The Alabama Exchange Agreement for Real Estate is a legal document that facilitates the exchange of properties between parties, while offering potential tax advantages. This agreement is part of a widely practiced strategy known as a 1031 exchange or like-kind exchange, which allows real estate investors to defer paying capital gains taxes upon the sale of an investment property when they reinvest the proceeds into a similar property. The Alabama Exchange Agreement for Real Estate outlines the terms and conditions that both parties involved in the exchange must adhere to. These terms typically include details about the properties being exchanged, the agreed-upon valuation, and the timeframe within which the exchange must be completed. There are different types of Alabama Exchange Agreements for Real Estate, which can be categorized based on the specific circumstances and strategies employed. Some common types of exchanges include: 1. Simultaneous Exchange: In this type of exchange, both properties are transferred simultaneously between parties. The parties, at closing, swap the properties involved in the exchange. 2. Delayed Exchange: Also known as a Starker exchange, this type of exchange involves a time gap between the sale of the relinquished property and the acquisition of the replacement property. During this time, a qualified intermediary holds the sale proceeds in an escrow account until the replacement property is identified and purchased. 3. Reverse Exchange: A reverse exchange occurs when a replacement property is acquired before the relinquished property is sold. In this scenario, an exchange accommodation titleholder (EAT) is utilized to temporarily hold either the replacement or relinquished property until the other property is sold. 4. Build-to-Suit Exchange: This type of exchange occurs when a taxpayer wishes to improve the replacement property before the exchange is completed. The taxpayer has the opportunity to construct or renovate the property to increase its value or meet specific requirements. Regardless of the type of exchange, it is important to consult with a qualified intermediary and consult legal advice to ensure compliance with Internal Revenue Service (IRS) regulations and guidelines. The Alabama Exchange Agreement for Real Estate serves as the binding contract that governs the terms of the exchange and outlines the responsibilities of both parties involved in the transaction.

Alabama Exchange Agreement for Real Estate

Description

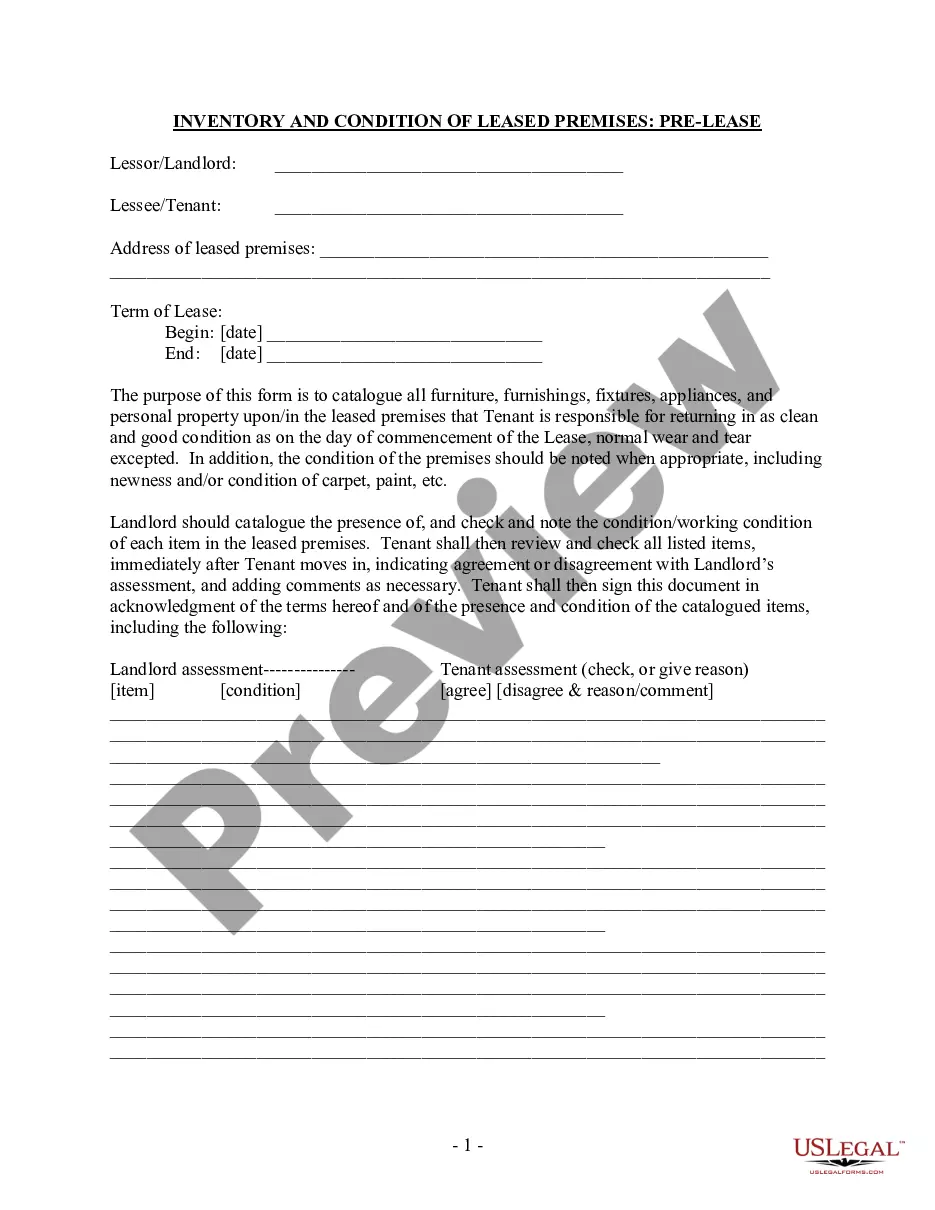

How to fill out Alabama Exchange Agreement For Real Estate?

US Legal Forms - among the greatest libraries of authorized varieties in the States - delivers a variety of authorized file web templates it is possible to down load or print out. Using the site, you may get a huge number of varieties for organization and specific functions, sorted by groups, states, or keywords.You will find the most up-to-date models of varieties such as the Alabama Exchange Agreement for Real Estate within minutes.

If you have a registration, log in and down load Alabama Exchange Agreement for Real Estate through the US Legal Forms catalogue. The Obtain option can look on every form you perspective. You have access to all in the past downloaded varieties in the My Forms tab of the accounts.

If you would like use US Legal Forms initially, listed below are straightforward instructions to help you began:

- Ensure you have picked out the proper form for the city/region. Click on the Review option to check the form`s information. Read the form explanation to ensure that you have selected the correct form.

- In case the form does not match your specifications, use the Look for field at the top of the display screen to obtain the one that does.

- If you are satisfied with the form, verify your option by simply clicking the Get now option. Then, select the pricing program you favor and supply your accreditations to register for an accounts.

- Approach the deal. Utilize your bank card or PayPal accounts to perform the deal.

- Pick the structure and down load the form on your gadget.

- Make changes. Load, modify and print out and indication the downloaded Alabama Exchange Agreement for Real Estate.

Each format you added to your money does not have an expiration date and it is yours for a long time. So, if you wish to down load or print out one more version, just go to the My Forms portion and click on about the form you want.

Get access to the Alabama Exchange Agreement for Real Estate with US Legal Forms, by far the most extensive catalogue of authorized file web templates. Use a huge number of skilled and condition-particular web templates that meet up with your business or specific requires and specifications.