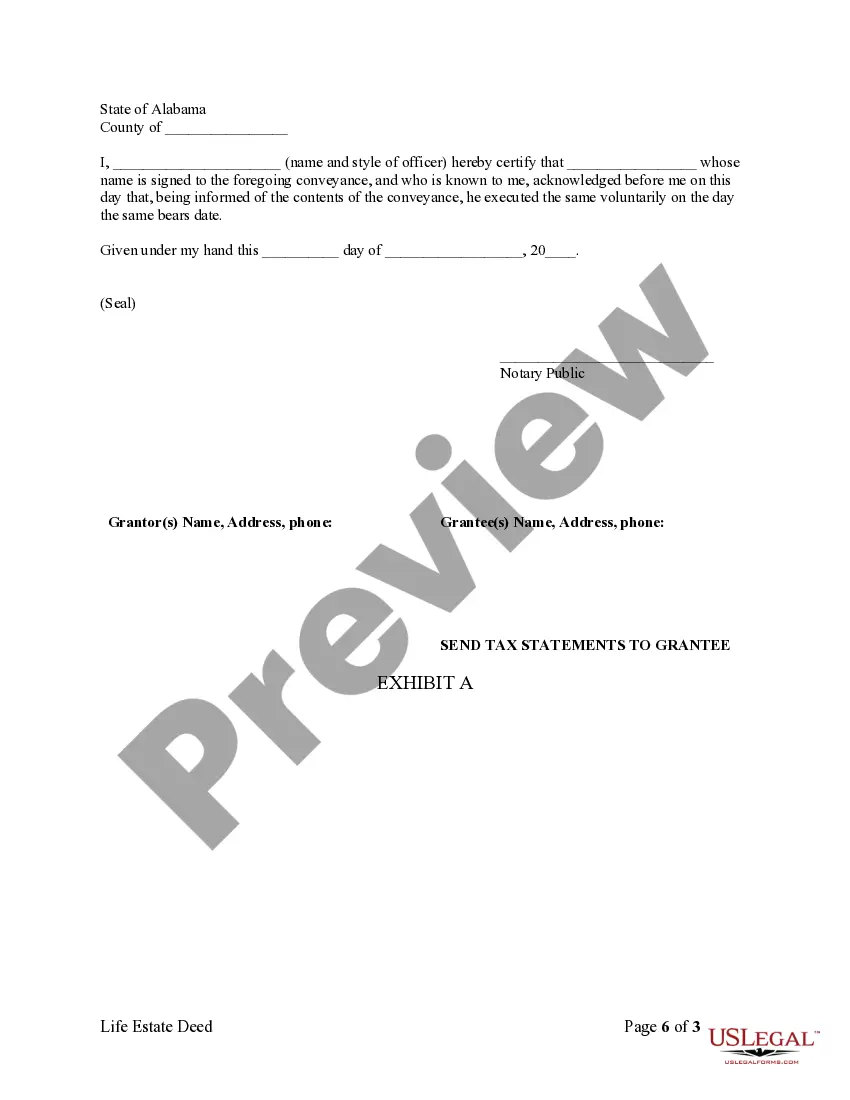

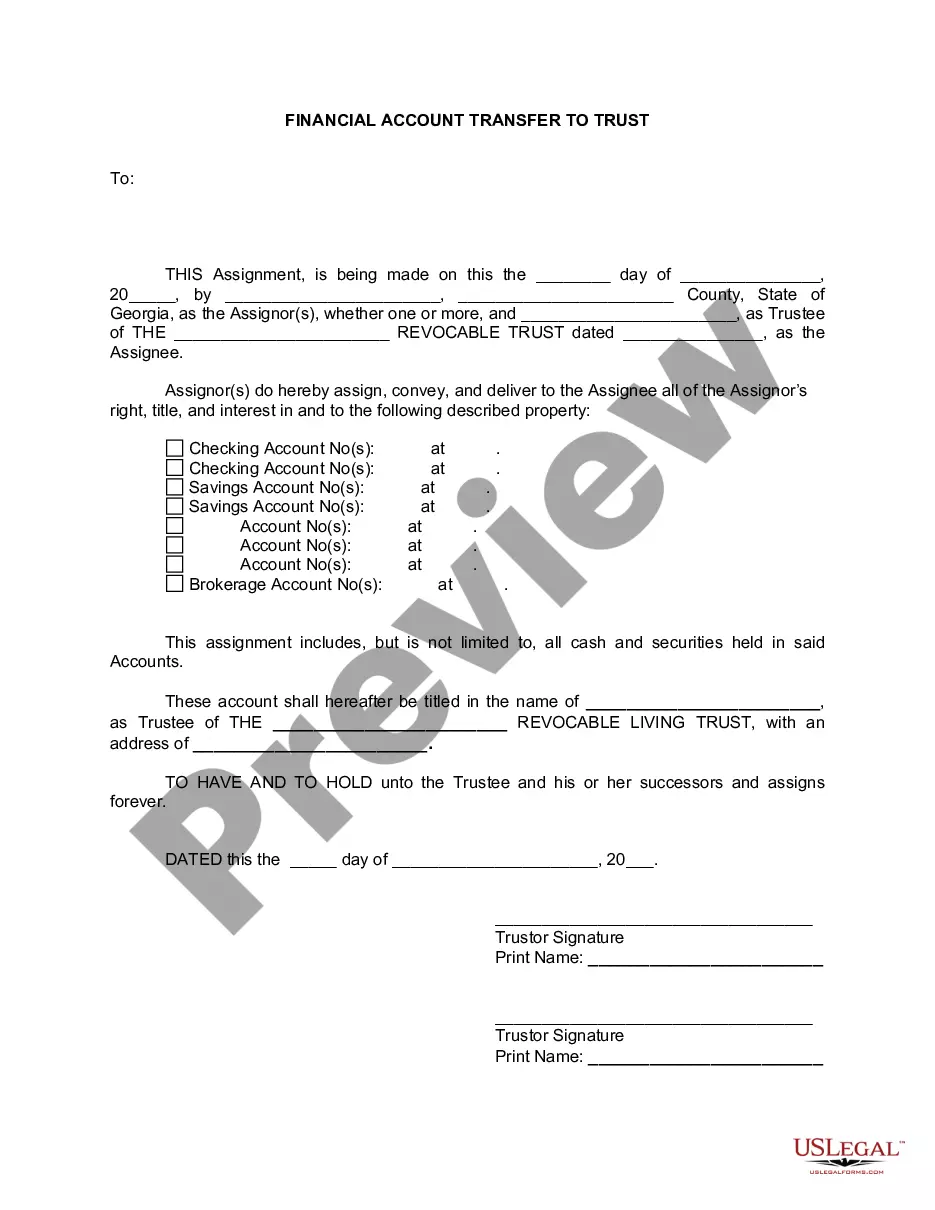

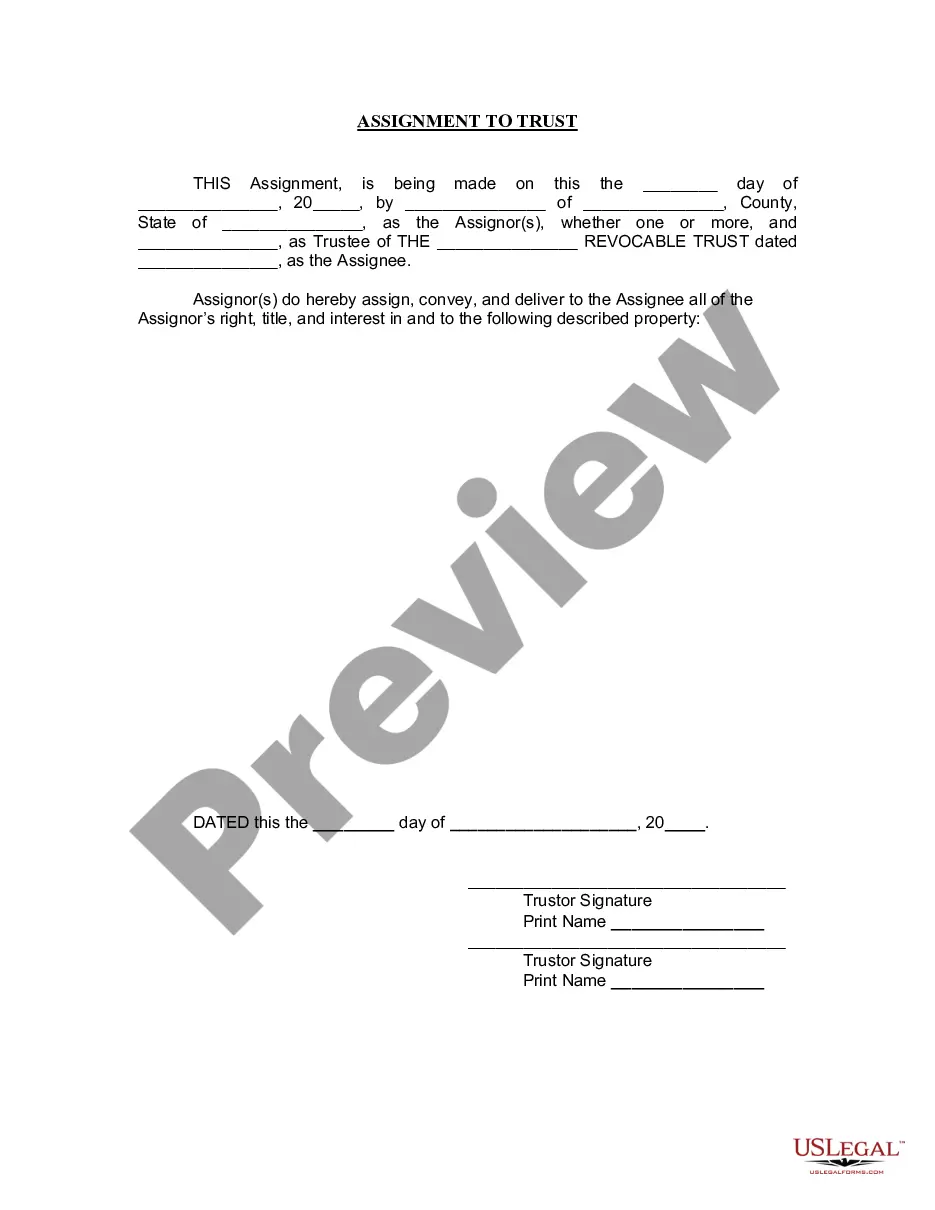

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. The grantees have a life estate interest in the named property.

Alabama Warranty Deed for Retention of Life Estate (Husband and Wife to Husband and Wife)

Description

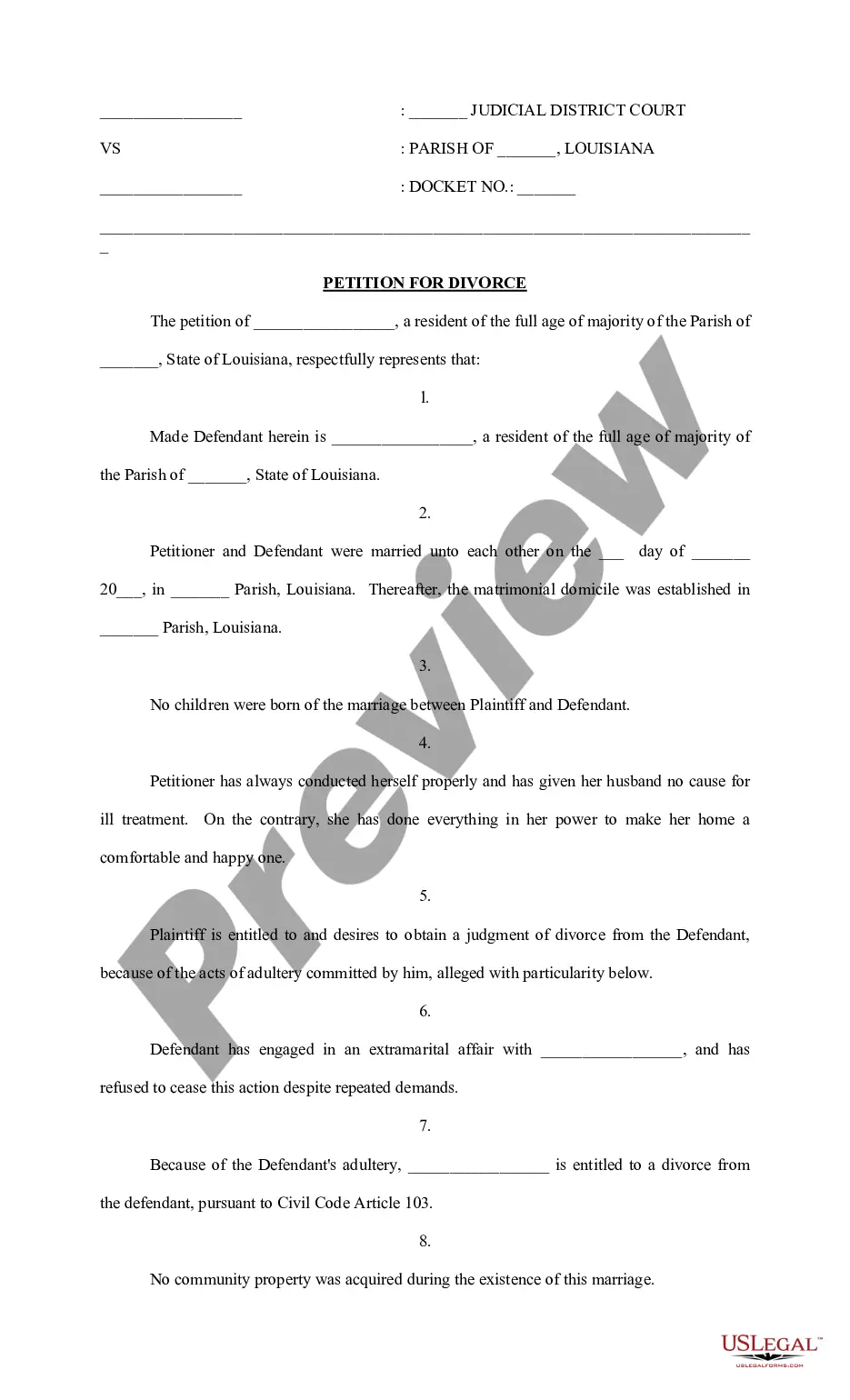

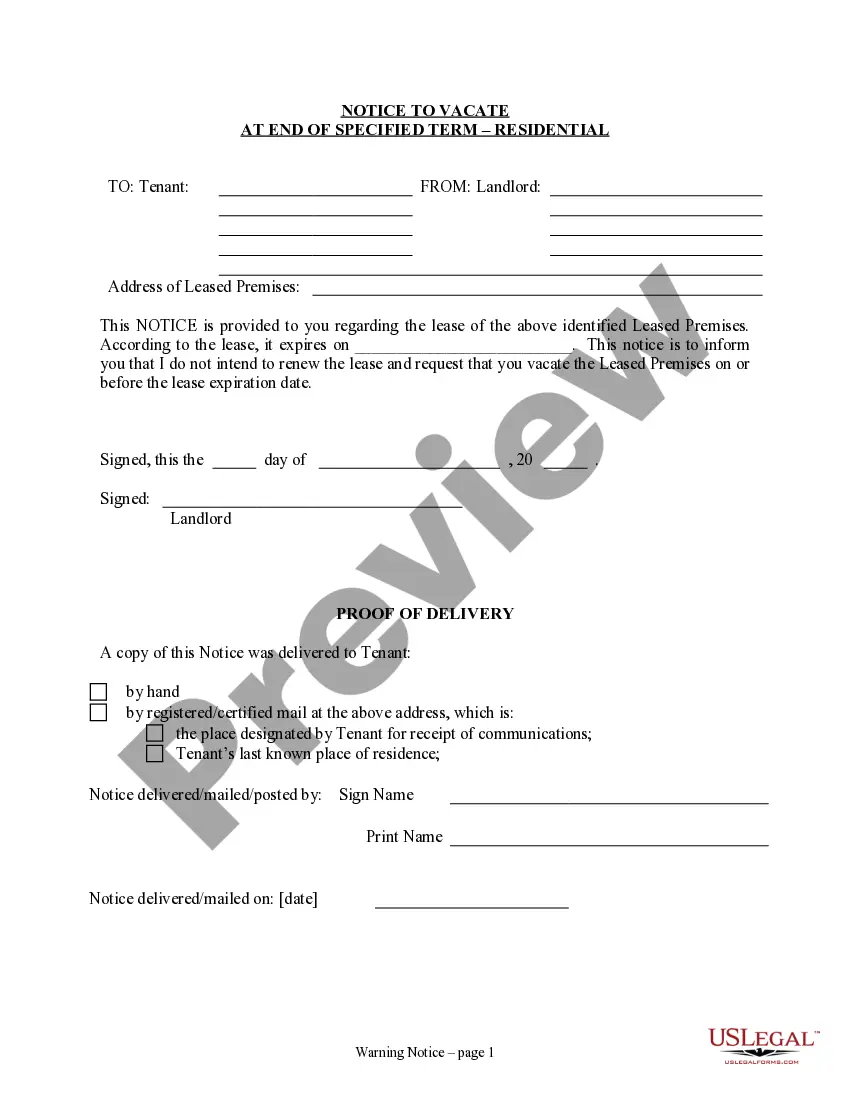

How to fill out Alabama Warranty Deed For Retention Of Life Estate (Husband And Wife To Husband And Wife)?

Amidst numerous paid and complimentary samples available online, you cannot guarantee their precision. For instance, it's unclear who created them or if they possess the necessary qualifications to fulfill your requirements.

Stay composed and utilize US Legal Forms! Obtain Alabama Warranty Deed for Retention of Life Estate (Husband and Wife to Husband and Wife) forms crafted by expert legal professionals and evade the costly and tedious task of searching for an attorney and subsequently compensating them to draft a document you can conveniently locate yourself.

If you hold a subscription, Log In to your account and locate the Download button adjacent to the document you seek. Additionally, you will have access to all your previously saved documents in the My documents section.

Once you have registered and purchased your subscription, you can utilize your Alabama Warranty Deed for Retention of Life Estate (Husband and Wife to Husband and Wife) as frequently as necessary or as long as it remains valid in your region. Edit it in your preferred online or offline editor, complete it, sign it, and produce a physical copy. Achieve more at a lower cost with US Legal Forms!

- Verify that the document you find is valid in your area.

- Review the document by utilizing the Preview feature.

- Click Buy Now to initiate the purchase process or search for another example using the Search bar at the top.

- Select a pricing option and set up an account.

- Complete the payment for the subscription using your credit/debit card or PayPal.

- Download the document in the desired file format.

Form popularity

FAQ

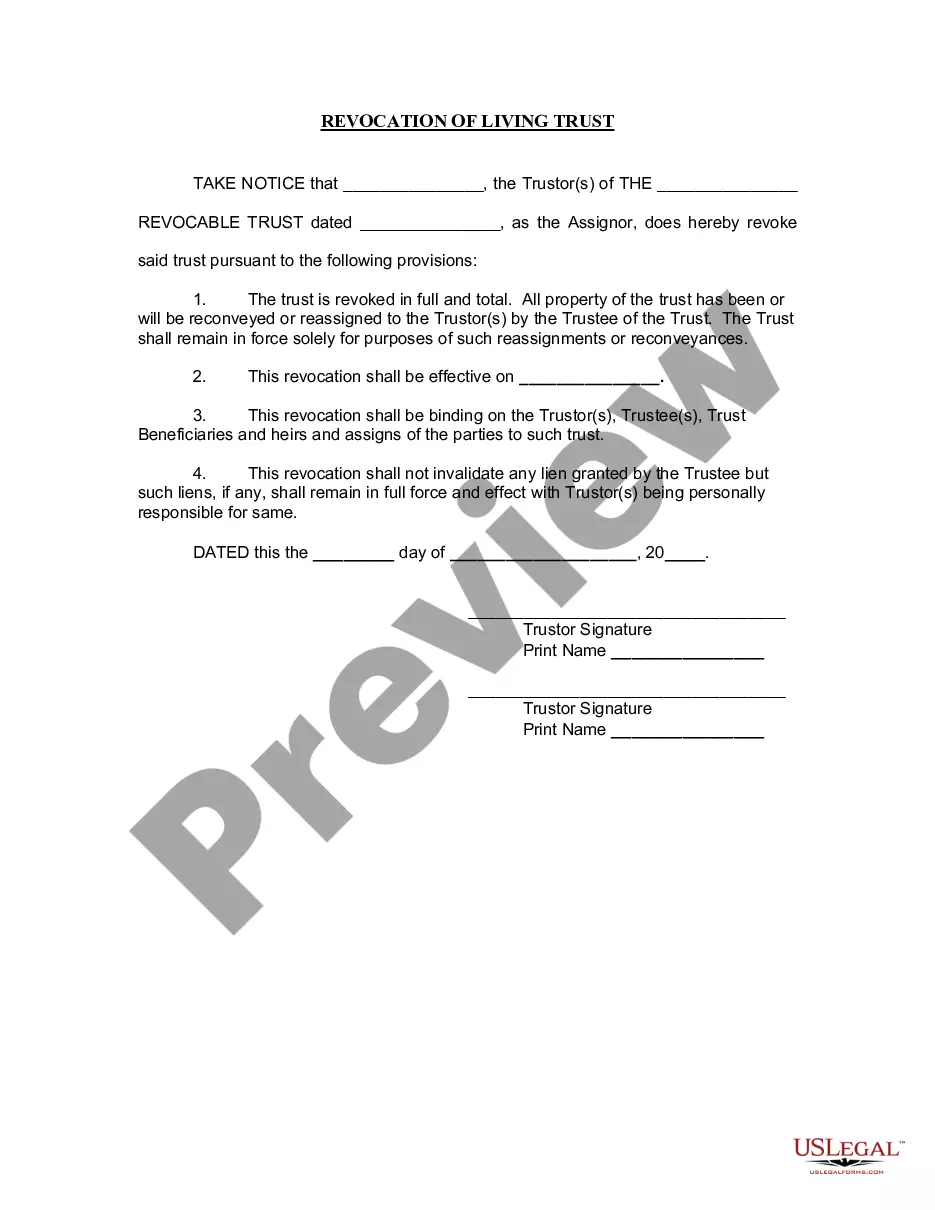

To dissolve a life estate, the life tenant can give their ownership interest to the remainderman. So, if a mother has a life estate and her son has the remainder, she can convey her interest to him, and he will then own the entire interest in the property.

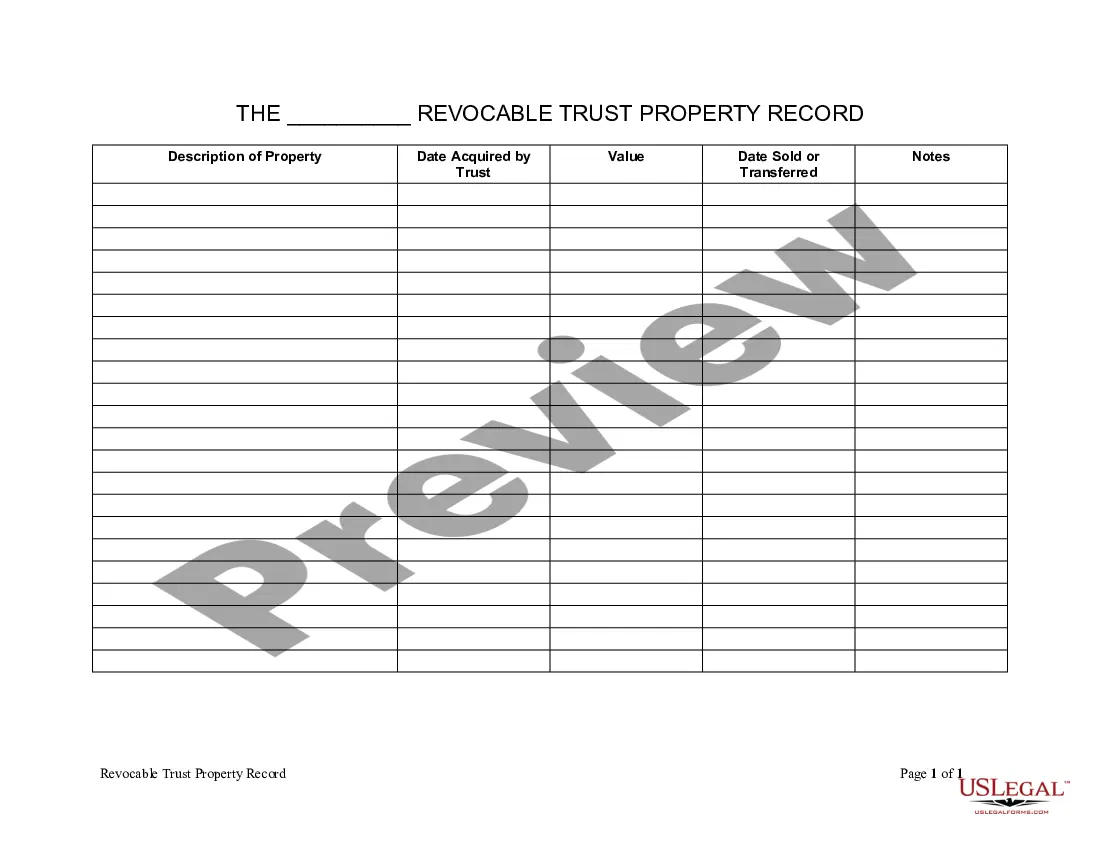

A remainderman is a property law term that refers to the person who inherits or is entitled to inherit property upon the termination of the life estate of the former owner.That person to whom ownership of the property is transferred is the remainderman.

A life estate is usually property that has been acquired during the lifetime of a person with his or her ownership only lasting through the time he or she lives.This also means he or she cannot sell it, rent it or alter it until the life tenant passes on or leaves permanently.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

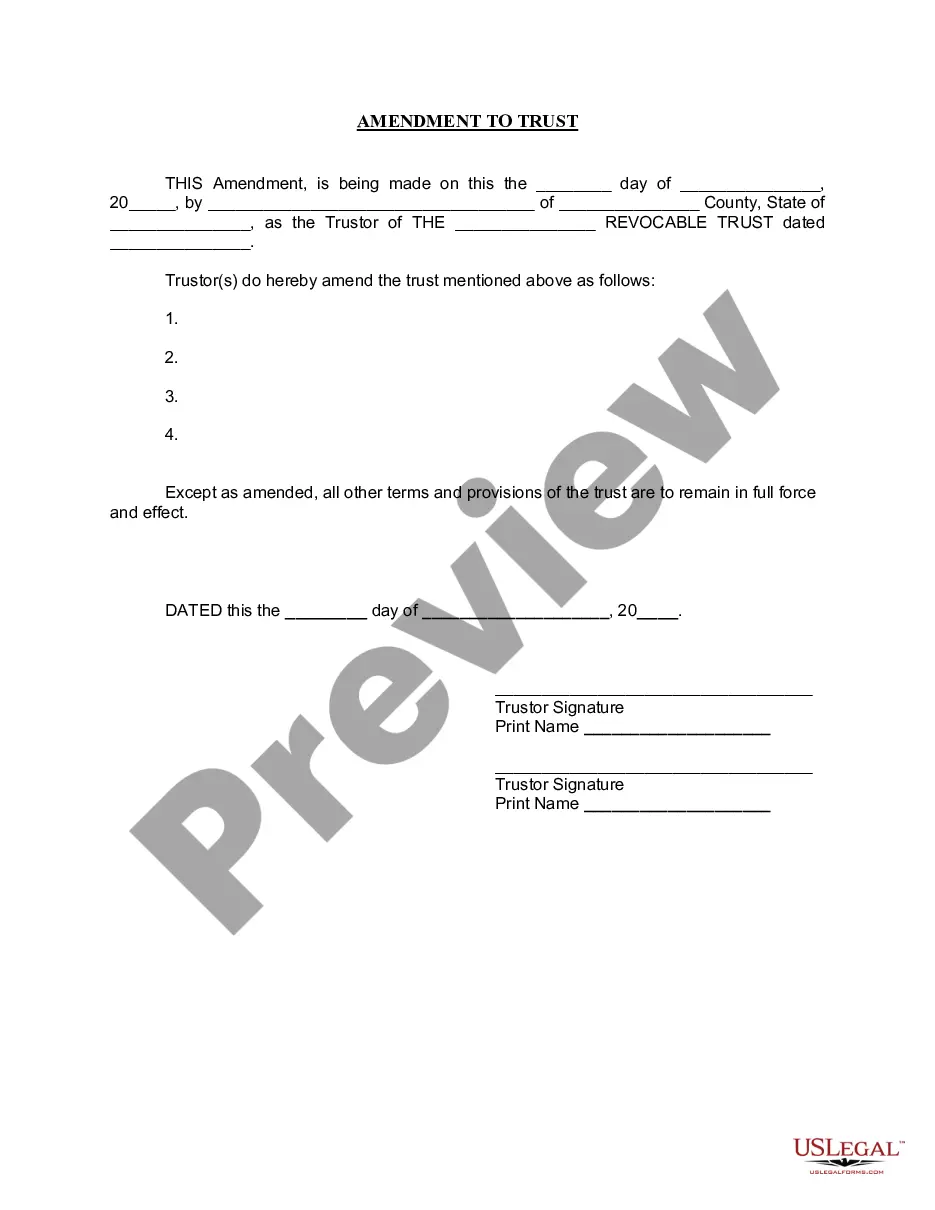

Can a life estate deed be changed? It is challenging to modify or change a life estate deed. The grantor cannot change the life estate as he or she has no power to do so after creating the life estate deed unless all of the future tenants agree. It requires the permission or consent of every one of the beneficiaries.

Alabama does not allow real estate to be transferred with transfer-on-death deeds.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.