The Alabama General Guaranty and Indemnification Agreement is a legal contract that outlines the rights and responsibilities of parties involved in a guarantee and indemnification agreement in the state of Alabama. This agreement serves as a binding contract and is designed to protect the interests of the parties involved. Under this agreement, a guarantor agrees to assume responsibility for the performance of another party's obligations. The guarantor provides a guarantee to the creditor that they will fulfill the obligations of the debtor in the event of default or non-performance. This agreement is often used in various business transactions, such as loans, leases, and contracts, where additional security and assurance are required. In addition to providing a guarantee, this agreement also includes provisions for indemnification. Indemnification is a legal concept that holds one party responsible for any losses, damages, or liabilities incurred by the other party. The indemnity agrees to compensate the indemnity for any losses or damages that arise from specific actions or events. The Alabama General Guaranty and Indemnification Agreement may be further categorized into different types based on specific factors or requirements. Some possible types of this agreement could include: 1. Financial Guaranty Agreement: This type of agreement is enacted for financial obligations, such as loans, bonds, or other financial transactions, providing a guarantee and indemnification to the creditor. 2. Performance Guaranty Agreement: This agreement is used to guarantee the fulfillment of performance obligations, such as timely completion of a construction project or delivery of goods or services. 3. Lease Guaranty Agreement: This type of agreement is often used in commercial leasing scenarios, where the guarantor ensures the payment of rent and other obligations under the lease contract. 4. Contract Guaranty Agreement: This agreement is specifically tailored to guarantee the fulfillment of contractual obligations, ensuring that parties involved in a contract can rely on the guarantor's assurance to fulfill their contractual duties. It is important to note that the specific terms and provisions of an Alabama General Guaranty and Indemnification Agreement may vary depending on the negotiation between the parties involved and the nature of the transaction. Seeking legal counsel to draft or review such agreements is highly recommended ensuring compliance with Alabama state laws and to protect the interests of all parties involved.

Alabama General Guaranty and Indemnification Agreement

Description

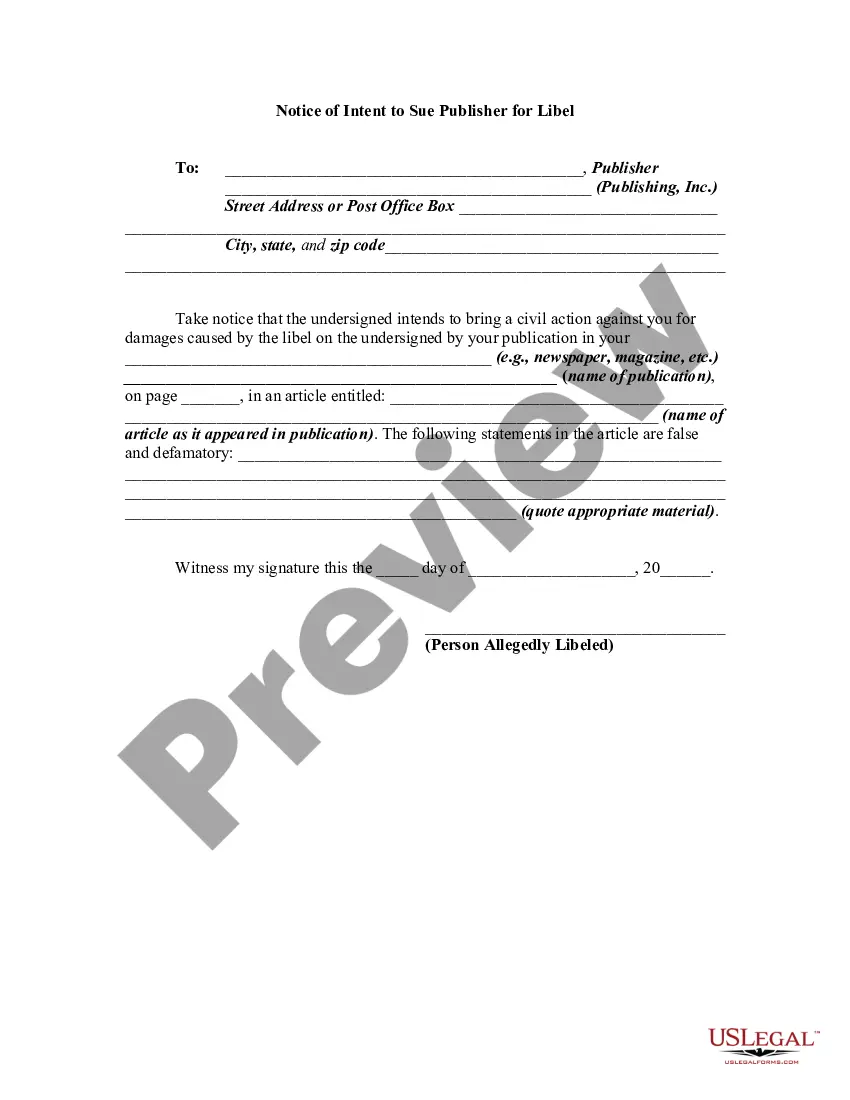

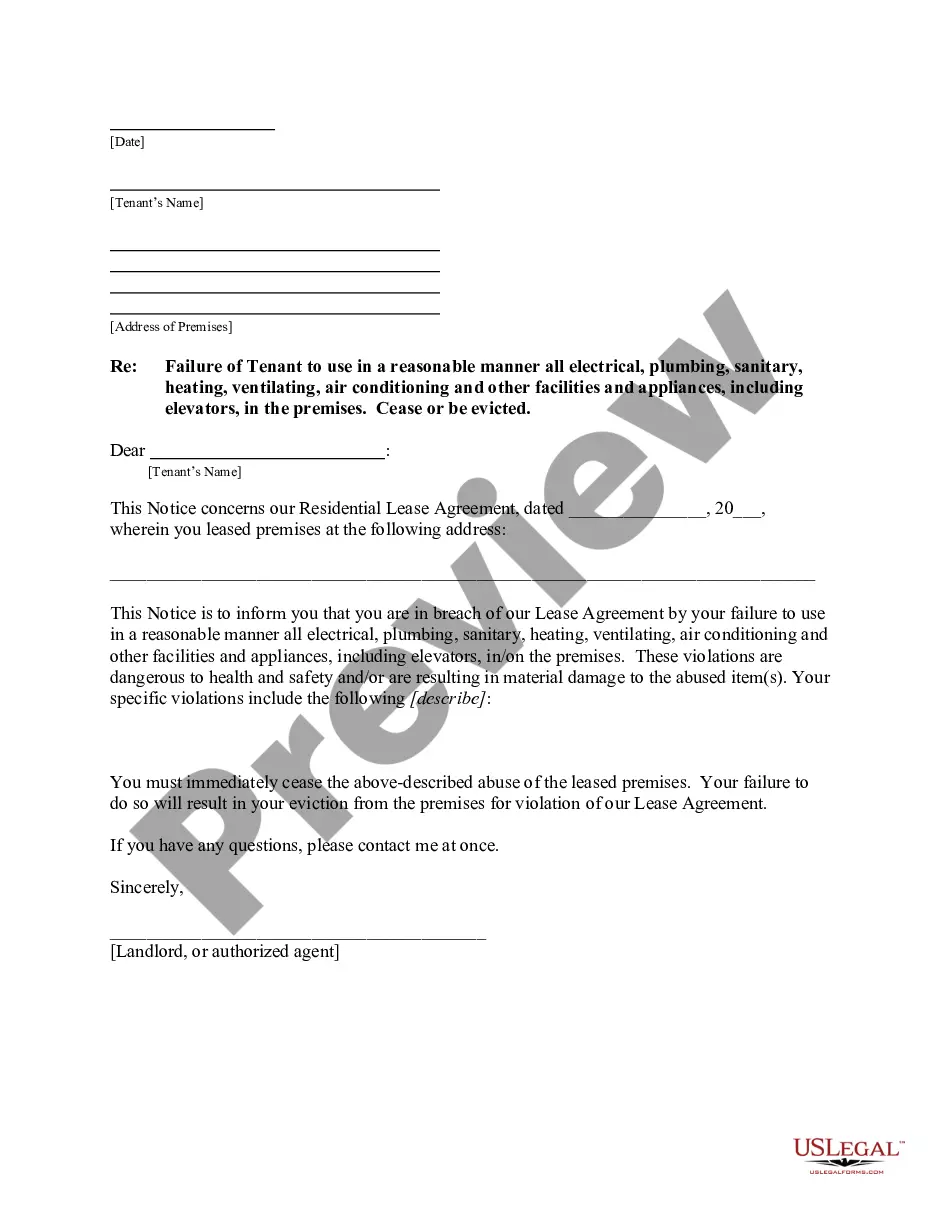

How to fill out Alabama General Guaranty And Indemnification Agreement?

You can dedicate hours online seeking the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the Alabama General Guaranty and Indemnification Agreement from our service.

To find another version of the form, use the Lookup field to locate the template that fits your preferences and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Alabama General Guaranty and Indemnification Agreement.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, verify that you have chosen the correct document template for your chosen state/region.

- Read the form description to ensure you have selected the right type.

Form popularity

FAQ

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

A warranty is a statement made by the seller at the time of sale that is factual and true. An indemnity, on the other hand, is a promise the seller makes at the time of sale to help the buyer make up any losses in case of the occurrence of a particular event.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

What is an Indemnity Agreement? An indemnity agreement, also known as a hold harmless agreement, waiver of liability, release of liability, or no-fault agreement, safeguards the indemnified party against loss or damages associated with a third-party business arrangement.

Unlike a guarantee, an indemnity need not be in writing or signed by the indemnifier in order to be effective. More robust. Being a primary obligation, an indemnity will be valid even if the underlying transaction is set aside; unlike a guarantee, which is dependent on the underlying transaction.

Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

Indemnification clauses are clauses in contracts that set out to protect one party from liability if a third-party or third entity is harmed in any way. It's a clause that contractually obligates one party to compensate another party for losses or damages that have occurred or could occur in the future.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

A guarantee is an agreement to meet someone else's agreement to do something usually to make a payment. An indemnity is an agreement to pay for a cost or reimburse a loss incurred by someone else.

Interesting Questions

More info

Xis Legal E-Mail Client software Court management software.